|

市場調查報告書

商品編碼

1833686

肺炎治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pneumonia Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

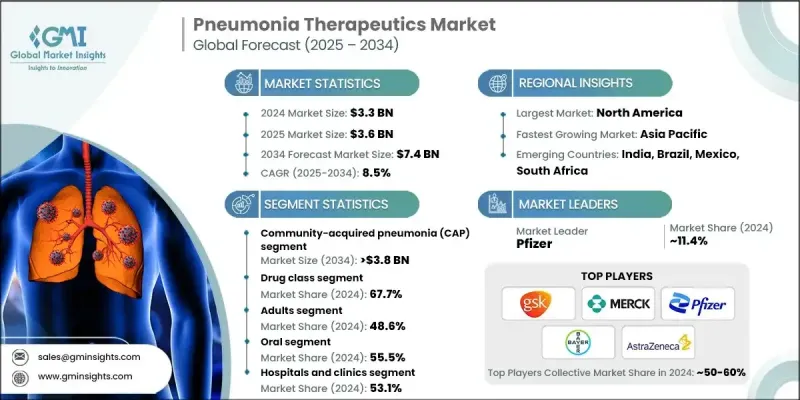

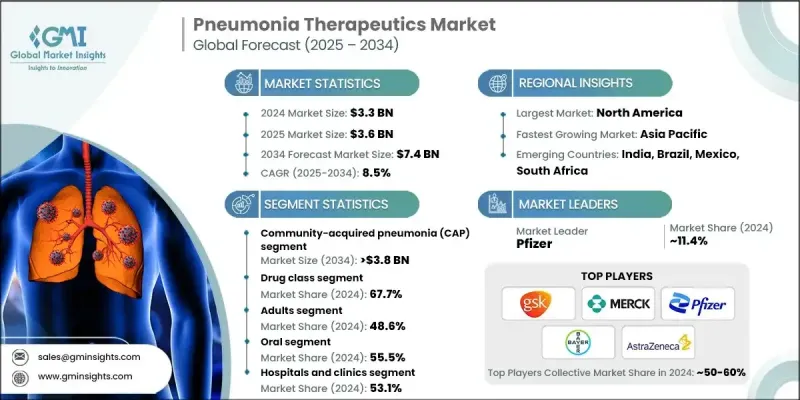

2024 年全球肺炎治療市場價值為 33 億美元,預計將以 8.5% 的複合年成長率成長,到 2034 年達到 74 億美元。

在全球範圍內,肺炎發生率呈上升趨勢,尤其是在老年人、幼兒和免疫系統較弱的人群中。呼吸衰竭是一種嚴重的併發症,會損害氧氣輸送和二氧化碳的清除,並顯著增加這些脆弱人群的死亡風險。隨著住院時間延長和機械通氣的普及,院內獲得性肺炎和呼吸器相關性肺炎也日益受到關注。肺炎的治療方案包括抗菌藥物、抗病毒藥物、抗黴菌藥物、疫苗、氧氣治療等支持性治療。這些藥物與更廣泛的呼吸系統藥物不同,它們以診斷檢測為指導,針對特定病原體。分子診斷和即時檢測的創新使病原體識別更加精準,從而可以更好地制定個人化治療方案,並減少抗生素的濫用。隨著線上藥局和直銷管道的擴張,患者和照護者能夠更輕鬆地獲得處方藥和非處方藥。從地區來看,北美佔據主導地位,這得益於高昂的醫療支出、強大的診斷基礎設施以及先進療法的早期採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 74億美元 |

| 複合年成長率 | 8.5% |

2024年,社區型肺炎 (CAP) 佔據了51.4%的市場佔有率,其促進因素包括多種病原體、患者風險因素(例如年齡和基礎健康狀況)以及導致其高發生率的環境因素。 CAP仍然是全球肺炎治療領域最突出的類別,影響著兒童和成人群體,而CAP住院率的上升刺激了對新型治療方案的需求。

