|

市場調查報告書

商品編碼

1833658

金屬和採礦廢水回收系統市場機會、成長動力、產業趨勢分析和預測 2025 - 2034Metal and Mining Wastewater Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

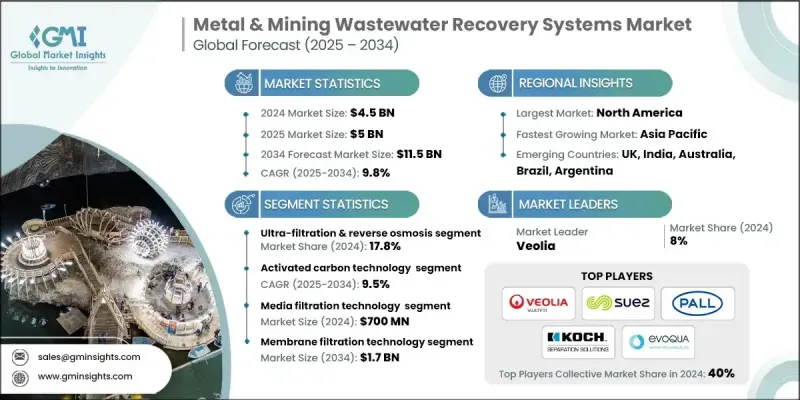

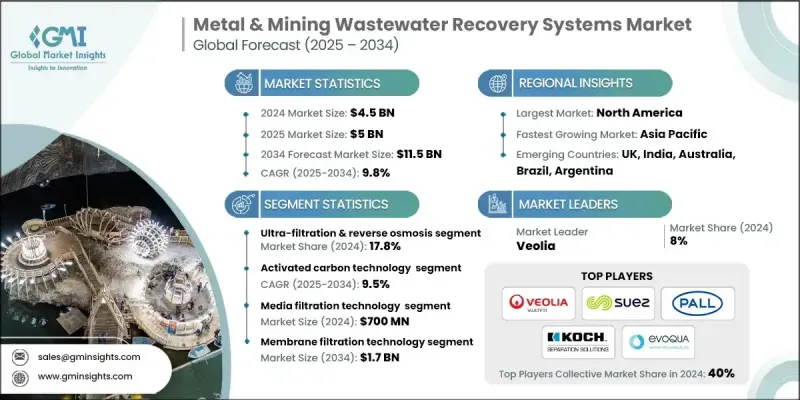

根據 Global Market Insights Inc. 發布的最新報告,全球金屬和採礦廢水回收系統市場規模在 2024 年估計為 45 億美元,預計將從 2025 年的 50 億美元成長到 2034 年的 115 億美元,複合年成長率為 9.8%。

世界各國政府正在收緊採礦作業中重金屬、懸浮固體和有毒化學物質的排放限制。這種監管壓力迫使礦業公司採用先進的廢水回收系統,以保持合規並避免巨額罰款。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 9.8% |

超濾和逆滲透技術的應用日益廣泛

超濾和逆滲透 (RO) 技術在 2024 年佔據了相當大的佔有率,這得益於其在去除溶解鹽、金屬和微觀污染物方面的有效性。這些基於薄膜的技術越來越受到青睞,用於生產適合採礦作業重複使用的高純度水,尤其是在淡水資源有限的地區。

活性碳技術需求不斷成長

2024年,活性碳技術佔據了相當大的佔有率,這得益於其從採礦廢水中去除有機污染物、重金屬和殘留化學物質的潛力。活性碳以其高吸附能力和成本效益而聞名,廣泛應用於獨立系統和多級處理過程。

介質過濾技術將獲得發展

介質過濾技術因其簡單易用、可擴展性強以及去除懸浮固體和顆粒物的有效性,在2024年佔據了永續的市場佔有率。該技術在水處理的早期階段尤其受歡迎,作為超濾或化學處理等更先進方法之前的預處理步驟。

北美將成為推動力地區

由於嚴格的環境法規、先進的技術能力以及成熟的採礦業,北美金屬和採礦廢水回收系統市場預計在2025-2034年間實現顯著的複合年成長率。該地區擁有大規模的銅、金、鋰和稀土礦開採作業,這些作業都會產生複雜的廢水流,需要高性能的處理系統。

金屬和採礦廢水回收系統行業的主要參與者有 KONTEK Ecology Systems Inc.、Evoqua Water Technologies LLC、Calgon Carbon Corporation、Mech-Chem Associates, Inc.、BioChem Technology、CECO Environmental、Saltworks Technologies、ClearBlu Environmental、Veolia、CLEARAS Watercovery、VDYT接D. Solutions、Puragen Activated Carbons、Clean TeQ Water、KORTE Kornyezettechnika Zrt.、ENCON Evaporators、Suez、Pall Corporation 和 EnviroWater Group。

為了鞏固在金屬和採礦廢水回收系統市場的領先地位,各公司正專注於創新、策略合作和服務多角化。領先的企業正在開發模組化、可擴展的系統,可根據特定現場條件進行客製化,從而幫助減少安裝時間和資本支出。其他企業則與礦業營運商建立合作夥伴關係,提供長期營運和維護 (O&M) 契約,以確保穩定的收入來源。數位化整合也日益受到關注,利用遠端監控、物聯網感測器和人工智慧進行預測性維護和效能最佳化。此外,各公司正向新興市場擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭基準測試

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 活性碳

- 超濾和逆滲透

- 薄膜過濾

- 離子交換樹脂系統

- 介質過濾

- 其他

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 波蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第7章:公司簡介

- Aquatech

- BioChem Technology

- Calgon Carbon Corporation

- CECO Environmental

- ChemREADY

- CLEARAS Water Recovery

- Clean TeQ Water

- ClearBlu Environmental

- DYNATEC SYSTEMS, INC.

