|

市場調查報告書

商品編碼

1844343

基於 LTE 和 5G NR 的 CBRS 網路市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測LTE and 5G NR-based CBRS Networks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

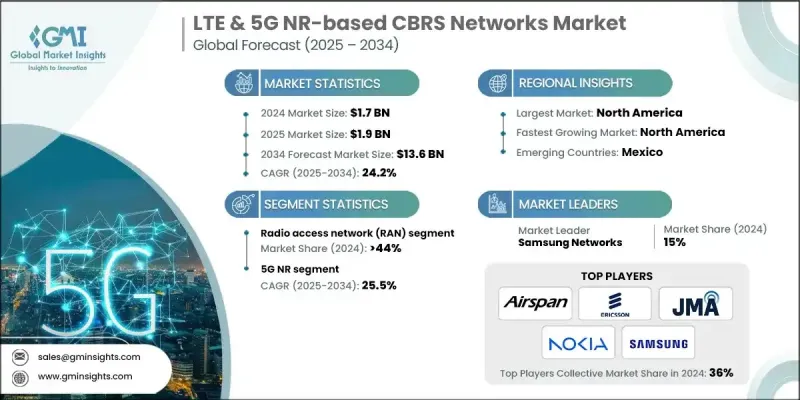

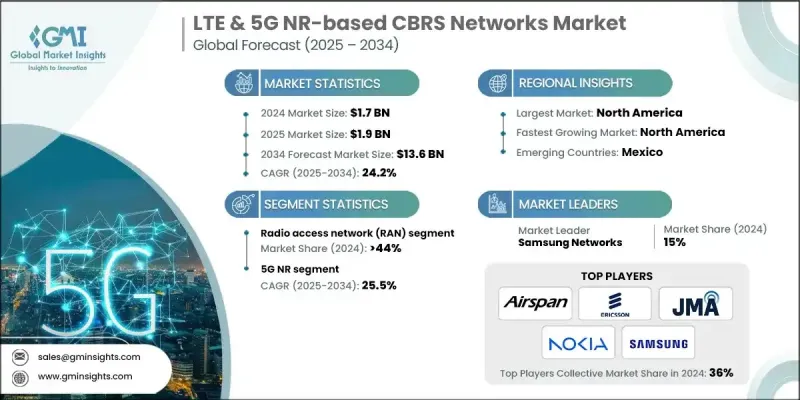

2024 年全球基於 LTE 和 5G NR 的 CBRS 網路市場價值為 17 億美元,預計到 2034 年將以 24.2% 的複合年成長率成長至 136 億美元。

製造業、物流業、港口和大型園區等企業正擴大轉向私有LTE和5G NR網路,以滿足日益成長的高速、低延遲和安全通訊需求。 CBRS提供3.5 GHz(3550至3700 MHz)中頻頻譜接入,為企業提供了一種經濟實惠的替代方案,以取代昂貴的授權頻譜。隨著數位轉型的加速,基於CBRS的私有蜂窩網路的使用持續成長。企業看到了部署客製化無線網路以實現園區行動化、工業自動化和固定無線存取的顯著優勢。各行各業正在進行試驗和即時部署,以驗證用例並證明CBRS網路的成本效益。中立主機解決方案、室內覆蓋應用以及由SAS提供者管理的共享頻譜存取的不斷發展,進一步增強了市場發展勢頭。儘管面臨聯邦協調、干擾風險和成本方面的挑戰,但市場前景仍然強勁。產業和監管機構正在努力解決這些障礙,而科技的進步也正在加快部署速度並擴大企業應用範圍。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 136億美元 |

| 複合年成長率 | 24.2% |

2024年,無線接取網路 (RAN) 市場佔有 44% 的佔有率。 RAN 元件(包括小型和大型基地台)對於將使用者裝置連接到核心網路,同時提供一致的室內外覆蓋至關重要。三星、諾基亞和愛立信等供應商的硬體支援波束成形和動態頻譜分配等功能,可提升網路效能並降低延遲。企業利用 RAN 系統建立可擴展且安全的網路,以處理密集流量和低延遲應用。

