|

市場調查報告書

商品編碼

1833680

迷你分離式空調系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Mini Split Air Conditioning System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球迷你分離式空調系統市值為 74 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長至 125 億美元。

隨著人們越來越重視減少能源消耗和碳排放,迷你分離式系統因其較高的 SEER 等級和能夠冷卻特定區域而不會在未使用的空間上浪費能源的能力而越來越受歡迎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 74億美元 |

| 預測值 | 125億美元 |

| 複合年成長率 | 5.5% |

單區迷你分離式空調需求不斷成長

單區迷你分離式空調憑藉其經濟實惠、操作簡單和精準冷凍的優勢,在2024年佔據了相當大的市場佔有率。這類系統非常適合小型住宅、獨立房間或家庭辦公室,使用者無需徹底改造整個暖通空調系統即可為特定空間冷卻。隨著越來越多的屋主尋求無需管道系統的節能解決方案,單區空調正逐漸成為首選,尤其是在空間和成本至關重要的城市環境中。

住宅領域採用率不斷提高

到2034年,住宅市場將保持可觀的複合年成長率,因為屋主越來越重視舒適性、客製化和節能。這些系統提供了無管道中央空調的替代方案,特別適合老舊住宅或無法安裝管道的擴建住宅。隨著遠距辦公和居家時間的增加,對靈活控制各種居住空間溫度的需求日益成長。各大品牌紛紛推出更安靜的型號、更簡潔的外觀以及支援Wi-Fi的功能,以順應智慧家庭的發展趨勢。

線下領域將獲得發展動力

2024年,線下市場佔據了相當大的佔有率,這得益於產品的複雜性以及購買過程中對專家指導的需求。許多客戶仍然傾向於透過實體零售商或授權經銷商來評估系統性能、獲得安裝支援並確保售後服務的可用性。各公司正在加強零售合作夥伴關係,提供捆綁安裝服務,並進行店內演示,以增強消費者信心並加速購買決策。

亞太地區將成為推動力地區

2024年,亞太地區迷你分離式空調系統市場佔據了相當大的佔有率,這得益於密集的城市化進程、中產階級收入的不斷成長以及該地區炎熱的氣候。中國、日本、韓國和印度等國家在新建住宅和改造項目中,對緊湊型節能製冷解決方案的需求正在激增。國內外企業正致力於擴大生產設施,客製化設計以滿足區域需求,並利用分銷商網路來擴大覆蓋範圍和提高響應速度。

迷你分離式空調系統市場的主要參與者包括東芝公司、Senville、大金工業、LG電子、特靈科技、富士通將軍、海爾集團公司、日立、三菱電機公司、開利公司、松下公司、三星電子、格力電器、江森自控國際和美的集團。

為了鞏固市場地位,迷你分離式空調系統領域的公司正在大力投資研發、智慧功能和區域擴張。關鍵策略包括整合變頻壓縮機以提高能源效率、開發支援物聯網的遠端控制機型,以及使用環保冷媒以符合全球環保標準。領先品牌也與安裝商建立策略聯盟,培訓服務網路,並進行宣傳活動,向消費者宣傳無管技術的優勢。透過提供從入門級到高階的可擴展產品線,公司能夠滿足各種預算和應用的需求,確保市場永續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- HVAC系統中能源效率的重要性

- 為特定區域客製化氣候控制

- 易於安裝和靈活設計

- 產業陷阱與挑戰

- 來自替代技術的激烈競爭

- 市場飽和

- 機會

- 現有建築改造需求不斷成長

- 與智慧家庭和物聯網技術的整合

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼:84158210)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 單區迷你分離式

- 多區域迷你分離式

第6章:市場估計與預測:按安裝量,2021-2034

- 主要趨勢

- 壁掛式

- 落地式

- 天花板式

- 其他(獨立式)

