|

市場調查報告書

商品編碼

1844273

住宅攜帶式儲能系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Residential Portable Energy Storage System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

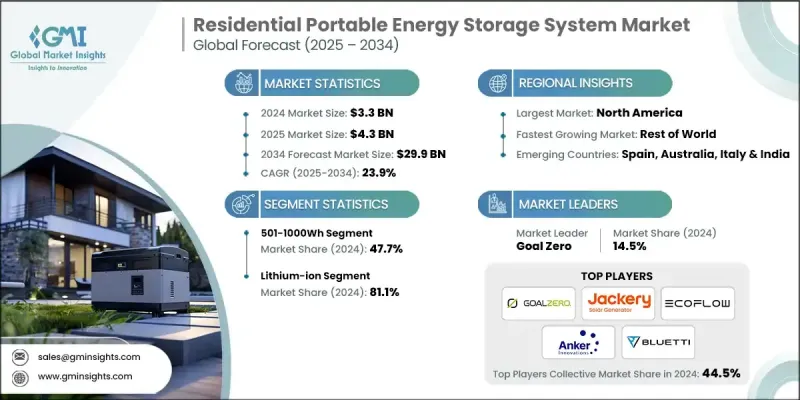

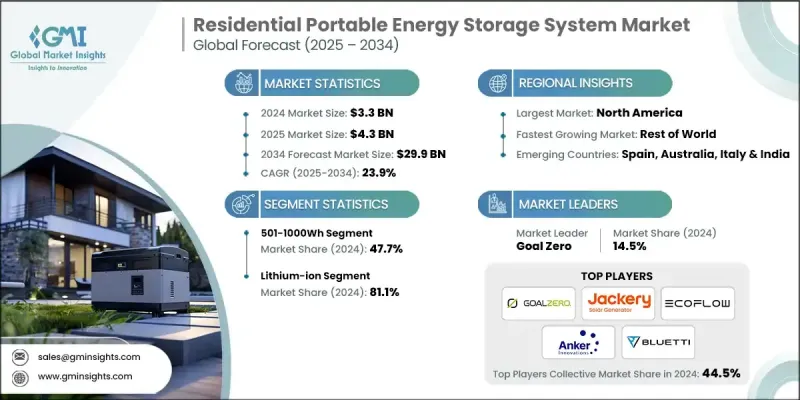

2024 年全球住宅攜帶式儲能系統市場價值為 33 億美元,預計到 2034 年將以 23.9% 的複合年成長率成長至 299 億美元。

這一顯著成長源於屋主對電網脆弱性的認知不斷提高,尤其是在自然災害和惡劣天氣條件日益增多的情況下。隨著停電頻率的不斷增加,許多家庭正在放棄傳統的燃油發電機,轉而選擇更乾淨、更安靜、更靈活的替代方案。家用攜帶式儲能系統提供了一種安靜、零排放的備用解決方案,它既可安全用於室內,也是停電期間為家用必需設備供電的理想選擇。這些電池供電的設備結構緊湊,易於運輸,既可在家中使用,也可在戶外活動中使用。向永續行動電源解決方案的轉變正在改變能源消耗模式。由於電力成本上漲和電網不穩定性加劇,北美地區對攜帶式儲能系統的接受度正在強勁成長。對遠距辦公和行動生活方式的日益依賴,進一步推動了攜帶式系統作為維持生產力和連接性的重要工具的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 299億美元 |

| 複合年成長率 | 23.9% |

家用攜帶式儲能系統通常由輕巧的輪式電池單元組成,其設計旨在提高移動性和便利性。與大型、永久安裝的家用電池系統不同,攜帶式儲能系統 (PESS) 的設計非常靈活,使用者可以在房間之間移動或隨身攜帶。這些系統用途廣泛:在停電時用作緊急備用電源,為娛樂或戶外使用提供攜帶式電源,以及作為噪音較大的燃油發電機的環保替代品。它們能夠提供可靠、清潔的能源,且無排放或運作噪音,正日益受到注重環保的消費者的青睞。