2024年,藥物類藥物因其在治療輕度和重度肺炎方面的有效性,佔據了67.7%的市場。該類藥物細分為抗菌藥物、抗病毒藥物、抗真菌藥物和其他藥物類型,其中抗菌藥物進一步細分為喹諾酮類、大環內酯類和其他抗菌藥物。細菌性肺炎的流行,加上多重抗藥性細菌的增多,推動了對新藥製劑和聯合療法的需求。

2024年,美國肺炎治療市場規模估計為12億美元。美國肺炎盛行率的上升、住院人數的增加以及與肺炎相關的死亡率的上升,正在推動市場擴張。隨著風險因素的日益普遍和診斷能力的不斷提高,對疫苗和標靶治療的需求正在急劇成長。

肺炎治療產業的主要參與者包括諾華、雅培實驗室、葛蘭素史克、阿斯特捷利康、西普拉、梯瓦製藥、拜耳、魯賓製藥、羅氏製藥、百特國際、默克公司、邁蘭、強生、第一三共、艾伯維、百時美施貴寶。肺炎治療市場的領先公司正專注於精準醫療、轉化研究和診斷整合,以鞏固其競爭地位。許多公司正在大力投資分子診斷工具和即時檢測,以區分病毒、細菌和真菌病例,從而實現更有效的治療並減少浪費。該公司也正在開發新型抗生素和生物製劑以解決抗藥性問題,以及縮短治療時間的聯合療法。與疫苗開發商的策略聯盟加強了產品組合,同時擴展到數位和遠距醫療管道增加了可及性和知名度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球肺炎病例上升

- 人口老化和免疫功能低下的患者

- 遠距醫療和電子藥房的擴展

- 政府疫苗接種計劃

- 產業陷阱與挑戰

- 品牌藥物和疫苗成本高

- 發展中地區的認知有限

- 市場機會

- 聯合療法的開發

- 醫療保健投資不斷增加的新興市場

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 未來市場趨勢

- 技術格局

- 目前技術

- 新興技術

- 定價分析

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按感染類型,2021 - 2034 年

- 主要趨勢

- 社區型肺炎(CAP)

- 院內獲得性肺炎(HAP)

- 呼吸器相關性肺炎(VAP)

- 其他感染類型

第6章:市場估計與預測:依治療類型,2021 - 2034

- 主要趨勢

- 藥品類別

- 抗菌藥物

- 喹諾酮類藥物

- 大環內酯類

- 其他抗菌藥物

- 抗病毒藥物

- 抗真菌藥物

- 其他藥物類別

- 抗菌藥物

- 疫苗

- 氧氣療法

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 兒科

- 成年人

- 老年病學

第 8 章:市場估計與預測:按管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 腸外

- 其他給藥途徑

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 其他最終用途

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Abbott Laboratories

- AbbVie

- AstraZeneca

- Baxter International

- Bayer

- Bristol Myers Squibb

- Cipla

- Daiichi Sankyo

- F. Hoffmann-La Roche

- GlaxoSmithKline

- Johnson & Johnson

- Lupin Pharmaceuticals

- Merck & Co.

- Mylan

- Novartis

- Pfizer

- Teva Pharmaceuticals

The Global Pneumonia Therapeutics Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 7.4 billion by 2034.

Pneumonia incidence is increasing globally, especially among older adults, young children, and people with weakened immune systems. Respiratory failure, a serious complication that impairs oxygen transfer and carbon dioxide removal, significantly increases mortality risk in these vulnerable populations. Hospital-acquired and ventilator-associated pneumonia are also growing concerns as stays lengthen, and mechanical ventilation becomes more common. Therapeutic options for pneumonia encompass antibacterial, antiviral, antifungal drugs, vaccines, and supportive treatments like oxygen therapy. These are distinguished from broader respiratory medications by targeting specific pathogens, guided by diagnostic testing. Innovations in molecular diagnostics and point-of-care testing are making pathogen identification more precise, allowing treatment to be better tailored and reducing misuse of antibiotics. With online pharmacies and direct-to-consumer channels expanding, patients and caregivers are gaining easier access to both prescription and over-the-counter treatments. Regionally, North America holds a dominant position, supported by high healthcare spending, strong diagnostic infrastructure, and early adoption of advanced therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 8.5% |

