|

市場調查報告書

商品編碼

1833676

鐵礦球團市場機會、成長動力、產業趨勢分析及2025-2034年預測Iron Ore Pellets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

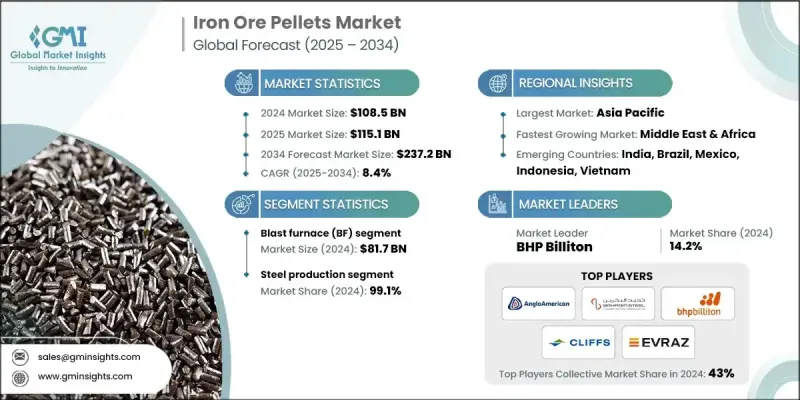

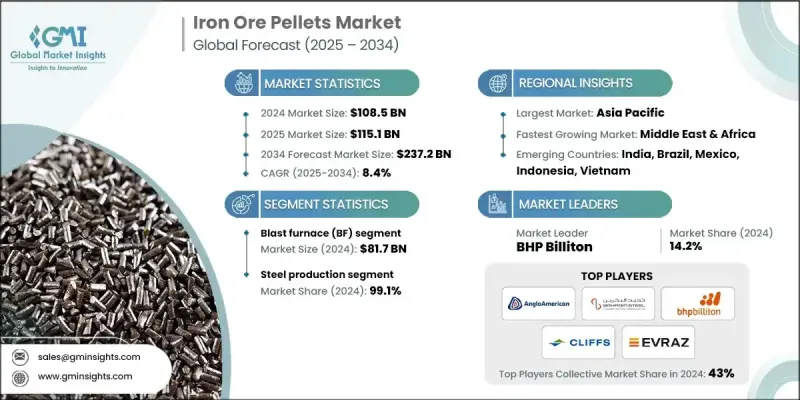

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球鐵礦球團市場規模估計為 1,085 億美元,預計將從 2025 年的 1,151 億美元成長到 2034 年的 2,372 億美元,複合年成長率為 8.4%。

鐵礦球團是煉鋼的關鍵原料,尤其是在高爐煉鋼和直接還原鐵 (DRI) 製程。隨著全球基礎設施項目、汽車生產和建築活動的持續擴張,對高品位鐵礦石球團的需求也隨之成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1085億美元 |

| 預測值 | 2372億美元 |

| 複合年成長率 | 8.4% |

高爐(BF)的採用率不斷上升

高爐 (BF) 領域在 2024 年佔據了顯著佔有率,這得益於其在大規模煉鋼作業中的關鍵作用。鐵礦球團因其尺寸均勻、鐵含量高且脈石含量低而成為高爐製程的首選,從而提高了爐效並降低了能耗。隨著綜合鋼廠力求在滿足更嚴格的排放標準的同時提高生產率,對高品質球團的需求持續成長。

鋼鐵產量不斷成長

2024年,鋼鐵生產領域佔據了相當大的佔有率,因為球團礦在冶金性能和爐效方面比塊礦和燒結礦更勝一籌。球團礦穩定的品質確保了穩定的生產,並有助於減少整體碳足跡,因此對於傳統高爐和新興的直接還原鐵 (DRI) 製程都至關重要。

亞太地區將成為利潤豐厚的地區

受快速工業化、城市化發展以及中國、印度和東南亞地區大規模鋼鐵產能的推動,亞太地區鐵礦石球團市場將在2034年前保持良好的複合年成長率。隨著基礎設施投資持續成長和環境法規日益嚴格,該地區正經歷向高品位球團的強勁轉變,以支持永續煉鋼。印度等國家也正在擴大國內球團生產,以減少對進口燒結料的依賴。地區企業正在擴大產能,投資選礦和球團技術,並成立合資企業,以確保原料供應並有效滿足日益成長的需求。

鐵礦石球團市場的主要參與者有 Cleveland-Cliffs、FERREXPO、METALLOINVEST、必和必拓、Jindal SAW、Evraz、LKAB Koncernkontor、英美資源集團、加拿大鐵礦石公司和巴林鋼鐵公司。

為了鞏固自身地位,鐵礦石球團產業的企業正在採用垂直整合、技術創新和策略合作相結合的策略。許多企業正在投資選礦廠和低品位礦石加工,以提高球團品質並最佳化資源利用率。從採礦到球團生產的垂直整合確保了更好的成本控制和穩定的原料供應。此外,企業正專注於低碳球團生產流程,並參與永續發展計劃,以符合ESG目標。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依等級,2021-2034