501-1000Wh容量細分市場在2024年佔據47.7%的市場佔有率,預計到2034年將以24.2%的複合年成長率成長。這個細分市場受到尋求中型系統的用戶的青睞,這些系統能夠在停電期間提供足夠的容量來為關鍵家用電器(例如安防系統、路由器、持續氣道正壓通氣機和照明設備)供電。遠端辦公的擴展和對行動辦公空間的需求進一步推動了這一類別的投資,因為消費者正在尋求為數位設備和通訊設備提供可靠的備用電源。這些設備在便攜性和性能之間取得了平衡,使其成為室內和室外應用的理想選擇。

2024年,北美住宅攜帶式儲能系統市場佔據94.3%的市場佔有率,預計到2034年將達到130億美元的市場規模。天氣相關緊急情況(尤其是嚴重的冬季風暴)的持續增加,促使更多屋主投資可靠的備用能源解決方案。隨著大眾越來越意識到柴油和燃氣發電機的缺點,例如噪音、排放和安全隱患,人們越來越傾向於使用基於電池的替代能源。這種轉變為美國住宅攜帶式儲能系統(PESS)產業的快速擴張奠定了基礎,能源彈性和永續性正成為美國家庭的首要任務。

一些知名公司正在全球住宅 PESS 領域積極競爭,包括 EcoFlow、Blueti Power、Anker Innovations、Enphase、Jackery Technology、AceOn Group、ChargeTech、Goal Zero、Chint Global、MIDLAND RADIO、ATGepower、LIPOWER、Yukinova、Yoshino Technology、iForway、Jntech Renewable Energy、江蘇森基新能源科技、Grecell、浙江西利新能源和施耐德電氣。為了鞏固其在快速成長的住宅攜帶式儲能系統市場中的立足點,主要參與者正在採取一系列策略方針。公司正在大力投資研發先進的電池技術,以提供更高的能量密度、更快的充電速度和更長的使用壽命。許多公司正在使其產品線多樣化,包括不同容量的選擇,以滿足不同的住宅需求。正在加強與電子商務平台和零售連鎖店的合作,以擴大消費者覆蓋率。此外,積極的行銷活動正在幫助品牌突出電池供電系統相對於傳統發電機的優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 成本結構分析

- 定價分析(美元/單位)

- 按容量

- 按地區

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034

- 主要趨勢

- 少於500瓦時

- 501-1000瓦時

- 1000Wh以上

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 鋰離子

- 鉛酸

- 其他

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 戶外的

- 緊急狀況

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 世界其他地區

第9章:公司簡介

- AceOn Group

- Anker Innovations

- ATGepower

- Bluetti Power

- Chint Global

- ChargeTech

- EcoFlow

- Enphase

- Goal Zero

- Grecell

- iForway

- Jackery Technology

- Jntech Renewable Energy

- Jiangsu Senji New Energy Technology

- LIPOWER

- MIDLAND RADIO

- Schneider Electric

- Yukinova

- Yoshino Technology

- Zhejiang Xili New Energy

The Global Residential Portable Energy Storage System Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 23.9% to reach USD 29.9 billion by 2034.

This remarkable growth is driven by increased awareness among homeowners about the vulnerabilities of the electric grid, particularly due to the rising occurrence of natural disasters and severe weather conditions. As power outages become more frequent, many households are moving away from traditional fuel-powered generators in favor of cleaner, quieter, and more flexible alternatives. Residential portable energy storage systems offer a silent, emissions-free backup solution that is safe for indoor use and ideal for powering essential home devices during outages. These battery-powered units are compact, easy to transport, and can be used both at home and during outdoor activities. The shift toward sustainable, mobile power solutions is transforming energy consumption patterns. North America is showing a strong uptake due to rising electricity costs and increasing grid instability. The growing reliance on remote work and mobile lifestyles further fuels the adoption of portable systems as essential tools for maintaining productivity and connectivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $29.9 Billion |

