|

市場調查報告書

商品編碼

1844309

智慧門鈴市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Doorbell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

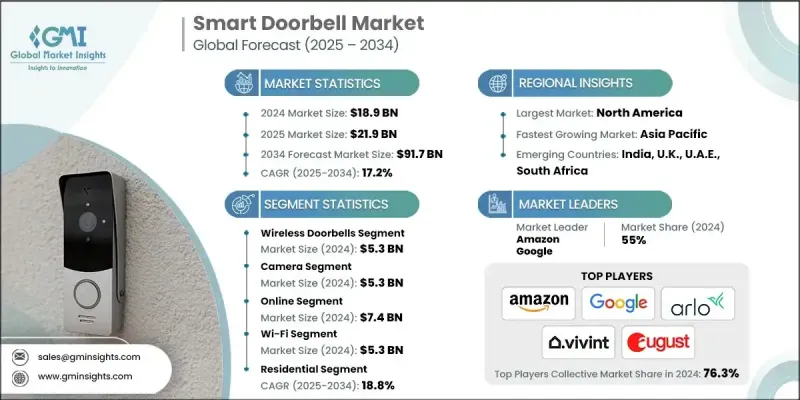

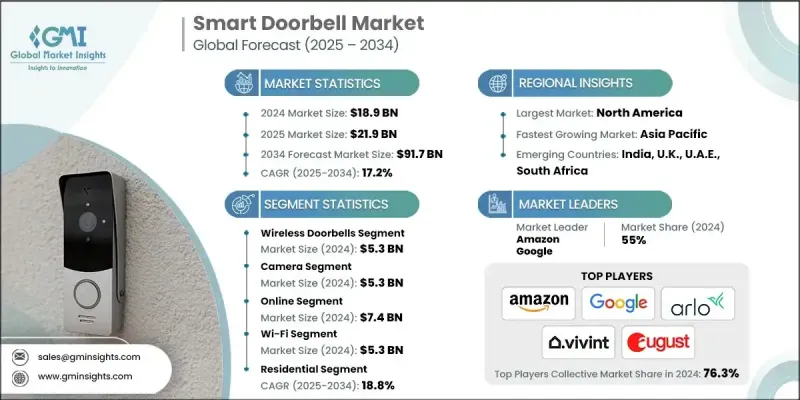

2024 年全球智慧門鈴市場價值為 189 億美元,預計到 2034 年將以 17.2% 的複合年成長率成長至 917 億美元。

這一成長源於消費者對家居安全和防盜日益成長的擔憂。許多家庭,尤其是在城市和郊區,開始使用智慧門鈴,不僅是為了監控入口,也是為了獲得內心的平靜。這些設備可以對入侵者起到明顯的威懾作用,加強人身安全和財產保護。隨著智慧家庭生態系統的發展,跨平台整合變得至關重要。消費者現在期望他們的智慧門鈴能夠與燈光、鎖和警報器等連網設備無縫協作。快速的城市化,尤其是在多單元住宅開發項目中,進一步推動了智慧門鈴的普及,因為物業經理正在尋求可擴展的解決方案來處理訪客進出和物品的配送。雖然人工智慧運動偵測和臉部辨識等功能很受歡迎,但基本款視覺門鈴在價格敏感的地區仍然很受歡迎,這促使製造商提供多樣化的產品線和價格點,以同時滿足高階和價值驅動型細分市場的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 189億美元 |

| 預測值 | 917億美元 |

| 複合年成長率 | 17.2% |

2024年,無線智慧門鈴市場規模達53億美元。其方便用戶使用的設計和便捷的安裝流程,使其對屋主和租戶都極具吸引力。無需重新佈線或專業人員協助即可安裝這些系統,這使其得到了廣泛的應用,尤其是在房屋改造領域。無線型號相容於現有的Wi-Fi網路,通常可以與智慧型手機快速配對,這進一步推動了其在成熟經濟體和新興經濟體的普及。隨著包裹竊盜、訪客驗證和門禁監控意識的不斷增強,消費者對無線型號的偏好持續增強,尤其是在人口密集的城市環境中,靈活性和安裝速度至關重要。

2024年,攝影機組件市場規模達53億美元。從高清到2K甚至4K解析度,影像品質的提升提升了使用者的期望。夜視功能、廣角視野、HDR清晰度以及盲點減少等功能正在影響使用者的購買決策。隨著消費者越來越依賴透過行動應用程式進行遠端監控,高效能攝影機已成為智慧門鈴價值主張的核心。視覺驗證在家庭安全中的作用日益增強,進一步鞏固了攝影機作為智慧門鈴系統最關鍵組成部分的地位。

2024年,北美智慧門鈴市場佔28.2%的市場佔有率,複合年成長率高達17.5%。該地區受益於智慧家居技術的早期應用以及消費者對連網設備的高度認可。隨著消費者對竊盜的擔憂日益加劇,家門口的安全成為首要考慮因素,相容平台的普及和強大的電商基礎設施推動了市場成長。高可支配收入和對物聯網技術的認知度進一步支持了該地區市場的擴張,使北美成為全球智慧門鈴應用表現最佳的地區之一。

