|

市場調查報告書

商品編碼

1833682

中壓開關設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Medium Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

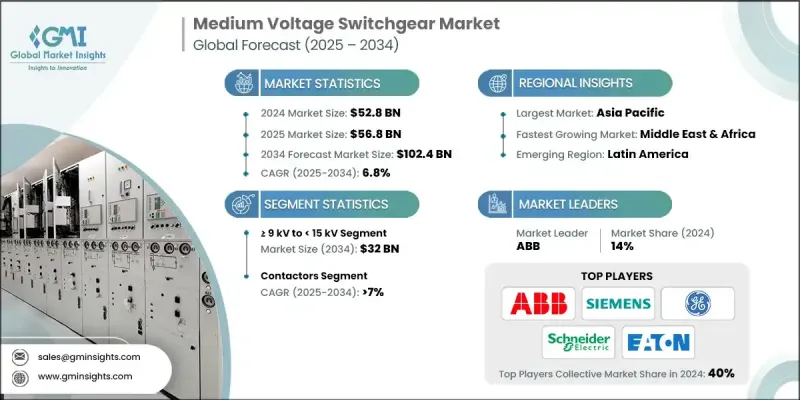

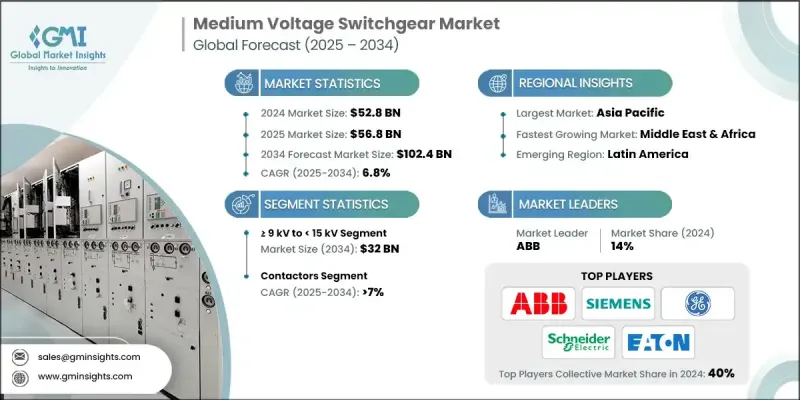

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球中壓開關設備市場規模估計為 528 億美元,預計將從 2025 年的 568 億美元成長到 2034 年的 1,024 億美元,複合年成長率為 6.8%。

工業和商業領域對穩定不間斷電源的需求日益成長,這推動了對中壓開關設備的需求。這些系統對於安全控制和保護電氣設備至關重要,對於確保電力可靠性和品質至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 528億美元 |

| 預測值 | 1024億美元 |

| 複合年成長率 | 6.8% |

>= 9 kV 至 15 kV 以獲得牽引力

2024年,≥9 kV至15 kV的市場佔有顯著佔有率,因為各行各業都需要更高電壓的系統,以便在更大規模的營運中實現高效安全的配電。此電壓範圍對於工業和商業應用至關重要,尤其是對於需要堅固可靠設備的電網、變電站和大型設施而言。各公司正致力於提升開關設備的設計和耐用性,以提供能夠最大程度減少停機時間並增強運行安全性的解決方案。鞏固該市場地位的關鍵策略包括利用先進材料延長設備壽命,融入數位監控技術以改進性能追蹤,以及提供可根據不同客戶需求進行調整的模組化解決方案。

接觸器需求不斷成長

2024年,接觸器細分市場佔據了相當大的佔有率,這得益於自動化系統和工業機械中電路的保護和控制。接觸器系統對於安全且有效率地切換大型電氣負載至關重要。其在製造業、能源業和基礎設施項目中日益成長的應用也推動了市場的成長。為了在這一細分市場中佔據更大的佔有率,各公司正專注於提高產品可靠性、降低維護成本,並開發能夠處理高壓操作且設計更節能的接觸器。策略性舉措包括豐富產品線,包括具有遠端監控功能的智慧接觸器,從而為用戶提供即時效能洞察,並進一步提高安全性。

亞太地區將崛起成為推動力地區

2024年,亞太地區中壓開關設備市場將佔據相當大的佔有率,這得益於該地區不斷擴大的工業基礎、日益加快的城市化進程以及對可靠電力分配日益成長的需求。該地區的企業正致力於安裝先進的開關設備系統,以支援城鄉地區的基礎設施建設。

中壓開關設備市場的主要參與者有東芝、正泰集團、CG電力和工業解決方案、伊頓、露西集團、富士電機、西門子、通用電氣、松下、施耐德電氣、BHEL、L&T、三菱電機、鮑威爾工業、歐瑪嘉寶、英制電氣、HD現代電機、Larsen & ToubrobroSGC、ABBABL、BABBAB、HD現代電機、Larsen & ToubroB、ABAB、BABB、BABB、SGC、BoubroB、BABbroB。

為了增強市場影響力,各公司正大力投入研發,以開發更有效率、更可靠、更具成本效益的中壓開關設備。智慧開關設備等創新技術正日益普及,這些技術能夠實現即時監控、遠端控制和預測性維護。透過整合數位技術和物聯網功能,各公司能夠為客戶提供更強大的電氣系統控制能力,從而延長系統正常運作時間並降低營運成本。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 進出口貿易分析

- 各地區價格趨勢分析(美元/單位)

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性基準描述

- 策略儀表板

- 創新與技術格局

第5章:中壓開關設備市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- ≥ 3 kV 至 < 9 kV