預計到2034年,5G NR細分市場的複合年成長率將達到25.5%。該細分市場的強勁表現得益於其能夠提供超低延遲、更高容量以及支援網路切片。在自主系統、擴增實境、機器人技術和智慧自動化等新興技術領域,企業越來越青睞5G NR而非LTE。 5G NR還支援高效的頻譜利用,並透過集中管理實現跨站點的無縫擴展。這使得它對於尋求性能驅動且面向未來的架構的網路的行業尤其具有吸引力。

2024年,美國基於LTE和5G NR的CBRS網路市場規模達7.255億美元。美國聯邦通訊委員會(FCC)的結構化頻譜共享框架允許聯邦用戶和商業用戶在三個存取層級下共存:現有用戶、優先接取授權(PAL)和通用授權接取(GAA)。此模式使企業能夠更靈活地使用頻譜,同時確保關鍵用戶的保護,從而促進創新。各大業者持續投資擴展以CBRS為基礎的基礎設施,以改善網路覆蓋範圍,增強服務彈性,並在共享頻譜資源充足的高需求區域分擔行動流量。

塑造基於 LTE 和 5G NR 的 CBRS 網路市場的關鍵公司包括康普、諾基亞、Airspan、康卡斯特、JMA Wireless、亞馬遜網路服務、思科、Radisys、三星和愛立信。這些參與者正在採取有針對性的策略來鞏固其市場地位,例如推出交鑰匙專用網路解決方案、整合邊緣運算和人工智慧功能以及擴大生態系統合作夥伴關係。他們正在投資軟體定義平台,這些平台提供集中管理並與企業 IT 系統無縫互通。一些公司也參與監管合作,以影響頻譜政策並改善 SAS 協調,旨在最大限度地減少干擾並簡化部署。他們的重點仍然是開發強大、可擴展且與應用程式無關的 CBRS 解決方案,以滿足不斷變化的企業連接需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預報

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 私有 LTE 和 5G NR 網路的採用率不斷上升

- 有線電視營運商增加 CBRS 小型基地台部署

- 投資攜帶式私有5G解決方案

- SAS 和 CBRS 2.0 的進步

- 企業對私人無線網路的興趣日益濃厚

- 產業陷阱與挑戰

- 干擾聯邦現任官員

- 協調複雜性和營運成本

- 市場機會

- 不斷發展的工業物聯網和企業園區網路

- MVNO 卸載和二次載波聚合

- 與私有 5G 解決方案整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術成熟度評估框架

- 當前的技術趨勢

- 新興技術

- 成本結構分析

- 專利分析

- 各地區專利申請情形(2021-2025 年)

- CBRS 特定的 SEP 類別

- 重要新聞和舉措

- 永續性和 ESG 影響評估

- 環境影響分析和指標

- 社會影響考量和指標

- 治理與合規框架

- ESG 投資含義與財務影響

- 用例和應用

- 最佳情況

- 投資和融資格局

- CBRS/私人5G領域的創投與私募股權投資

- 政府補助、獎勵和補貼

- 資金對部署速度和創新的影響

- 市場進入和商業策略

- 服務捆綁策略(FWA、IoT、企業套餐)

- 行銷和客戶獲取策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依基礎設施子市場,2021 - 2034 年

- 主要趨勢

- 無線接取網路(RAN)

- 移動核心

- 交通網路

- 小型蜂巢 RU(無線電單元)

- 分散式和集中式基頻單元(DU/CU)

第6章:市場估計與預測:按空中介面技術,2021 - 2034 年

- 主要趨勢

- LTE

- 5G NR

第7章:市場估計與預測:按細胞,2021 - 2034

- 主要趨勢

- 室內小型基地台

- 室外小型基地台

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 行動網路密集化

- 固定無線接入(FWA)

