|

市場調查報告書

商品編碼

1833661

睡眠科技設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sleep Tech Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

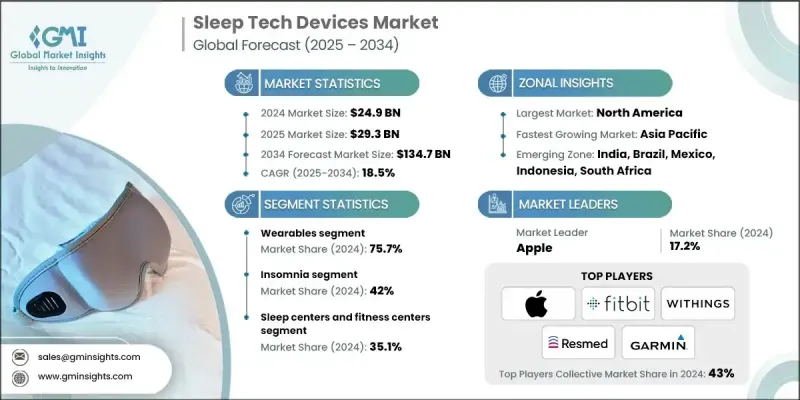

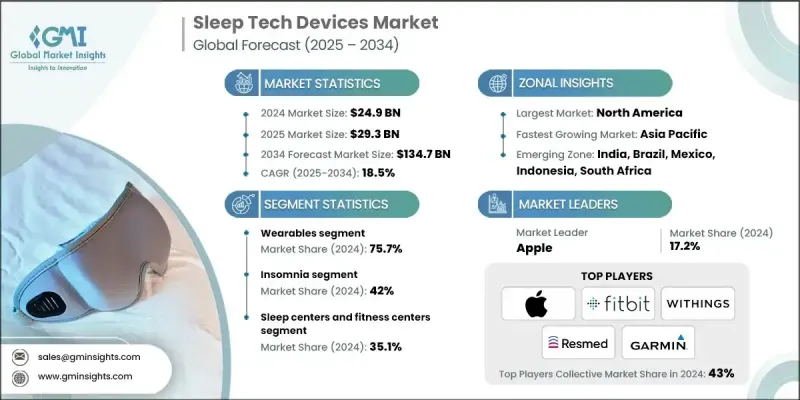

根據 Global Market Insights Inc. 發布的最新報告,全球睡眠技術設備市場規模預計在 2024 年為 249 億美元,預計將從 2025 年的 293 億美元成長到 2034 年的 1,347 億美元,複合年成長率為 18.5%。

根據多項健康研究,目前相當一部分成年人有睡眠品質不佳或睡眠時間不足的問題,但往往沒有正式診斷。這種診斷不足的情況進一步推動了消費者對非侵入式設備的需求,這些設備可以幫助人們自我監控並及早採取行動。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 249億美元 |

| 預測值 | 1347億美元 |

| 複合年成長率 | 18.5% |

穿戴式裝置的普及率不斷提高

2024年,穿戴式裝置市場佔據了顯著佔有率。消費者擴大選擇智慧手錶、健身手環和其他配備感測器的穿戴式設備,以監測睡眠模式、心率變異性和夜間血氧飽和度。這種需求很大程度源自於人們對持續、非侵入式健康追蹤的需求,而這種追蹤方式可以無縫融入日常生活。隨著感測器精度和人工智慧分析技術的提升,穿戴式裝置正從基本的睡眠追蹤器發展成為全方位的健康伴侶。

失眠症盛行率不斷上升

到2034年,失眠領域將保持良好的複合年成長率,因為數百萬人正飽受慢性睡眠入睡和維持問題的困擾。針對此市場量身訂製的睡眠科技設備,例如智慧枕頭、基於認知行為療法 (CBT) 的應用程式以及噪音掩蔽設備,正受到消費者和臨床醫生的青睞。這些設備的重點是提供非藥物的個人化解決方案,以提升睡眠質量,且無不良副作用。主要參與者正在投資實證醫學和數位療法,以解決失眠的根本原因,同時提供實際的見解,促進更好的睡眠衛生和長期行為改變。

睡眠中心和健身中心將獲得關注

2024年,睡眠中心和健身中心佔據了相當大的佔有率。睡眠實驗室擴大採用先進的監測系統、人工智慧診斷和連網設備,以簡化睡眠研究並改善臨床結果。同時,健身中心正在將睡眠追蹤服務整合到更廣泛的健康計劃中,並認知到睡眠品質、身體表現和恢復之間的直接聯繫。這些合作關係正在為製造商開闢新的B2B收入來源,並創建一個混合生態系統,讓睡眠技術的醫療和生活方式應用能夠共存並蓬勃發展。

