|

市場調查報告書

商品編碼

1844322

外牆系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Exterior Wall System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

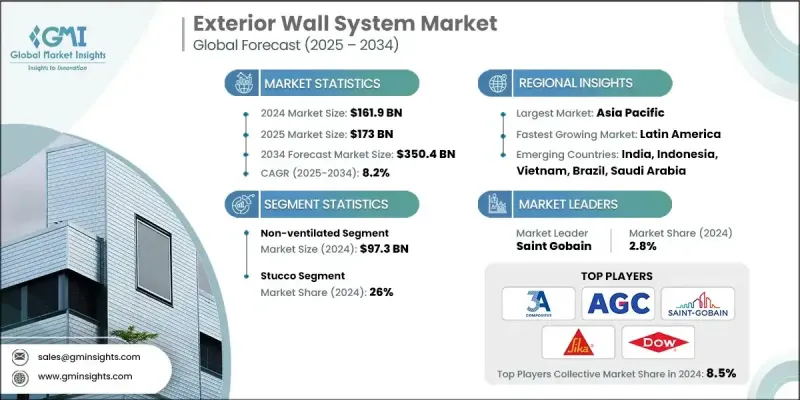

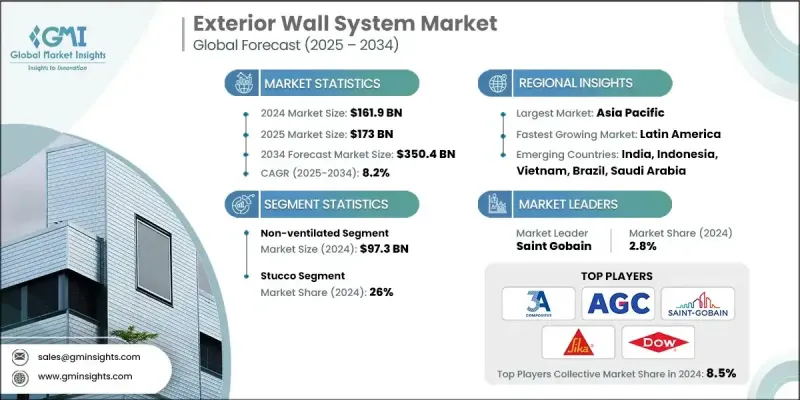

2024 年全球外牆系統市場價值為 1,619 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長至 3,504 億美元。

這一成長的動力源於對永續建築解決方案、節能建築規範和模組化建築技術日益成長的需求。對環保材料和建築實踐的日益重視正在重塑整個行業的採購決策。開發商和承包商現在優先考慮符合綠建築認證並符合範圍三排放目標的牆體系統。因此,市場正在見證保溫一體化、防火和智慧材料技術的快速創新。都市化進程的加速和勞動力短缺也導致預製牆體系統的採用率不斷提高,這提高了安裝速度,確保了更好的品質控制,並縮短了施工時間。製造商正專注於配備隔熱層、覆層和防潮層的預製面板,以滿足日益成長的性能和便利性需求。此外,外牆系統也不斷發展,包括相變材料、耐熱塗層和智慧隔熱層等節能特性。這些進步有助於創造更能源韌性的建築環境,尤其是在北美、中東和亞洲部分地區等基礎設施投資龐大的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1619億美元 |

| 預測值 | 3504億美元 |

| 複合年成長率 | 8.2% |

2024年,不通風外牆市場規模達973億美元,預計2034年將以7.3%的複合年成長率成長。不通風系統的普及主要歸功於其較低的前期成本和較低的安裝複雜性。這類牆體系統所需的組件更少,且外形更纖薄,是空間受限的城市開發項目的理想選擇。其簡化的設計也適用於外牆施工技術熟練勞動力資源有限的地區。因此,尋求經濟高效牆體解決方案的開發商在商業和住宅應用中繼續青睞不通風系統。

2024年,灰泥市場規模達421億美元,佔26%。其吸引力在於其耐用性、成本效益和多功能性。灰泥可提供持久保護,維護成本極低,並可應用於各種紋理、飾面和顏色,使建築師能夠靈活地實現各種設計目標。灰泥還可作為天然隔熱材料,有助於降低能耗並增強聲學性能。灰泥能夠有效地黏附在混凝土、磚石和木材等各種結構材料上,使其成為各種氣候條件的理想選擇,尤其適合乾燥或溫和的氣候條件。

2024年,美國外牆系統市場規模達403億美元,預計2025年至2034年期間的複合年成長率將達到7.1%。住宅、商業和政府建築的持續擴張推動了這一成長。城市發展、外商投資以及對節能建築的需求不斷成長是推動美國市場佔有率成長的關鍵因素。因此,旨在降低暖通空調負荷的系統正日益受到青睞,而整合隔熱功能的牆體解決方案正成為建築業的首選。

活躍於全球外牆系統市場的關鍵公司包括 JamesHardie、USG Corporation、Fletcher Buildings、旭硝子 (AGC)、歐文斯科寧、3A Composites Holding AG、CSR Limited、聖戈班、東麗工業有限公司、Boral Limited、SIKA Group、Kronospan Limited、拉法基豪瑞、日本玻璃板和陶氏公司。外牆系統市場的公司正在利用創新、地理擴張和永續性等多種方式來鞏固其市場地位。領先的公司正在投資研發,以開發具有整合隔熱、蒸汽控制和防火功能的模組化節能牆體系統。許多公司還引入了輕型預製解決方案,以減少現場勞動力、最佳化安裝速度並滿足城市環境的需求。策略性併購正在幫助擴大產品組合併進入新興市場。公司正在使產品與綠色建築認證和低碳材料標準保持一致,以滿足不斷變化的監管規範和具有永續發展意識的消費者的需求。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區和類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 通風

- 不通風

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 乙烯基塑膠

- 纖維水泥

- 灰泥

- 石工

- 木頭

- 其他

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- 3A Composites Holding AG

- Asahi Glass (AGC)

- Boral Limited

- CSR Limited

- Fletcher Buildings

- JamesHardie

- Lafargeholcim

- Kronospan Limited

- Nippon Glass Sheet

- Owens Corning

- Saint Gobain

- SIKA Group

- The Dow Company

- Toray Industries Ltd.

