|

市場調查報告書

商品編碼

1833653

工業空氣過濾市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Air Filtration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

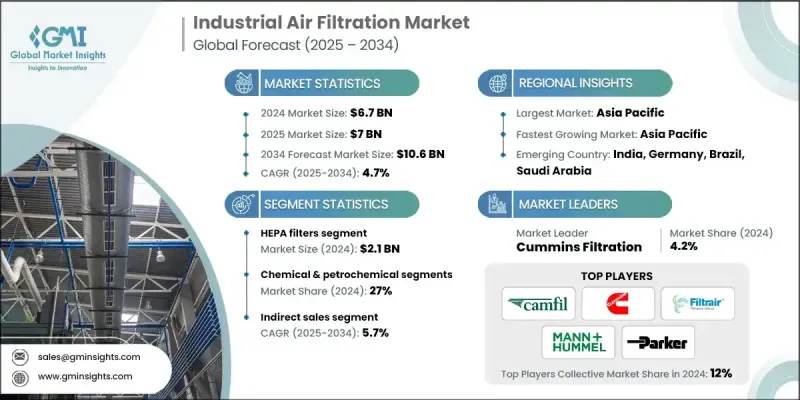

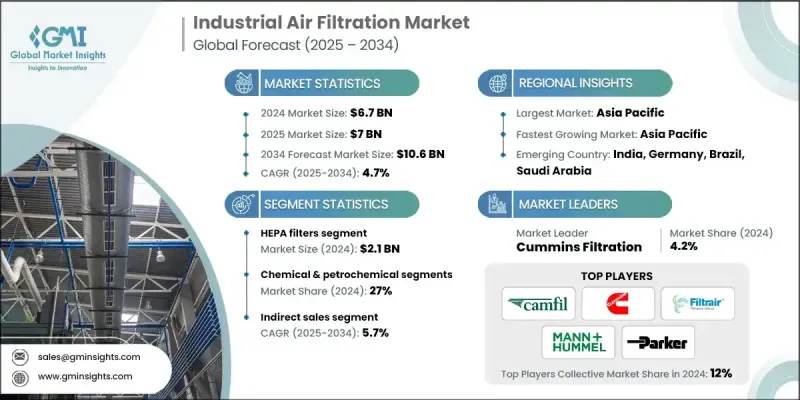

2024 年全球工業空氣過濾市場價值為 67 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 106 億美元。

美國職業安全與健康管理局 (OSHA)、美國環保署 (EPA) 等政府機構及其全球同行正在對工業環境實施更嚴格的空氣品質標準。企業被迫安裝先進的空氣過濾系統,以保持合規並避免罰款,這極大地刺激了市場需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 67億美元 |

| 預測值 | 106億美元 |

| 複合年成長率 | 4.7% |

HEPA過濾器的採用率不斷上升

HEPA過濾器由於其高效捕獲細顆粒物(包括灰塵、氣溶膠和微生物)的能力,在2024年佔據了相當大的市場佔有率。這類過濾器在需要超潔淨空氣的環境中尤其重要,例如製藥生產、電子製造和食品加工。

化學品和石化產品需求不斷成長

2024年,化學和石化產業佔據了相當大的佔有率,這主要得益於其高濃度的空氣污染物和有害氣體。維持這些設施的空氣品質不僅對於合規性至關重要,也對工人安全和製程穩定性至關重要。該領域的過濾解決方案通常需要先進的化學吸收劑和耐腐蝕材料,這進一步推動了對專業高性能系統的需求。

間接銷售獲得牽引力

在加值經銷商和系統整合商的支持下,間接銷售領域將在2025年至2034年期間實現可觀的複合年成長率。這些管道使製造商無需龐大的內部銷售團隊即可擴大市場覆蓋範圍。經銷商還提供技術諮詢、售後服務和客製化安裝,在過濾供應商和工業客戶之間建立起至關重要的紐帶。

亞太地區將崛起成為推動力地區

受快速工業化、城市污染挑戰和日益嚴格的環境法規的推動,亞太地區工業空氣過濾市場在2024年佔據了相當大的佔有率。中國、印度和韓國等國家在製造業、汽車業、水泥業和發電業等領域的需求領先。政府旨在減少空氣污染和提高職業安全標準的措施推動了市場成長。隨著基礎設施支出的增加,對堅固耐用且可擴展的空氣過濾系統的需求預計將穩定成長。

工業空氣過濾市場的主要參與者有 Fives Group、Absolent、Mann+Hummel、Donaldson、BWF、Freudenberg、Universal Air Filter、AAF、Camfil、Cummins Filtration、Pall、Parker Hannifin、Nederman、Filtration Group Corporation 和 Lydall Gutsche Corporation。