- 有線電視營運商和新進入者

- 中立主機

- 私人蜂窩網路

- 教育

- 政府和市政當局

- 衛生保健

- 製造業

- 軍隊

- 礦業

- 石油和天然氣

- 零售和酒店

- 其他

第9章:市場估計與預測:按頻段,2021 - 2034

- 主要趨勢

- 低於 2.3 GHz

- 2.3-2.6 GHz

- 3.3-3.6 GHz

- 3.55-3.7 GHz

- 3.7-3.8 GHz

- 3.8-4.2 GHz

- 4.6-4.9 GHz

- 20 GHz以上

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者

- Airspan

- Amazon Web Services

- AT&T

- Charter Communications

- Cisco Systems

- Comcast

- CommScope

- Ericsson

- HPE

- Huawei

- Intel

- JMA Wireless

- Microsoft Azure

- NEC

- Nokia

- Qualcomm

- Samsung

- Sony

- T-Mobile

- Verizon Communications

- 區域參與者

- ZTE

- Baicells

- Fujitsu

- 新興參與者/顛覆者

- Altiostar

- Federated Wireless

- Mavenir

- Radisys

The Global LTE & 5G NR-based CBRS Networks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 13.6 billion by 2034.

Enterprises across manufacturing, logistics, ports, and large campuses are increasingly turning to private LTE and 5G NR networks to meet the growing need for high-speed, low-latency, secure communication. CBRS offers access to mid-band spectrum in the 3.5 GHz range (3550 to 3700 MHz), giving organizations an affordable alternative to costly licensed spectrum. As digital transformation accelerates, the use of private cellular networks over CBRS continues to expand. Businesses see clear benefits in deploying tailored wireless networks for campus mobility, industrial automation, and fixed wireless access. Trials and live deployments are underway across industries, validating use cases and proving the cost-efficiency of CBRS networks. Market momentum is further supported by the evolution of neutral-host solutions, indoor coverage applications, and shared spectrum access managed by SAS providers. Despite challenges around federal coordination, interference risks, and cost, the market outlook remains strong. Industry and regulatory efforts continue to address these barriers, while advancements in technology are enabling faster rollouts and broader enterprise adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 24.2% |

In 2024, the radio access network (RAN) segment held a 44% share. RAN components, including small and macro cell radios, are essential for connecting user devices to the core network while delivering consistent indoor and outdoor coverage. With support for features like beamforming and dynamic spectrum allocation, hardware from vendors such as Samsung, Nokia, and Ericsson enhances network performance while reducing latency. Enterprises utilize RAN systems to build scalable and secure networks capable of handling intensive traffic and low-latency applications.

The 5G NR segment is forecast to grow at a CAGR of 25.5% through 2034. The segment's strong performance is attributed to its ability to deliver ultra-low latency, higher capacity, and support for network slicing. Enterprises increasingly favor 5G NR over LTE for emerging technologies such as autonomous systems, augmented reality, robotics, and smart automation. 5G NR also supports efficient spectrum use and seamless scaling across multiple sites with centralized management. This makes it particularly attractive to industries seeking performance-driven networks with future-ready architecture.

United States LTE & 5G NR-based CBRS Networks Market generated USD 725.5 million in 2024. The FCC's structured spectrum-sharing framework has allowed the coexistence of federal and commercial users under three access tiers: Incumbent, Priority Access License (PAL), and General Authorized Access (GAA). This model fosters innovation by enabling enterprises to use spectrum more flexibly while maintaining protection for critical users. Major operators continue to invest in expanding CBRS-based infrastructure to improve network coverage, enhance service flexibility, and offload mobile traffic in high-demand areas where shared spectrum is readily available.

Key companies shaping the LTE & 5G NR-based CBRS Networks Market include Commscope, Nokia, Airspan, Comcast, JMA Wireless, Amazon Web Services, Cisco, Radisys, Samsung, and Ericsson. These players are using targeted strategies to strengthen their market position, such as launching turnkey private network solutions, integrating edge computing and AI capabilities, and expanding ecosystem partnerships. They are investing in software-defined platforms that offer centralized management and seamless interoperability with enterprise IT systems. Some companies are also engaging in regulatory collaborations to influence spectrum policy and improve SAS coordination, aiming to minimize interference and streamline deployments. Their focus remains on developing robust, scalable, and application-agnostic CBRS solutions that can meet the evolving demands of enterprise connectivity.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infrastructure submarkets

