|

市場調查報告書

商品編碼

1833681

睡眠呼吸中止症植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sleep Apnea Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

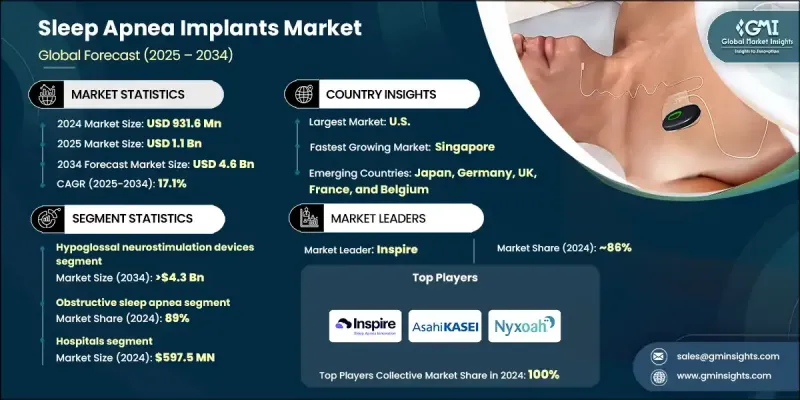

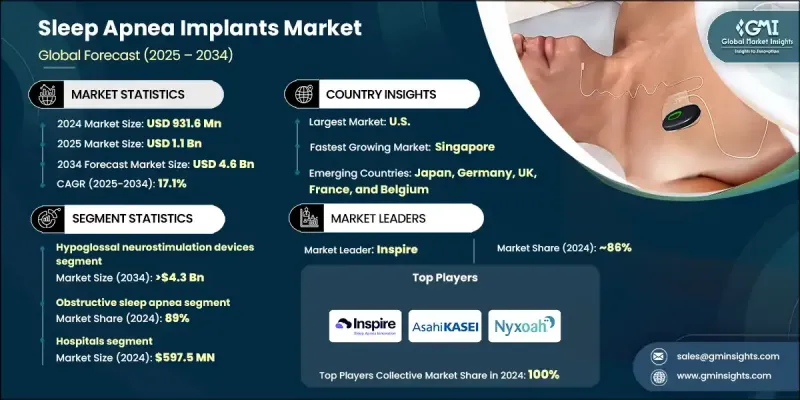

2024 年全球睡眠呼吸中止症植入物市場價值為 9.316 億美元,預計到 2034 年將以 17.1% 的複合年成長率成長至 46 億美元。

這項快速成長的動力源自於阻塞性睡眠呼吸中止症(OSA)盛行率的上升、持續性正壓呼吸器(CPAP)療法依從性有限以及人們對睡眠相關健康狀況日益成長的認知。睡眠呼吸中止症植入物提供了一種替代面罩式治療的方案,它提供微創、無需面罩的解決方案,刺激氣道肌肉,防止睡眠期間出現阻塞。由於許多患者在使用傳統療法時感到不適、不耐受或不便,這些設備正日益受到關注。隨著臨床創新和對患者友善設備的日益關注,植入物正成為尋求長期有效解決方案的患者的關鍵選擇。由於醫生支持力度的增加、技術進步以及人們對未治療的阻塞性睡眠呼吸中止症(OSA)與心血管、代謝和神經系統風險之間聯繫的認知不斷加深,市場也在不斷擴大。 Inspire、Nyxoah 和旭化成等主要參與者正在塑造競爭格局,大型公司利用廣泛的產品組合和全球影響力,而小型企業則透過利基技術和專注的研究工作來推動成長。這些動態共同推動著全球睡眠呼吸中止症治療的變革性轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.316億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 17.1% |

2024年,舌下神經刺激裝置市場佔據了86.7%的市場佔有率,這得益於其成熟的臨床療效、醫生的偏好以及對傳統療法不耐受的患者群體的廣泛採用。 CPAP的長期依從性有限,只有約三分之一的患者能夠持續使用,這進一步增強了人們對可改善生活品質、帶來便利的植入式治療方案的需求。

阻塞性睡眠呼吸中止症(OSA)領域在2024年佔據了89%的市場佔有率,這主要得益於OSA的高盛行率和傳統治療方法的不足。數百萬患者仍未得到診斷,但人們越來越意識到該疾病與心臟病、糖尿病和認知能力下降之間的聯繫,這推動了能夠帶來長期益處的植入療法的發展。

2024年,醫院植入手術市場收入達5.975億美元,主要得益於植入手術。醫院植入手術的主導地位源於其先進的基礎設施、經驗豐富的專業外科醫生以及全面的術後護理,這些因素確保了植入手術的安全,並持續監測舌下神經刺激器和膈神經刺激器等器械。多學科團隊和先進的診斷工具進一步提升了醫院植入手術的採用率。

2024年,美國睡眠呼吸中止症植入物市場規模達8.4億美元。該地區的成長得益於大量的阻塞性睡眠呼吸中止症(OSA)患者、優惠的報銷框架以及早期植入式設備的普及。強大的醫療保健基礎設施、積極的臨床研究以及旭化成、Inspire Medical Systems和Nyxoah等公司的參與,將繼續推動美國在該領域的領先地位。

睡眠呼吸中止症植入物產業的知名企業包括Inspire、Nyxoah和旭化成。為了鞏固在睡眠呼吸中止症植入物市場的立足點,各公司正在實施以產品創新、臨床研究和區域擴張為中心的策略。各公司正大力投資開發微創、患者友善設備,這些設備與傳統療法相比,可提高患者的依從性。擴大臨床試驗計畫對於驗證療效、獲得監管部門批准和建立醫生信心也至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 阻塞性睡眠呼吸中止症盛行率不斷上升