第7章:市場估計與預測:依技術,2021-2034

- 主要趨勢

- 逆變器迷你分離式機

- 非逆變器迷你分離式空調

第8章:市場估計與預測:按價格,2021-2034

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 高達 9,000 BTU/小時

- 9,000 至 12,000 BTU/小時

- 12,000 至 18,000 BTU/小時

- 18,000 BTU/小時以上

第 10 章:市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 住宅

- 商業的

第 11 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 公司網站

- 電子商務網站

- 離線

- 專賣店

- 超市和大賣場

- 工廠直營店

- 其他零售店

第 12 章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Carrier Corporation

- Daikin Industries

- Fujitsu General

- GREE Electric Appliances

- Haier Group Corporation

- Hitachi

- Johnson Controls International

- LG Electronics

- Midea Group

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Samsung Electronics

- Senville

- Toshiba Corporation

- Trane Technologies

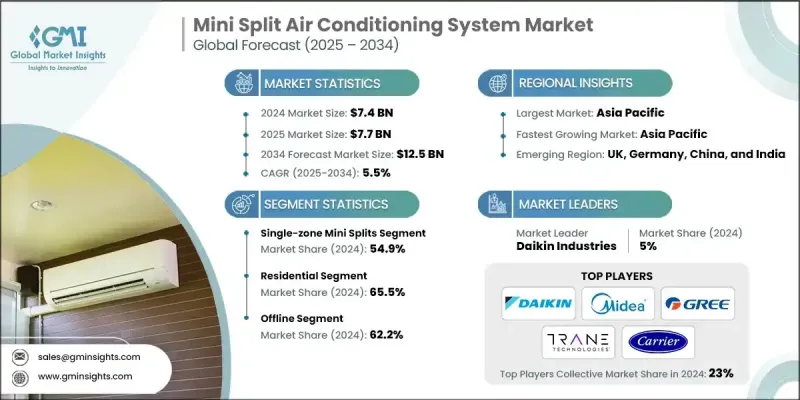

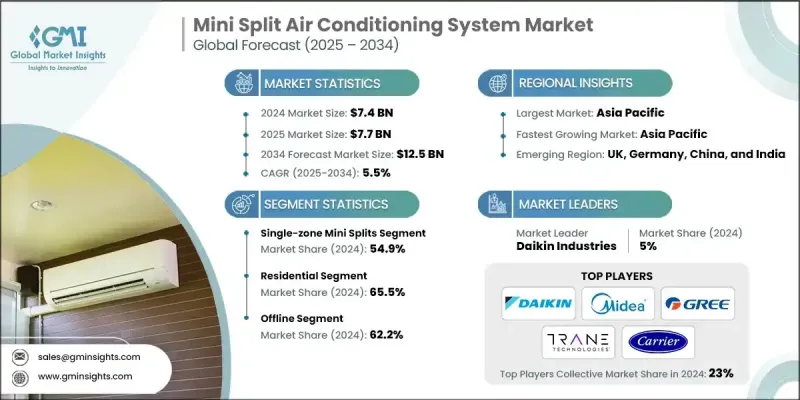

The Global Mini Split Air Conditioning System Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 12.5 billion by 2034.

With growing emphasis on reducing energy consumption and carbon emissions, mini split systems are gaining popularity due to their high SEER ratings and ability to cool specific zones without wasting energy on unused spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 billion |

| Forecast Value | $12.5 billion |

| CAGR | 5.5% |

Rising Demand for Single-Zone Mini Splits

The single-zone mini splits segment held a significant share in 2024, driven by its affordability, simplicity, and targeted cooling benefits. These systems are ideal for small homes, individual rooms, or home offices, allowing users to cool specific spaces without overhauling their entire HVAC setup. As more homeowners seek energy-efficient solutions without the need for ductwork, single zone units are emerging as the go-to option, particularly in urban environments where space and cost are critical.

Increasing Adoption in the Residential Sector

The residential segment will grow at a decent CAGR through 2034, as homeowners prioritize comfort, customization, and energy savings. These systems offer a ductless alternative to central AC, making them especially attractive for older homes or additions where duct installation is not feasible. With remote work and time spent at home increasing, there's a growing need for flexible climate control across living spaces. Brands are responding by introducing quieter models, cleaner aesthetics, and Wi-Fi enabled features that align with smart home movement.

Offline Sector to Gain Traction

The offline segment generated a sizeable share in 2024, backed by the complexity of the product and the need for expert guidance during purchase. Many customers still prefer brick-and-mortar retailers or authorized dealers to assess system performance, get installation support, and ensure after-sales service availability. Companies are strengthening retail partnerships, offering bundled installation services, and conducting in-store demos to drive consumer confidence and accelerate purchase decisions.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific mini split air conditioning system market held a significant share in 2024, driven by dense urbanization, rising middle-class income, and the region's hot climate. Countries like China, Japan, South Korea, and India are witnessing surging demand for compact, energy-efficient cooling solutions in both new residential developments and retrofit projects. Local and international players are focusing on expanding production facilities, customizing designs to meet regional preferences, and leveraging distributor networks to increase reach and responsiveness.

Major players in the mini split air conditioning system market are Toshiba Corporation, Senville, Daikin Industries, LG Electronics, Trane Technologies, Fujitsu General, Haier Group Corporation, Hitachi, Mitsubishi Electric Corporation, Carrier Corporation, Panasonic Corporation, Samsung Electronics, GREE Electric Appliances, Johnson Controls International, and Midea Group.

To strengthen their market presence, companies in the mini split air conditioning system space are investing heavily in R&D, smart features, and regional expansion. Key strategies include the integration of inverter compressors for enhanced energy efficiency, the development of IoT-enabled models for remote control, and the use of eco-friendly refrigerants to comply with global environmental standards. Leading brands are also forming strategic alliances with installers, training service networks, and launching awareness campaigns to educate consumers on the benefits of ductless technology. By offering scalable product lines-from entry-level to premium-companies are catering to a wide range of budgets and applications, ensuring sustainable market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Installation

- 2.2.4 Technology

- 2.2.5 Price

- 2.2.6 Capacity

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The significance of energy efficiency in HVAC systems

- 3.2.1.2 Tailoring climate control for specific zone

- 3.2.1.3 Ease of installation and flexibility design

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition from alternative technologies

- 3.2.2.2 Market saturation

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for retrofit installations in existing buildings

- 3.2.3.2 Integration with smart home & IoT technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 84158210)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single-zone mini splits

- 5.3 Multi-zone mini splits

Chapter 6 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wall mounted

- 6.3 Floor-mounted

- 6.4 Ceiling-mounted

- 6.5 Other (Free standing)

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Inverter mini splits

- 7.3 Non-inverter mini splits

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Up to 9,000 BTU/hr

- 9.3 9,000 to 12,000 BTU/hr

- 9.4 12,000 to 18,000 BTU/hr

- 9.5 18,000 BTU/hr and above

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 Company websites

- 11.2.2 E-commerce website

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Supermarket & hypermarkets

- 11.3.3 Factory outlets

- 11.3.4 Other retail stores

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Carrier Corporation

- 13.2 Daikin Industries

- 13.3 Fujitsu General

- 13.4 GREE Electric Appliances

- 13.5 Haier Group Corporation

- 13.6 Hitachi

- 13.7 Johnson Controls International

- 13.8 LG Electronics

- 13.9 Midea Group

- 13.10 Mitsubishi Electric Corporation

- 13.11 Panasonic Corporation

- 13.12 Samsung Electronics

- 13.13 Senville

- 13.14 Toshiba Corporation

- 13.15 Trane Technologies