|

市場調查報告書

商品編碼

1833655

靜脈血栓栓塞症治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Venous Thromboembolism Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

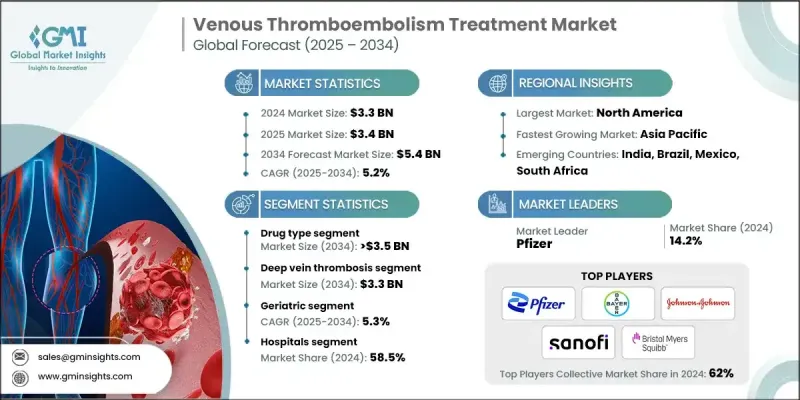

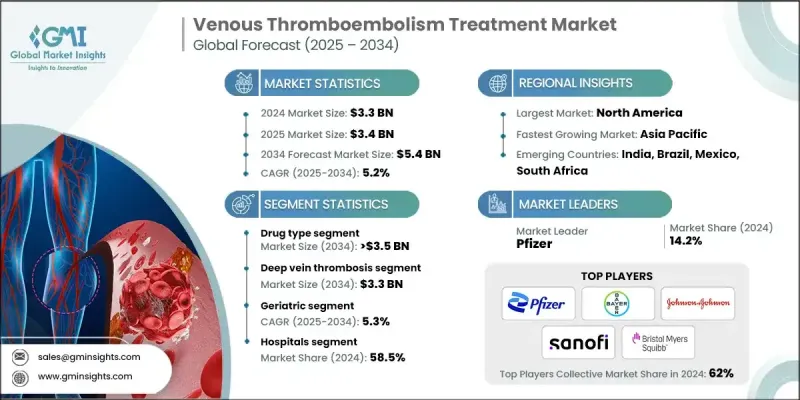

2024 年全球靜脈血栓栓塞症治療市場價值為 33 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 54 億美元。

這一上升趨勢的驅動力源自於全球靜脈血栓栓塞症(VTE)發生率的不斷上升,增加了對抗凝血藥物、溶栓療法和血管介入器材的需求。 VTE治療包括一組專門設計用於溶解、預防或控制靜脈系統內血栓的藥物和器械。這些療法根據患者自身的多種因素進行量身定做,包括年齡、免疫反應、整體健康狀況和病情嚴重程度。公眾和專業人士對未經治療的VTE危險性認知的提高、臨床環境中預防性護理方案的擴展以及遠距醫療在遠距抗凝血監測中的廣泛應用,進一步推動了市場的成長。此外,醫藥電商平台的廣泛普及提高了口服治療和壓力產品的可近性,促進了更早、更有效的介入。持續關注教育、診斷和數位化護理整合,正在支持更積極主動的疾病管理,從而改善患者預後,並提高醫院和家庭環境中治療方案的採用率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 5.2% |

現代治療方案正在改變醫療保健系統管理靜脈血栓栓塞症(VTE)的方式,為患者提供更高的安全性、準確性和便利性。藥物配方和血栓清除工具的技術進步有助於提高治療精準度並減少併發症。長效口服抗凝血藥物、AI引導血栓取出系統以及微創血管裝置的研發,顯著提高了患者對治療計劃的依從性,並最大限度地減少了不良反應。這些創新不僅提高了護理標準,也使醫生能夠提供高效的治療,並獲得更好的長期療效。

2024年,藥物類藥物佔了65.5%的市場佔有率,這得益於抗凝血劑和溶栓藥物在臨床和門診的廣泛使用。此類藥物主要分為兩大類:抗凝血劑和溶栓劑。抗凝血劑又細分為直介面服抗凝血劑、肝素產品和維生素K拮抗劑。這種優點源自於現代抗凝血劑具有可預測的療效、更長的藥效持續時間以及更少的監測需求。這些特性使其成為靜脈血栓栓塞(VTE)初始治療和持續治療的理想選擇,特別適用於各種患者環境。

