|

市場調查報告書

商品編碼

1844301

羽毛加工設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Feather Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

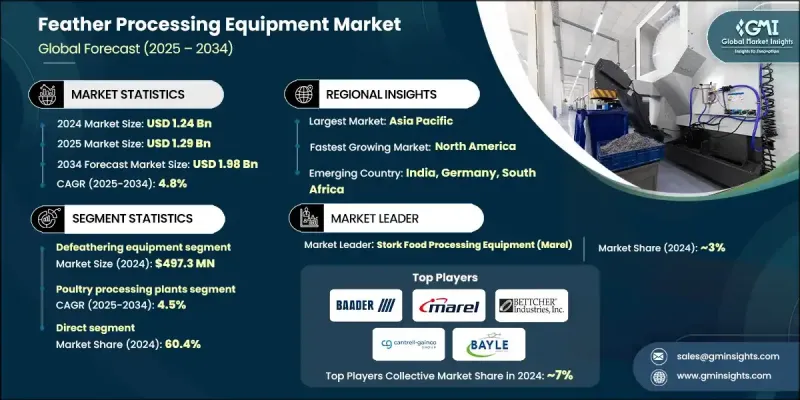

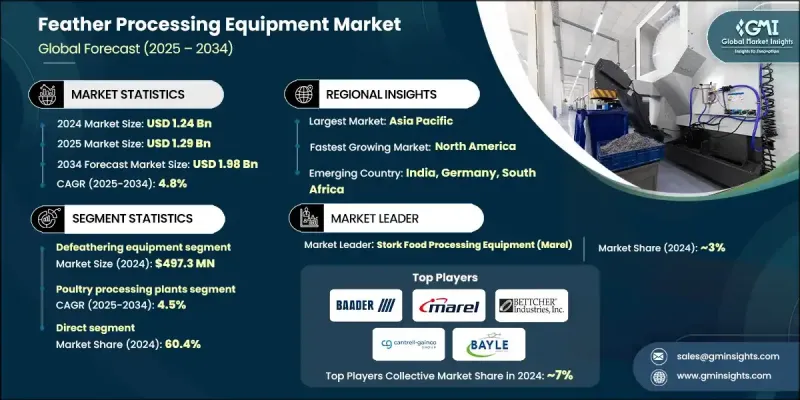

2024 年全球羽毛加工設備市場價值為 12.4 億美元,預計將以 4.8% 的複合年成長率成長,到 2034 年達到 19.8 億美元。

人們日益重視環保的廢棄物管理實踐,這大大推動了羽毛回收技術的應用。據估計,每年約有800萬噸家禽羽毛產生,這為永續利用提供了重大機會。這些曾經被當作廢物丟棄的羽毛,如今正被重新利用,製成肥料、紡織品和動物飼料等利潤豐厚的產品。這種轉變有助於減少環境影響,同時為企業開啟新的收入來源。隨著永續發展目標和更嚴格的環保合規標準日益凸顯,製造商正在增加對下一代羽毛加工設備的投資。這些發展正在重塑市場格局,使永續性成為成長的核心驅動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12.4億美元 |

| 預測值 | 19.8億美元 |

| 複合年成長率 | 4.8% |

持續的技術進步正在改變羽毛加工方式。自動化程度的提高和節能機械的出現正在提升生產力、改善衛生標準並簡化操作流程。日益嚴格的廢棄物處理法規促使家禽加工企業採用更有效、更環保的解決方案。越來越多的家禽加工廠正在將羽毛加工單元與更廣泛的提煉系統整合。這種轉變推動了對模組化、易於安裝的機器的需求,這些機器可以無縫融入現有的工作流程,從而提高操作靈活性和效率。

2024年,除毛設備市場規模達4.973億美元,預計2025年至2034年期間的複合年成長率將達到4.4%。家禽產品需求激增,尤其是在新興經濟體,促使加工廠實現自動化營運,減少對人工的依賴。除毛機在禽肉加工早期階段,對於實現高產量、保持清潔度和確保均勻性起著至關重要的作用。隨著生產規模的擴大,對快速衛生的除毛解決方案的需求也日益迫切。

