|

市場調查報告書

商品編碼

1833674

眼底照相機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fundus Cameras Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

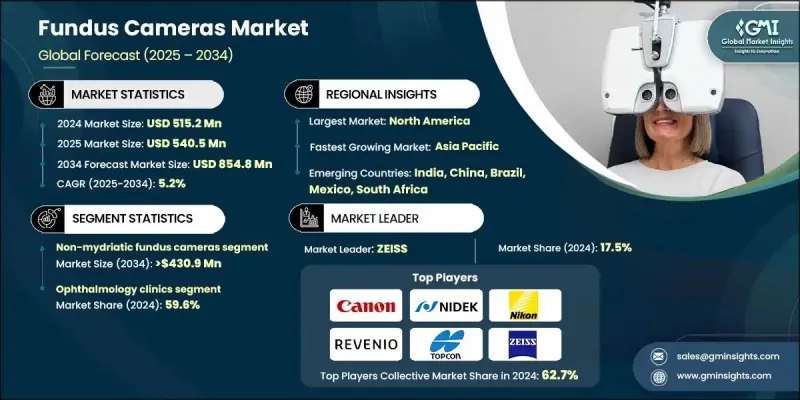

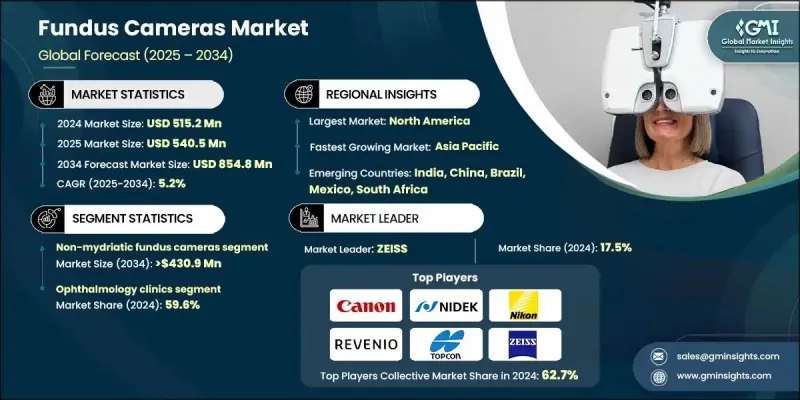

2024 年全球眼底相機市場價值為 5.152 億美元,預計將以 5.2% 的複合年成長率成長,到 2034 年達到 8.548 億美元。

由於眼部疾病的增加、老年人口的擴大、成像技術的快速進步以及政府和醫療機構為加強視力保健而採取的舉措不斷增多,市場正在持續成長。對慢性眼疾早期診斷和管理的需求日益成長,促使醫療機構擴大採用先進的視網膜影像工具。向遠距醫療服務的轉變也在擴大眼科護理的可近性方面發揮了至關重要的作用,尤其是在醫療服務不足的地區。整合數位技術的眼底照相機使醫療保健提供者能夠更輕鬆地進行遠端篩檢,從而能夠及早發現病情並減少親自就診的需求。產品設計的持續創新,包括緊湊且方便用戶使用的介面,改善了臨床工作流程並提高了效率。將光學相干斷層掃描與眼底成像技術結合在一台設備中也正在改變眼科醫生診斷和治療患者的方式,提供高解析度、全面的視網膜評估,從而節省時間和資源。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.152億美元 |

| 預測值 | 8.548億美元 |

| 複合年成長率 | 5.2% |

免散瞳眼底照相機市場在2024年佔據了52.8%的市場佔有率,這得益於其無需散瞳即可快速高效成像的優勢。這類相機在基層醫療機構和遠距眼科計畫中廣受歡迎,成為高通量眼疾篩檢的理想選擇。其易用性和患者舒適度有助於提高臨床和遠端環境下的依從性和可近性。這些系統消除了傳統散瞳過程帶來的不適和延遲,使其成為第一線篩檢和定期眼科檢查的首選。

眼科診所市場在2024年佔據59.6%的佔有率,到2034年將達到5.129億美元。診所是診斷和持續治療黃斑部病變、糖尿病視網膜病變和青光眼等眼部疾病的主要中心。隨著這些慢性疾病在全球範圍內的發病率持續成長,診所擴大採用先進的診斷解決方案,以支持更快、更準確的治療。許多診所正在轉向將眼底照相與OCT技術相結合的混合成像系統,以便在一次診療中完成全面的評估。

2024年,北美眼底照相機市場佔41.6%的市佔率。該地區受益於強大的醫療基礎設施、完善的眼科診斷檢查報銷體係以及政府在預防保健方面的積極參與。保險覆蓋範圍極大地支持了醫院、診所和專科中心對眼底照相機的採用。北美在採用先進的眼科技術方面也處於領先地位,尤其是支援人工智慧和混合技術的系統,這些技術可以簡化成像流程並提高診斷準確性。

全球眼底照相機市場的主要製造商和供應商包括蔡司、Nikon(Optos)、尼德克、拓普康、Canon、三星、維信諾、epipole、Forus Health、Huvitz、Kowa、OPTOMED、Remidio、REVENIO 和 Volk Optical。為了獲得競爭優勢,眼底照相機市場的領先公司專注於持續的產品開發、與數位平台的智慧整合以及全球業務的拓展。許多公司正在透過人工智慧、雲端儲存和遠距醫療相容性來增強其設備,以滿足不斷變化的臨床需求。與醫療保健提供者、非政府組織和政府計畫的合作有助於公司打入新興市場並改善偏遠地區的篩檢服務。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 眼部疾病盛行率不斷上升

