|

市場調查報告書

商品編碼

1844261

環境管理系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Environmental Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

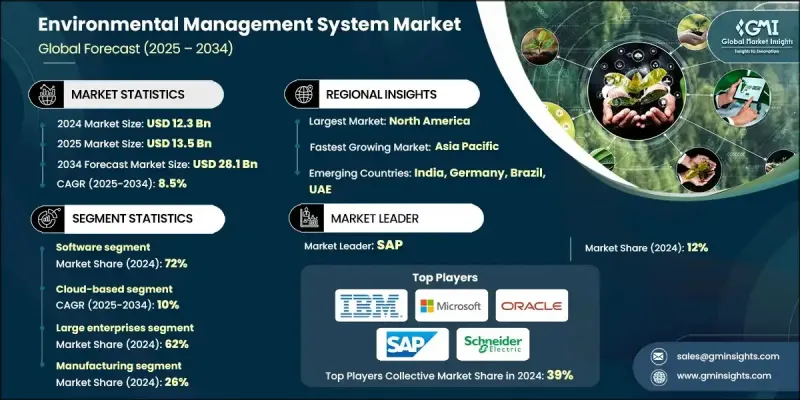

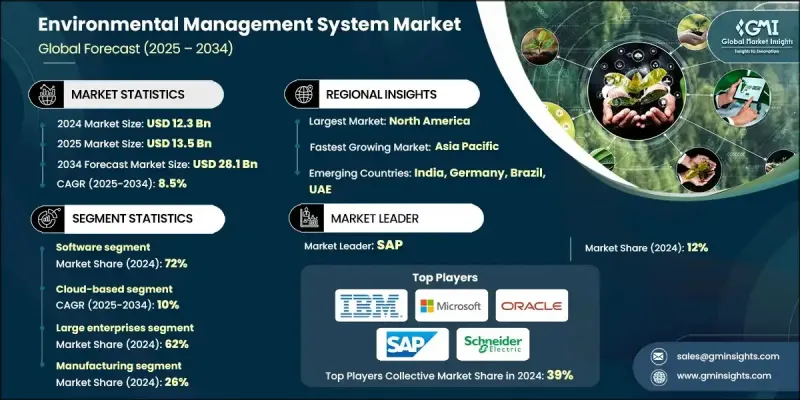

2024 年全球環境管理系統市場價值為 123 億美元,預計將以 8.5% 的複合年成長率成長,到 2034 年達到 281 億美元。

隨著企業致力於加強環境責任制和合規性,環境管理系統 (EMS) 解決方案的採用率日益提升。這些系統提供結構化的框架和數位化平台,以高效管理環境責任。 EMS 解決方案基於 ISO 14001 和 EMAS 等全球標準,可協助企業制定政策、規劃和實施營運控制、監控績效並進行審查,以確保合規性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 123億美元 |

| 預測值 | 281億美元 |

| 複合年成長率 | 8.5% |

市場成長的動力源自於日益嚴格的合規要求、企業永續發展目標以及追蹤各產業環境績效的數位化解決方案日益成長的需求。企業正在利用環境管理系統 (EMS) 來展現透明度、管理環境風險,並將環境、社會和治理 (ESG) 優先事項融入其營運中。從能源和建築業到製造業和公共服務業,企業紛紛部署環境管理系統 (EMS) 工具,以標準化流程並減少各職能部門的環境影響。隨著監管機構和利害關係人對實現嚴格環境目標的壓力日益增大,企業正在將環境管理體系與更廣泛的業務策略相結合,從而提高效率並實現長期永續性。

2024年,軟體部門佔了72%的佔有率。這些平台旨在簡化環境資料收集,自動化合規報告,並集中關鍵指標,以便更好地做出決策。與企業軟體、物聯網感測器和雲端系統的整合,可實現跨多個地點的即時效能監控。以軟體為基礎的環境管理系統 (EMS) 可協助組織遵守環境法規,同時最佳化其資源使用和營運工作流程。遵循ISO 14001和其他標準的公司高度依賴EMS軟體來維護記錄、預測潛在問題,並協調複雜營運中的永續發展計畫。

預計2025年至2034年,基於雲端的EMS解決方案細分市場的複合年成長率將達到10%。這些平台提供可擴展的網際網路託管環境,支援快速部署和從任何位置進行遠端存取。雲端EMS無需巨額前期投資,並支援與物聯網設備無縫整合以實現即時追蹤。訂閱有助於降低資本成本,而集中式系統則支援跨站點協作、分析和自動更新。雲端基礎架構還增強了災難復原、維護和版本控制功能,使團隊能夠在不同區域跨不同區域以更高的敏捷性和回應速度開展工作。

2024年,美國環境管理系統市場規模達38億美元。受聯邦和州兩級環境政策執行和永續發展承諾的推動,美國環境管理系統平台的採用率持續上升。各機構致力於減少排放、改善廢棄物控制並增強環境公平,這催生了對結構化系統的需求,以確保合規性。公用事業、製造業和能源等行業擴大採用環境管理系統來監控排放、管理資源並簡化合規報告。