In 2024, the community-acquired pneumonia (CAP) segment held 51.4% share, driven by a wide mix of pathogens, patient risk factors like age and underlying health conditions, and environmental influences contributing to its high incidence. CAP remains the most prominent category in pneumonia therapeutics globally, affecting both pediatric and adult populations, and rising hospitalization rates for CAP are spurring demand for novel therapeutic solutions.

The drug class segment held 67.7% share in 2024 owing to its effectiveness in treating both mild and severe pneumonia. This segment breaks down into antibacterial, antiviral, antifungal, and other drug types, with antibacterial treatments further divided into quinolones, macrolides, and other antibacterial agents. The prevalence of bacterial pneumonia, coupled with increasing multidrug-resistant organisms, has driven demand for new drug formulations and combination therapies.

U.S. Pneumonia Therapeutics Market was estimated at USD 1.2 billion in 2024. Rising prevalence, increasing hospitalizations, and mortality associated with pneumonia in the U.S. are fueling market expansion. The demand for vaccines and targeted therapies is growing sharply as risk factors become more prevalent and diagnostic capabilities become more advanced.

Major players operating in the pneumonia therapeutics industry include Novartis, Abbott Laboratories, GlaxoSmithKline, AstraZeneca, Cipla, Teva Pharmaceuticals, Bayer, Lupin Pharmaceuticals, F. Hoffmann-La Roche, Baxter International, Merck & Co., Mylan, Johnson & Johnson, Daiichi Sankyo, AbbVie, Bristol Myers Squibb. Leading firms in pneumonia therapeutics market are focusing on precision medicine, translational research, and diagnostic integration to solidify their competitive positions. Many are investing heavily in molecular diagnostic tools and point-of-care testing to distinguish between viral, bacterial, and fungal cases, enabling more effective therapy and reducing wastage. Companies are also developing novel antibiotics and biologics to address drug resistance, and combination treatments that shorten treatment duration. Strategic alliances with vaccine developers strengthen portfolios, while expanding into digital and telehealth channels increases access and awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infection type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global pneumonia cases

- 3.2.1.2 Aging population and immunocompromised patients

- 3.2.1.3 Expansion of telehealth and e-pharmacy

- 3.2.1.4 Government vaccination programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded drugs and vaccines

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination therapies

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.8 Pipeline analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Community-acquired pneumonia (CAP)

- 5.3 Hospital-acquired pneumonia (HAP)

- 5.4 Ventilator-associated pneumonia (VAP)

- 5.5 Other infection types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug class

- 6.2.1 Antibacterial drugs

- 6.2.1.1 Quinolones

- 6.2.1.2 Macrolide

- 6.2.1.3 Other antibacterial drugs

- 6.2.2 Antiviral drugs

- 6.2.3 Antifungal drugs

- 6.2.4 Other drug classes

- 6.2.1 Antibacterial drugs

- 6.3 Vaccines

- 6.4 Oxygen therapy

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

- 7.4 Geriatrics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 AbbVie

- 11.3 AstraZeneca

- 11.4 Baxter International

- 11.5 Bayer

- 11.6 Bristol Myers Squibb

- 11.7 Cipla

- 11.8 Daiichi Sankyo

- 11.9 F. Hoffmann-La Roche

- 11.10 GlaxoSmithKline

- 11.11 Johnson & Johnson

- 11.12 Lupin Pharmaceuticals

- 11.13 Merck & Co.

- 11.14 Mylan

- 11.15 Novartis

- 11.16 Pfizer

- 11.17 Teva Pharmaceuticals