| CAGR | 23.9% |

A residential portable energy storage system typically consists of a lightweight, wheeled battery unit designed for mobility and convenience. Unlike large, permanently installed home battery systems, PESS units are engineered for flexibility, allowing users to move them between rooms or take them on the go. These systems serve multiple purposes: they act as emergency backup during power failures, offer portable power for recreational or outdoor use, and serve as an eco-friendly substitute for noisy fuel-based generators. Their ability to deliver reliable, clean energy without emissions or operational noise is increasingly appealing to environmentally conscious consumers.

The 501-1000Wh capacity segment held 47.7% share in 2024 and is projected to grow at a CAGR of 24.2% through 2034. This segment is favored by users seeking mid-size systems that provide enough capacity to power critical household appliances, such as security systems, routers, CPAP machines, and lighting, during outages. The expansion of remote work and demand for mobile workspaces is further driving investment in this category, as consumers seek reliable backup power for digital devices and communications equipment. These units strike a balance between portability and performance, making them ideal for both indoor and outdoor applications.

North America Residential Portable Energy Storage System Market held 94.3% share in 2024 and is expected to generate USD 13 billion by 2034. A steady rise in weather-related emergencies, particularly severe winter storms, is pushing more homeowners to invest in dependable backup energy solutions. As the public becomes increasingly aware of the drawbacks of diesel and gas-powered generators, such as noise, emissions, and safety concerns, there is a growing preference for battery-based alternatives. This transition is setting the stage for the rapid expansion of the PESS sector across the U.S., where energy resilience and sustainability are becoming household priorities.

Several notable companies are actively competing in the global residential PESS space, including EcoFlow, Bluetti Power, Anker Innovations, Enphase, Jackery Technology, AceOn Group, ChargeTech, Goal Zero, Chint Global, MIDLAND RADIO, ATGepower, LIPOWER, Yukinova, Yoshino Technology, iForway, Jntech Renewable Energy, Jiangsu Senji New Energy Technology, Grecell, Zhejiang Xili New Energy, and Schneider Electric. To solidify their foothold in the rapidly growing residential portable energy storage system market, key players are adopting a range of strategic approaches. Companies are investing heavily in R&D to develop advanced battery technologies that offer higher energy density, faster charging, and longer life cycles. Many are diversifying their product lines to include varying capacity options to meet different residential needs. Partnerships with e-commerce platforms and retail chains are being strengthened to expand consumer reach. Additionally, aggressive marketing campaigns are helping brands highlight the advantages of battery-powered systems over traditional generators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Technology trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Pricing analysis (USD/ Units)

- 3.3.1 By capacity

- 3.3.2 By region

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Billion & Million Units)

- 5.1 Key trends

- 5.2 Less than 500Wh

- 5.3 501-1000Wh

- 5.4 Above 1000Wh

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion & Million Units)

- 6.1 Key trends

- 6.2 Lithium-ion

- 6.3 Lead acid

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & Million Units)

- 7.1 Key trends

- 7.2 Outdoor

- 7.3 Emergency

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 AceOn Group

- 9.2 Anker Innovations

- 9.3 ATGepower

- 9.4 Bluetti Power

- 9.5 Chint Global

- 9.6 ChargeTech

- 9.7 EcoFlow

- 9.8 Enphase

- 9.9 Goal Zero

- 9.10 Grecell

- 9.11 iForway

- 9.12 Jackery Technology

- 9.13 Jntech Renewable Energy

- 9.14 Jiangsu Senji New Energy Technology

- 9.15 LIPOWER

- 9.16 MIDLAND RADIO

- 9.17 Schneider Electric

- 9.18 Yukinova

- 9.19 Yoshino Technology

- 9.20 Zhejiang Xili New Energy