影響全球環境管理系統市場的關鍵參與者包括賽默飛世爾科技、SAP、IBM、威立雅環境、施耐德電機、甲骨文、微軟、西門子、霍尼韋爾國際和艾默生電氣。環境管理系統市場的領先公司正專注於產品創新、雲端整合和數據驅動的洞察,以鞏固其市場地位。許多公司正在開發基於人工智慧的平台,以實現預測分析、即時報告和自動合規性追蹤。與 ERP 和物聯網供應商的合作使得 EMS 解決方案能夠更順暢地整合到企業營運中。企業也透過區域辦事處、基於雲端的服務和多語言支援系統擴大全球影響力。持續的網路安全投資確保了資料的安全處理,而可擴展的訂閱模式則吸引了更廣泛的客戶。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預報

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 日益嚴格的監管合規要求

- 擴大企業永續發展與 ESG 計劃

- 數位平台在環境資料管理的應用日益增多

- 公共部門環境監督體系的發展

- 採用 ISO 14001 和 EMAS 等國際標準

- 產業陷阱與挑戰

- 與現有企業系統的複雜整合

- 組織內部缺乏專業知識

- 市場機會

- 與物聯網、雲端和分析平台整合

- 越來越關注生命週期資源效率

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本分解分析

- 軟體授權和訂閱費用

- 硬體和感測器投資

- 實施和整合費用

- 培訓和變更管理成本

- 持續維護和支持

- 合規與審計成本

- 專利分析

- 永續性和環境方面

- 綠色IT實施

- 碳中和技術營運

- 永續軟體開發

- 科技對環境的影響

- 循環經濟原則

- 淨零技術目標

- 用例和應用

- 最佳情況

- 風險評估框架

- 環境合規風險

- 技術實施風險

- 資料安全和隱私風險

- 供應商依賴風險

- 監理變化風險

- 營運中斷風險

- 聲譽和品牌風險

- 投資格局分析

- 環境技術領域的創投

- 企業永續發展投資

- 政府環境資金

- 綠色債券與永續金融

- ESG投資趨勢

- 以投資類型進行的投資報酬率分析

- 氣候科技資金

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 軟體

- 服務

第6章:市場估計與預測:依部署,2021 - 2034 年

- 主要趨勢

- 本地部署

- 基於雲端

第7章:市場估計與預測:依企業規模,2021 - 2034

- 主要趨勢

- 大型企業

- 中小企業

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 製造業

- 建造

- 能源和公用事業

- 化學品

- 汽車

- 製藥

- 食品和飲料

- 政府和公共部門

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Emerson Electric

- Honeywell

- IBM

- Microsoft

- Oracle

- SAP

- Schneider Electric

- Siemens

- Thermo Fisher Scientific

- Veolia Environnement

- 區域參與者

- ABB

- APEVA

- AspenTech

- Bentley Systems

- Dassault Systemes

- GE Digital

- Hexagon

- Rockwell Automation

- Trimble

- Yokogawa Electric

- 新興企業和創新者

- EcoOnline

- Enablon

- Gensuite

- Intelex Technologies

- ProcessMAP

- Quentic

- SafetySync

- SHE Software

- Sphera Solutions

- VelocityEHS

The Global Environmental Management System Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 28.1 billion by 2034.

Environmental Management System solutions are seeing increased adoption as businesses work toward stronger environmental accountability and regulatory compliance. These systems provide structured frameworks and digital platforms to manage environmental responsibilities efficiently. Built on global standards such as ISO 14001 and EMAS, EMS solutions help organizations develop policies, plan and implement operational controls, monitor performance, and conduct reviews to maintain regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $28.1 Billion |

| CAGR | 8.5% |

Market growth is fueled by tightening compliance demands, corporate sustainability objectives, and the rising need for digital solutions that track environmental performance across sectors. Businesses are leveraging EMS to demonstrate transparency, manage environmental risks, and integrate ESG priorities into their operations. From energy and construction to manufacturing and public sector services, EMS tools are deployed to standardize procedures and reduce environmental impact across various functions. With mounting pressure from regulators and stakeholders to meet strict environmental goals, companies are aligning EMS with wider business strategies, improving efficiency and long-term sustainability in the process.

In 2024, the software segment held a 72% share. These platforms are designed to streamline environmental data collection, automate compliance reporting, and centralize key metrics for better decision-making. Integration with enterprise software, IoT sensors, and cloud systems enables real-time performance monitoring across multiple locations. Software-based EMS helps organizations adhere to environmental regulations while optimizing their resource usage and operational workflows. Companies following ISO 14001 and other standards rely heavily on EMS software to maintain records, predict potential issues, and coordinate sustainability initiatives across complex operations.