- 有利的報銷方案

- 技術進步

- 早期疾病檢測和篩檢的需求不斷成長

- 產業陷阱與挑戰

- 眼底照相機成本高

- 發展中經濟體缺乏眼科醫生

- 市場機會

- 手持式和手提式眼底照相機的普及率不斷提高

- 日益重視兒童和新生兒視網膜篩檢

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 2024年定價分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 散瞳眼底照相機

- 桌面

- 手持式

- 免散瞳眼底照相機

- 桌面

- 手持式

- 混合眼底照相機

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 眼科診所

- 醫院

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 印尼

- 菲律賓

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 以色列

- 伊朗

第8章:公司簡介

- Canon

- epipole

- Forus Health

- Huvitz

- Kowa

- NIDEK

- Nikon (Optos)

- OPTOMED

- Remidio

- REVENIO

- SAMSUNG

- TOPCON

- Visionix

- Volk Optical

- ZEISS

The Global Fundus Cameras Market was valued at USD 515.2 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 854.8 million by 2034.

The market is seeing consistent growth due to an increase in eye-related disorders, expanding geriatric populations, rapid improvements in imaging technology, and growing initiatives by governments and healthcare organizations to enhance vision care. Rising demand for early diagnosis and management of chronic eye diseases is increasing the adoption of advanced retinal imaging tools across medical settings. The transition to telehealth services has also played a vital role in broadening access to eye care, especially in underserved areas. Fundus cameras integrated with digital technologies are making it easier for healthcare providers to conduct remote screenings, enabling early detection of conditions and reducing the need for in-person visits. Continued innovation in product design, including compact and user-friendly interfaces, has enhanced clinical workflows and boosted efficiency. The combination of optical coherence tomography with fundus imaging in a single device is also transforming how ophthalmologists diagnose and treat patients, providing high-resolution, comprehensive retinal evaluations that save both time and resources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $515.2 million |

| Forecast Value | $854.8 million |

| CAGR | 5.2% |

The non-mydriatic fundus cameras segment accounted for a 52.8% share in 2024, fueled by their ability to perform quick and efficient imaging without the need for pupil dilation. These cameras have gained widespread popularity across primary care settings and teleophthalmology programs, making them ideal for high-throughput eye disease screening. Their ease of use and patient comfort have helped improve compliance and accessibility in both clinical and remote settings. These systems eliminate the discomfort and delay of traditional dilation processes, making them the preferred choice for first-line screening and regular eye checkups.

The ophthalmology clinics segment held a 59.6% share in 2024 and will reach USD 512.9 million by 2034. Clinics serve as the main centers for diagnosis and ongoing treatment of eye conditions such as macular degeneration, diabetic retinopathy, and glaucoma. As the incidence of these chronic diseases continues to grow globally, clinics are increasingly adopting advanced diagnostic solutions to support faster and more accurate care. Many are turning to hybrid imaging systems that combine fundus photography with OCT technology for comprehensive assessments in a single session.

North America Fundus Cameras Market held a 41.6% share in 2024. The region benefits from strong healthcare infrastructure, well-defined reimbursement systems for diagnostic eye exams, and proactive government involvement in preventive care. Insurance coverage significantly supports the uptake of fundus cameras in hospitals, clinics, and specialty centers. North America also leads in embracing advanced ophthalmic technologies, particularly AI-enabled and hybrid systems that streamline imaging and enhance diagnostic accuracy.

Major manufacturers and suppliers in the Global Fundus Cameras Market include ZEISS, Nikon (Optos), NIDEK, TOPCON, Canon, Samsung, Visionix, epipole, Forus Health, Huvitz, Kowa, OPTOMED, Remidio, REVENIO, and Volk Optical. To gain a competitive edge, leading companies in the fundus cameras market are focusing on continuous product development, smart integration with digital platforms, and expanding global reach. Many are enhancing their devices with artificial intelligence, cloud-based storage, and telehealth compatibility to meet evolving clinical demands. Partnerships with healthcare providers, NGOs, and government programs help companies penetrate emerging markets and improve screening access in remote areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Favorable reimbursement scenario

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising demand for early disease detection and screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of fundus cameras

- 3.2.2.2 Lack of ophthalmologists in developing economies

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of handheld and portable fundus cameras

- 3.2.3.2 Increasing focus on pediatric and neonatal retinal screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Mydriatic fundus cameras

- 5.2.1 Tabletop

- 5.2.2 Handheld

- 5.3 Non-mydriatic fundus cameras

- 5.3.1 Tabletop

- 5.3.2 Handheld

- 5.4 Hybrid fundus cameras

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology clinics

- 6.3 Hospitals

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.3.7 Poland

- 7.3.8 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Philippines

- 7.4.8 Vietnam

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Colombia

- 7.5.5 Chile

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Turkey

- 7.6.5 Israel

- 7.6.6 Iran

Chapter 8 Company Profiles

- 8.1 Canon

- 8.2 epipole

- 8.3 Forus Health

- 8.4 Huvitz

- 8.5 Kowa

- 8.6 NIDEK

- 8.7 Nikon (Optos)

- 8.8 OPTOMED

- 8.9 Remidio

- 8.10 REVENIO

- 8.11 SAMSUNG

- 8.12 TOPCON

- 8.13 Visionix

- 8.14 Volk Optical

- 8.15 ZEISS