- 對 CPAP 的依從性和堅持性較低

- 技術進步

- 提高對睡眠呼吸中止症的認知

- 產業陷阱與挑戰

- 睡眠呼吸中止症植入物成本高昂

- 與睡眠呼吸中止症植入物相關的併發症

- 市場機會

- 確診 OSA 患者數量不斷增加

- 向新興市場擴張

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 美國

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 新興國家的採用

- 2021-2024 年 OSA 發生率和盛行率

- 產品線分析

- 啟動場景

- 2024年定價分析

- 投資前景

- 消費者行為分析

- 患者旅程圖

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 美國

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 舌下神經刺激裝置

- 膈神經刺激器

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 阻塞性睡眠呼吸中止症

- 中樞性睡眠呼吸中止症

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 門診手術中心

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 美國

- 歐洲

- 德國

- 英國

- 瑞士

- 法國

- 西班牙

- 義大利

- 荷蘭

- 比利時

- 奧地利

- 芬蘭

- 日本

- 新加坡

第9章:公司簡介

- Asahi Kasei

- Inspire

- Nyxoah

The Global Sleep Apnea Implants Market was valued at USD 931.6 million in 2024 and is estimated to grow at a CAGR of 17.1% to reach USD 4.6 billion by 2034.

This rapid growth is being propelled by the rising prevalence of obstructive sleep apnea, limited compliance with CPAP therapy, and increasing awareness of sleep-related health conditions. Sleep apnea implants provide an alternative to mask-based treatments, offering minimally invasive, mask-free solutions that stimulate airway muscles to prevent obstruction during sleep. These devices are gaining traction as many patients experience discomfort, intolerance, or inconvenience with conventional therapies. With clinical innovations and a growing focus on patient-friendly devices, implants are becoming a critical option for individuals seeking long-term, effective solutions. The market is also expanding due to growing physician support, technological advancements, and heightened recognition of the link between untreated OSA and cardiovascular, metabolic, and neurological risks. Major players such as Inspire, Nyxoah, and Asahi Kasei are shaping the competitive landscape, with larger companies leveraging extensive product portfolios and global reach while smaller firms drive growth through niche technologies and focused research efforts. Collectively, these dynamics are driving a transformative shift in sleep apnea treatment worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931.6 Million |

| Forecast Value | $4.6 Billion |

| CAGR | 17.1% |

The hypoglossal neurostimulation devices segment held 86.7% share in 2024, supported by proven clinical outcomes, physician preference, and widespread adoption among patients intolerant to traditional therapies. The limited long-term adherence to CPAP, with only about one-third of patients maintaining consistent use, has further reinforced demand for implantable options that offer improved quality of life and convenience.

The obstructive sleep apnea segment held an 89% share in 2024, driven by the high prevalence of OSA and the shortcomings of conventional treatment methods. Millions of individuals remain undiagnosed, yet awareness of the condition's connection to heart disease, diabetes, and cognitive decline is rising, driving the push for implant-based therapies that can deliver long-term benefits.

The hospitals segment generated USD 597.5 million in 2024, driven by the implant procedures. Their dominance stems from advanced infrastructure, availability of expert surgeons, and comprehensive post-operative care, ensuring safe implantation and ongoing monitoring of devices such as hypoglossal and phrenic nerve stimulators. Multidisciplinary teams and advanced diagnostic tools further strengthen hospital adoption rates.

United States Sleep Apnea Implants Market was valued at USD 840 million in 2024. Growth in the region is fueled by the high number of OSA patients, favorable reimbursement frameworks, and early adoption of implantable devices. A robust healthcare infrastructure, combined with active clinical research and the presence of companies like Asahi Kasei, Inspire Medical Systems, and Nyxoah, continues to drive the country's leadership in this space.

Prominent players in the Sleep Apnea Implants Industry include Inspire, Nyxoah, and Asahi Kasei. To strengthen their foothold in the sleep apnea implants market, companies are implementing strategies centered on product innovation, clinical research, and regional expansion. Firms are investing heavily in developing minimally invasive, patient-friendly devices that improve adherence compared to traditional therapies. Expanding clinical trial programs is also critical to validate efficacy, secure regulatory approvals, and build physician confidence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Indication channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of obstructive sleep apnea

- 3.2.1.2 Low compliance and adherence towards CPAP

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising awareness regarding sleep apnea

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of sleep apnea implants

- 3.2.2.2 Complications associated with sleep apnea implants

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing number of diagnosed OSA patients

- 3.2.3.2 Expansion into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Adoption in emerging countries

- 3.9 Hypoglossal neurostimulation devices market, 2021 - 2034 (Units)

- 3.10 Incidence and prevalence of OSA, 2021-2024

- 3.11 Product pipeline analysis

- 3.12 Start-up scenario

- 3.13 Pricing analysis, 2024

- 3.14 Investment landscape

- 3.15 Consumer behaviour analysis

- 3.16 Patient journey map

- 3.17 Porter's analysis

- 3.18 PESTEL analysis

- 3.19 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hypoglossal neurostimulation devices

- 5.3 Phrenic nerve stimulators

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea

- 6.3 Central sleep apnea

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Switzerland

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Italy

- 8.3.7 Netherlands

- 8.3.8 Belgium

- 8.3.9 Austria

- 8.3.10 Finland

- 8.4 Japan

- 8.5 Singapore

Chapter 9 Company Profiles

- 9.1 Asahi Kasei

- 9.2 Inspire

- 9.3 Nyxoah