The cloud-based EMS solutions segment is forecasted to grow at a CAGR of 10% from 2025 to 2034. These platforms offer scalable, internet-hosted environments that enable rapid deployment and remote access from any location. Cloud EMS eliminates the need for heavy upfront investment and supports seamless integration with IoT devices for real-time tracking. Subscriptions help reduce capital costs, while centralized systems support cross-site collaboration, analytics, and automated updates. Cloud infrastructure also enhances disaster recovery, maintenance, and version control, allowing teams to operate with greater agility and responsiveness across different regions.

United States Environmental Management System Market generated USD 3.8 billion in 2024. Adoption of EMS platforms in the US continues to rise, driven by environmental policy enforcement and sustainability commitments across federal and state levels. Agencies promote reducing emissions, improving waste control, and enhancing environmental equity, creating demand for structured systems to ensure compliance. Industries such as utilities, manufacturing, and energy are increasingly turning to EMS to monitor emissions, manage resources, and streamline compliance reporting.

Key players shaping the Global Environmental Management System Market include Thermo Fisher Scientific, SAP, IBM, Veolia Environnement, Schneider Electric, Oracle, Microsoft, Siemens, Honeywell International, and Emerson Electric. Leading companies in the Environmental Management System Market are focusing on product innovation, cloud integration, and data-driven insights to strengthen their market position. Many are developing AI-powered platforms that enable predictive analytics, real-time reporting, and automated compliance tracking. Partnerships with ERP and IoT vendors allow for smoother integration of EMS solutions into enterprise operations. Businesses are also expanding global reach through regional offices, cloud-based services, and multilingual support systems. Ongoing investment in cybersecurity ensures secure data handling, while scalable subscription models attract a wider range of clients.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment

- 2.2.4 Enterprise Size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing regulatory compliance requirements

- 3.2.1.2 Expansion of corporate sustainability and ESG programs

- 3.2.1.3 Rising use of digital platforms for environmental data management

- 3.2.1.4 Growth in public sector environmental oversight systems

- 3.2.1.5 Adoption of international standards like ISO 14001 and EMAS

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex integration with existing enterprise systems

- 3.2.2.2 Lack of specialized expertise within organizations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with IoT, cloud, and analytics platforms

- 3.2.3.2 Rising focus on lifecycle resource efficiency

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software licensing & subscription costs

- 3.8.2 Hardware & sensor investment

- 3.8.3 Implementation & integration expenses

- 3.8.4 Training & change management costs

- 3.8.5 Ongoing maintenance & support

- 3.8.6 Compliance & audit costs

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Green IT implementation

- 3.10.2 Carbon neutral technology operations

- 3.10.3 Sustainable software development

- 3.10.4 Environmental impact of technology

- 3.10.5 Circular economy principles

- 3.10.6 Net-zero technology goals

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Risk assessment framework

- 3.13.1 Environmental compliance risks

- 3.13.2 Technology implementation risks

- 3.13.3 Data security & privacy risks

- 3.13.4 Vendor dependency risks

- 3.13.5 Regulatory change risks

- 3.13.6 Operational disruption risks

- 3.13.7 Reputation & brand risks

- 3.14 Investment landscape analysis

- 3.14.1 Venture capital in environmental technology

- 3.14.2 Corporate sustainability investment

- 3.14.3 Government environmental funding

- 3.14.4 Green bond & sustainable finance

- 3.14.5 ESG investment trends

- 3.14.6 ROI analysis by investment type

- 3.14.7 Climate technology funding

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud-Based

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small and Medium Enterprises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Construction

- 8.4 Energy and utilities

- 8.5 Chemicals

- 8.6 Automotive

- 8.7 Pharmaceuticals

- 8.8 Food and Beverage

- 8.9 Government & public sector

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Emerson Electric

- 10.1.2 Honeywell

- 10.1.3 IBM

- 10.1.4 Microsoft

- 10.1.5 Oracle

- 10.1.6 SAP

- 10.1.7 Schneider Electric

- 10.1.8 Siemens

- 10.1.9 Thermo Fisher Scientific

- 10.1.10 Veolia Environnement

- 10.2 Regional Players

- 10.2.1 ABB

- 10.2.2 APEVA

- 10.2.3 AspenTech

- 10.2.4 Bentley Systems

- 10.2.5 Dassault Systemes

- 10.2.6 GE Digital

- 10.2.7 Hexagon

- 10.2.8 Rockwell Automation

- 10.2.9 Trimble

- 10.2.10 Yokogawa Electric

- 10.3 Emerging Players & Innovators

- 10.3.1 EcoOnline

- 10.3.2 Enablon

- 10.3.3 Gensuite

- 10.3.4 Intelex Technologies

- 10.3.5 ProcessMAP

- 10.3.6 Quentic

- 10.3.7 SafetySync

- 10.3.8 SHE Software

- 10.3.9 Sphera Solutions

- 10.3.10 VelocityEHS