深部靜脈血栓形成 (DVT) 領域在 2024 年的市場規模為 20 億美元,預計到 2034 年將達到 33 億美元,成為整個靜脈血栓栓塞 (VTE) 治療市場的最大貢獻者。 DVT 的特徵是深部靜脈栓塞,主要發生在下肢,如果未能及時發現和治療,將構成嚴重的健康風險。 DVT 的盛行率受多種風險因素影響,例如久坐的生活方式、吸菸、高體重和慢性疾病。這種日益加重的負擔促使醫療專業人員強調早期發現、指導抗凝血治療,並在必要時進行機械干預,以提高康復率並減少危及生命的併發症。

北美靜脈血栓栓塞症治療市場佔40.1%的市佔率。該地區的主導地位源於其完善的醫療保健體系,包括先進的診斷資源、技術嫻熟的醫護人員以及高度的患者意識。以預防和早期症狀識別為重點的公共衛生運動促進了靜脈血栓栓塞症的及時治療,同時,研發投入持續為市場帶來新產品和新技術。總部位於北美的製藥和醫療技術公司正在持續開發具有卓越療效和安全性的創新解決方案,這支撐了該地區強勁的市場表現。

積極影響靜脈血栓栓塞症治療市場的知名公司包括強生、飛利浦醫療、勃林格殷格翰、第一三共、賽諾菲、諾華、AngioDynamics、拜耳、Argon Medical Products、波士頓科學、大成海洋、輝瑞、康德樂、庫克醫療、葛蘭素史克、百時美貴施貴敦和醫療醫療(美力寶敦)。靜脈血栓栓塞症治療市場的領導者正專注於創新、策略合作和地理擴張的結合,以鞏固其市場地位。許多公司正在大力投資研發,以推出可提供更安全、更有效治療選擇的下一代療法和設備。與學術和臨床機構的策略合作有助於加速臨床試驗和技術開發。各公司也透過進入新興市場和加強分銷網路來擴大其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 靜脈血栓栓塞症盛行率不斷上升

- 人口老化和流動性不足

- 抗凝血治療的進展

- 人們對血栓後症候群的認知不斷提高

- 產業陷阱與挑戰

- 出血併發症的風險

- 發展中地區的認知有限

- 市場機會

- 雙重作用療法的開發

- 遠距醫療平台的擴展

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 未來市場趨勢

- 技術格局

- 現有技術

- 新興技術

- 專利格局

- 管道分析

- 定價分析

- 疾病的流行病學

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按治療類型,2021 - 2034

- 主要趨勢

- 裝置

- 壓縮系統

- 血栓切除系統

- 下腔靜脈過濾器

- 長襪

- 其他設備

- 藥物類型

- 抗凝血劑

- 直介面服抗凝血藥

- 肝素

- 維生素K拮抗劑

- 血栓溶解劑

- 抗凝血劑

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 深層靜脈栓塞

- 肺栓塞

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 成年人

- 老年

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 導管室

- 門診手術中心(ASC)

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AngioDynamics

- Argon Medical Products

- Bayer

- Boehringer Ingelheim

- Boston Scientific

- Bristol Myers Squibb

- Cardinal Health

- Cook Medical

- Covidien (Medtronic)

- Daesung Maref

- Daiichi Sankyo

- GlaxoSmithKline

- Johnson & Johnson

- Novartis

- Pfizer

- Philips Healthcare

- Sanofi

目錄

第 11 章:方法與範圍

第 12 章:執行摘要

第 13 章:產業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 靜脈血栓栓塞症盛行率不斷上升

- 人口老化和流動性不足

- 抗凝血治療的進展

- 人們對血栓後症候群的認知不斷提高

- 產業陷阱與挑戰

- 出血併發症的風險

- 發展中地區的認知有限

- 市場機會

- 雙重作用療法的開發

- 遠距醫療平台的擴展

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 未來市場趨勢

- 技術格局

- 現有技術

- 新興技術

- 專利格局

- 管道分析

- 定價分析

- 疾病的流行病學

- 波特的分析

- PESTEL分析

第 14 章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第 15 章:市場估計與預測:按治療類型,2021 - 2034 年

- 主要趨勢

- 裝置

- 壓縮系統

- 血栓切除系統

- 下腔靜脈過濾器

- 長襪

- 其他設備

- 藥物類型

- 抗凝血劑

- 直介面服抗凝血藥

- 肝素

- 維生素K拮抗劑

- 血栓溶解劑

- 抗凝血劑

第 16 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 深層靜脈栓塞

- 肺栓塞

第 17 章:市場估計與預測:按年齡層,2021 年至 2034 年

- 主要趨勢

- 成年人

- 老年

第 18 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 導管室

- 門診手術中心(ASC)

- 其他最終用途

第 19 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 20 章:公司簡介

- AngioDynamics

- Argon Medical Products

- Bayer

- Boehringer Ingelheim

- Boston Scientific

- Bristol Myers Squibb

- Cardinal Health

- Cook Medical

- Covidien (Medtronic)

- Daesung Maref

- Daiichi Sankyo

- GlaxoSmithKline

- Johnson & Johnson

- Novartis

- Pfizer

- Philips Healthcare

- Sanofi

The Global Venous Thromboembolism Treatment Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.4 billion by 2034.

