|

市場調查報告書

商品編碼

1833671

臨床營養市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Clinical Nutrition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

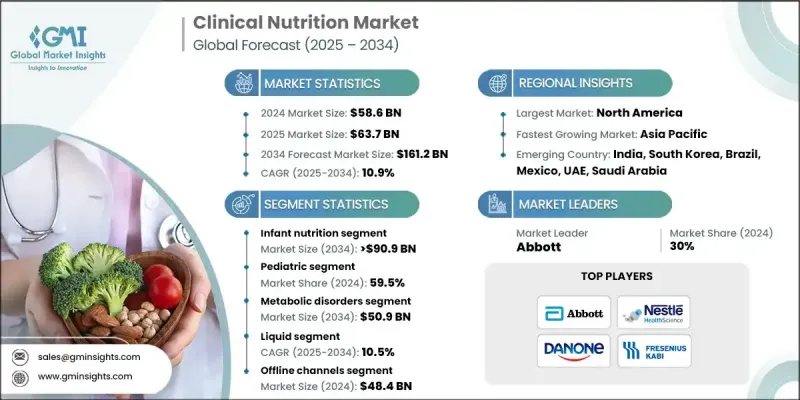

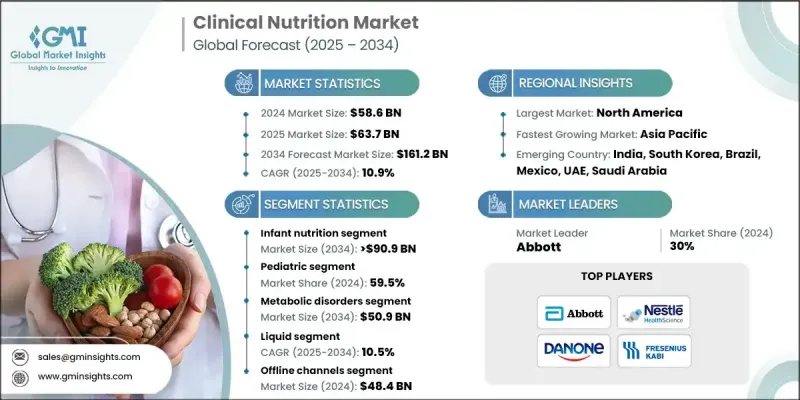

2024 年全球臨床營養市場價值為 586 億美元,預計將以 10.9% 的複合年成長率成長,到 2034 年達到 1,612 億美元。

癌症、糖尿病、胃腸道疾病和腎臟病等慢性疾病常導致營養吸收障礙,增加營養需求。因此,臨床營養在患者復健和疾病管理中發揮著至關重要的作用,並推動持續的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 586億美元 |

| 預測值 | 1612億美元 |

| 複合年成長率 | 10.9% |

嬰兒營養需求不斷增加

2024年,嬰兒營養品市場佔據了相當大的佔有率,這得益於出生率上升、早產率上升以及人們對早期營養重要性的認知不斷增強。嬰兒配方奶粉用於補充或替代母乳餵養,尤其是在工作家庭和出現醫療併發症的情況下。

兒科採用率不斷提高

2025-2034年期間,兒科市場將以可觀的複合年成長率成長。對於胃腸道疾病、囊性纖維化和神經系統疾病患者,營養支持至關重要,因為這些疾病患者的常規食物攝取量可能不足。隨著護理人員和兒科醫生意識的增強,對即食兒科配方奶粉和針對特定疾病的營養品的需求持續成長。

代謝紊亂盛行率不斷上升

代謝紊亂領域在2024年創造了可觀的收入。苯酮尿症(PKU)、楓糖尿病和其他先天性代謝異常等疾病需要終生飲食管理,通常透過醫學營養進行。製造商正在開發蛋白質改質和氨基酸配方,以滿足這些獨特的需求。

北美將成為利潤豐厚的地區

2024年,北美臨床營養市場佔據強勁佔有率,這得益於其完善的醫療基礎設施、更高的診斷率以及強大的保險覆蓋率。美國在該地區處於領先地位,醫院、長期照護中心和家庭醫療保健機構的需求不斷成長。產品創新和個人化營養正日益受到關注,尤其是在慢性病管理和術後復原領域。

臨床營養市場的主要參與者有雀巢健康科學、百特、巴斯夫、荷美爾食品、費森尤斯卡比、雅培(雅培營養)、達能、基立福集團、百利高、美贊臣(利潔時)、明治控股、Hero Nutritionals、Aculife Healthcare 和 B. Braun。

為了鞏固市場地位,臨床營養領域的公司正專注於研發符合現代醫療方案的專用和針對特定疾病的產品。與醫院和醫療保健提供者建立策略合作夥伴關係正在擴大覆蓋範圍,同時部署數位化工具來追蹤患者治療結果並提高依從性。各公司也透過在地化生產和客製化行銷策略瞄準新興經濟體。隨著領導企業尋求擴大產品組合和全球影響力,併購活動依然頻繁。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 營養不良發生率高

