|

市場調查報告書

商品編碼

1844345

心室輔助裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ventricular Assist Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

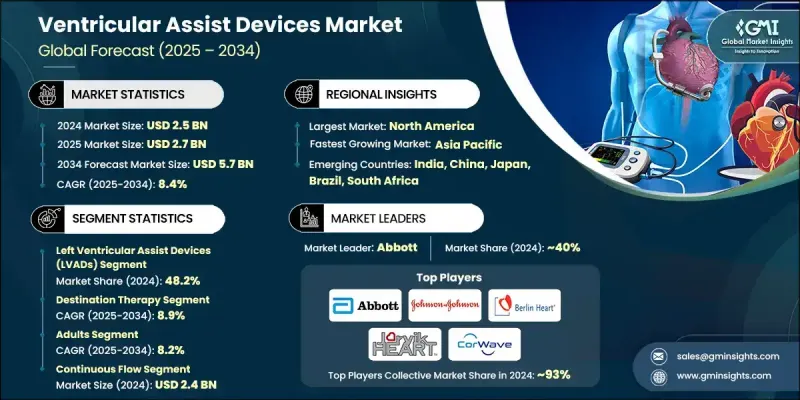

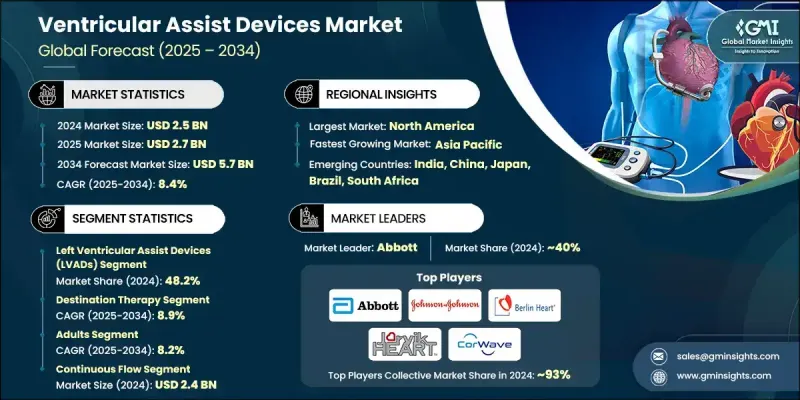

2024 年全球心室輔助裝置市場價值為 25 億美元,預計到 2034 年將以 8.4% 的複合年成長率成長至 57 億美元。

市場成長的驅動力在於心血管疾病和心臟衰竭盛行率的不斷上升,加上患者意識的不斷增強以及心臟捐贈者的持續短缺。由於心臟移植數量仍然有限,心室輔助裝置 (VAD) 已成為長期支持和移植前過渡病例的重要替代方案。技術的快速發展提高了臨床性能和用戶安全性,從而提高了患者存活率並使其在全球範圍內得到更廣泛的應用。植入式技術、材料科學和數位健康整合方面的進步,正在支持其在重症監護和門診環境中的廣泛應用。微型化和生物相容性的組件,結合無線監控和遠端診斷等智慧功能,正在幫助心室輔助裝置從侵入性機械支援轉變為智慧心臟護理系統。隨著新興市場和已開發市場都在不斷提升其心臟護理能力,心室輔助裝置在心臟衰竭綜合治療中發揮越來越重要的作用,尤其是在單靠藥物治療無法奏效的情況下。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 57億美元 |

| 複合年成長率 | 8.4% |

到2034年,右心室輔助裝置 (RVAD) 市場將以9.4%的複合年成長率成長。其需求的成長與右心併發症患者數量的增加以及先進心臟治療中對專業心室支持的需求密切相關。隨著緊湊型設備架構和降低排斥風險的材料的不斷改進,RVAD 在需要針對性干預的複雜心臟手術中越來越受歡迎。這些設備現在更適用於移植橋接手術和短期復健應用,從而增強了它們在多種護理途徑中的相關性。

