|

市場調查報告書

商品編碼

1844263

高磷血症治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hyperphosphatemia Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

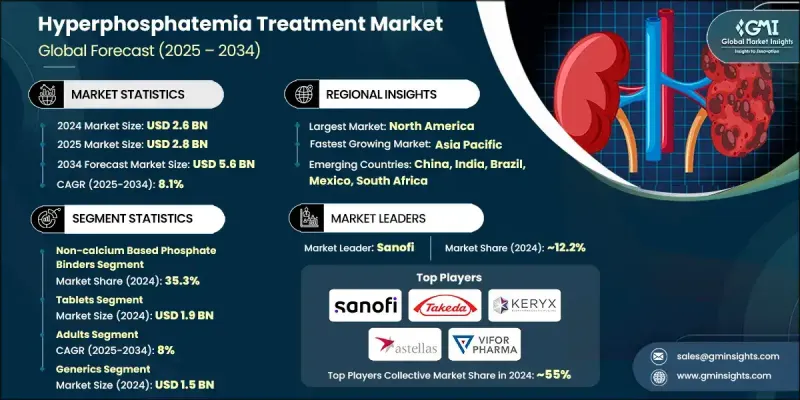

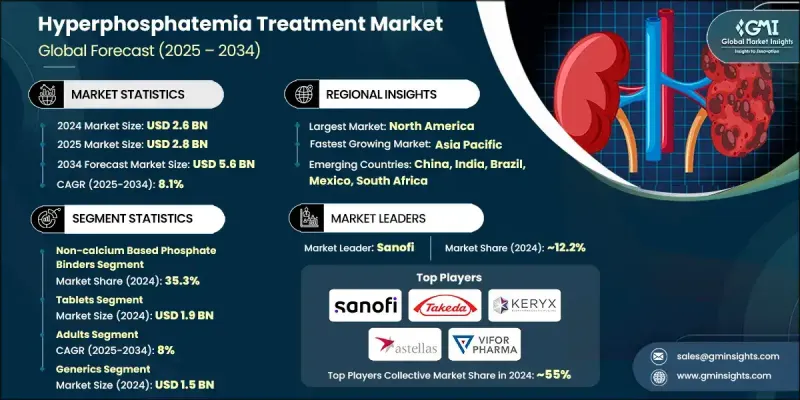

2024 年全球高血磷治療市場價值為 26 億美元,預計到 2034 年將以 8.1% 的複合年成長率成長至 56 億美元。

這一成長的動力源於全球範圍內慢性腎病 (CKD) 病例的增加、末期腎臟病 (ESRD) 患者數量的增加以及透析應用的日益普及。人口老化,加上糖尿病和高血壓的發生率上升,導致全球 CKD 盛行率持續上升,直接影響了高血磷症治療的需求。加工食品和久坐不動的生活方式的轉變也導致了磷酸鹽失衡,迫使患者採取長期治療方案。為此,治療方案正在快速發展,已從傳統的鈣基黏合劑轉向更具創新性的選擇,例如鐵基黏合劑和磷酸鹽吸收抑制劑。這些新一代療法耐受性更高、副作用更少,從而提高了依從性和療效。隨著監管部門的批准和臨床試驗的增加,非鈣基黏合劑和新型藥物正在各地區得到更廣泛的應用,從而支持了長期的市場發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 56億美元 |

| 複合年成長率 | 8.1% |

2024年,非鈣基磷酸鹽結合劑佔35.3%的市場佔有率,預計到2034年將達到20億美元,複合年成長率為8%。此類藥物的藥片尺寸較小,胃腸道不適更少,從而提高了患者的依從性。由於高血磷症需要終身治療,患者對更便利、耐受性更好的治療方案的需求正在穩定成長。醫療保健提供者和透析中心越來越青睞非鈣基磷酸鹽結合劑,因為它們符合現代價值導向型醫療目標,即注重改善心血管結局和增強磷酸鹽調節,從而增強了該領域在市場擴張中的作用。