北美將成為推動力地區

預計到2034年,北美睡眠科技設備市場將創造可觀的收入,這得益於消費者認知度的提升、先進的醫療基礎設施以及對個人化健康解決方案的強勁需求。尤其值得一提的是,美國佔據了該地區收入的最大佔有率,睡眠障礙和慢性疾病的發生率不斷上升,對消費級和臨床級設備的需求持續成長。在優惠的醫療器材報銷政策、穿戴式科技創新以及數位健康平台擴張的推動下,北美市場預計將繼續穩定成長。

睡眠科技設備市場的主要參與者有 Smart Nora、Fitbit、BedJet、Withings、ResMed、Emfit、Oura Health、SleepScore Labs、Somnofy、Balluga、ChiliSleep、Apple、ReST、Itamar Medical、華為、Somnox、Pulsetto、飛利浦、Garmin、Eightin、小米 Medicalmin、Fisher Healthcare。

為了鞏固在睡眠科技設備市場的領先地位,領先公司正在採取策略合作、產品創新和定向收購等多種策略。許多公司專注於整合人工智慧和機器學習,以提供更深入的洞察和預測分析,從而提升用戶參與度和臨床相關性。其他公司則透過與健康應用程式和智慧家庭平台的互通性來擴展其生態系統。品牌差異化也透過直接面對消費者的模式、網紅行銷和訂閱式服務模式來實現。此外,與醫療保健提供者和睡眠診所的合作有助於公司驗證其產品,同時開拓新的患者群體和報銷管道。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 睡眠科技設備的技術進步

- 提高對睡眠技術設備可用性的認知

- 老年人口不斷增加

- 對攜帶式、高效、優質的睡眠技術設備的需求激增

- 主要市場參與者的產品創新和不同策略的採用

- 產業陷阱與挑戰

- 睡眠技術設備成本高昂

- 嚴格的監管框架

- 市場機會

- 與遠距醫療和遠距病人監控的整合

- 拓展心理健康與保健領域

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 消費者行為趨勢

- 市場進入策略分析

- 波特的分析

- 品牌分析

- 頂尖公司的商業模式

- 蘋果

- 瑞思邁

- PESTEL分析

- 未來市場趨勢

- 差距分析

- 2024年定價分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 穿戴式裝置

- 智慧手錶和手環

- 其他穿戴式裝置

- 非穿戴式裝置

- 睡眠監測器

- 智慧床

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 阻塞性睡眠呼吸中止症

- 失眠

- 嗜睡症

- 其他應用

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 睡眠中心及健身中心

- 大型超市和超市

- 電子商務

- 藥局和零售店

- 其他分銷管道

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Apple

- Balluga

- BedJet

- ChiliSleep

- Eight Sleep

- Emfit

- Fisher & Paykel Healthcare

- Fitbit

- Garmin

- Huawei

- Itamar Medical

- Oura Health

- Philips

- Pulsetto

- ResMed

- ReST

- SleepScore Labs

- Smart Nora

- Somnofy

- Somnox

- Withings

- Xiaomi

The global sleep tech devices market was estimated at USD 24.9 billion in 2024 and is expected to grow from USD 29.3 billion in 2025 to USD 134.7 billion in 2034, at a CAGR of 18.5%, according to the latest report published by Global Market Insights Inc.

According to various health studies, a significant portion of the adult population now experiences poor sleep quality or insufficient sleep duration, often without being formally diagnosed. This underdiagnosis further drives demand for consumer-facing, non-invasive devices that allow individuals to self-monitor and take early action.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.9 Billion |

| Forecast Value | $134.7 Billion |

| CAGR | 18.5% |

Increasing Adoption of Wearables

The wearables segment held a notable share in 2024. Consumers are increasingly turning to smartwatches, fitness bands, and other sensor-equipped wearables to monitor sleep patterns, heart rate variability, and oxygen saturation throughout the night. The demand is largely driven by the desire for continuous, non-invasive health tracking that fits seamlessly into daily life. With improvements in sensor accuracy and AI-powered analytics, wearables are evolving from basic sleep trackers to holistic wellness companions.