- ≥ 9 kV 至 < 15 kV

- ≥ 15 千伏至 < 21 千伏

- ≥ 21 千伏至 < 27 千伏

- ≥ 27 千伏至 < 33 千伏

- ≥33千伏

第6章:中壓開關設備市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 斷路器

- 接觸器

- 開關和斷路器

- 保險絲

- 其他

第7章:中壓開關設備市場規模及預測:依絕緣類型,2021 - 2034

- 主要趨勢

- 空氣

- 氣體

- 其他

第8章:中壓開關設備市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 發電站

- 變電站

- 當地電力供應

- 其他

第9章:中壓開關設備市場規模及預測:按應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

- 公用事業

第 10 章:中壓開關設備市場規模及預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司簡介

- ABB

- Bharat Heavy Electricals

- CG Power and Industrial Solutions

- Chint Group

- Eaton

- Fuji Electric

- General Electric

- HD Hyundai Electric

- Hyosung Heavy Industries

- Larsen & Toubro Limited

- Lucy Group

- Legrand

- Mitsubishi Electric

- Orecco Electric

- Ormazabal

- Panasonic

- Powell Industries

- Schneider Electric

- SGC

- Siemens

- Toshiba

The global medium voltage switchgear market was estimated at USD 52.8 billion in 2024 and is expected to grow from USD 56.8 billion in 2025 to USD 102.4 billion by 2034, at a CAGR of 6.8%, according to the latest report published by Global Market Insights Inc.

The growing demand for a stable and uninterrupted power supply, particularly in industrial and commercial sectors, is driving the need for medium voltage switchgear. These systems are essential for safely controlling and protecting electrical equipment, making them crucial for ensuring power reliability and quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.8 Billion |

| Forecast Value | $102.4 Billion |

| CAGR | 6.8% |

>= 9 kV to 15 kV to Gain Traction

The >= 9 kV to 15 kV segment held a notable share in 2024, as industries require higher voltage systems for efficient and safe power distribution in larger operations. This range is crucial for industrial and commercial applications, particularly for power grids, substations, and large-scale facilities that demand robust and reliable equipment. Companies are focusing on advancing the design and durability of their switchgear to offer solutions that minimize downtime and enhance operational safety. Key strategies to strengthen market position in this segment include leveraging advanced materials for longer equipment life, incorporating digital monitoring technologies to improve performance tracking, and offering modular solutions that can be adapted to different customer needs.

Rising Demand for Contactors

The contactors segment generated a significant share in 2024, driven by protection and control of electrical circuits in automated systems and industrial machinery. Contactor systems are essential for switching large electrical loads safely and efficiently. Market growth is also driven by their growing use in manufacturing, energy, and infrastructure projects. To capture a larger share of this segment, companies are focusing on enhancing product reliability, reducing maintenance costs, and developing contactors that can handle high-voltage operations with more energy-efficient designs. Strategic moves involve diversifying product offerings to include smart contactors with remote monitoring capabilities, thereby providing users with real-time performance insights and further improving safety.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific medium voltage switchgear market held a sizeable share in 2024, driven by the region's expanding industrial base, increasing urbanization, and rising demand for reliable electricity distribution. Companies in this region are focusing on the installation of advanced switchgear systems to support infrastructure development in both urban and rural areas.

Major players in the medium voltage switchgear market are Toshiba, Chint Group, CG Power and Industrial Solutions, Eaton, Lucy Group, Fuji Electric, Siemens, General Electric, Panasonic, Schneider Electric, BHEL, L&T, Mitsubishi Electric, Powell Industries, Ormazabal, Orecco Electric, HD Hyundai Electric, Larsen & Toubro Limited, SGC, ABB, and Hyosung Heavy Industries.

To strengthen their presence, companies are heavily investing in R&D to develop more efficient, reliable, and cost-effective medium voltage switchgear. Innovations such as smart switchgear, which allows real-time monitoring, remote control, and predictive maintenance, are gaining popularity. By integrating digital technologies and IoT capabilities, companies are providing customers with enhanced control over their electrical systems, thereby improving system uptime and reducing operational costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Medium Voltage Switchgear Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 ≥ 3 kV to < 9 kV

- 5.3 ≥ 9 kV to < 15 kV

- 5.4 ≥ 15 kV to < 21 kV

- 5.5 ≥ 21 kV to < 27 kV

- 5.6 ≥ 27 kV to < 33 kV

- 5.7 ≥ 33 kV

Chapter 6 Medium Voltage Switchgear Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Circuit Breakers

- 6.3 Contactors

- 6.4 Switches & Disconnector

- 6.5 Fuses

- 6.6 Others

Chapter 7 Medium Voltage Switchgear Market Size and Forecast, By Insulation, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Air

- 7.3 Gas

- 7.4 Others

Chapter 8 Medium Voltage Switchgear Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 Power Stations

- 8.3 Transformer Substations

- 8.4 Local Electricity Supply

- 8.5 Others

Chapter 9 Medium Voltage Switchgear Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

- 9.5 Utility

Chapter 10 Medium Voltage Switchgear Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Turkey

- 10.5.4 South Africa

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bharat Heavy Electricals

- 11.3 CG Power and Industrial Solutions

- 11.4 Chint Group

- 11.5 Eaton

- 11.6 Fuji Electric

- 11.7 General Electric

- 11.8 HD Hyundai Electric

- 11.9 Hyosung Heavy Industries

- 11.10 Larsen & Toubro Limited

- 11.11 Lucy Group

- 11.12 Legrand

- 11.13 Mitsubishi Electric

- 11.14 Orecco Electric

- 11.15 Ormazabal

- 11.16 Panasonic

- 11.17 Powell Industries

- 11.18 Schneider Electric

- 11.19 SGC

- 11.20 Siemens

- 11.21 Toshiba