|

市場調查報告書

商品編碼

1844337

筋膜間隔症候群監測設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Compartment Syndrome Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

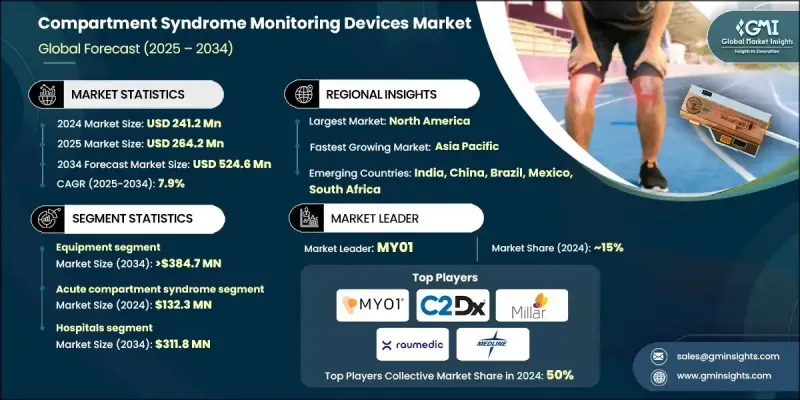

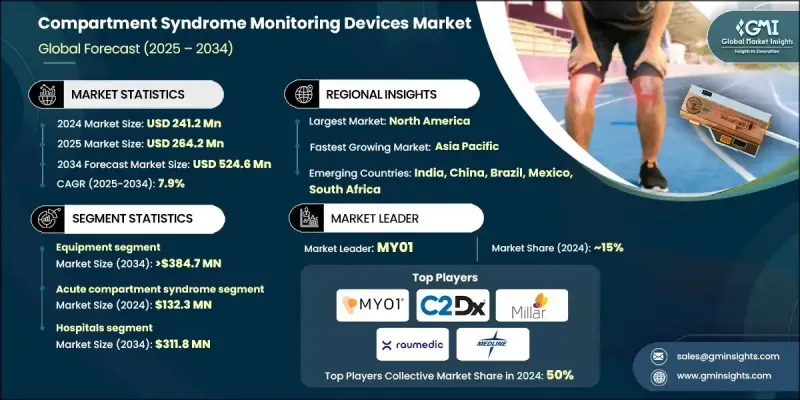

2024 年全球腔室症候群監測設備市場價值為 2.412 億美元,預計到 2034 年將以 7.9% 的複合年成長率成長至 5.246 億美元。

這一強勁成長的動力源於創傷相關損傷病例的不斷增加、對早期精準診斷的日益追求、壓力監測系統的技術突破以及醫療基礎設施的不斷擴展。筋膜室症候群監測設備旨在測量肌肉筋膜室內壓力,幫助臨床醫生檢測疾病的急性和慢性表現。這些設備對於預防肌肉筋膜室血流受限造成的不可逆組織損傷至關重要。醫務人員意識的不斷提高,加上診斷精度的提高和方便用戶使用型設備設計的改進,正在推動市場擴張。從傳統侵入式方法向智慧微創監測系統的轉變,也在推動創傷護理和外科手術中設備的普及方面發揮著重要作用。製造商不斷增加的研發投入,進一步推動了緊湊型、無線和連續監測技術的推廣,從而確保了更高的患者安全性和臨床準確性。隨著對快速診斷和患者個人化治療方案的日益重視,全球醫療保健系統對可靠監測設備的需求正在加速成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.412億美元 |

| 預測值 | 5.246億美元 |

| 複合年成長率 | 7.9% |

2024年,設備細分市場佔據了74.4%的市場佔有率,這得益於先進醫院監測系統的普及率不斷提高,以及對支援持續使用的一次性套件的需求不斷成長。醫療機構注重能夠提供一致且準確的室內壓力測量的設備,以減少臨床錯誤並改善患者預後。醫療專業人員越來越青睞專用監測系統而非手動工具,因為它們能夠提供可靠的讀數並支援關鍵決策。

2024年,腹腔間隔室症候群佔據了相當大的佔有率,預計到2034年將以8.5%的複合年成長率成長。創傷病例的增加、術後併發症的發生率的上升以及ICU入院人數的增加,都推動了對腹腔內壓監測解決方案的需求。隨著人們對延誤診斷風險的認知不斷提高,臨床醫生越來越依賴能夠及早發現腹腔內高壓並幫助指導及時干預的先進監測系統。對早期發現和臨床效率的日益重視,正在推動該領域的成長。

2024年,北美腔室症候群監測設備市場佔55.7%的市場。該地區的主導地位得益於主要製造商的強大影響力、新技術的快速應用以及強大的分銷網路。先進的醫療設施以及對創傷和重症監護服務的持續投入,將繼續支撐該地區的成長。

活躍於全球筋膜間隔症候群監測設備市場的一些主要公司包括 C2DX、Accuryn、Spiegelberg、RAUMEDIC、Sentinel Medical Technologies、Millar、Biometrix、MY01、Medline、DELTAMED 和 ConvaTec。筋膜間隔症候群監測設備市場的領先公司正在透過持續研發來優先創新,以推出下一代監測系統。許多公司正在推出提供即時資料和改進可用性的無線和微創設備。為了保持市場競爭力,製造商正在透過與醫院、創傷中心和醫療分銷商建立策略合作夥伴關係來擴大其全球影響力。一些公司還在提高設備的可負擔性並增加新興市場的可及性。專注於法規核准、臨床試驗驗證以及整合資料追蹤和連接等數位健康功能,有助於加強市場定位。此外,公司正在投資行銷活動和醫學教育,以提高人們對早期發現和診斷的認知,確保更深入的市場滲透和更高的醫療服務提供者的採用率。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 創傷和骨折發生率上升

