|

市場調查報告書

商品編碼

1833652

汽車啟動停止系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Automotive Start-Stop System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

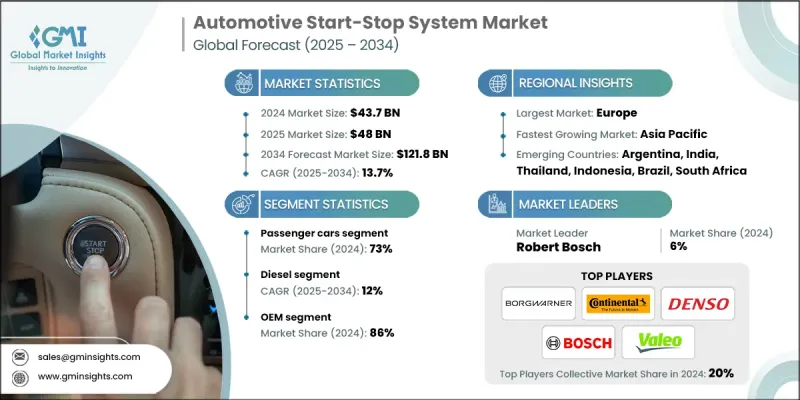

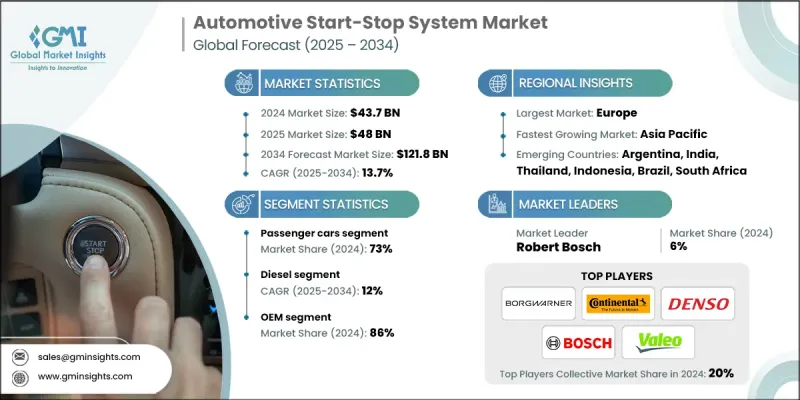

根據 Global Market Insights Inc. 發布的最新報告,全球汽車啟動/停止系統市場規模在 2024 年估計為 437 億美元,預計將從 2025 年的 480 億美元成長到 2034 年的 1,218 億美元,複合年成長率為 13.7%。

全球各國政府正在實施更嚴格的排放標準和燃油經濟性標準,迫使汽車製造商整合啟停系統等節油技術。這些系統有助於減少怠速排放並提高整體燃油效率,使其成為合規的首選解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 437億美元 |

| 預測值 | 1218億美元 |

| 複合年成長率 | 13.7% |

乘用車需求不斷成長

2024年,乘用車市場將佔據顯著佔有率,這得益於日常用車對節油環保解決方案的強勁需求。汽車製造商正在將啟動/停止系統作為各種車型(包括緊湊型、中型和高階車型)的標準配置,以符合排放法規並滿足消費者對更高燃油經濟性的期望。

柴油使用量上升

由於柴油動力系統在乘用車和輕型商用車中仍然佔據主導地位,柴油市場在2024年佔據了相當大的佔有率。柴油引擎以其高扭力和燃油效率而聞名,啟動停止系統可顯著降低怠速時的油耗和排放,使其受益匪淺。儘管電氣化進程正在逐步推進,但配備啟動停止技術的柴油車仍然受到車隊營運商和注重成本的消費者的青睞。

OEM獲得發展動力

2024年,原始設備製造商(OEM)市場佔據了相當大的佔有率,這得益於新車平台內建功能的推動。原始設備製造商(OEM)認為這項技術是一種經濟高效的解決方案,無需完全過渡到混合動力或電動傳動系統即可滿足燃油經濟性目標和排放要求。 OEM正在與一級供應商緊密合作,共同開發更緊湊、更耐用、更有效率的系統,並可擴展應用於所有車型。