影響全球智慧門鈴產業的關鍵參與者包括 Eufy Security(Anker Innovations)、Vivint Smart Home, Inc.、松下公司、SkyBell Technologies, Inc.、羅技(Logi Circle)、Robin Telecom Development、Netatmo(Legrand 旗下)、Honeywell 國際公司、August Home(ASSA ABLOY. Inc.、Ecobee、Zmodo、VTech Communications, Inc.、Arlo Technologies, Inc.、Google(Nest)、dbell Inc.、博世安防系統、Owlet Home LLC 和亞馬遜(Ring)。智慧門鈴產業的領先公司正專注於生態系統整合,確保與主要智慧家庭平台的無縫相容性。許多公司正在投資先進的人工智慧功能,包括臉部辨識和行為分析,使其產品脫穎而出。其他公司則透過經濟實惠的型號擴展到新興市場,這些型號在保持核心功能的同時降低了成本。我們正在與電子商務平台、電信供應商和家庭安全服務建立策略合作夥伴關係,以擴大覆蓋範圍和分銷範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 無線和電池供電的智慧門鈴迅速普及

- 與語音助理和智慧家居生態系統(Alexa、Google、Apple HomeKit、Matter)整合

- 電子商務成長與送貨上門安全需求

- 城市安全問題與防盜

- 智慧城市專案和多住戶單位的物業管理應用

- 產業陷阱與挑戰

- 隱私和監管障礙

- 連線限制

- 市場機會

- 採用 Matter 和 Thread 標準

- 人工智慧驅動的邊緣分析

- 擴展到多住宅單元和商業設施

- 與更廣泛的智慧安全解決方案捆綁

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 公司簡介 市佔率分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 市場集中度分析

- 關鍵參與者的競爭基準化分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理分佈比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 有線智慧門鈴

- 無線門鈴

- 混合門鈴

- 太陽能門鈴

- 其他

第6章:市場估計與預測:按配銷通路,2021-2034 年

- 線上

- 離線

第7章:市場估計與預測:按組件,2021 - 2034

- 相機

- 運動感應器

- 麥克風和揚聲器

- 鐘聲/鈴聲模組

- 其他

第8章:市場估計與預測:按連結性,2021 - 2034 年

- 無線上網

- 線索/事項

- Zigbee

- 蜂巢

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034

- 住宅

- 商業的

- 多住戶單元(MDU)

- 工業的

- 公共/政府設施

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 魚子

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 羅拉塔姆

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 羅馬

第 11 章:公司簡介

- Amazon (Ring)

- Arlo Technologies, Inc.

- August Home

- Bosch Security Systems

- dbell Inc.

- Ecobee

- Eufy Security

- Google (Nest)

- Honeywell International Inc.

- Logitech

- Netatmo

- Owlet Home LLC

- Panasonic Corporation

- Remo+ (Olive & Dove)

- Reolink

- Robin Telecom Development

- SkyBell Technologies, Inc.

- VTech Communications, Inc.

- Vivint Smart Home, Inc.

- Wyze Labs, Inc.

- Zmodo

- Zumimall

The Global Smart Doorbell Market was valued at USD 18.9 billion in 2024 and is estimated to grow at a CAGR of 17.2% to reach USD 91.7 billion by 2034.

This growth is fueled by increasing consumer concerns around home security and theft prevention. Many households, especially in urban and suburban regions, are turning to smart doorbells not only for monitoring entry points but also for gaining peace of mind. These devices serve as visible deterrents to intruders, reinforcing both personal safety and property protection. As smart home ecosystems evolve, integration across platforms becomes essential. Consumers now expect their smart doorbells to function effortlessly with connected devices like lights, locks, and alarms. Rapid urbanization, particularly in multi-unit residential developments, is further boosting adoption as property managers seek scalable solutions to handle visitor access and deliveries. While features like AI motion detection and facial recognition are in demand, basic video doorbells remain popular in price-sensitive regions, prompting manufacturers to diversify product tiers and price points to cater to both premium and value-driven segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.9 Billion |

| Forecast Value | $91.7 Billion |

| CAGR | 17.2% |

In 2024, the wireless smart doorbells segment generated USD 5.3 billion. Their user-friendly design and easy installation process make them appealing to both homeowners and renters. The ability to set up these systems without rewiring or professional help contributes to their widespread use, especially in retrofit applications. Wireless models are compatible with existing Wi-Fi networks and typically offer quick pairing with smartphones, further boosting adoption in both established and emerging economies. Growing awareness about package theft, visitor verification, and front-door surveillance continues to drive consumer preference toward wireless models, particularly in dense urban settings where flexibility and speed of installation are essential.

