|

市場調查報告書

商品編碼

1844293

盤管鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Coil Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

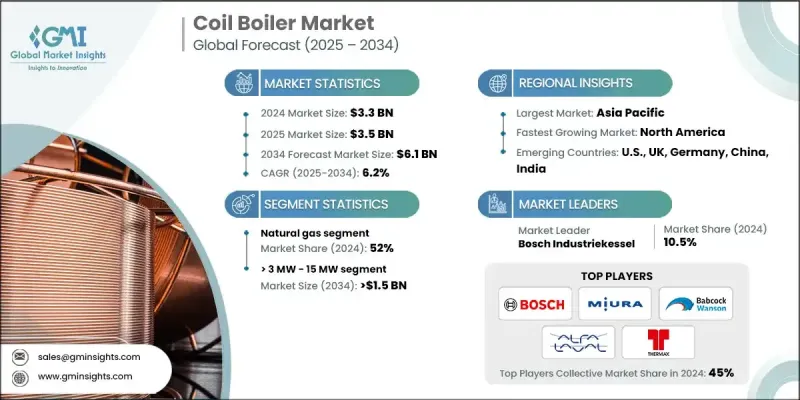

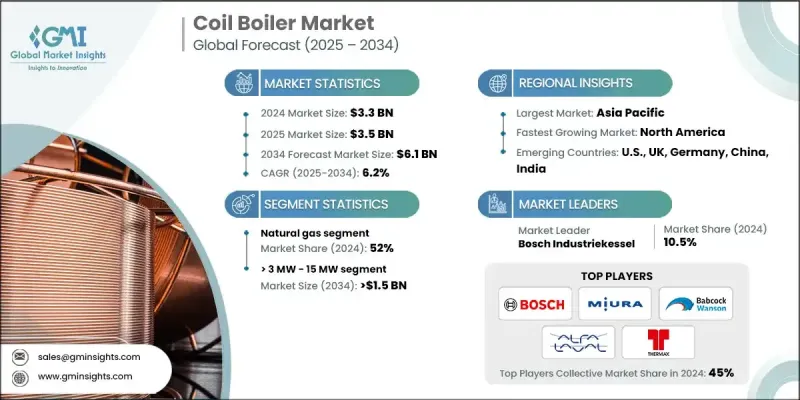

2024 年全球盤管鍋爐市場價值為 33 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長至 61 億美元。

這一成長軌跡反映出業界對緊湊、高效、快速反應的鍋爐系統日益成長的偏好。隨著對節能解決方案的需求不斷成長以及環境法規日益嚴格,企業正轉向能夠縮短啟動時間並最佳化燃料利用率的盤管鍋爐系統。這些系統尤其適合需要穩定且靈活地產生蒸氣或熱水的行業。連續盤管設計最大限度地減少了水的儲存並加快了熱傳遞速度,使盤管鍋爐成為傳統鍋爐經濟高效且節省空間的替代方案。燃燒系統、排放控制和模組化鍋爐配置的技術進步也正在加速各工業領域的應用。移動式和模組化裝置能夠靈活部署,以適應臨時和遠端操作,而自動化和智慧控制系統正成為滿足效能和合規性需求的不可或缺的功能。在北美,尤其是美國,現代化舉措和環境標準正在推動各行各業使用更先進的低排放鍋爐解決方案升級傳統設備,從而增強了盤管鍋爐市場在預測期內的成長勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 6.2% |

盤管鍋爐旨在透過連續盤管式熱交換器產生蒸汽或熱水,從而實現快速、直接的熱傳遞。與管殼式系統不同,盤管式系統無需大量水,從而縮短啟動時間並提高運作穩定性。盤管結構確保水流經蛇形路徑,直接接觸熱源,使整個過程更快、更節能。隨著各行各業致力於在不擴大設施佔地面積的情況下最佳化生產,這些緊湊型模組化系統的吸引力正在穩步成長。技術進步持續塑造這個市場,尤其是在燃燒控制、低氮氧化物排放以及提高營運效率和合規性的自動化方面的創新。

