|

市場調查報告書

商品編碼

1833670

獸醫監測設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Veterinary Monitoring Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

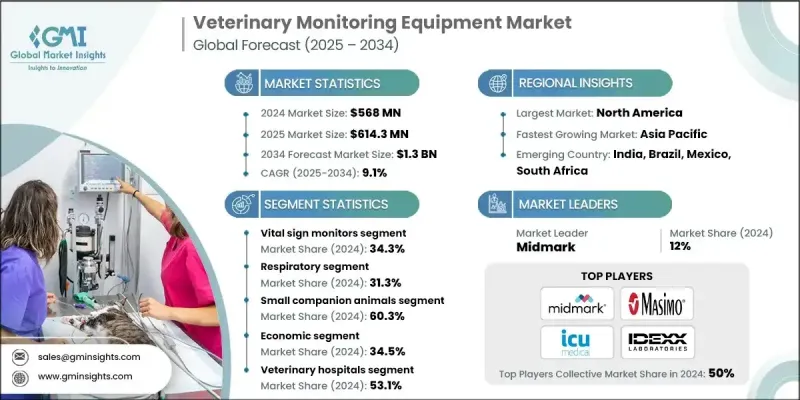

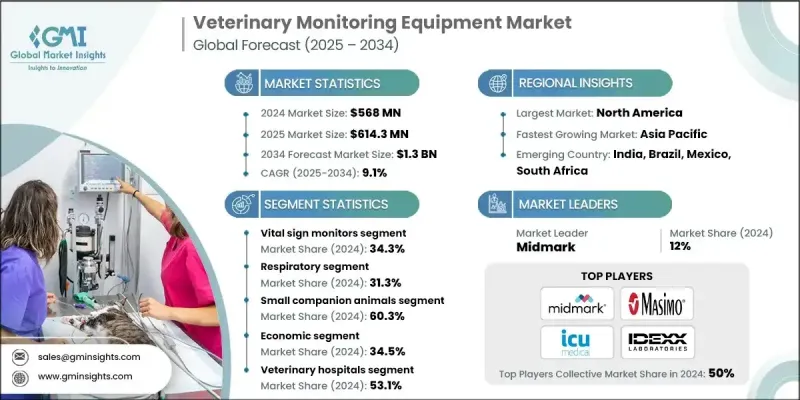

2024 年全球獸醫監測設備市場價值為 5.68 億美元,預計將以 9.1% 的複合年成長率成長,到 2034 年達到 13 億美元。

寵物主人數量不斷成長,尤其是在城市和已開發地區,這增加了對高品質獸醫護理的需求。由於人們將寵物視為家庭成員,他們更願意投資先進的監測工具,以確保更好的健康狀況。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.68億美元 |

| 預測值 | 13億美元 |

| 複合年成長率 | 9.1% |

生命徵象監測儀的使用日益增多

生命徵象監測器在2024年佔據了顯著的市場佔有率,這得益於其在追蹤動物核心健康指標(包括心率、血壓、體溫和血氧飽和度)方面發揮的重要作用。這些設備廣泛應用於從常規體檢到手術和重症監護病房等各種場合,是現代獸醫實踐中不可或缺的設備。隨著對早期疾病檢測和預防保健的需求日益成長,診所正在採用能夠提供即時資料和綜合分析的多參數監測器。

呼吸監測器需求不斷成長

隨著獸醫管理寵物和牲畜呼吸系統疾病病例的增多,呼吸監測領域將在2025-2034年期間實現可觀的複合年成長率。二氧化碳分析儀和肺量計等設備用於評估通氣、氣體交換和整體肺功能,尤其是在麻醉和術後恢復期間。隨著動物外科手術越來越複雜,準確的呼吸監測對於最大限度地減少併發症至關重要。

小型伴侶動物盛行率上升

小型伴侶動物市場在2024年佔據了相當大的佔有率,這得益於寵物收養率的提高和寵物人性化的提升。寵物主人更願意投資高品質的醫療服務,包括手術期間的進階監測、慢性病管理和預防性檢查。獸醫診所正在為其設施配備專門針對小型動物校準的監測儀,以確保讀數準確並最大程度地減少不適感。

北美將成為利潤豐厚的地區

由於先進的獸醫基礎設施、較高的寵物擁有率以及對動物健康的高度關注,北美獸醫監測設備將在2025-2034年間實現可觀的複合年成長率。美國城市診所和農村畜牧設施對診斷技術的需求不斷成長。該地區市場受益於早期採用的數位醫療工具、強大的分銷網路以及獸醫手術的良好報銷趨勢。領先的企業正在透過擴大其在學術型獸醫院的業務、推出雲端連接監測解決方案以及為連鎖獸醫機構提供客製化服務合約來提升其市場地位。

獸醫監測設備市場的主要參與者有 Masimo、Vetland Medical、ICU Medical、Digicare Animal Health、Mindray Animal Health、Bionet America、Burtons Veterinary、Midmark、Medtronic、Avante Animal Health、Hallmarq Veterinary Imaging、Dextronix、Nonin 和 IDEXX Labories。

為了在獸醫監測設備市場獲得競爭優勢,各公司正大力專注於產品創新、策略合作夥伴關係以及精準的客戶互動。許多公司正在開發緊湊型多參數監測器,這些監測器具有無線連接和即時資料整合功能,以支援各種臨床環境下的高效診斷。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 動物疾病盛行率不斷上升