2024年,醫院市場佔據43.1%的佔有率,預計到2034年將達到24億美元。醫院仍然是心臟輔助裝置(VAD)患者手術植入、即時監測和術後護理的中心。嚴重心臟衰竭病例日益增多,需要高階干預,這推動了醫院環境中設備安裝的需求。此外,專業的心臟科室和訓練有素的人員提高了設備部署的效率和安全性,鞏固了醫院的市場主導地位。現代化基礎設施的配備和創新工具的日益普及,使醫院系統成為VAD計畫長期成功的關鍵因素。

由於其完善的心臟照護生態系統,美國心室輔助裝置市場在2024年的估值達到13億美元。先進的醫療設施、大量訓練有素的心血管外科醫生以及獲得最新外科創新技術的管道,是推動心室輔助裝置(VAD)應用的主要因素。美國在手術量、創新應用和植入後護理方面繼續保持領先地位。憑藉健全的報銷框架和高度的病患意識,美國為拓展VAD解決方案的公司提供了有利的環境。

全球心室輔助裝置市場的知名企業包括 CorWave、Berlin Heart、雅培、BrioHealth、Jarvik HEART、EVAHEART 和強生。心室輔助裝置市場的領先公司正致力於創新驅動型成長,開發注重小型化、無線連接和生物相容性的下一代技術。許多公司正在透過智慧材料和流動演算法來延長設備使用壽命並降低併發症風險。為了涵蓋更廣泛的患者群體,各公司正在投資微創植入技術和完全植入式系統。與醫院和研究中心建立策略合作夥伴關係有助於推動臨床試驗並加快法規核准。此外,企業也透過分銷聯盟和外科團隊培訓計畫進入新興醫療市場,實現地理擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心臟衰竭和心血管疾病患者數量增加

- 技術進步

- 提高對心臟衰竭治療的認知

- 心臟捐贈者短缺

- 產業陷阱與挑戰

- 設備成本高

- 手術風險和併發症

- 市場機會

- 新興市場的採用

- 對患者友善解決方案的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 現有技術

- 新興技術

- 未來市場趨勢

- 報銷場景

- 全球心臟移植狀況

- 流行病學概況

- 管道分析

- 投資前景

- 2024年定價分析

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 左心室輔助裝置(LVAD)

- 右心室輔助裝置(RVAD)

- 雙心室輔助裝置(BIVAD)

- 經皮心室輔助裝置

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 目的地療法

- 橋接候選(BTC)治療

- 移植前橋接(BTT)治療

- 橋接復健(BTR)療法

- 其他應用

第7章:市場估計與預測:按患者,2021 - 2034

- 主要趨勢

- 成年人

- 兒科

第8章:市場估計與預測:按流量,2021 - 2034 年

- 主要趨勢

- 脈動流

- 連續流

- 軸向連續流

- 離心連續流

第9章:市場估計與預測:依設計,2021 - 2034

- 主要趨勢

- 經皮

- 可植入

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 心導管實驗室

- 門診手術中心

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Abbott

- Berlin Heart

- BrioHealth

- CorWave

- EVAHEART

- Jarvik HEART

- Johnson & Johnson

The Global Ventricular Assist Devices Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 5.7 billion by 2034.

Market growth is driven by the increasing prevalence of cardiovascular disorders and heart failure, coupled with growing patient awareness and the persistent shortage of heart donors. With heart transplants remaining limited, VADs have become an essential alternative for long-term support and bridge-to-transplant cases. Rapid technological evolution has enhanced both clinical performance and user safety, leading to better patient survival rates and wider global adoption. Advancements in implantable technologies, material science, and digital health integration are supporting expanded use in both critical care and outpatient settings. Miniaturized and biocompatible components, combined with smart functionalities such as wireless monitoring and remote diagnostics, are helping shift VADs from invasive mechanical supports to intelligent cardiac care systems. As both emerging and developed markets expand their cardiac care capabilities, VADs are playing an increasingly important role in comprehensive heart failure treatment, especially in cases where medical therapy alone falls short.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 8.4% |