2024年,天然氣盤管鍋爐系統市場佔有52%的佔有率,預計2034年將以5.8%的複合年成長率成長。這些系統因其能夠滿足性能要求且對環境影響最小而越來越受到青睞。燃氣盤管鍋爐以其高熱效率和處理波動負荷的能力而聞名,廣泛應用於尋求更清潔、響應更快的熱源的行業。與傳統鍋爐相比,燃氣盤管鍋爐的排放量更低,使其成為注重永續性和合規性的企業的良好選擇。

2024年,額定功率小於等於290千瓦的盤管鍋爐市場規模達3.3億美元。這些低容量機組因其易於安裝、快速升溫以及緊湊的設計而備受青睞。空間受限或供熱需求動態變化的產業往往青睞此類設備,因為它兼具能源性能和占地面積效率。隨著生產環境的演變,對這些小容量系統的需求持續成長,尤其是在尋求可擴展且可靠解決方案的營運商群體中。

2024年,美國盤管鍋爐市場佔據84.3%的市場佔有率,產值達5.342億美元,這得益於其強大的工業基礎、積極的基礎設施現代化建設以及更嚴格的排放標準。日益增強的節能意識和更嚴格的合規法規,促使製造商和工廠營運商採用先進的盤管鍋爐系統。從過時的高排放鍋爐轉向更清潔、更有效率、能夠滿足新性能基準的鍋爐型號的轉變,進一步推動了市場擴張。

盤管鍋爐市場匯聚了許多行業領導企業和新興企業,包括 Bryan Steam、Bosch Industriekessel、Thermax、Babcock Wanson、Hurst Boiler & Welding、Ross Boilers、ALFA LAVAL、Unical AG、Vapor Power International、PARKER BOILER、Kawasaki Thermal、ICIcal AG、Vapor Power International、PARKER BOILER、Kawasaki Thermal、ICIa America、Cochran、CERTUSS、Ascentec、Maxtherm Boilers、Thermodyne Boilers、HTT ENERGY、Devotion Boiler、Rentech Boiler System、Forbes Marshall、Cannon Bono、Heat11、GekaKonus、Industrial Boilers 和 Clayton Industries。為了鞏固市場地位,盤管鍋爐產業的企業正在採取多項前瞻性策略。持續投入研發仍然是重中之重,重點是提高能源效率、減少排放和整合智慧控制系統。許多參與者正在擴大其產品組合以滿足不同的容量需求和負載情況。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 盤管鍋爐成本結構分析

- 價格趨勢分析(美元/單位)

- 按地區

- 按容量

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

- 投資分析及未來展望

- 策略情境規劃

- 投資機會評估

- 策略夥伴關係和聯盟機會

- 市場進入策略框架

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按燃料,2021 - 2034

- 主要趨勢

- 天然氣

- 油

- 電的

- 再生能源

- 雙燃料

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 熱水

- 蒸氣

- 熱流體

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 食品和飲料

- 化學

- 製藥和醫院

- 紙漿和造紙

- 金屬加工

- 紡織品

- 油脂精煉

- 其他

第8章:市場規模及預測:依產能,2021 - 2034

- 主要趨勢

- ≤ 290 千瓦

- > 290 千瓦 - 1.5 兆瓦

- > 1.5 兆瓦 - 3 兆瓦

- > 3 兆瓦 - 15 兆瓦

- > 15 兆瓦

第9章:市場規模及預測:按壓力,2021 - 2034

- 主要趨勢

- ≤ 10 bar

- > 10 巴 - 25 巴

- > 25 巴

第 10 章:市場規模與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 格林菲爾德

- 布朗菲爾德

第 11 章:市場規模與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 挪威

- 丹麥

- 芬蘭

- 愛爾蘭

- 烏克蘭

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 北韓

- 澳洲

- 印尼

- 巴基斯坦

- 孟加拉

- 越南

- 台灣

- 香港

- 哈薩克

- 泰國

- 馬來西亞

- 新加坡

- 烏茲別克

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 肯亞

- 摩洛哥

- 南非

- 突尼西亞

- 阿爾及利亞

- 土耳其

- 阿拉伯共和國

- 約旦

- 伊拉克

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

- 哥倫比亞

第 12 章:公司簡介

- ALFA LAVAL

- Ascentec GmbH

- Babcock Wanson

- Bosch Industriekessel

- Bryan Steam

- Cannon Bono SpA

- CERTUSS

- Clayton Industries

- Cochran

- Devotion Boiler

- Forbes Marshall

- Fulton

- GekaKonus

- Heat11

- HTT ENERGY GMBH

- Hurst Boiler & Welding Co.