家禽加工設施領域在2024年佔據52.9%的市場佔有率,預計到2034年將以4.5%的複合年成長率成長。隨著全球禽肉消費量持續成長,加工商正在擴大產能並升級現有系統,以經濟高效、衛生且永續的方式管理羽毛副產品。隨著工廠致力於最佳化每個操作步驟,能夠清潔、脫毛、乾燥和包裝羽毛的整合系統的需求日益成長。

2024年,美國羽毛加工設備市場規模達2.664億美元,預計2025年至2034年的複合年成長率為4.7%。美國羽毛加工產業受益於強勁的國內家禽業,該產業由高消費率和嚴格的監管框架支撐。各企業正大力投資先進、節能和自動化設備,以符合食品安全法規、環境政策和生產力目標。這些發展使美國在現代羽毛加工技術的採用方面處於領先地位。

影響羽毛加工設備市場競爭格局的關鍵參與者包括 Kuiper & Zonen、Taizy Machinery、Bayle、TALSA、Bettcher Industries、Cantrell-Gainco、MAJA、LINCO、Baader Group、Meyn、Scott Automation、Banss、Stork (Marel)、Hubbard Systems 和 Ruvii。羽毛加工設備市場的公司正在採取多種策略來鞏固其市場地位。主要重點是透過自動化和能源效率進行產品創新,以滿足不斷發展的永續性和監管標準。許多參與者正在透過模組化、即插即用的解決方案擴展其產品線,這些解決方案可輕鬆整合到現有的處理系統中。與家禽加工廠的合作和長期服務協議正在幫助公司獲得經常性收入來源。策略性併購也被用來加強技術能力和擴大地理覆蓋範圍。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 家禽業快速擴張

- 對永續廢棄物管理的需求增加

- 羽毛副產品需求不斷成長

- 產業陷阱與挑戰

- 初期投資成本高

- 維護和技術專業知識

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 除毛設備

- 清洗乾燥設備

- 研磨和切割設備

- 分類和分級設備

- 壓制和捆紮設備

- 乾燥和脫水系統

- 包裝和搬運設備

- 其他(滅菌消毒系統、鼓風機、除塵等)

第6章:市場估計與預測:按用途,2021 - 2034 年

- 主要趨勢

- 回收羽毛

- 處女羽毛

第7章:市場估計與預測:依產能,2021 - 2034

- 主要趨勢

- 高達 500 公斤/小時

- 500-2,500公斤/小時

- 高於2500公斤/小時

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 家禽

- 雞

- 鵝

- 鴨子

- 其他

- 孔雀

- 其他(鴕鳥等)

第9章:市場估計與預測:依最終用途產業,2021 - 2034 年

- 主要趨勢

- 家禽加工廠

- 家禽飼養

- 屠宰

- 羽絨和羽毛

- 衣服

- 寢具

- 羽毛粉生產商

- 藝術與手工藝

- 其他(肥料、建築隔熱、過濾系統等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Baader Group

- Banss

- Bayle

- Bettcher Industries

- Cantrell-Gainco

- Hubbard Systems

- Kuiper & Zonen

- LINCO

- MAJA

- Meyn

- Ruvii

- Scott Automation

- Stork (Marel)

- TALSA

- Taizy Machinery

The Global Feather Processing Equipment Market was valued at USD 1.24 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.98 billion by 2034.

Growing emphasis on eco-friendly waste management practices is significantly driving the adoption of feather recycling technologies. According to estimates, around 8 million metric tons of poultry feathers are generated each year, presenting a major opportunity for sustainable utilization. These feathers, once discarded as waste, are now being repurposed into profitable products such as fertilizers, textiles, and animal feed. This shift is helping to cut down environmental impact while opening new revenue streams for businesses. As sustainability targets and stricter environmental compliance standards become more prominent, manufacturers are increasing investments in next-gen feather processing equipment. These developments are reshaping the market landscape, making sustainability a central driver of growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.24 Billion |

| Forecast Value | $1.98 Billion |

| CAGR | 4.8% |

Ongoing technological improvements are transforming how feather processing is carried out. Enhanced automation and energy-efficient machinery are boosting productivity, improving hygiene standards, and streamlining operations. Tighter regulations related to waste disposal are prompting poultry processors to adopt more effective and environmentally conscious solutions. A growing number of poultry processing plants are now integrating feather processing units with broader rendering systems. This shift is fueling demand for modular, easy-to-install machines that seamlessly fit into existing workflows, boosting operational flexibility and efficiency.