2034年,成人患者群體的複合年成長率將達到8%。 40歲以上的成年人是慢性腎臟病和末期腎病(ESRD)的高危險群,因此他們也是降磷治療的最大消費者。隨著全球成人慢性腎臟病(CKD)患者數量的成長,高磷血症治療的需求持續成長,尤其是在腎臟科醫師和透析中心資源豐富的市場。在已開發地區,結構化的護理方案和早期介入框架正在提高診斷和治療依從性,有助於維持成人群體的市場主導地位。

2024年,北美高血磷治療市場佔44.3%的市場佔有率,其中美國貢獻了該地區最大的收入佔有率。慢性腎臟病(CKD)的高負擔和透析的廣泛應用推動了該地區對降磷藥物的強勁需求。由領先醫療機構管理的完善的透析診所網路,能夠實現可靠的磷酸鹽監測和持續的治療。這項基礎設施支持傳統療法和新一代療法的推廣,使北美成為塑造全球市場動態和治療創新的核心力量。

影響全球高磷血症治療市場的關鍵參與者包括費森尤斯醫療、Vifor Pharma (CSL Limited)、Dr. Reddy's、武田製藥、安斯泰來製藥、賽諾菲、魯賓、西普拉、Glenmark、梯瓦製藥、Amneal、三菱田邊製藥、Aurobindo Pharma、Macleods 和 Keryx Biopaceuticals。在高磷血症治療市場運作的公司正專注於透過藥物創新和策略性許可交易來擴大其治療組合。許多公司正在投資臨床研究,以開發非鈣和鐵基黏合劑,以提供更好的安全性並改善患者的治療效果。與透析網路和腎臟病診所的合作有助於確保一致的分銷和患者的可及性。賽諾菲和 Vifor Pharma 等公司正在透過區域合作加強全球影響力,而西普拉和梯瓦製藥等學名藥公司則憑藉具有成本效益的配方進入新興市場。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 慢性腎臟病(CKD)和透析患者盛行率上升

- 人口老化和生活方式相關疾病

- 藥物開發和新療法的進展

- 提高認知和預防性醫療保健舉措

- 產業陷阱與挑戰

- 藥物負擔高,患者依從性差

- 治療費用高

- 市場機會

- 低藥物負擔療法的開發

- 個人化醫療和聯合療法

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 鈣基磷酸鹽結合劑

- 非鈣基磷酸鹽結合劑

- 鐵基磷酸鹽結合劑

- 碳酸鑭

- 其他產品

第6章:市場估計與預測:按劑型,2021 - 2034

- 主要趨勢

- 平板電腦

- 粉末

- 其他劑型

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 成年人

- 兒科

第8章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 品牌

- 泛型

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 居家照護環境

- 透析中心

- 其他最終用途

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Amneal

- Astellas Pharma

- Aurobindo Pharma

- Cipla

- Dr. Reddy's

- Glenmark

- Fresenius Medical Care

- Keryx Biopharmaceuticals

- Lupin

- Macleods

- Mitsubishi Tanabe Pharma

- Sanofi

- Takeda Pharmaceuticals

- Teva Pharmaceuticals

- Vifor Pharma (CSL Limited)

The Global Hyperphosphatemia Treatment Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 5.6 billion by 2034.

The growth is fueled by rising cases of chronic kidney disease (CKD), the expanding number of end-stage renal disease (ESRD) patients, and the increasing adoption of dialysis worldwide. An aging population, together with higher rates of diabetes and hypertension, continues to drive up CKD prevalence globally, directly impacting the demand for hyperphosphatemia treatments. The shift toward processed food and sedentary lifestyles has also contributed to phosphate imbalances, pushing patients into long-term therapeutic regimens. In response, the treatment landscape is evolving rapidly, moving beyond traditional calcium-based binders toward more innovative options like iron-based binders and phosphate absorption inhibitors. These next-generation therapies offer improved tolerability and fewer side effects, boosting adherence and outcomes. As regulatory approvals and clinical trials increase, non-calcium binders and novel agents are being adopted more broadly across regions, supporting long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 8.1% |