- ICI Caldaie

- Industrial Boilers Ltd.

- Kawasaki Thermal Engineering Co., Ltd.

- Maxtherm Boilers

- Miura America Co.

- NTI Boilers

- PARKER BOILER

- Rentech Boiler System

- Ross Boilers

- SAZ BOILERS

- Thermax

- Thermodyne Boilers

The Global Coil Boiler Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 6.1 billion by 2034.

This growth trajectory reflects the industry's increasing preference for compact, efficient, and quick-response boiler systems. With rising demand for energy-efficient solutions and stricter environmental regulations, businesses are shifting toward coil boiler systems that reduce startup time and optimize fuel usage. These systems are particularly well-suited for industries requiring consistent but flexible steam or hot water generation. The continuous coil design minimizes water storage and speeds up heat transfer, making coil boilers a cost-effective and space-saving alternative to traditional models. Technological advancements in combustion systems, emissions control, and modular boiler configurations are also accelerating adoption across various industrial sectors. Mobile and modular units are enabling flexible deployment for temporary and remote operations, while automation and intelligent control systems are becoming integral features to meet performance and compliance needs. In North America, especially the U.S., modernization initiatives and environmental standards are pushing industries to upgrade legacy equipment with more advanced, low-emission boiler solutions, reinforcing the coil boiler market's momentum over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 6.2% |

A coil boiler is designed to produce steam or hot water through a continuous coil heat exchanger that facilitates fast, direct heat transfer. Unlike shell-and-tube systems, the coil-based approach eliminates the need for large water volumes, allowing quicker start-up times and more consistent operation. The coil configuration ensures water flows through a serpentine path exposed directly to a heat source, making the entire process faster and more energy-efficient. As industries aim to optimize production without expanding facility footprints, the appeal of these compact and modular systems is growing steadily. Technological enhancements continue to shape this market, particularly innovations focused on combustion control, low-NOx emissions, and automation for operational efficiency and regulatory compliance.

The natural gas-fired coil boiler systems segment held a 52% share in 2024 and is forecasted to grow at a CAGR of 5.8% through 2034. These systems are increasingly selected for their ability to meet performance requirements with minimal environmental impact. Known for their high thermal efficiency and ability to handle fluctuating loads, gas-fired coil boilers are widely adopted in industries seeking a cleaner, more responsive heat source. The lower emissions profile compared to conventional boilers makes them a favorable option for businesses prioritizing sustainability and regulatory alignment.

In 2024, the coil boiler market for systems rated <= 290 kW generated USD 330 million. These lower-capacity units are valued for their ease of installation, fast heat-up capabilities, and compact design. Industries with constrained space or dynamic heat demands tend to favor this segment for its balance of energy performance and footprint efficiency. As production environments evolve, demand for these smaller capacity systems continues to rise, especially among operators looking for scalable and reliable solutions.

U.S. Coil Boiler Market held 84.3% share in 2024, generating USD 534.2 million driven by a strong industrial base, aggressive infrastructure modernization efforts, and tighter emission standards. Growing awareness around energy conservation and stricter compliance regulations are motivating manufacturers and plant operators to adopt advanced coil boiler systems. Market expansion is further supported by the shift from outdated, high-emission boilers to cleaner, more efficient models capable of meeting new performance benchmarks.