The defeathering equipment segment was valued at USD 497.3 million in 2024 and is forecasted to grow at a CAGR of 4.4% between 2025 and 2034. Surging demand for poultry products, particularly in emerging economies, is prompting processing facilities to automate their operations and reduce their reliance on manual labor. Defeathering machines play a critical role in achieving high throughput, maintaining cleanliness, and ensuring uniformity during the early stages of poultry processing. As production scales up, the need for fast and hygienic defeathering solutions becomes more essential.

The poultry processing facilities segment held a 52.9% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. With poultry meat consumption continuing to rise globally, processors are expanding capacity and upgrading existing systems to manage feather by-products in a cost-effective, sanitary, and sustainable manner. Integrated systems that can clean, defeather, dry, and package feathers are seeing rising demand as plants aim to optimize every step of the operation.

United States Feather Processing Equipment Market was valued at USD 266.4 million in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2034. The U.S. feather processing industry benefits from a strong domestic poultry sector supported by high consumption rates and stringent regulatory frameworks. Companies are investing heavily in advanced, energy-efficient, and automated equipment to align with food safety mandates, environmental policies, and productivity goals. These developments are positioning the U.S. as a frontrunner in the adoption of modern feather processing technologies.

Key players shaping the competitive landscape of the Feather Processing Equipment Market include Kuiper & Zonen, Taizy Machinery, Bayle, TALSA, Bettcher Industries, Cantrell-Gainco, MAJA, LINCO, Baader Group, Meyn, Scott Automation, Banss, Stork (Marel), Hubbard Systems, and Ruvii. Companies in the Feather Processing Equipment Market are adopting several strategies to reinforce their market position. A primary focus is on product innovation through automation and energy efficiency to meet evolving sustainability and regulatory standards. Many players are expanding their product lines with modular, plug-and-play solutions that integrate easily into existing processing systems. Collaborations with poultry processing plants and long-term service agreements are helping companies secure recurring revenue streams. Strategic mergers and acquisitions are also being used to strengthen technical capabilities and broaden geographic reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Usage

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion of poultry industry

- 3.2.1.2 Increased demand for sustainable waste management

- 3.2.1.3 Rising demand for feather-based by-products

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and technical expertise

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Defeathering equipment

- 5.3 Cleaning and drying equipment

- 5.4 Grinding & cutting equipment

- 5.5 Sorting & grading equipment

- 5.6 Pressing & bunching equipment

- 5.7 Drying and dehydration systems

- 5.8 Packaging and handling equipment

- 5.9 Others (sterilization and disinfection systems, blowers, dusting, etc.)

Chapter 6 Market Estimates & Forecast, By Usage, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Recycling feathers

- 6.3 Virgin feathers

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Upto 500 kg/hr

- 7.3 500-2,500 kg/hr

- 7.4 Above 2.500 kg/hr

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Poultry

- 8.3 Chicken

- 8.4 Goose

- 8.5 Duck

- 8.6 Others

- 8.7 Peacock

- 8.8 Others (ostrich, etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Poultry processing plants

- 9.3 Poultry rearing

- 9.4 Slaughtering

- 9.5 Down & feather

- 9.6 Clothing

- 9.7 Bedding products

- 9.8 Feather meal producers

- 9.9 Arts & crafts

- 9.10 Others (fertilizer, construction insulation, filtration system, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Baader Group

- 12.2 Banss

- 12.3 Bayle

- 12.4 Bettcher Industries

- 12.5 Cantrell-Gainco

- 12.6 Hubbard Systems

- 12.7 Kuiper & Zonen

- 12.8 LINCO

- 12.9 MAJA

- 12.10 Meyn

- 12.11 Ruvii

- 12.12 Scott Automation

- 12.13 Stork (Marel)

- 12.14 TALSA

- 12.15 Taizy Machinery