|

市場調查報告書

商品編碼

1833648

成人失禁產品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Adult Incontinence Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

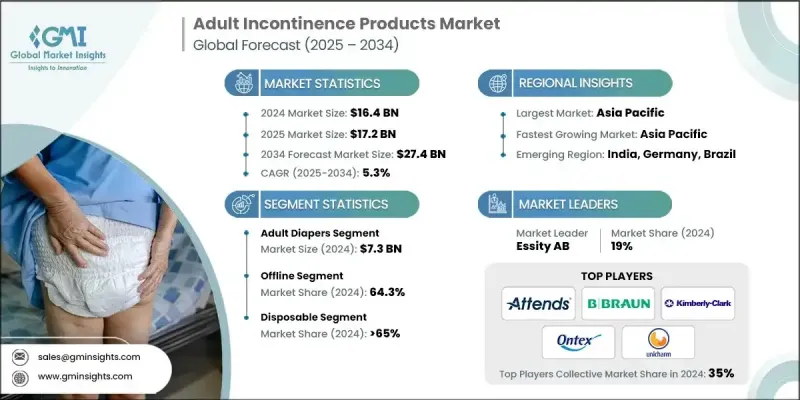

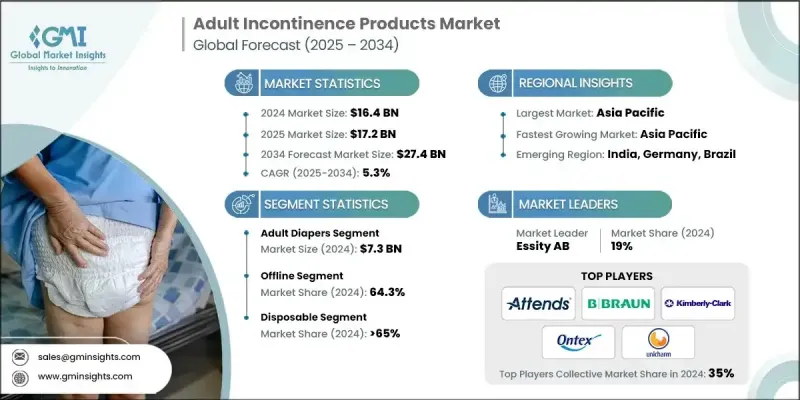

2024 年全球成人失禁產品市場價值為 164 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 274 億美元。

老年人口的成長,尤其是在已開發國家,是主要促進因素。隨著年齡的成長,尿失禁和大便失禁等疾病的盛行率也會上升,導致成人紙尿褲、護墊和防護內衣的需求增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 164億美元 |

| 預測值 | 274億美元 |

| 複合年成長率 | 5.3% |

成人紙尿褲使用率上升

成人紙尿褲市場在2024年佔據了相當大的佔有率,這得益於其在醫療機構和居家護理環境中的廣泛應用。這些產品旨在緩解中度至重度失禁,並提供增強的吸收性、防漏性和舒適性。隨著老齡化人口需求的成長,製造商正在創新,採用更薄的材料、氣味控制技術和性別特定的設計,以提高用戶的信心和判斷力。

線下需求不斷成長

2024年,在數位化程度較低或消費者更傾向於實體零售購買個人衛生用品的地區,線下市場實現了永續的收入。藥局、超市和專賣店讓顧客可以直接購買產品、獲得面對面諮詢並即時比較品牌。為了獲得優勢,領先的公司專注於店內教育、產品試用和策略性貨架擺放。許多公司也與零售商合作,提供忠誠度計畫和捆綁優惠,從而提升品牌在線下零售生態系統中的知名度和復購率。

一次性用品將獲得青睞

2024年,一次性用品憑藉其便利性、衛生性和日常適用性佔據了相當大的市場佔有率。這類產品包括一次性設計的成人紙尿褲、護墊和拉拉褲,非常適合家庭護理和機構環境。一次性用品易於丟棄,吸收性更強,且採用親膚材質,因此深受照護者和使用者的青睞。

亞太地區將成為利潤豐厚的地區

受人口快速老化、預期壽命延長以及醫療保健覆蓋範圍擴大的推動,亞太地區成人失禁產品市場將在2025-2034年期間實現可觀的複合年成長率。日本、中國和韓國等國家的需求正在激增,這不僅來自養老機構,也來自日益壯大的老年人群體,他們尋求謹慎可靠的解決方案。

成人失禁產品市場的主要參與者有康維特、金佰利、NorthShore Care Supply、Abena、Attends Healthcare、寶潔、B. Braun Melsungen、Hollister、Hayat Kimya、尤妮佳、Ontex、First Quality Enterprises、Nobel Hygiene、Cardinal Health 和 Essity。

為了鞏固其在成人失禁產品市場的地位,各公司正在採取一系列產品創新、精準行銷和擴大分銷管道的策略。許多公司專注於超薄、高吸收性材料,以提供隱藏的保護,同時開發環保的一次性產品,以吸引注重永續發展的消費者。數位轉型是另一個核心策略,各品牌正在提升電商影響力,提供訂閱服務,並利用資料分析來個人化產品推薦。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 人口老化