Increasing Prevalence of Insomnia

The insomnia segment will grow at a decent CAGR through 2034, as millions of individuals struggle with chronic sleep initiation and maintenance problems. Sleep tech devices tailored for this market-such as smart pillows, cognitive behavioral therapy (CBT)-based apps, and noise-masking devices-are gaining traction among both consumers and clinicians. The focus is on providing drug-free, personalized solutions that enhance sleep quality without adverse side effects. Key players are investing in evidence-based features and digital therapeutics to address the root causes of insomnia while delivering actionable insights that promote better sleep hygiene and long-term behavioral changes.

Sleep Centers and Fitness Centers to Gain Traction

The sleep centers and fitness centers held a sizeable share in 2024. Sleep labs are increasingly adopting advanced monitoring systems, AI-powered diagnostics, and connected devices to streamline sleep studies and improve clinical outcomes. At the same time, fitness centers are integrating sleep tracking services as part of broader wellness programs, recognizing the direct link between sleep quality, physical performance, and recovery. These partnerships are opening new B2B revenue streams for manufacturers and creating a hybrid ecosystem where medical and lifestyle applications of sleep technology can coexist and thrive.

North America to Emerge as a Propelling Region

North America sleep tech devices market is expected to generate significant revenues by 2034, fueled by high consumer awareness, advanced healthcare infrastructure, and strong demand for personalized wellness solutions. The United States, in particular, accounts for the lion's share of the region's revenue, with rising rates of sleep disorders and chronic health conditions creating ongoing demand for both consumer-grade and clinical-grade devices. The market in North America is expected to continue growing steadily, supported by favorable reimbursement policies for medical devices, innovation in wearable technologies, and the expansion of digital health platforms.

Major players in the sleep tech devices market are Smart Nora, Fitbit, BedJet, Withings, ResMed, Emfit, Oura Health, SleepScore Labs, Somnofy, Balluga, ChiliSleep, Apple, ReST, Itamar Medical, Huawei, Somnox, Pulsetto, Philips, Garmin, Eight Sleep, Xiaomi, Fisher & Paykel Healthcare.

To strengthen their foothold in the sleep tech devices market, leading companies are employing a mix of strategic partnerships, product innovation, and targeted acquisitions. Many are focusing on integrating AI and machine learning to deliver deeper insights and predictive analytics, enhancing user engagement and clinical relevance. Others are expanding their ecosystems through interoperability with health apps and smart home platforms. Brand differentiation is also being achieved through direct-to-consumer models, influencer marketing, and subscription-based service models. Additionally, collaborations with healthcare providers and sleep clinics help companies validate their offerings while tapping into new patient segments and reimbursement channels.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in sleep tech devices

- 3.2.1.2 Increasing awareness regarding availability of sleep tech devices

- 3.2.1.3 Rising geriatric population

- 3.2.1.4 Surging demand for portable, efficient and superior sleep tech devices

- 3.2.1.5 Product innovation and adoption of different strategies by key market participants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of sleep tech devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with telehealth and remote patient monitoring

- 3.2.3.2 Expansion into mental health and wellness segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Consumer behaviour trend

- 3.8 Go-to-market strategy analysis

- 3.9 Porter's analysis

- 3.10 Brand analysis

- 3.11 Business model of top companies

- 3.11.1 Apple

- 3.11.2 ResMed

- 3.12 PESTEL analysis

- 3.13 Future market trends

- 3.14 Gap analysis

- 3.15 Pricing analysis, 2024

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearables

- 5.2.1 Smart watches and bands

- 5.2.2 Other wearables

- 5.3 Non-wearables

- 5.3.1 Sleep monitors

- 5.3.2 Smart beds

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea

- 6.3 Insomnia

- 6.4 Narcolepsy

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Sleep centers and fitness centers

- 7.3 Hypermarkets and supermarkets

- 7.4 E-commerce

- 7.5 Pharmacy and retail stores

- 7.6 Other distribution channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Apple

- 9.2 Balluga

- 9.3 BedJet

- 9.4 ChiliSleep

- 9.5 Eight Sleep

- 9.6 Emfit

- 9.7 Fisher & Paykel Healthcare

- 9.8 Fitbit

- 9.9 Garmin

- 9.10 Huawei

- 9.11 Itamar Medical

- 9.12 Oura Health

- 9.13 Philips

- 9.14 Pulsetto

- 9.15 ResMed

- 9.16 ReST

- 9.17 SleepScore Labs

- 9.18 Smart Nora

- 9.19 Somnofy

- 9.20 Somnox

- 9.21 Withings

- 9.22 Xiaomi