為了鞏固市場地位,工業空氣過濾市場的領導者正在加大對產品創新、數位化整合和永續性的投資。許多公司正在推出配備物聯網感測器的智慧過濾系統,用於即時空氣品質監測和預測性維護。與原始設備製造商、分銷商和工程公司建立策略合作夥伴關係有助於擴大分銷網路,並根據行業特定需求量身定做解決方案。併購仍然是獲取新技術或區域市場的熱門途徑。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- HEPA 過濾器

- 袋式除塵器/織物過濾器

- 靜電集塵器(ESP)

- 旋風分離器

- 活性碳過濾器

- 其他(ULPA過濾器等)

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 潔淨室空氣過濾

- 工業製程空氣淨化

- HVAC系統過濾

- 除塵系統

- 排放控制

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術

- 半導體和電子產品

- 食品和飲料

- 汽車

- 化工和石化

- 其他(醫療保健和醫院等)

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AAF

- Absolent

- BWF

- Camfil

- Cummins Filtration

- Donaldson

- Filtration Group Corporation

- Fives Group

- Freudenberg

- Lydall Gutsche

- Mann+Hummel

- Nederman

- Pall

- Parker Hannifin

- Universal Air Filter

The Global Industrial Air Filtration Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 10.6 billion by 2034.

Government agencies such as OSHA, EPA, and their global counterparts are enforcing stricter air quality standards in industrial environments. Companies are compelled to install advanced air filtration systems to remain compliant and avoid fines, which significantly boosts market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $10.6 Billion |

| CAGR | 4.7% |

Rising Adoption of HEPA Filters

The HEPA filters segment held a significant share in 2024, owing to its high efficiency in capturing fine particulate matter, including dust, aerosols, and microorganisms. These filters are especially critical in environments requiring ultra-clean air, such as pharmaceutical production, electronics manufacturing, and food processing.

Increasing Demand in Chemicals and Petrochemicals

The chemical and petrochemical segment generated a substantial share in 2024, driven by high levels of airborne pollutants and hazardous gases involved. Maintaining air quality in these facilities is essential not only for regulatory compliance but also for worker safety and process stability. Filtration solutions in this space often require advanced chemical absorbents and corrosion-resistant materials, further pushing the demand for specialized high-performance systems.

Indirect Sales to Gain Traction

The indirect sales segment will grow at a decent CAGR during 2025-2034, backed by value-added resellers and system integrators. These channels enable manufacturers to extend their market reach without the need for an extensive in-house sales force. Distributors also offer technical consulting, after-sales service, and customized installation, making a critical link between filtration providers and industrial clients.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific industrial air filtration market held a sizeable share in 2024, driven by rapid industrialization, urban pollution challenges, and growing environmental regulations. Countries like China, India, and South Korea are leading demand across sectors such as manufacturing, automotive, cement, and power generation. Market growth is fueled by government initiatives aimed at reducing air pollution and enhancing occupational safety standards. As infrastructure spending increases, the need for robust and scalable air filtration systems is expected to rise steadily.

Major players in the industrial air filtration market are Fives Group, Absolent, Mann+Hummel, Donaldson, BWF, Freudenberg, Universal Air Filter, AAF, Camfil, Cummins Filtration, Pall, Parker Hannifin, Nederman, Filtration Group Corporation, Lydall Gutsche.

To strengthen their foothold, leading players in the industrial air filtration market are investing in product innovation, digital integration, and sustainability. Many companies are launching smart filtration systems equipped with IoT sensors for real-time air quality monitoring and predictive maintenance. Strategic partnerships with OEMs, distributors, and engineering firms help expand distribution networks and tailor solutions to industry-specific needs. Mergers and acquisitions remain a popular route to gain access to new technologies or regional markets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 HEPA filters

- 5.3 Baghouse/fabric filters

- 5.4 Electrostatic precipitators (ESP)

- 5.5 Cyclone separators

- 5.6 Activated carbon filters

- 5.7 Others (ULPA filters etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Cleanroom air filtration

- 6.3 Industrial process air cleaning

- 6.4 HVAC system filtration

- 6.5 Dust collection systems

- 6.6 Emission control

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceuticals & biotechnology

- 7.3 Semiconductor & electronics

- 7.4 Food & beverages

- 7.5 Automotive

- 7.6 Chemical & petrochemical

- 7.7 Others (healthcare & hospitals etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAF

- 10.2 Absolent

- 10.3 BWF

- 10.4 Camfil

- 10.5 Cummins Filtration

- 10.6 Donaldson

- 10.7 Filtration Group Corporation

- 10.8 Fives Group

- 10.9 Freudenberg

- 10.10 Lydall Gutsche

- 10.11 Mann+Hummel

- 10.12 Nederman

- 10.13 Pall

- 10.14 Parker Hannifin

- 10.15 Universal Air Filter