The camera component segment reached USD 5.3 billion in 2024. Advancements in image quality, from HD to 2K and even 4K resolution, have raised user expectations. Features such as improved night vision, wide-angle views, HDR clarity, and reduced blind spots are shaping purchase decisions. As consumers increasingly rely on remote monitoring through mobile apps, high-performance cameras have become central to the value proposition of smart doorbells. The growing role of visual verification in home security continues to cement the camera as the most crucial part of smart doorbell systems.

North America Smart Doorbell Market held 28.2% share in 2024, growing at a robust CAGR of 17.5%. This region benefits from early adoption of smart home technologies and a high level of consumer readiness for connected devices. The availability of compatible platforms and strong e-commerce infrastructure fuels growth as consumers prioritize doorstep security amid rising concerns over theft. High disposable income and awareness of IoT technologies further support market expansion in this region, making North America one of the top-performing regions globally for smart doorbell adoption.

Key players shaping the Global Smart Doorbell Industry include Eufy Security (Anker Innovations), Vivint Smart Home, Inc., Panasonic Corporation, SkyBell Technologies, Inc., Logitech (Logi Circle), Robin Telecom Development, Netatmo (part of Legrand), Honeywell International Inc., August Home (part of ASSA ABLOY), Reolink, Remo+ (Olive & Dove), Zumimall, Wyze Labs, Inc., Ecobee, Zmodo, VTech Communications, Inc., Arlo Technologies, Inc., Google (Nest), dbell Inc., Bosch Security Systems, Owlet Home LLC, and Amazon (Ring). Leading companies in the smart doorbell industry are focusing on ecosystem integration by ensuring seamless compatibility with major smart home platforms. Many are investing in advanced AI capabilities, including facial recognition and behavioral analytics, to differentiate their offerings. Others are expanding into emerging markets with budget-friendly models that maintain core functionality while reducing costs. Strategic partnerships with e-commerce platforms, telecom providers, and home security services are being formed to expand reach and distribution.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1. Material Type

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 End use Industry

- 2.2.5 Region

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid adoption of wireless and battery-powered smart doorbells

- 3.2.1.2 Integration with voice assistants and smart home ecosystems (Alexa, Google, Apple HomeKit, Matter)

- 3.2.1.3 E-commerce growth and doorstep delivery security needs

- 3.2.1.4 Urban safety concerns and burglary prevention

- 3.2.1.5 Smart city projects and property management adoption in MDUs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and regulatory barriers

- 3.2.2.2 Connectivity limitations

- 3.2.3 Market Opportunities

- 3.2.3.1 Adoption of Matter and Thread standards

- 3.2.3.2 AI-powered edge analytics

- 3.2.3.3 Expansion into Multi-Dwelling Units and commercial facilities

- 3.2.3.4 Bundling with broader smart security solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.4. Latin America

- 4.2.5. MEA

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034

- 5.1 Wired Smart Doorbells

- 5.2 Wireless Doorbells

- 5.3 Hybrid Doorbells

- 5.4 Solar-Powered Doorbells

- 5.5 Others

Chapter 6 Market estimates & forecast, By Distribution Channel, 2021 - 2034

- 6.1 Online

- 6.2 Offline

Chapter 7 Market estimates & forecast, By Component, 2021 - 2034

- 7.1 Camera

- 7.2 Motion Sensor

- 7.3 Microphone & Speaker

- 7.4 Chime / Bell Module

- 7.5 Others

Chapter 8 Market estimates & forecast, By Connectivity, 2021 - 2034

- 8.1 Wi-Fi

- 8.2 Thread / Matter

- 8.3 Zigbee

- 8.4 Cellular

- 8.5 Others

Chapter 9 Market estimates & forecast, By End use, 2021 - 2034

- 8.6 Residential

- 8.7 Commercial

- 8.8 Multi-Dwelling Units (MDUs)

- 8.9 Industrial

- 8.10 Public / Government Facilities

- 8.11 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 ROE

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 RoAPAC

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 RoLATAM

- 10.6 Middle East & Africa

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

- 10.6.4 RoMEA

Chapter 11 Company Profile

- 11.1 Amazon (Ring)

- 11.2 Arlo Technologies, Inc.

- 11.3 August Home

- 11.4 Bosch Security Systems

- 11.5 dbell Inc.

- 11.6 Ecobee

- 11.7 Eufy Security

- 11.8 Google (Nest)

- 11.9 Honeywell International Inc.

- 11.10 Logitech

- 11.11 Netatmo

- 11.12 Owlet Home LLC

- 11.13 Panasonic Corporation

- 11.14 Remo+ (Olive & Dove)

- 11.15 Reolink

- 11.16 Robin Telecom Development

- 11.17 SkyBell Technologies, Inc.

- 11.18 VTech Communications, Inc.

- 11.19 Vivint Smart Home, Inc.

- 11.20 Wyze Labs, Inc.

- 11.21 Zmodo

- 11.22 Zumimall