The upward trend is driven by the growing incidence of VTE conditions globally, which has heightened demand for anticoagulant medications, thrombolytic therapies, and vascular intervention devices. VTE treatment includes a targeted group of drugs and devices that are specifically designed to dissolve, prevent, or manage blood clots within the venous system. These therapies are customized based on multiple patient-specific factors, including age, immune response, overall health, and the severity of the condition. The market growth is further fueled by increased public and professional awareness about the dangers of untreated VTE, the expansion of preventive care protocols in clinical settings, and the broader use of telemedicine for remote anticoagulant monitoring. Additionally, the widespread availability of pharmaceutical e-commerce platforms has improved access to both oral treatments and compression products, promoting earlier and more effective intervention. The continued focus on education, diagnostics, and digital care integration is supporting more proactive management of the condition, leading to improved patient outcomes and increased adoption of therapeutic solutions across both hospital and home settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.2% |

Modern treatment options are transforming how healthcare systems manage VTE, offering greater safety, accuracy, and convenience for patients. Technological progress in drug formulation and clot-removal tools is helping enhance therapeutic precision and limit complications. The development of longer-acting oral anticoagulants, AI-guided clot retrieval systems, and less invasive vascular devices is significantly improving patient adherence to treatment plans and minimizing adverse reactions. These innovations are not only improving the standard of care but also enabling physicians to deliver efficient treatment with better long-term outcomes.

In 2024, the drug-based segment held a 65.5% share, driven by the wide-scale use of anticoagulants and thrombolytic drugs across both clinical and outpatient environments. This segment is divided into two main categories: anticoagulants and thrombolytics. The anticoagulant category is further segmented into direct oral anticoagulants, heparin products, and vitamin K antagonists. This dominance is the result of modern anticoagulants offering predictable therapeutic effects, longer activity durations, and requiring less intensive monitoring. These features make them ideal for both initial and ongoing management of VTE, especially in varied patient settings.

The deep vein thrombosis (DVT) segment generated USD 2 billion in 2024 and will reach USD 3.3 billion by 2034, making it the largest contributor to the overall VTE treatment market. DVT is characterized by clot formation in deep veins, primarily in the lower limbs, and poses serious health risks if not identified and treated promptly. The prevalence of DVT is influenced by multiple risk factors such as sedentary lifestyles, smoking, high body weight, and chronic illnesses. This increasing burden has prompted medical professionals to emphasize early detection, guided use of anticoagulant therapy, and, where necessary, mechanical interventions to improve recovery rates and reduce life-threatening complications.

North America Venous Thromboembolism Treatment Market held a 40.1% share. The dominance of this region stems from its well-established healthcare framework, including advanced diagnostic resources, skilled healthcare personnel, and high patient awareness levels. Public health campaigns focused on prevention and early symptom recognition have contributed to the timely treatment of VTE, while research investments continue to bring new products and technologies to the market. Pharmaceutical and medical technology companies based in North America are consistently developing innovative solutions that offer superior efficacy and safety, which support the region's strong market performance.

Prominent companies actively shaping the venous thromboembolism treatment market include Johnson & Johnson, Philips Healthcare, Boehringer Ingelheim, Daiichi Sankyo, Sanofi, Novartis, AngioDynamics, Bayer, Argon Medical Products, Boston Scientific, Daesung Maref, Pfizer, Cardinal Health, Cook Medical, GlaxoSmithKline, Bristol Myers Squibb, and Covidien (Medtronic). Leading players in the venous thromboembolism treatment market are focusing on a blend of innovation, strategic partnerships, and geographic expansion to solidify their market standing. Many are investing heavily in R&D to launch next-generation therapies and devices that provide safer, more effective treatment options. Strategic collaborations with academic and clinical institutions are helping accelerate clinical trials and technology development. Companies are also expanding their global footprint by entering emerging markets and strengthening distribution networks to improve access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi

Table of Contents

Chapter 11 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 12 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 13 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 14 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 15 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 16 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 17 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 18 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 19 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 20 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi