|

市場調查報告書

商品編碼

1844276

DTP 疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測DTP Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

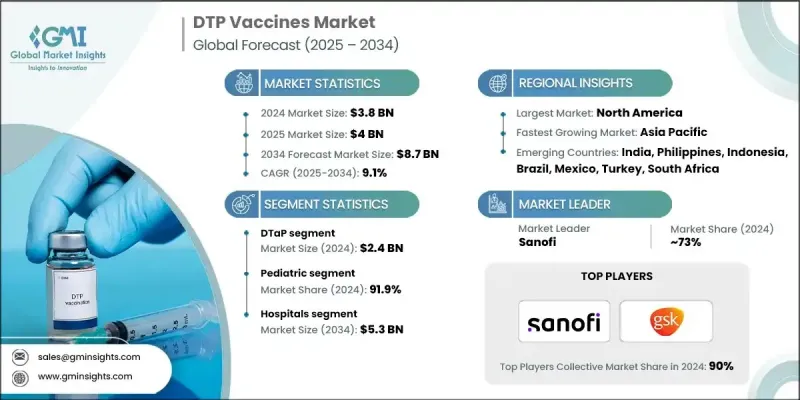

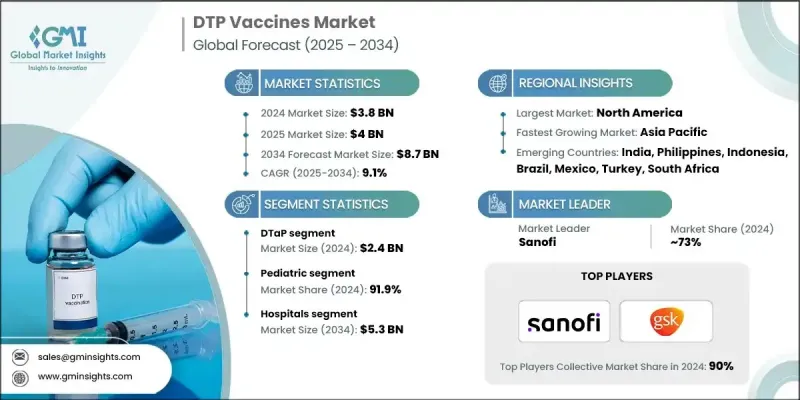

2024 年全球 DTP 疫苗市場價值為 38 億美元,預計到 2034 年將以 9.1% 的複合年成長率成長至 87 億美元。

這一顯著成長得益於全球免疫接種力度的加大,尤其是在傳染病仍構成嚴重威脅的發展中國家。人們對疫苗可預防疾病的認知不斷提高以及醫療基礎設施的改善,在促進疫苗接種方面發揮關鍵作用。此外,疫苗技術的創新,尤其是更安全、更有效的聯合疫苗的研發,正在增強公眾信心,並推動疫苗接種率的提高。在全球衛生組織和國家醫療保健計畫的支持下,兒童免疫接種仍然是主要的需求促進因素。預防嬰兒白喉、破傷風和百日咳的需求日益成長,這促使人們增加對疫苗研發和分發的投資。隨著免疫覆蓋率的擴大,將百白破疫苗納入更大規模的聯合方案,正在提高依從性、簡化接種程序並提高可及性。世界各國政府正投入更多資源加強免疫網路,同時公私合作也正在擴大覆蓋範圍和推廣範圍。這些因素,加上不斷上升的出生率和更廣泛的醫療保健可近性,預計將在預測期內支撐全球百白破疫苗市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 38億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 9.1% |

2024年,百日咳疫苗(DTaP)市場規模達24億美元。由於在常規兒科免疫接種計劃中被廣泛採用,該市場仍佔據主導地位。 DTaP疫苗採用無細胞百日咳成分,與先前的全細胞疫苗相比,其安全性更高,副作用更少。全球衛生機構和國家免疫規劃積極推廣DTaP疫苗的使用,進一步推動了需求成長。對聯合疫苗的偏好日益成長以及加強針接種的增加是該市場成長的關鍵因素,尤其是在醫療基礎設施和政府疫苗接種項目涵蓋範圍更廣的地區。

2024年,兒科疫苗市佔率達91.9%。這得歸功於全球高出生率以及百白破疫苗被納入兒童早期免疫接種計劃。各國政府和衛生組織持續重視兒科疫苗接種,從而增加了資金投入,改善了疫苗接種系統,並提高了兒童疾病預防意識。隨著百白破疫苗成分擴大融入五價和六價疫苗等多價疫苗配方,兒科疫苗覆蓋率進一步提高。這些疫苗配方簡化了疫苗接種程序,簡化了物流,並提高了醫護人員和家長的遵從性。

2024年,北美百白破疫苗市場佔據41.3%的市佔率。其領先地位得益於高額的醫療保健投入、完善的免疫框架以及持續的公眾教育工作。賽諾菲、默克和葛蘭素史克等主要製藥公司強大的分銷網路確保了疫苗在美國和加拿大的廣泛供應。全面的報銷政策和全國性的宣傳措施有助於維持穩定的疫苗接種率。公共衛生機構積極推廣兒童免疫接種,鞏固了該地區在疫苗覆蓋率和普及率方面的領先地位。

積極參與全球 DTP 疫苗市場的主要參與者包括 LG Chem、Biological E、Walvax、Finlay Institute、Indian Immunologicals、HLL Lifecare Limited (HLL)、Bilthoven Biologicals、葛蘭素史克 (GSK)、賽諾菲、默克、Microgen、Panacea Biotectec、PTA、AakA. Biomed、Boryung、印度血清研究所、北京民海生物技術和 ST Pharma。為了鞏固其在 DTP 疫苗市場的地位,領先公司正在採取策略性舉措,包括擴大生產能力和擴大生產規模,以滿足全球市場日益成長的需求。企業擴大與公共衛生機構和政府合作,以確保供應合約並加強疫苗分發。許多公司也投資研究,開發副作用更少、免疫原性更好的下一代製劑。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 日益重視預防性醫療保健

- 擴大免疫接種計劃

- 政府措施和支持措施

- 不斷進步的技術

- 產業陷阱與挑戰

- 嚴格的法規核准流程

- 開發和生產成本高

- 市場機會

- 加強疫苗分發的公私夥伴關係

- 擴大成人疫苗接種計劃

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 技術格局

- 投資和融資格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 公司矩陣分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按疫苗類型,2021 - 2034 年

- 主要趨勢

- 百時美施貴寶

- DTwP

- 經皮/經皮穿刺

第6章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 兒科

- 成人

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 民眾

- 私人的

- 專科診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Arab Company for Pharmaceutical Products (Arabio)

- Beijing Minhai Biological Technology

- Bilthoven Biologicals

- Biological E

- Boryung

- Finlay Institute

- GlaxoSmithKline (GSK)

- HLL Lifecare Limited (HLL)

- IBSS Biomed

- Indian Immunologicals

- LG Chem

- Merck

- Microgen

- Panacea Biotec

- PT Bio Farma

- Sanofi

- Serum Institute of India

- Walvax

The Global DTP Vaccines Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 8.7 billion by 2034.

This significant growth is driven by increasing immunization efforts worldwide, especially across developing countries where infectious diseases remain a serious threat. Enhanced awareness of vaccine-preventable diseases and improvements in healthcare infrastructure are playing a key role in boosting vaccine uptake. Further, innovation in vaccine technology, especially the development of safer and more effective combination vaccines, is increasing public confidence and driving higher adoption rates. Pediatric immunization continues to be a major demand driver, supported by global health organizations and national healthcare programs. The growing need to prevent diphtheria, tetanus, and pertussis among infants is encouraging greater investment in vaccine research and distribution. As immunization coverage expands, the integration of DTP vaccines into larger combination schedules is improving compliance, simplifying administration, and increasing accessibility. Governments across the globe are allocating more resources to strengthen their immunization networks, while public-private collaborations are enhancing outreach and coverage. These factors, combined with rising birth rates and broader healthcare access, are expected to support the global DTP vaccines market over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.1% |

In 2024, the DTaP segment generated USD 2.4 billion. This segment remains dominant due to its broad adoption in routine pediatric immunization schedules. DTaP vaccines utilize acellular pertussis components, which offer a safer profile and fewer adverse effects compared to earlier whole-cell options. Global health bodies and national immunization programs actively promote DTaP's use, further driving demand. The rising preference for combination vaccines and increased administration of booster shots are key growth factors for the segment, especially in regions with better access to healthcare infrastructure and government vaccination programs.

The pediatric segment held a 91.9% share in 2024. This is due to high global birth rates and the inclusion of DTP vaccines in early childhood immunization schedules. Governments and health organizations continue to prioritize pediatric vaccinations, leading to increased funding, improved vaccine delivery systems, and heightened awareness of disease prevention in children. With the growing integration of DTP components into multivalent formulations, such as pentavalent and hexavalent vaccines, pediatric coverage is further strengthened. These formulations streamline vaccine schedules, simplify logistics, and increase compliance from both healthcare providers and parents.

North America DTP Vaccines Market held a 41.3% share in 2024. The leading position is supported by high healthcare investments, established immunization frameworks, and continuous public education efforts. Robust distribution networks of key pharmaceutical companies like Sanofi, Merck, and GSK ensure broad vaccine availability across the U.S. and Canada. Comprehensive reimbursement policies and national awareness initiatives help sustain consistent vaccination rates. Public health agencies actively promote childhood immunizations, reinforcing the region's leadership in vaccine coverage and adoption.

Key players actively involved in the Global DTP Vaccines Market include LG Chem, Biological E, Walvax, Finlay Institute, Indian Immunologicals, HLL Lifecare Limited (HLL), Bilthoven Biologicals, GlaxoSmithKline (GSK), Sanofi, Merck, Microgen, Panacea Biotec, PT Bio Farma, Arab Company for Pharmaceutical Products (Arabio), IBSS Biomed, Boryung, Serum Institute of India, Beijing Minhai Biological Technology, and ST Pharma. To strengthen their position in the DTP vaccines market, leading companies are adopting strategic initiatives that include expanding production capacity and scaling manufacturing operations to meet growing demand across global markets. Firms are increasingly collaborating with public health bodies and governments to secure supply contracts and enhance vaccine distribution. Many are also investing in research to develop next-generation formulations with fewer side effects and better immunogenicity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vaccine type trends

- 2.2.3 Age group trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising emphasis on preventive healthcare

- 3.2.1.2 Expanding immunization programs

- 3.2.1.3 Government initiatives and supportive measures

- 3.2.1.4 Growing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval processes

- 3.2.2.2 High development and production costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing public-private partnerships for vaccine distribution

- 3.2.3.2 Expanding adult vaccination programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Technology landscape

- 3.7 Investment and funding landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 DTaP

- 5.3 DTwP

- 5.4 Td/TdaP

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.2.1 Public

- 7.2.2 Private

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arab Company for Pharmaceutical Products (Arabio)

- 9.2 Beijing Minhai Biological Technology

- 9.3 Bilthoven Biologicals

- 9.4 Biological E

- 9.5 Boryung

- 9.6 Finlay Institute

- 9.7 GlaxoSmithKline (GSK)

- 9.8 HLL Lifecare Limited (HLL)

- 9.9 IBSS Biomed

- 9.10 Indian Immunologicals

- 9.11 LG Chem

- 9.12 Merck

- 9.13 Microgen

- 9.14 Panacea Biotec

- 9.15 PT Bio Farma

- 9.16 Sanofi

- 9.17 Serum Institute of India

- 9.18 Walvax