歐洲將崛起成為推手地區

2024年,歐洲汽車啟動停止系統市場收入強勁,這得益於嚴格的歐盟排放法規、高昂的燃油價格以及對永續發展的高度重視。包括德國、法國和英國在內的主要歐洲國家都實施了積極的碳減排政策,推動了啟停系統等節油技術的廣泛應用。此外,成熟的汽車製造基礎和消費者對環保功能的認知度也推動了該地區OEM的強勁成長。

汽車啟停系統市場的主要參與者包括法雷奧、日立汽車、羅伯特博世、麥格納、博格華納、大陸集團、採埃孚、江森自控、愛信精機和電裝。

為了鞏固市場地位,汽車啟動停止系統領域的企業正專注於創新、合作和成本最佳化。領先的供應商正在開發更強大的電池管理系統、再生煞車整合系統和靜音啟動電機,以提升系統性能和耐用性。原始設備製造商 (OEM) 和技術供應商之間的合作正在加快針對特定動力系統配置客製化的先進系統的上市時間。同時,企業正在擴大其全球生產佈局,以確保供應鏈的彈性和成本效率。透過平衡性能、可靠性和價格承受能力,這些策略舉措正在幫助企業與汽車製造商簽訂長期契約,並在日益嚴格的行業監管中保持競爭優勢。

目錄

第1章:方法論

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- GMI 專有 AI 系統

- 人工智慧驅動的研究增強

- 來源一致性協議

- 人工智慧準確度指標

- 預測模型

- 初步研究和驗證

- 市場估計的主要趨勢

- 量化市場影響分析

- 生長參數對預測的數學影響

- 情境分析框架

- 一些主要來源(但不限於)

- 資料探勘來源

- 次要

- 付費來源

- 公共資源

- 來源(按地區)

- 次要

- 研究路徑和信心評分

- 研究路徑組成部分:

- 評分組件

- 研究透明度附錄

- 來源歸因框架

- 品質保證指標

- 我們對信任的承諾

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 嚴格的排放和燃油經濟法規

- 燃料價格上漲和消費者對效率的需求

- 起動馬達和電池的技術進步

- 混合動力和輕度混合動力汽車產量激增

- 政府對環保技術的獎勵措施

- 產業陷阱與挑戰

- 系統和組件成本高

- 電池磨損和更換頻率

- 市場機會

- 與混合動力和電動動力系統的整合

- 電池技術與能量回收的進步

- 拓展新興汽車市場

- 與 ADAS 和智慧行動平台整合

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

- 用例和應用分析

- 城市駕駛應用

- 城市交通走走停停場景

- 配送車輛最佳化

- 計程車和共乘應用程式

- 大眾運輸整合

- 高速公路和混合駕駛條件

- 長途旅行應用

- 商業船隊營運

- 緊急車輛應用

- 休閒車整合

- 特殊用例

- 建築和工業車輛

- 農業設備應用

- 船舶和非公路應用

- 城市駕駛應用

- 成本效益和投資報酬率分析框架

- 總擁有成本分析

- 初始系統成本明細

- 維護和更換成本

- 燃料節省量化

- 生命週期成本建模

- 投資報酬率指標

- 依車輛類型分析投資回收期

- 淨現值計算

- 內部報酬率評估

- 敏感度分析框架

- 總擁有成本分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034

- 主要趨勢

- 二輪車

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車

- 輕型商用車

- 中型商用車

- 重型商用車

第6章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- 汽油

- 天然氣

- 混合

第7章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 增強型啟動器

- 常規啟動器

- 雙聯電磁啟動器

- 皮帶驅動交流發電機起動器(BAS)

- 直噴引擎系統

- 整合起動發電機(ISG)

第8章:市場估計與預測:按組件,2021 - 2034

- 主要趨勢

- 引擎控制單元(ECU)

- 電池

- 交流發電機

- 起動馬達

- DC/DC轉換器

- 感應器

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者

- Aisin Seiki

- BorgWarner

- Continental

- Denso

- Exide Technologies

- GS Yuasa

- Hitachi

- Infineon Technologies

- Johnson Controls

- Magna International Inc.