- 營養科學的進步

- 意識增強,醫療保健支出增加

- 產業陷阱與挑戰

- 先進配方成本高

- 有限的報銷政策

- 市場機會

- 家庭醫療保健領域的擴張

- 數位健康整合

- 成長動力

- 成長潛力分析

- 技術格局

- 當前的技術趨勢

- 新興技術

- 臨床營養的供應鏈分析

- 膳食補充劑的使用場景

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 嬰兒營養

- 牛奶基

- 大豆基

- 有機配方

- 其他嬰兒配方奶粉

- 腸內營養

- 標準成分

- 疾病特異性組成

- 元素公式

- 其他腸內配方

- 腸外營養

- 胺基酸

- 脂肪

- 碳水化合物

- 維生素和礦物質

- 其他腸外配方

第6章:市場估計與預測:依消費者分類,2021 - 2034 年

- 主要趨勢

- 兒科

- 成人

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 營養不良

- 癌症營養

- 代謝紊亂

- 神經系統疾病

- 胃腸道疾病

- 其他應用

第8章:市場估計與預測:按劑型,2021 - 2034

- 主要趨勢

- 粉末

- 液體

- 堅硬的

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線下通路

- 醫院藥房

- 零售藥局

- 其他線下通路

- 線上通路

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Abbott (Abbott Nutrition)

- Aculife Healthcare

- B Braun

- BASF

- Baxter

- Danone

- Fresenius Kabi

- Grifols

- Hero Nutritionals

- Hormel Foods

- Mead Johnson (Reckitt Benckiser)

- Meiji Holdings

- Nestle Health Science

- Perrigo

The Global Clinical Nutrition Market was valued at USD 58.6 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 161.2 billion by 2034.

Chronic conditions such as cancer, diabetes, gastrointestinal disorders, and kidney disease often lead to impaired nutrient absorption and increased nutritional needs. As a result, clinical nutrition plays a vital role in patient recovery and disease management, driving consistent demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.6 Billion |

| Forecast Value | $161.2 Billion |

| CAGR | 10.9% |

Rising Demand for Infant Nutrition

The infant nutrition segment held a substantial share in 2024, driven by rising birth rates, increasing rates of preterm births, and growing awareness of the importance of early-life nutrition. Infant formulas are used to supplement or replace breastfeeding, especially in working households and in cases of medical complications.

Growing Adoption Among Pediatrics

The pediatric segment will grow at a decent CAGR during 2025-2034. Nutritional support is essential in cases of gastrointestinal disorders, cystic fibrosis, and neurological impairments, where regular food intake may be insufficient. Demand for ready-to-use pediatric formulas and condition-specific nutrition continues to grow as awareness among caregivers and pediatricians increases.

Increasing Prevalence of Metabolic Disorders

The metabolic disorders segment generated significant revenues in 2024. Conditions like phenylketonuria (PKU), maple syrup urine disease, and other inborn errors of metabolism require lifelong dietary management, often through medical nutrition. Manufacturers are developing protein-modified and amino acid-based formulas to cater to these unique requirements.

North America to Emerge as a Lucrative Region

North America clinical nutrition market held a robust share in 2024, driven by a well-established healthcare infrastructure, higher diagnosis rates, and strong insurance coverage. The U.S. leads the region, with increasing demand across hospitals, long-term care centers, and home healthcare settings. Product innovation and personalized nutrition are gaining traction, especially in the context of chronic disease management and post-surgical recovery.

Major players in the clinical nutrition market are Nestle Health Science, Baxter, BASF, Hormel Foods, Fresenius Kabi, Abbott (Abbott Nutrition), Danone, Grifols SA, Perrigo, Mead Johnson (Reckitt Benckiser), Meiji Holdings, Hero Nutritionals, Aculife Healthcare, and B. Braun.

To solidify their market presence, companies in the clinical nutrition space are focusing on R&D to develop specialized and condition-specific products that align with modern medical protocols. Strategic partnerships with hospitals and healthcare providers are expanding access, while digital tools deploy to track patient outcomes and improve compliance. Firms are also targeting emerging economies through localized manufacturing and tailored marketing strategies. Mergers and acquisitions remain common, as leading players seek to expand their product portfolios and global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Consumer

- 2.2.4 Application

- 2.2.5 Dosage Form

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 High incidence of malnutrition

- 3.2.1.3 Advancements in nutritional science

- 3.2.1.4 Growing awareness and healthcare spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced formulations

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of the home healthcare sector

- 3.2.3.2 Digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Supply chain analysis for clinical nutrition

- 3.6 Dietary supplements usage scenario

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Infant nutrition

- 5.2.1 Milk-based

- 5.2.2 Soy-based

- 5.2.3 Organic formula

- 5.2.4 Other infant formulas

- 5.3 Enteral nutrition

- 5.3.1 Standard composition

- 5.3.2 Disease-specific composition

- 5.3.3 Elemental formulas

- 5.3.4 Other enteral formulas

- 5.4 Parenteral nutrition

- 5.4.1 Amino acids

- 5.4.2 Fats

- 5.4.3 Carbohydrates

- 5.4.4 Vitamins & minerals

- 5.4.5 Other parenteral formulas

Chapter 6 Market Estimates and Forecast, By Consumer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Malnutrition

- 7.3 Cancer nutrition

- 7.4 Metabolic disorders

- 7.5 Neurological diseases

- 7.6 Gastrointestinal disorder

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Liquid

- 8.4 Solid

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channels

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline channels

- 9.3 Online channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott (Abbott Nutrition)

- 11.2 Aculife Healthcare

- 11.3 B Braun

- 11.4 BASF

- 11.5 Baxter

- 11.6 Danone

- 11.7 Fresenius Kabi

- 11.8 Grifols

- 11.9 Hero Nutritionals

- 11.10 Hormel Foods

- 11.11 Mead Johnson (Reckitt Benckiser)

- 11.12 Meiji Holdings

- 11.13 Nestle Health Science

- 11.14 Perrigo