|

市場調查報告書

商品編碼

1833672

陶瓷過濾器市場機會、成長動力、產業趨勢分析及2025-2034年預測Ceramic Filters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

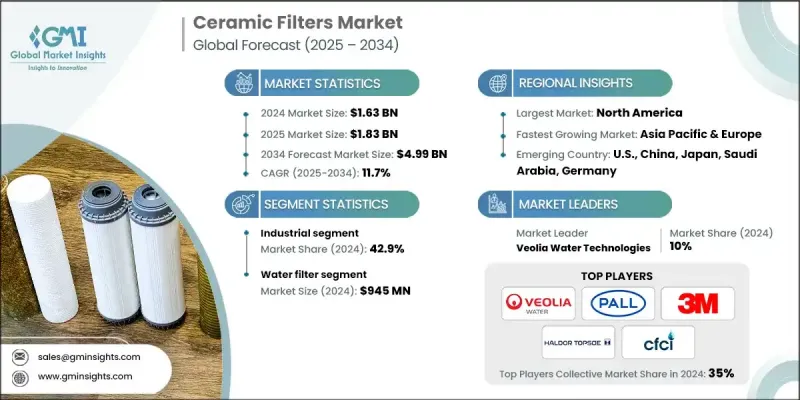

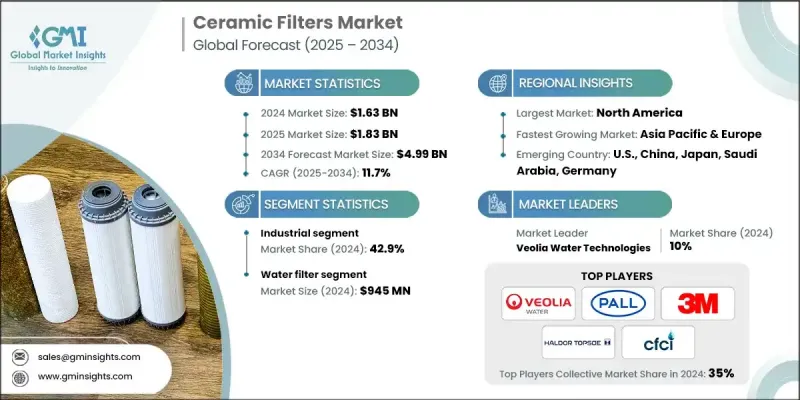

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球陶瓷過濾器市場規模估計為 16.3 億美元,預計將從 2025 年的 18.3 億美元成長到 2034 年的 49.9 億美元,複合年成長率為 11.7%。

全球對清潔安全飲用水日益成長的需求是陶瓷過濾器市場的主要驅動力之一。隨著人們對水污染問題的日益擔憂,尤其是在發展中地區,陶瓷過濾器因其高效的過濾性能、價格實惠以及在提供飲用水方面的便利性而越來越受歡迎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16.3億美元 |

| 預測值 | 49.9億美元 |

| 複合年成長率 | 11.7% |

工業領域採用率不斷上升

2024年,工業領域佔據了顯著的佔有率,這得益於化工、製藥、食品加工和石化等各行各業對高效過濾日益成長的需求。陶瓷過濾器的耐高溫和耐用性使其成為嚴苛工業環境的理想選擇,能夠提供長期性能和低維護成本。該領域的公司正致力於開發更強大、更可自訂的過濾解決方案,以滿足不同工業領域的特定需求,從而進一步推動市場成長。

淨水器將獲得青睞

2024年,淨水器市場佔據了相當大的佔有率,因為這類過濾器為清潔飲用水提供了高效且經濟的解決方案,尤其是在發展中國家。它們能夠去除細菌、沉積物和其他雜質,成為家庭、非政府組織和市政水處理廠的熱門選擇。隨著人們對水污染的擔憂日益加劇,各大公司紛紛推出更易於使用、更有效率、更環保的新型陶瓷過濾器設計,以滿足全球日益成長的安全飲用水需求。

北美將成為利潤豐厚的地區

到2034年,北美陶瓷過濾器市場預計將實現顯著成長,這得益於陶瓷過濾器在工業和消費領域的日益普及。在美國和加拿大,對經濟高效、經久耐用且能夠改善水質的水過濾解決方案的需求日益成長,尤其是在農村和偏遠地區。隨著環境法規的嚴格實施和對永續性的日益重視,陶瓷過濾器因其環保和可重複使用的特性而越來越受歡迎。

陶瓷過濾器市場的主要參與者包括 Pall、Veolia Water Technologies、Morgan Advanced Materials、LiqTech International、Ceramicx、Doulton、Kyocera、Nanostone Water、Aquacera、Metkem Silicon、Haldor Topsoe、3M、CeramTec、Klean Kanteen 和 Ceramic ters Company。