- 技術進步

- 腹內高壓盛行率不斷上升

- 臨床醫師對筋膜間隔症候群的認知不斷提高

- 產業陷阱與挑戰

- 與侵入性測量相關的風險

- 市場機會

- 與醫院 EMR 和遠端監控平台整合

- 新興市場的成長以及創傷護理能力的不斷擴大

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 裝置

- 配件和一次性用品

第6章:市場估計與預測:依症候群類型,2021 - 2034

- 主要趨勢

- 急性筋膜室症候群

- 腹腔間隔室症候群

- 慢性骨筋膜室症候群

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 專科診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Accuryn

- Biometrix

- C2DX

- ConvaTec

- DELTAMED

- Medline

- Millar

- MY01

- RAUMEDIC

- Sentinel Medical Technologies

- Spiegelberg

The Global Compartment Syndrome Monitoring Devices Market was valued at USD 241.2 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 524.6 million by 2034.

This robust growth is fueled by rising cases of trauma-related injuries, a growing push for early and accurate diagnosis, technological breakthroughs in pressure monitoring systems, and expanding healthcare infrastructure. Compartment syndrome monitoring devices are designed to measure intracompartmental pressure in muscles, helping clinicians detect both acute and chronic forms of the condition. These devices are crucial in preventing irreversible tissue damage caused by restricted blood flow within muscle compartments. Increasing awareness among medical professionals, coupled with improvements in diagnostic precision and user-friendly device design, is contributing to market expansion. The shift from traditional invasive methods to smart, minimally invasive monitoring systems also plays a significant role in driving device adoption across trauma care and surgical settings. Rising investment in R&D by manufacturers is further enabling the rollout of compact, wireless, and continuous monitoring technologies, ensuring better patient safety and clinical accuracy. With growing emphasis on faster diagnosis and patient-specific treatment protocols, the demand for reliable monitoring devices is accelerating across global healthcare systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $241.2 Million |

| Forecast Value | $524.6 Million |

| CAGR | 7.9% |

The equipment segment accounted for 74.4% share in 2024, driven by rising adoption of advanced hospital monitoring systems and increasing demand for disposable kits that support ongoing use. Healthcare facilities focus on equipment that offers consistent and accurate intracompartmental pressure measurement to reduce clinical errors and improve patient outcomes. Medical professionals increasingly prefer dedicated monitoring systems over manual tools for their ability to deliver reliable readings and support critical decision-making.

In 2024, the abdominal compartment syndrome accounted for a significant share and is projected to grow at a CAGR of 8.5% through 2034. An uptick in trauma cases, increased occurrence of post-surgical complications, and growing ICU admissions are contributing to higher demand for intra-abdominal pressure monitoring solutions. As awareness rises around the dangers of delayed diagnosis, clinicians are relying more heavily on advanced monitoring systems that can detect elevated pressure early and help guide timely intervention. This increasing focus on early detection and clinical efficiency is pushing the segment's growth.

North America Compartment Syndrome Monitoring Devices Market held a 55.7% share in 2024. The region's dominance can be attributed to the strong presence of major manufacturers, rapid adoption of new technologies, and robust distribution networks. The availability of advanced healthcare facilities, along with consistent investment in trauma and critical care services, continues to support regional growth.

Some of the key companies active in the Global Compartment Syndrome Monitoring Devices Market include C2DX, Accuryn, Spiegelberg, RAUMEDIC, Sentinel Medical Technologies, Millar, Biometrix, MY01, Medline, DELTAMED, and ConvaTec. Leading companies in the compartment syndrome monitoring devices market are prioritizing innovation through continuous R&D to launch next-generation monitoring systems. Many are introducing wireless and minimally invasive devices that offer real-time data and improved usability. To maintain market competitiveness, manufacturers are expanding their global presence through strategic partnerships with hospitals, trauma centers, and medical distributors. Some firms are also enhancing device affordability and increasing access in emerging markets. Focused efforts on regulatory approvals, clinical trial validation, and integrating digital health features like data tracking and connectivity are helping strengthen market positioning. Moreover, firms are investing in marketing campaigns and medical education to raise awareness about early detection and diagnosis, ensuring deeper market penetration and higher adoption rates among healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Syndrome type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of traumatic injuries and fractures

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing prevalence of intra-abdominal hypertension

- 3.2.1.4 Growing awareness of compartment syndrome among clinicians

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk associated with invasive measurement

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with hospital EMR and remote monitoring platforms

- 3.2.3.2 Growth in emerging markets with expanding trauma care capacity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.3 Accessories and disposables

Chapter 6 Market Estimates and Forecast, By Syndrome Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Acute compartment syndrome

- 6.3 Abdominal compartment syndrome

- 6.4 Chronic compartment syndrome

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuryn

- 9.2 Biometrix

- 9.3 C2DX

- 9.4 ConvaTec

- 9.5 DELTAMED

- 9.6 Medline

- 9.7 Millar

- 9.8 MY01

- 9.9 RAUMEDIC

- 9.10 Sentinel Medical Technologies

- 9.11 Spiegelberg