- Mahle

- NXP Semiconductors

- Panasonic

- Robert Bosch

- Schaeffler

- Valeo

- ZF Friedrichshafen

- 區域參與者

- Calsonic Kansei

- Eaton Corporation

- Faurecia

- Hella GmbH & Co.

- Hyundai Mobis

- JTEKT Corporation

- Lear Corporation

- Schaeffler AG

- Visteon Corporation

- 新興玩家

- ABB Ltd.

- Aptiv PLC

- Infineon Technologies

- LEM Holding

The global automotive start-stop system market was estimated at USD 43.7 billion in 2024 and is expected to grow from USD 48 billion in 2025 to USD 121.8 billion by 2034, at a CAGR of 13.7%, according to the latest report published by Global Market Insights Inc.

Governments across the globe are enforcing stricter emission norms and fuel economy standards, compelling automakers to integrate fuel-saving technologies like start-stop systems. These systems help reduce idling emissions and improve overall fuel efficiency, making them a go-to solution for compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.7 Billion |

| Forecast Value | $121.8 Billion |

| CAGR | 13.7% |

Growing Demand for Passenger Cars

The passenger cars segment held a notable share in 2024, driven by strong demand for fuel-efficient and environmentally friendly solutions in daily-use vehicles. Automakers are integrating start-stop systems as a standard feature across a wide range of car models, including compact, midsize, and premium offerings, to comply with emissions regulations and meet consumer expectations for improved fuel economy.

Rising Usage of Diesel

The diesel segment generated a significant share in 2024, as diesel powertrains remain prevalent in the passenger and light commercial vehicles. Diesel engines, known for their high torque and fuel efficiency, benefit significantly from start-stop systems that further reduce idle-time fuel consumption and emissions. Despite a gradual shift toward electrification, diesel vehicles equipped with start-stop technology continue to appeal to fleet operators and cost-conscious consumers.

OEM to Gain Traction

The OEM segment held a sizeable share in 2024, driven by built-in features across new vehicle platforms. Original Equipment Manufacturers view this technology as a cost-effective solution to meet fuel economy targets and emission mandates without fully transitioning to hybrid or electric drivetrains. OEMs are partnering closely with tier-1 suppliers to co-develop more compact, durable, and efficient systems that can be scaled across vehicle lineups.

Europe to Emerge as a Propelling Region

Europe automotive start-stop system market generated robust revenues in 2024, backed by stringent EU emission regulations, high fuel prices, and a strong emphasis on sustainability. Major European countries, including Germany, France, and the UK, have implemented aggressive carbon reduction policies, prompting widespread adoption of fuel-saving technologies like start-stop systems. Additionally, a mature automotive manufacturing base and consumer awareness around eco-friendly features are driving strong OEM uptake in the region.

Major players in the automotive start-stop system market are Valeo, Hitachi Automotive, Robert Bosch, Magna, BorgWarner, Continental, ZF Friedrichshafen, Johnson Controls, Aisin Seiki, and Denso.

To strengthen their market position, companies in the automotive start-stop system space are focusing on innovation, partnerships, and cost optimization. Leading suppliers are developing more robust battery management systems, regenerative braking integration, and silent start motors to enhance system performance and durability. Collaborations between OEMs and technology providers are accelerating time-to-market for advanced systems tailored to specific powertrain configurations. At the same time, firms are expanding their global production footprints to ensure supply chain resilience and cost efficiency. By balancing performance, reliability, and affordability, these strategic moves are helping companies secure long-term contracts with automakers and maintain a competitive edge in an increasingly regulated industry.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicles

- 2.2.3 Fuel

- 2.2.4 Technology

- 2.2.5 Component

- 2.2.6 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.1.1 Stringent emission and fuel economy regulations