The coil boiler market features a broad mix of industry leaders and emerging players, including Bryan Steam, Bosch Industriekessel, Thermax, Babcock Wanson, Hurst Boiler & Welding, Ross Boilers, ALFA LAVAL, Unical AG, Vapor Power International, PARKER BOILER, Kawasaki Thermal Engineering, ICI Caldaie, NTI Boilers, Miura America, Cochran, CERTUSS, Ascentec, Maxtherm Boilers, Thermodyne Boilers, HTT ENERGY, Devotion Boiler, Rentech Boiler System, Forbes Marshall, Cannon Bono, Heat11, GekaKonus, Industrial Boilers, and Clayton Industries. To strengthen their market position, companies in the coil boiler industry are adopting several forward-focused strategies. Continuous investment in R&D remains a priority, with a focus on improving energy efficiency, reducing emissions, and integrating intelligent control systems. Many players are expanding their product portfolios to cater to varying capacity needs and load profiles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of coil boilers

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future prospects

- 3.11 Strategic scenario planning

- 3.12 Investment opportunity assessment

- 3.13 Strategic partnership & alliance opportunities

- 3.14 Market entry strategy framework

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Electric

- 5.5 Renewables

- 5.6 Dual fuel

- 5.7 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Hot water

- 6.3 Steam

- 6.4 Thermal fluid

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Chemical

- 7.4 Pharmaceutical & hospital

- 7.5 Pulp & paper

- 7.6 Metal processing

- 7.7 Textile

- 7.8 Oil & fats refining

- 7.9 Others

Chapter 8 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 ≤ 290 kW

- 8.3 > 290 kW - 1.5 MW

- 8.4 > 1.5 MW - 3 MW

- 8.5 > 3 MW - 15 MW

- 8.6 > 15 MW

Chapter 9 Market Size and Forecast, By Pressure, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 ≤ 10 bar

- 9.3 > 10 bar - 25 bar

- 9.4 > 25 bar

Chapter 10 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 Greenfield

- 10.3 Brownfield

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 France

- 11.3.2 UK

- 11.3.3 Poland

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Austria

- 11.3.7 Germany

- 11.3.8 Sweden

- 11.3.9 Norway

- 11.3.10 Denmark

- 11.3.11 Finland

- 11.3.12 Ireland

- 11.3.13 Ukraine

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Philippines

- 11.4.4 Japan

- 11.4.5 South Korea

- 11.4.6 North Korea

- 11.4.7 Australia

- 11.4.8 Indonesia

- 11.4.9 Pakistan

- 11.4.10 Bangladesh

- 11.4.11 Vietnam

- 11.4.12 Taiwan

- 11.4.13 Hong Kong

- 11.4.14 Kazakhstan

- 11.4.15 Thailand

- 11.4.16 Malaysia

- 11.4.17 Singapore

- 11.4.18 Uzbekistan

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 Iran

- 11.5.3 UAE

- 11.5.4 Egypt

- 11.5.5 Nigeria

- 11.5.6 Kenya

- 11.5.7 Morocco

- 11.5.8 South Africa

- 11.5.9 Tunisia

- 11.5.10 Algeria

- 11.5.11 Turkey

- 11.5.12 Arab Republic

- 11.5.13 Jordan

- 11.5.14 Iraq

- 11.6 Latin America

- 11.6.1 Argentina

- 11.6.2 Chile

- 11.6.3 Brazil

- 11.6.4 Colombia

Chapter 12 Company Profiles

- 12.1 ALFA LAVAL

- 12.2 Ascentec GmbH

- 12.3 Babcock Wanson

- 12.4 Bosch Industriekessel

- 12.5 Bryan Steam

- 12.6 Cannon Bono S.p.A.

- 12.7 CERTUSS

- 12.8 Clayton Industries

- 12.9 Cochran

- 12.10 Devotion Boiler

- 12.11 Forbes Marshall

- 12.12 Fulton

- 12.13 GekaKonus

- 12.14 Heat11

- 12.15 HTT ENERGY GMBH

- 12.16 Hurst Boiler & Welding Co.

- 12.17 ICI Caldaie

- 12.18 Industrial Boilers Ltd.

- 12.19 Kawasaki Thermal Engineering Co., Ltd.

- 12.20 Maxtherm Boilers

- 12.21 Miura America Co.

- 12.22 NTI Boilers

- 12.23 PARKER BOILER

- 12.24 Rentech Boiler System

- 12.25 Ross Boilers

- 12.26 SAZ BOILERS

- 12.27 Thermax

- 12.28 Thermodyne Boilers