In 2024, the non-calcium-based phosphate binders held a 35.3% share and are anticipated to reach USD 2 billion by 2034, growing at a CAGR of 8%. These treatments offer smaller pill sizes and reduced gastrointestinal discomfort, leading to better patient adherence. As lifelong therapy is required for hyperphosphatemia, patient demand for more convenient and better-tolerated options is increasing steadily. Healthcare providers and dialysis centers increasingly prefer non-calcium binders due to their alignment with modern value-based care goals, which focus on improved cardiovascular outcomes and enhanced phosphate regulation, thereby reinforcing this segment's role in market expansion.

The adult patient group segment is growing at a CAGR of 8% throughout 2034. Adults over the age of 40 represent the highest-risk demographic for both chronic kidney disease and ESRD, making them the largest consumers of phosphate-lowering treatments. As the global adult CKD population grows, demand for hyperphosphatemia therapies continues to scale, especially in markets where access to nephrology specialists and dialysis centers is widespread. In developed regions, structured care protocols and early intervention frameworks are improving diagnosis and treatment compliance, helping maintain the adult segment's market dominance.

North America Hyperphosphatemia Treatment Market held 44.3% share in 2024, with the United States contributing the largest portion of regional revenue. The high burden of CKD and the widespread adoption of dialysis drive strong demand for phosphate-lowering drugs across the region. A well-established network of dialysis clinics, managed by leading providers, enables reliable phosphate monitoring and consistent therapy delivery. This infrastructure supports the expansion of both traditional and next-generation treatments, making North America a central force in shaping global market dynamics and therapeutic innovation.

Key players shaping the Global Hyperphosphatemia Treatment Market include Fresenius Medical Care, Vifor Pharma (CSL Limited), Dr. Reddy's, Takeda Pharmaceuticals, Astellas Pharma, Sanofi, Lupin, Cipla, Glenmark, Teva Pharmaceuticals, Amneal, Mitsubishi Tanabe Pharma, Aurobindo Pharma, Macleods, and Keryx Biopharmaceuticals. Companies operating in the hyperphosphatemia treatment market are focusing on expanding their therapeutic portfolios through drug innovation and strategic licensing deals. Many are investing in clinical research to develop non-calcium and iron-based binders that provide better safety profiles and improved patient outcomes. Partnerships with dialysis networks and nephrology clinics help ensure consistent distribution and patient access. Firms like Sanofi and Vifor Pharma are strengthening global reach through regional collaborations, while generics players such as Cipla and Teva Pharmaceuticals are entering emerging markets with cost-effective formulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Dosage form trends

- 2.2.4 Age group trends

- 2.2.5 Type trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic kidney disease (CKD) and dialysis patients

- 3.2.1.2 Aging population and lifestyle-related disorders

- 3.2.1.3 Advancements in drug development and novel therapies

- 3.2.1.4 Increasing awareness and preventive healthcare initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High pill burden and poor patient compliance

- 3.2.2.2 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-pill-burden therapies

- 3.2.3.2 Personalized medicine and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Calcium-based phosphate binders

- 5.3 Non-calcium based phosphate binders

- 5.4 Iron-based phosphate binders

- 5.5 Lanthanum carbonate

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Powder

- 6.4 Other dosage forms

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Pediatrics

Chapter 8 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Homecare settings

- 9.4 Dialysis centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amneal

- 11.2 Astellas Pharma

- 11.3 Aurobindo Pharma

- 11.4 Cipla

- 11.5 Dr. Reddy's

- 11.6 Glenmark

- 11.7 Fresenius Medical Care

- 11.8 Keryx Biopharmaceuticals

- 11.9 Lupin

- 11.10 Macleods

- 11.11 Mitsubishi Tanabe Pharma

- 11.12 Sanofi

- 11.13 Takeda Pharmaceuticals

- 11.14 Teva Pharmaceuticals

- 11.15 Vifor Pharma (CSL Limited)