- 3.2.1.1.2 Rising fuel prices and consumer demand for efficiency

- 3.2.1.1.3 Technological advancements in starter motors and batteries

- 3.2.1.1.4 Surge in hybrid and mild-hybrid vehicle production

- 3.2.1.1.5 Government incentives for eco-friendly technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system and component costs

- 3.2.2.2 Battery wear and replacement frequency

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with hybrid and electric powertrains

- 3.2.3.2 Advancements in battery technology and energy recovery

- 3.2.3.3 Expansion into emerging automotive markets

- 3.2.3.4 Integration with ADAS and smart mobility platforms

- 3.2.1.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases and application analysis

- 3.10.1 Urban driving applications

- 3.10.1.1 City traffic stop-start scenarios

- 3.10.1.2 Delivery vehicle optimization

- 3.10.1.3 Taxi & ride-sharing applications

- 3.10.1.4 Public transportation integration

- 3.10.2 Highway and mixed driving conditions

- 3.10.2.1 Long-distance travel applications

- 3.10.2.2 Commercial fleet operations

- 3.10.2.3 Emergency vehicle applications

- 3.10.2.4 Recreational vehicle integration

- 3.10.3 Specialized use cases

- 3.10.3.1 Construction & industrial vehicles

- 3.10.3.2 Agricultural equipment applications

- 3.10.3.3 Marine & off-road applications

- 3.10.1 Urban driving applications

- 3.11 Cost-benefit and ROI analysis framework

- 3.11.1 Total cost of ownership analysis

- 3.11.1.1 Initial system cost breakdown

- 3.11.1.2 Maintenance & replacement costs

- 3.11.1.3 Fuel savings quantification

- 3.11.1.4 Lifecycle cost modeling

- 3.11.2 Return on investment metrics

- 3.11.2.1 Payback period analysis by vehicle type

- 3.11.2.2 Net present value calculations

- 3.11.2.3 Internal rate of return assessment

- 3.11.2.4 Sensitivity analysis framework

- 3.11.1 Total cost of ownership analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Two wheelers

- 5.3 Passenger cars

- 5.3.1 Hatchbacks

- 5.3.2 Sedans

- 5.3.3 SUVs

- 5.4 Commercial vehicles

- 5.4.1 Light commercial vehicle

- 5.4.2 Medium commercial vehicle

- 5.4.3 Heavy commercial vehicle

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 (USD Mn)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gasoline

- 6.4 CNG

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Enhanced starter

- 7.2.1 Conventional starter

- 7.2.2 Tandem solenoid starter

- 7.3 Belt-driven alternator starter (BAS)

- 7.4 Direct injection engine systems

- 7.5 Integrated starter generator (ISG)

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Engine control unit (ECU)

- 8.3 Battery

- 8.4 Alternator

- 8.5 Starter Motor

- 8.6 DC/DC converter

- 8.7 Sensors

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Mn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aisin Seiki

- 11.1.2 BorgWarner

- 11.1.3 Continental

- 11.1.4 Denso

- 11.1.5 Exide Technologies

- 11.1.6 GS Yuasa

- 11.1.7 Hitachi

- 11.1.8 Infineon Technologies

- 11.1.9 Johnson Controls

- 11.1.10 Magna International Inc.

- 11.1.11 Mahle

- 11.1.12 NXP Semiconductors

- 11.1.13 Panasonic

- 11.1.14 Robert Bosch

- 11.1.15 Schaeffler

- 11.1.16 Valeo

- 11.1.17 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Calsonic Kansei

- 11.2.2 Eaton Corporation

- 11.2.3 Faurecia

- 11.2.4 Hella GmbH & Co.

- 11.2.5 Hyundai Mobis

- 11.2.6 JTEKT Corporation

- 11.2.7 Lear Corporation

- 11.2.8 Schaeffler AG

- 11.2.9 Visteon Corporation

- 11.3 Emerging Players

- 11.3.1 ABB Ltd.

- 11.3.2 Aptiv PLC

- 11.3.3 Infineon Technologies

- 11.3.4 LEM Holding