- ENCON Evaporators

- EnviroWater Group

- Evoqua Water Technologies LLC

- Koch Separation Solutions

- KONTEK Ecology Systems Inc.

- KORTE Kornyezettechnika Zrt.

- Mech-Chem Associates, Inc.

- Pall Corporation

- Puragen Activated Carbons

- Suez

- Saltworks Technologies

- Veolia

The global metal & mining wastewater recovery systems market was estimated at USD 4.5 billion in 2024 and is expected to grow from USD 5 billion in 2025 to USD 11.5 billion by 2034, at a CAGR of 9.8%, according to the latest report published by Global Market Insights Inc.

Governments worldwide are tightening discharge limits for heavy metals, suspended solids, and toxic chemicals from mining operations. This regulatory pressure is pushing mining companies to adopt advanced wastewater recovery systems to remain compliant and avoid hefty fines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 9.8% |

Rising Adoption in Ultrafiltration & Reverse Osmosis

The ultrafiltration and reverse osmosis (RO) segment held a significant share in 2024, driven by its effectiveness in removing dissolved salts, metals, and microscopic contaminants. These membrane-based technologies are increasingly preferred for achieving high-purity water suitable for reuse in mining operations, particularly in regions with limited freshwater resources.

Increasing Demand for Activated Carbon Technology

The activated carbon technology held a substantial share in 2024, fueled by the removal of organic pollutants, heavy metals, and residual chemicals from mining wastewater streams. Known for its high adsorption capacity and cost-effectiveness, activated carbon is widely used in both standalone systems and as part of multi-stage treatment processes.

Media Filtration Technology to Gain Traction

The media filtration technology segment generated a sustainable share in 2024 owing to its simplicity, scalability, and effectiveness in removing suspended solids and particulates. This segment is particularly popular in the early stages of water treatment, serving as a pre-treatment step before more advanced methods like ultrafiltration or chemical treatment.

North America to Emerge as a Propelling Region

North America metal & mining wastewater recovery systems market is poised to grow at a significant CAGR during 2025-2034, backed by stringent environmental regulations, advanced technological capabilities, and a mature mining sector. The region is home to large-scale operations in copper, gold, lithium, and rare earth mining, all of which generate complex wastewater streams requiring high-performance treatment systems.

Major players operating in the metal & mining wastewater recovery systems industry are KONTEK Ecology Systems Inc., Evoqua Water Technologies LLC, Calgon Carbon Corporation, Mech-Chem Associates, Inc., BioChem Technology, CECO Environmental, Saltworks Technologies, ClearBlu Environmental, Veolia, CLEARAS Water Recovery, DYNATEC SYSTEMS, INC., Aquatech, ChemREADY, Koch Separation Solutions, Puragen Activated Carbons, Clean TeQ Water, KORTE Kornyezettechnika Zrt., ENCON Evaporators, Suez, Pall Corporation, EnviroWater Group.

To strengthen their foothold in the metal & mining wastewater recovery systems market, companies are focusing on innovation, strategic collaborations, and service diversification. Leading players are developing modular and scalable systems that can be customized for specific site conditions, helping reduce installation time and capital expenditure. Others are forming partnerships with mining operators to offer long-term operation and maintenance (O&M) contracts, ensuring steady revenue streams. Digital integration is also gaining traction, with the use of remote monitoring, IoT sensors, and AI for predictive maintenance and performance optimization. Additionally, companies are expanding into emerging markets

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Activated carbon

- 5.3 Ultra-filtration & reverse osmosis

- 5.4 Membrane filtration

- 5.5 Ion exchange resin systems

- 5.6 Media filtration

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Poland

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Malaysia

- 6.4.6 Indonesia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Mexico

- 6.6.3 Argentina

Chapter 7 Company Profiles

- 7.1 Aquatech

- 7.2 BioChem Technology

- 7.3 Calgon Carbon Corporation

- 7.4 CECO Environmental

- 7.5 ChemREADY

- 7.6 CLEARAS Water Recovery

- 7.7 Clean TeQ Water

- 7.8 ClearBlu Environmental

- 7.9 DYNATEC SYSTEMS, INC.

- 7.10 ENCON Evaporators

- 7.11 EnviroWater Group

- 7.12 Evoqua Water Technologies LLC

- 7.13 Koch Separation Solutions

- 7.14 KONTEK Ecology Systems Inc.

- 7.15 KORTE Kornyezettechnika Zrt.

- 7.16 Mech-Chem Associates, Inc.

- 7.17 Pall Corporation

- 7.18 Puragen Activated Carbons

- 7.19 Suez

- 7.20 Saltworks Technologies

- 7.21 Veolia