- 寵物保險的普及率不斷上升

- 伴侶動物數量不斷增加

- 增加寵物健康支出

- 產業陷阱與挑戰

- 監控設備成本高

- 低收入地區和農村地區的交通受限

- 市場機會

- 寵物照護需求不斷成長的新興市場

- 採用穿戴式和遠端監控設備

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 未來市場趨勢

- 定價分析

- 技術和創新格局

- 目前技術

- 新興技術

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 生命徵象監測儀

- 二氧化碳監測及血氧測定系統

- 麻醉監視器

- ECG 和 EKG 監視器

- 磁振造影(MRI)系統

- 其他獸醫監測設備

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 體重和溫度監測

- 心臟病學

- 呼吸系統

- 神經病學

- 多參數監測

- 其他應用

第7章:市場估計與預測:依動物類型,2021 - 2034

- 主要趨勢

- 小型伴侶動物

- 狗

- 貓

- 其他小型伴侶動物

- 大型動物

- 馬科動物

- 其他大型動物

- 珍稀動物

第8章:市場估計與預測:按價格層級,2021 - 2034 年

- 主要趨勢

- 經濟的

- 中檔

- 優質的

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 獸醫診所和診斷中心

- 獸醫院

- 研究機構

- 其他最終用途

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Avante Animal Health

- Bionet America

- Burtons Veterinary

- Dextronix

- Digicare Animal Health

- Hallmarq Veterinary Imaging

- ICU Medical

- IDEXX Laboratories

- Masimo

- Medtronic

- Midmark

- Mindray Animal Health

- Nonin

- Vetland Medical

- Vetronic Services

The Global Veterinary Monitoring Equipment Market was valued at USD 568 million in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 1.3 billion by 2034.

The growing number of pet owners, especially in urban and developed regions, is increasing demand for high-quality veterinary care. As people view pets as family members, they are more willing to invest in advanced monitoring tools to ensure better health outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $568 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 9.1% |

Rising use of Vital Sign Monitors

The vital sign monitors segment held a notable share in 2024, owing to its essential role in tracking an animal's core health indicators, including heart rate, blood pressure, temperature, and oxygen saturation. These devices are used across a range of settings from routine checkups to surgeries and intensive care units making them indispensable in modern veterinary practice. With increasing demand for early disease detection and preventive care, clinics are adopting multi-parameter monitors that deliver real-time data and integrated analytics.

Growing Demand for Respiratory Monitors

The respiratory monitoring segment will grow at a decent CAGR during 2025-2034 as veterinarians manage rising cases of respiratory illnesses in pets and livestock. Devices like capnographs and spirometers are used to assess ventilation, gas exchange, and overall lung function, especially during anesthesia and post-operative recovery. With more complex surgical procedures being performed on animals, accurate respiratory monitoring is crucial for minimizing complications.

Rising Prevalence Among Small Companion Animals

The small companion animals segment held a significant share in 2024, driven by increasing pet adoption and the humanization of pets. Pet owners are more willing to invest in high-quality medical care, including advanced monitoring during surgeries, chronic disease management, and preventive exams. Veterinary clinics are equipping their facilities with monitors specifically calibrated for smaller species, ensuring accurate readings and minimal discomfort.

North America to Emerge as a Lucrative Region

North America veterinary monitoring equipment will grow at a decent CAGR during 2025-2034, backed by advanced veterinary infrastructure, high pet ownership rates, and a strong focus on animal wellness. The U.S. has seen rising demand for diagnostic technologies in both urban clinics and rural livestock facilities. This regional market benefits from early adoption of digital health tools, robust distribution networks, and favorable reimbursement trends for veterinary procedures. Leading players are enhancing their market position by expanding their presence in academic veterinary hospitals, rolling out cloud-connected monitoring solutions, and providing tailored service contracts to veterinary chains.

Major players in the veterinary monitoring equipment market are Masimo, Vetland Medical, ICU Medical, Digicare Animal Health, Mindray Animal Health, Bionet America, Burtons Veterinary, Midmark, Medtronic, Avante Animal Health, Hallmarq Veterinary Imaging, Dextronix, Nonin, and IDEXX Laboratories.

To gain a competitive edge in the veterinary monitoring equipment market, companies are focusing heavily on product innovation, strategic partnerships, and targeted customer engagement. Many are developing compact, multi-parameter monitors with wireless connectivity and real-time data integration to support efficient diagnostics across a variety of clinical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Animal Type

- 2.2.5 Price Tier

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of animal disorders

- 3.2.1.2 Rising adoption of pet insurance

- 3.2.1.3 Growing companion animal population

- 3.2.1.4 Increasing spending on pet health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of monitoring equipment

- 3.2.2.2 Limited access in low-income and rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with growing pet care demand

- 3.2.3.2 Adoption of wearable and remote monitoring devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technologies

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Vital sign monitors

- 5.3 Capnography and oximetry systems

- 5.4 Anesthesia monitors

- 5.5 ECG and EKG monitors

- 5.6 Magnetic resonance imaging (MRI) systems

- 5.7 Other veterinary monitoring equipment

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Weight and temperature monitoring

- 6.3 Cardiology

- 6.4 Respiratory

- 6.5 Neurology

- 6.6 Multi-parameter monitoring

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Others small companion animals

- 7.3 Large animals

- 7.3.1 Equines

- 7.3.2 Other large animals

- 7.4 Exotic animals

Chapter 8 Market Estimates and Forecast, By Price Tier, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Economic

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary clinics and diagnostic centers

- 9.3 Veterinary hospitals

- 9.4 Research institutes

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avante Animal Health

- 11.2 Bionet America

- 11.3 Burtons Veterinary

- 11.4 Dextronix

- 11.5 Digicare Animal Health

- 11.6 Hallmarq Veterinary Imaging

- 11.7 ICU Medical

- 11.8 IDEXX Laboratories

- 11.9 Masimo

- 11.10 Medtronic

- 11.11 Midmark

- 11.12 Mindray Animal Health

- 11.13 Nonin

- 11.14 Vetland Medical

- 11.15 Vetronic Services