- 慢性健康狀況增加

- 改善醫療保健服務

- 產業陷阱與挑戰

- 監理合規性

- 環境影響

- 機會

- 電子商務擴張

- 環保產品開發創新

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 成人紙尿褲

- 防護內衣

- 護墊和襯墊

- 其他

第6章:市場估計與預測:依消費者群體分類,2021 年至 2034 年

- 主要趨勢

- 男性

- 女性

- 男女通用的

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 年輕人(20-39歲)

- 中年人(40-64歲)

- 老年人(65歲以上)

第8章:市場估計與預測:按類別,2021 - 2034

- 主要趨勢

- 可重複使用的

- 一次性的

第9章:市場估計與預測:按規模,2021 - 2034

- 主要趨勢

- 小的

- 中等的

- 大的

- 特大號

第10章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 離線

- 超市和大賣場

- 藥局

- 其他

- 線上

- 電子商務

- 品牌網站

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Abena

- Attends Healthcare

- B. Braun Melsungen

- Cardinal Health

- ConvaTec

- Essity

- First Quality Enterprises

- Hayat Kimya

- Hollister

- Kimberly Clark

- Nobel Hygiene

- NorthShore Care Supply

- Ontex

- Procter & Gamble

- Unicharm

The Global Adult Incontinence Products Market was valued at USD 16.4 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 27.4 billion by 2034.

The rise in the elderly population, particularly in developed countries, is a primary driver. As people age, the prevalence of conditions like urinary and fecal incontinence increases, leading to higher demand for adult diapers, pads, and protective underwear.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.4 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 5.3% |

Rising Adoption of Adult Diapers

The adult diaper segment held a significant share in 2024, driven by its wide usage across both healthcare facilities and at-home care environments. These products are designed to manage moderate to severe incontinence and offer enhanced absorbency, leak protection, and comfort for users. With growing demand from the aging population, manufacturers are innovating with thinner materials, odor control technology, and gender-specific designs to improve user confidence and discretion.

Increasing Demand in Offline

The offline segment generated sustainable revenues in 2024, in regions with limited digital adoption or where consumers prefer physical retail for personal hygiene purchases. Pharmacies, supermarkets, and specialty stores allow customers to access products directly, receive in-person advice, and compare brands in real time. To gain an edge, leading companies are focusing on in-store education, product sampling, and strategic shelf placements. Many also work with retailers to offer loyalty programs and bundle deals, boosting both brand visibility and repeat purchases within the offline retail ecosystem.

Disposables to Gain Traction

The disposable segment held a sizeable share in 2024 owing to its convenience, hygiene benefits, and suitability for daily use. Products in this category include adult diapers, pads, and pull-ups designed for one-time use, making them ideal for both home care and institutional environments. The ease of disposal, along with improved absorbency and skin-friendly materials, makes disposable options highly favored among caregivers and users alike.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific adult incontinence products market will grow at a decent CAGR during 2025-2034, fueled by a rapidly aging population, increasing life expectancy, and expanding access to healthcare. Countries like Japan, China, and South Korea are seeing a surge in demand, not only from elder care facilities but also from a growing base of active seniors seeking discreet and reliable solutions.

Major players in the adult incontinence products market are ConvaTec, Kimberly-Clark, NorthShore Care Supply, Abena, Attends Healthcare, Procter & Gamble, B. Braun Melsungen, Hollister, Hayat Kimya, Unicharm, Ontex, First Quality Enterprises, Nobel Hygiene, Cardinal Health, and Essity.

To strengthen their position in the adult incontinence products market, companies are embracing a mix of product innovation, targeted marketing, and expanded distribution. Many are focusing on ultra-thin, high-absorbency materials that offer discreet protection, while also developing eco-conscious disposable options to appeal to sustainability-minded consumers. Digital transformation is another core strategy, with brands enhancing their e-commerce presence, offering subscription services, and using data analytics to personalize product recommendations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Consumer group

- 2.2.4 Age group

- 2.2.5 Category

- 2.2.6 Size

- 2.2.7 Price

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population

- 3.2.1.2 Increase in chronic health conditions

- 3.2.1.3 Improved healthcare access

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory compliance

- 3.2.2.2 Environmental impact

- 3.2.3 Opportunities

- 3.2.3.1 E-commerce expansion

- 3.2.3.2 Innovations in development of eco-friendly products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Adult diapers

- 5.3 Protective underwear

- 5.4 Pads & liners

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Male

- 6.3 Female

- 6.4 Unisex

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Young adults (20-39)

- 7.3 Middle-aged adults (40-64)

- 7.4 Senior (65 & above)

Chapter 8 Market Estimates and Forecast, By Category, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Reusable

- 8.3 Disposable

Chapter 9 Market Estimates and Forecast, By Size, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Small

- 9.3 Medium

- 9.4 Large

- 9.5 Extra large

Chapter 10 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Offline

- 11.2.1 Supermarkets & hypermarkets

- 11.2.2 Pharmacies

- 11.2.3 Others

- 11.3 Online

- 11.3.1 E-commerce

- 11.3.2 Brand websites

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Abena

- 13.2 Attends Healthcare

- 13.3 B. Braun Melsungen

- 13.4 Cardinal Health

- 13.5 ConvaTec

- 13.6 Essity

- 13.7 First Quality Enterprises

- 13.8 Hayat Kimya

- 13.9 Hollister

- 13.10 Kimberly Clark

- 13.11 Nobel Hygiene

- 13.12 NorthShore Care Supply

- 13.13 Ontex

- 13.14 Procter & Gamble

- 13.15 Unicharm