- 2.2.3 Air interface technology

- 2.2.4 Cells

- 2.2.5 Application

- 2.2.6 Frequency band

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of private LTE and 5G NR networks

- 3.2.1.2 Increasing CBRS small cell deployments by cable operators

- 3.2.1.3 Investment in portable private 5G solutions

- 3.2.1.4 Advancements in SAS and CBRS 2.0

- 3.2.1.5 Growing enterprise interest in private wireless networks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Interference near federal incumbents

- 3.2.2.2 Coordination complexity and operational costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing industrial IoT and enterprise campus networks

- 3.2.3.2 MVNO offload and secondary carrier aggregation

- 3.2.3.3 Integration with private 5G solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.9.1 Patent applications by region (2021-2025)

- 3.9.2 CBRS-Specific SEP categories

- 3.10 Key News and Initiatives

- 3.11 Sustainability and ESG impact assessment

- 3.11.1 Environmental impact analysis and metrics

- 3.11.2 Social impact considerations and metrics

- 3.11.3 Governance and compliance framework

- 3.11.4 ESG investment implications and financial impact

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment and funding landscape

- 3.14.1. Venture capital and private equity investments in CBRS/Private 5 G

- 3.14.2 Government grants, incentives, and subsidies

- 3.14.3 Impact of funding on deployment speed and innovation

- 3.15 Go-to-market and commercial strategies

- 3.15.1 Service bundling strategies (FWA, IoT, Enterprise Packages)

- 3.15.2 Marketing & customer acquisition strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Infrastructure Submarkets, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Radio Access Network (RAN)

- 5.3 Mobile core

- 5.4 Transport network

- 5.5 Small Cell RUs (Radio Units)

- 5.6 Distributed & Centralized Baseband Units (DUs/CUs)

Chapter 6 Market Estimates & Forecast, By Air Interface Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 LTE

- 6.3 5G NR

Chapter 7 Market Estimates & Forecast, By Cells, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Indoor small cells

- 7.3 Outdoor small cells

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Mobile network densification

- 8.3 Fixed Wireless Access (FWA)

- 8.4 Cable operators & new entrants

- 8.5 Neutral hosts

- 8.6 Private cellular networks

- 8.6.1 Education

- 8.6.2 Governments & municipalities

- 8.6.3 Healthcare

- 8.6.4 Manufacturing

- 8.6.5 Military

- 8.6.6 Mining

- 8.6.7 Oil & gas

- 8.6.8 Retail & hospitality

- 8.6.9 Others

Chapter 9 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Below 2.3 GHz

- 9.3 2.3-2.6 GHz

- 9.4 3.3-3.6 GHz

- 9.5 3.55-3.7 GHz

- 9.6 3.7-3.8 GHz

- 9.7 3.8-4.2 GHz

- 9.8 4.6-4.9 GHz

- 9.9 Above 20 GHz

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Airspan

- 11.1.2 Amazon Web Services

- 11.1.3 AT&T

- 11.1.4 Charter Communications

- 11.1.5 Cisco Systems

- 11.1.6 Comcast

- 11.1.7 CommScope

- 11.1.8 Ericsson

- 11.1.9 Google

- 11.1.10 HPE

- 11.1.11 Huawei

- 11.1.12 Intel

- 11.1.13 JMA Wireless

- 11.1.14 Microsoft Azure

- 11.1.15 NEC

- 11.1.16 Nokia

- 11.1.17 Qualcomm

- 11.1.18 Samsung

- 11.1.19 Sony

- 11.1.20 T-Mobile

- 11.1.21 Verizon Communications

- 11.2 Regional Players

- 11.2.1 ZTE

- 11.2.2 Baicells

- 11.2.3 Fujitsu

- 11.3 Emerging Players / Disruptors

- 11.3.1 Altiostar

- 11.3.2 Federated Wireless

- 11.3.3 Mavenir

- 11.3.4 Radisys