- USG Corporation

The Global Exterior Wall System Market was valued at USD 161.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 350.4 billion by 2034.

The growth is fueled by rising demand for sustainable construction solutions, energy-efficient building codes, and modular construction techniques. A growing emphasis on environmentally responsible materials and building practices is reshaping procurement decisions across the sector. Developers and contractors now prioritize wall systems that meet green building certifications and align with Scope 3 emissions objectives. As a result, the market is witnessing rapid innovation in insulation integration, fire resistance, and smart material technologies. Increasing urbanization and labor shortages have also led to higher adoption of prefabricated wall systems, which enhance installation speed, ensure better quality control, and reduce construction time. Manufacturers are focusing on prefabricated panels equipped with insulation, cladding, and vapor barriers to meet growing demands for performance and convenience. Additionally, exterior wall systems are evolving to include energy-saving features such as phase-change materials, thermal-resistant coatings, and smart insulation layers. These advancements support a more energy-resilient built environment, particularly in regions investing heavily in infrastructure, including North America, the Middle East, and parts of Asia.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161.9 Billion |

| Forecast Value | $350.4 Billion |

| CAGR | 8.2% |

In 2024, the non-ventilated exterior wall segment generated USD 97.3 billion and is expected to grow at a CAGR of 7.3% through 2034. The popularity of non-ventilated systems is largely attributed to their lower upfront costs and reduced installation complexity. These wall systems require fewer components and offer a thinner profile, which makes them ideal for space-constrained urban developments. Their simplified design also suits regions with a limited skilled labor pool for facade construction. As a result, developers seeking cost-effective yet efficient wall solutions continue to favor non-ventilated systems across commercial and residential applications.

The stucco segment generated USD 42.1 billion in 2024 and held a 26% share. Its appeal lies in its durability, cost-efficiency, and versatility. Stucco offers long-lasting protection with minimal upkeep and can be applied in various textures, finishes, and colors, giving architects the flexibility to meet a wide range of design goals. It also serves as a natural insulator, contributing to reduced energy consumption and enhanced acoustic performance. Stucco adheres effectively to different structural materials like concrete, masonry, and wood, making it ideal for diverse climates, particularly those with dry or temperate conditions.

U.S. Exterior Wall System Market was valued at USD 40.3 billion in 2024 and is estimated to grow at a CAGR of 7.1% between 2025 and 2034. The continued expansion in residential, commercial, and government construction is fueling this growth. Urban development, foreign investments, and rising demand for energy-efficient structures are key contributors to the country's growing market share. In response, systems designed to reduce HVAC loads are gaining traction, with wall solutions offering integrated thermal insulation becoming a preferred choice across building sectors.

Key companies active in the Global Exterior Wall System Market include JamesHardie, USG Corporation, Fletcher Buildings, Asahi Glass (AGC), Owens Corning, 3A Composites Holding AG, CSR Limited, Saint Gobain, Toray Industries Ltd., Boral Limited, SIKA Group, Kronospan Limited, LafargeHolcim, Nippon Glass Sheet, and The Dow Company. Companies in the exterior wall system market are leveraging a mix of innovation, geographic expansion, and sustainability to strengthen their market positions. Leading firms are investing in R&D to develop modular and energy-efficient wall systems with integrated insulation, vapor control, and fire resistance. Many are also introducing lightweight prefabricated solutions to reduce on-site labor, optimize installation speed, and meet demand in urban environments. Strategic mergers and acquisitions are helping expand product portfolios and reach into emerging markets. Firms are aligning offerings with green building certifications and low-carbon material standards to cater to evolving regulatory norms and sustainability-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type

- 2.2.2 Material

- 2.2.3 Application

- 2.2.4 Distribution Channel

- 2.2.5 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 5.1 Key trends

- 5.2 Ventilated

- 5.3 Non-ventilated

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 6.1 Key trends

- 6.2 Vinyl

- 6.3 Fiber cement

- 6.4 Stucco

- 6.5 Masonry

- 6.6 Wood

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Sq ft)

- 8.1 Key trends

- 8.2 Direct Sales

- 8.3 Indirect Sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Sq ft)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 3A Composites Holding AG

- 10.2 Asahi Glass (AGC)

- 10.3 Boral Limited

- 10.4 CSR Limited

- 10.5 Fletcher Buildings

- 10.6 JamesHardie

- 10.7 Lafargeholcim

- 10.8 Kronospan Limited

- 10.9 Nippon Glass Sheet

- 10.10 Owens Corning

- 10.11 Saint Gobain

- 10.12 SIKA Group

- 10.13 The Dow Company

- 10.14 Toray Industries Ltd.

- 10.15 USG Corporation