The right ventricular assist devices (RVADs) segment will grow at a CAGR of 9.4% through 2034. Their rising demand is closely tied to the growing number of patients with right-sided heart complications and the need for specialized ventricular support in advanced cardiac therapies. With continuous enhancements in compact device architecture and materials that reduce rejection risks, RVADs are increasingly favored in complex cardiac procedures requiring targeted intervention. These devices are now more suitable for bridge-to-transplant procedures and short-term recovery applications, strengthening their relevance across multiple care pathways.

In 2024, the hospitals segment held a 43.1% share and is projected to reach USD 2.4 billion by 2034. Hospitals remain the epicenter of surgical implantation, real-time monitoring, and postoperative care for VAD patients. The increasing burden of severe heart failure cases requiring advanced intervention is fueling demand for device installation in hospital environments. Additionally, specialized cardiac units and trained personnel enhance the efficiency and safety of device deployment, reinforcing hospitals' dominant market position. The presence of modern infrastructure and growing access to innovative tools are positioning hospital systems as critical contributors to the long-term success of VAD programs.

United States Ventricular Assist Devices Market was valued at USD 1.3 billion in 2024, owing to its well-established cardiac care ecosystem. Advanced medical facilities, a large base of trained cardiovascular surgeons, and access to the latest surgical innovations are major enablers for VAD adoption. The nation continues to lead in surgical volumes, innovation uptake, and post-implantation care. With its robust reimbursement frameworks and strong patient awareness, the U.S. offers a favorable environment for companies expanding VAD solutions.

Prominent players in the Global Ventricular Assist Devices Market include CorWave, Berlin Heart, Abbott, BrioHealth, Jarvik HEART, EVAHEART, and Johnson & Johnson. Leading companies in the ventricular assist devices market are focusing heavily on innovation-driven growth by developing next-gen technologies that emphasize miniaturization, wireless connectivity, and biocompatibility. Many are enhancing device lifespans and lowering complication risks through smart materials and flow algorithms. To reach wider patient populations, firms are investing in less-invasive implantation techniques and fully implantable systems. Strategic partnerships with hospitals and research centers help drive clinical trials and accelerate regulatory approvals. Additionally, players are expanding geographically by entering emerging healthcare markets through distribution alliances and training programs for surgical teams.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Patient trends

- 2.2.5 Flow trends

- 2.2.6 Design trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of heart failures and cardiovascular diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rise in awareness regarding heart failure treatment

- 3.2.1.4 Shortage of heart donors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Surgical risks and complications

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption in emerging markets

- 3.2.3.2 Growing demand for patient-friendly solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Global heart transplantation scenario

- 3.9 Epidemiology landscape

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Left ventricular assist devices (LVADs)

- 5.3 Right ventricular assist devices (RVADs)

- 5.4 Biventricular assist devices (BIVADs)

- 5.5 Percutaneous ventricular assist devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Destination therapy

- 6.3 Bridge-to-candidacy (BTC) therapy

- 6.4 Bridge-to-transplant (BTT) therapy

- 6.5 Bridge-to-recovery (BTR) therapy

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Flow, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pulsatile flow

- 8.3 Continuous flow

- 8.3.1 Axial continuous flow

- 8.3.2 Centrifugal continuous flow

Chapter 9 Market Estimates and Forecast, By Design, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Transcutaneous

- 9.3 Implantable

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Cardiac catheterization labs

- 10.4 Ambulatory surgical centers

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott

- 12.2 Berlin Heart

- 12.3 BrioHealth

- 12.4 CorWave

- 12.5 EVAHEART

- 12.6 Jarvik HEART

- 12.7 Johnson & Johnson