- 主要趨勢

- 高爐(BF)

- 直接還原(DR)

第6章:市場規模與預測:Balling Technologies,2021-2034

- 主要趨勢

- 球形磁碟

- 球鼓

第7章:市場規模與預測:按應用,2021-2034

- 主要趨勢

- 鋼鐵生產

- 鐵基化學品

第 8 章:市場規模與預測:按技術,2021-2034 年

- 主要趨勢

- 電弧爐

- 電感應爐

- 氧基/高爐

第 9 章:市場規模與預測:按產品來源,2021-2034 年

- 主要趨勢

- 赤鐵礦

- 磁鐵礦

- 其他

第 10 章:市場規模與預測:依製粒工藝,2021-2034 年

- 主要趨勢

- 移動爐篦(TG)

- 鏈篦窯(GK)

- 其他

第 11 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- Anglo American

- Bahrain Steel

- BHP Billiton

- Cleveland-Cliffs

- Evraz

- FERREXPO

- Iron Ore Company of Canada

- Jindal SAW

- LKAB Koncernkontor

- METALLOINVEST

The global iron ore pellets market was estimated at USD 108.5 billion in 2024 and is expected to grow from USD 115.1 billion in 2025 to USD 237.2 billion in 2034 at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Iron ore pellets are a critical raw material in steelmaking, particularly in blast furnaces and direct reduced iron (DRI) processes. As global infrastructure projects, automotive production, and construction activities continue to expand, the demand for high-grade iron ore pellets rises in parallel.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.5 Billion |

| Forecast Value | $237.2 Billion |

| CAGR | 8.4% |

Rising Adoption of Blast Furnace (BF)

The blast furnace (BF) segment held a notable share in 2024, driven by its critical role in large-scale steelmaking operations. Iron ore pellets are preferred in BF processes due to their consistent size, high iron content, and lower gangue levels, which improve furnace efficiency and reduce energy consumption. As integrated steel plants aim to increase productivity while meeting stricter emission norms, the demand for high-quality pellets continues to rise.

Growing Steel Production

The steel production segment generated a significant share in 2024, as pellets offer superior performance over lump ore and sinter in terms of metallurgical properties and furnace efficiency. The consistent quality of pellets ensures stable production and helps reduce the overall carbon footprint, making them vital for both traditional blast furnaces and emerging direct reduced iron (DRI) processes.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific iron ore pellets market will grow at a decent CAGR through 2034, bolstered by rapid industrialization, urban development, and massive steel production capacity across China, India, and Southeast Asia. As infrastructure investments continue to surge and environmental regulations become more stringent, the region is witnessing a strong shift toward high-grade pellets to support sustainable steelmaking. Countries like India are also expanding their domestic pellet production to reduce dependence on imported sinter feed. Regional players are scaling up capacity, investing in beneficiation and pelletizing technologies, and forming joint ventures to secure raw material access and meet growing demand efficiently.

Major players involved in the iron ore pellets market are Cleveland-Cliffs, FERREXPO, METALLOINVEST, BHP Billiton, Jindal SAW, Evraz, LKAB Koncernkontor, Anglo American, Iron Ore Company of Canada, and Bahrain Steel.

To strengthen their position, companies in the iron ore pellets industry are adopting a blend of vertical integration, technological innovation, and strategic partnerships. Many are investing in beneficiation plants and low-grade ore processing to enhance pellet quality and optimize resource utilization. Vertical integration-from mining to pellet production-ensures better cost control and consistent feedstock supply. Additionally, firms are focusing on low-carbon pellet production processes and engaging in sustainability initiatives to align with ESG goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Grade

- 2.2.2 Balling Technologies

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Product Source

- 2.2.6 Pelletizing Process

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Blast furnace (BF)

- 5.3 Direct reduction (DR)

Chapter 6 Market Size and Forecast, By Balling Technologies, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Balling disc

- 6.3 Balling drum

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Steel production

- 7.3 Iron based chemicals

Chapter 8 Market Size and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric arc furnace

- 8.3 Electric induction furnace

- 8.4 Oxygen based/blast furnace

Chapter 9 Market Size and Forecast, By Product Source, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Hematite

- 9.3 Magnetite

- 9.4 Others

Chapter 10 Market Size and Forecast, By Pelletizing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Travelling grate (TG)

- 10.3 Grate kiln (GK)

- 10.4 Others

Chapter 11 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Anglo American

- 12.2 Bahrain Steel

- 12.3 BHP Billiton

- 12.4 Cleveland-Cliffs

- 12.5 Evraz

- 12.6 FERREXPO

- 12.7 Iron Ore Company of Canada

- 12.8 Jindal SAW

- 12.9 LKAB Koncernkontor

- 12.10 METALLOINVEST