為了鞏固其在陶瓷過濾器市場的地位,各公司正專注於多項策略舉措。首先,他們正在加大研發投入,以提升陶瓷過濾器的效率和功能,並採用先進材料和創新製造技術。此外,各公司也正在擴展其產品組合,提供滿足特定客戶需求的客製化解決方案,例如更高的過濾精度或更快的過濾速度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 日益嚴重的環境問題

- 對清潔水和空氣的需求不斷增加

- 嚴格的規定

- 技術進步

- 產業陷阱與挑戰

- 初始成本高

- 替代方案的可用性

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 空氣過濾器

- 水過濾器

第6章:市場估計與預測:依陶瓷類型,2021 - 2034 年

- 主要趨勢

- 氧化鋁

- 氧化鋯

- 碳化矽

- 泰坦尼亞

- 其他

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 水處理

- 空氣過濾

- 食品和飲料過濾

- 汽車排放控制

- 工業製程過濾

- 其他

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 商業的

- 住宅

- 工業的

第9章:市場估計與預測:按配銷通路,2021 - 2034

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- 3M

- Aquacera

- Ceramic Filters Company

- Ceramicx

- CeramTec

- Doulton

- Haldor Topsoe

- Klean Kanteen

- Kyocera

- LiqTech International

- Metkem Silicon

- Morgan Advanced Materials

- Nanostone Water

- Pall

- Veolia Water Technologies

The global ceramic filters market was estimated at USD 1.63 billion in 2024 and is expected to grow from USD 1.83 billion in 2025 to USD 4.99 billion by 2034, at a CAGR of 11.7%, according to the latest report published by Global Market Insights Inc.

The growing global demand for clean and safe drinking water is one of the main drivers for the ceramic filters market. With rising concerns over water contamination, particularly in developing regions, ceramic filters are gaining popularity due to their effective filtration properties, affordability, and ease of use in providing potable water.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.63 Billion |

| Forecast Value | $4.99 Billion |

| CAGR | 11.7% |

Rising Adoption in the Industrial Sector

The industrial segment held a notable share in 2024, driven by the increasing demand for efficient filtration in various industries, including chemicals, pharmaceuticals, food processing, and petrochemicals. The high temperature resistance and durability of ceramic filters make them ideal for challenging industrial environments, where they offer long-term performance and low maintenance. Companies in this segment are focusing on developing more robust and customizable filter solutions that can meet the specific needs of diverse industrial sectors, further propelling market growth.

Water Filter to Gain Traction

The water filter segment generated a significant share in 2024, as these filters offer a highly effective and affordable solution for clean drinking water, especially in developing countries. Their ability to remove bacteria, sediments, and other impurities make them a popular choice for households, NGOs, and municipal water treatment plants. With increasing concerns over water contamination, companies are introducing new ceramic filter designs that are easier to use, more efficient, and eco-friendly, catering to the growing need for safe drinking water worldwide.

North America to Emerge as a Lucrative Region

North America ceramic filters market is poised for significant growth through 2034, driven by the increasing adoption of ceramic filters in both industrial and consumer applications. In the U.S. and Canada, there is a rising demand for water filtration solutions that are cost-effective, durable, and capable of improving water quality, particularly in rural and remote areas. With stringent environmental regulations and a growing focus on sustainability, ceramic filters are gaining popularity for their eco-friendly and reusable nature.

Key players in the ceramic filters market are Pall, Veolia Water Technologies, Morgan Advanced Materials, LiqTech International, Ceramicx, Doulton, Kyocera, Nanostone Water, Aquacera, Metkem Silicon, Haldor Topsoe, 3M, CeramTec, Klean Kanteen, and Ceramic Filters Company.

To strengthen their presence and position in the ceramic filters market, companies are focusing on several strategic initiatives. First, they are investing in research and development to enhance the efficiency and functionality of their ceramic filters, incorporating advanced materials and innovative manufacturing techniques. Companies are also expanding their product portfolios to include customized solutions that cater to specific customer needs, such as higher filtration precision or faster filtration speeds.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Ceramic Type

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing environmental concerns

- 3.2.1.2 Increasing demand for cleaner water and air

- 3.2.1.3 Stringent regulations

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Availability of alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Air filters

- 5.3 Water filters

Chapter 6 Market Estimates & Forecast, By Ceramic Type, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Alumina

- 6.3 Zirconia

- 6.4 Silicon carbide

- 6.5 Titania

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Water treatment

- 7.3 Air filtration

- 7.4 Food and beverage filtration

- 7.5 Automotive emission control

- 7.6 Industrial process filtration

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Residential

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Aquacera

- 11.3 Ceramic Filters Company

- 11.4 Ceramicx

- 11.5 CeramTec

- 11.6 Doulton

- 11.7 Haldor Topsoe

- 11.8 Klean Kanteen

- 11.9 Kyocera

- 11.10 LiqTech International

- 11.11 Metkem Silicon

- 11.12 Morgan Advanced Materials

- 11.13 Nanostone Water

- 11.14 Pall

- 11.15 Veolia Water Technologies