|

市場調查報告書

商品編碼

1833645

油浸式電力變壓器市場機會、成長動力、產業趨勢分析及2025-2034年預測Oil Filled Power Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

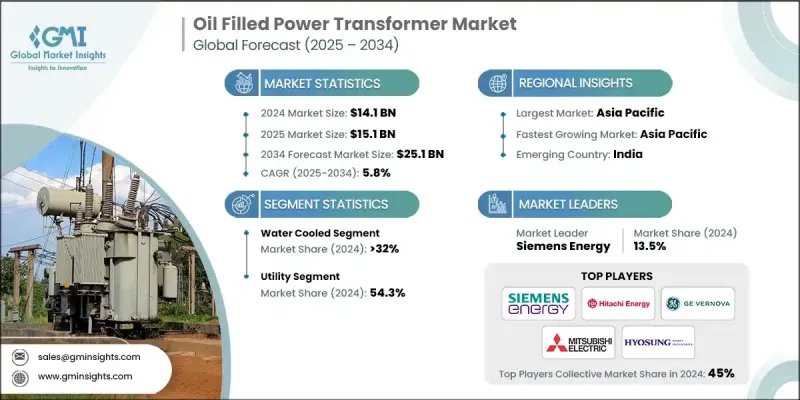

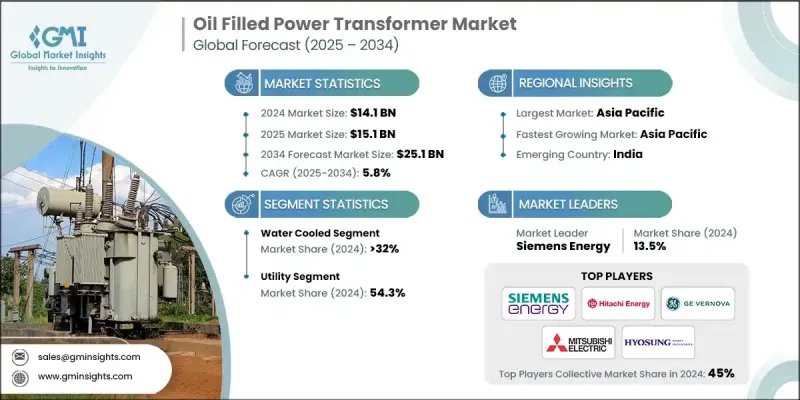

根據 Global Market Insights Inc. 發布的最新報告,油浸式電力變壓器市場規模在 2024 年估計為 141 億美元,預計將從 2025 年的 151 億美元成長到 2034 年的 251 億美元,複合年成長率為 5.8%。

在快速城鎮化、工業發展和數位基礎設施的推動下,全球對電力的依賴日益加深,這給現有電網帶來了巨大壓力。無論是已開發經濟體或新興經濟體,對穩定、不間斷的電力供應的需求都變得至關重要,尤其是在製造業、交通運輸、資料中心和醫療保健等領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 141億美元 |

| 預測值 | 251億美元 |

| 複合年成長率 | 5.8% |

水冷式變壓器的採用率不斷上升

2024年,水冷變壓器市場佔據了相當大的佔有率,尤其是在需要高容量冷卻和空間最佳化的應用中。這些系統使用水作為除油之外的二次冷卻介質,從而在緊湊的安裝或炎熱氣候條件下實現卓越的熱管理。在空氣流通受限或有噪音限制的地區,公用事業和重工業更傾向於使用水冷變壓器。為了充分利用這一市場,製造商正在提高冷卻效率,整合用於熱監控的智慧感測器,並提供模組化設計以簡化安裝和維護。

實用性獲得青睞

受國家輸配電網路持續擴大、升級和穩定需求的推動,公用事業部門在2024年將保持永續的佔有率。電力公司依賴油浸式變壓器,因為其可靠性、負載處理能力和使用壽命(尤其是在高壓應用中)久經考驗。隨著許多國家再生能源的整合和基礎設施的老化,公用事業部門正在大力投資變壓器升級。

亞太地區將成為利潤豐厚的地區

2024年,亞太地區油浸式電力變壓器市場佔據了相當大的佔有率,這得益於快速的工業化、人口成長以及對電力基礎設施的大規模投資。中國、印度和印尼等國家正在擴大電網以滿足不斷成長的電力需求,同時對老舊系統進行現代化改造,以降低損耗並提高效率。該地區的市場充滿活力,本土製造業、政府支持的電氣化項目以及強大的公私合作夥伴關係推動著這個市場的發展。

油浸式電力變壓器市場的主要參與者有 KPRS、西門子能源、LS ELECTRIC、大林變壓器、富士電機、CG 電力與工業解決方案、日立能源、Ormazabal、印度重型電氣有限公司 (BHEL)、SGB SMIT、GE Vernova、東芝能源系統與解決方案公司、Bharat Bijlee 有限公司、三菱電機有限公司、三菱電機有限公司、Bharakwelee 有限公司Company、Celme、曉星重工、伊頓、施耐德電氣。

為了鞏固其市場地位,油浸式電力變壓器市場的領先製造商正在推行多管齊下的策略,專注於創新、區域擴張和數位化整合。許多製造商正在加大研發投入,以開發高效鐵芯、先進絕緣材料和緊湊型設計,以滿足不斷變化的電網需求。與公用事業供應商和工程總承包 (EPC) 承包商的策略合作,使其能夠提供交鑰匙專案並簽署長期服務協議。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 進出口貿易分析

- 主要進口國

- 主要出口國

- 價格趨勢分析,(美元/單位)

- 依技術

- 油浸式電力變壓器的成本分析

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 自冷

- 水冷

- 強製油

- 其他

第6章:市場規模及預測:依評級,2021 - 2034

- 主要趨勢

- ≤100兆伏安

- > 100 MVA 至 ≤ 500 MVA

- > 500 MVA 至 ≤ 800 MVA

- > 800 兆伏安

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 秘魯

- 阿根廷

第9章:公司簡介

- Bharat Heavy Electricals Limited (BHEL)

- Bharat Bijlee Limited

- Celme

- CG Power & Industrial Solutions

- Daelim Transformer

- Eaton

- Elsewedy Electric

- Fuji Electric

- GE Vernova

- Hitachi Energy

- Hyosung Heavy Industries

- Kirloskar Electric Company

- KPRS

- LS ELECTRIC

- Mitsubishi Electric

- Ormazabal

- Schneider Electric

- SGB SMIT

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

The oil filled power transformer market was estimated at USD 14.1 billion in 2024 and is expected to grow from USD 15.1 billion in 2025 to USD 25.1 billion by 2034, at a CAGR of 5.8%, as per the latest report published by Global Market Insights Inc.

The increasing global reliance on electricity, driven by rapid urbanization, industrial development, and digital infrastructure, has placed enormous pressure on existing power grids. In both developed and emerging economies, the need for a consistent, uninterrupted power supply has become critical, particularly in sectors like manufacturing, transportation, data centers, and healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.1 Billion |

| Forecast Value | $25.1 Billion |

| CAGR | 5.8% |

Rising Adoption of Water-Cooled Transformers

The water-cooled segment held a significant share in 2024, particularly in applications that demand high-capacity cooling and space optimization. These systems use water as a secondary cooling medium alongside oil, allowing for superior thermal management in compact installations or hot climates. Utilities and heavy industries prefer water-cooled transformers where air circulation is limited or where noise restrictions apply. To capitalize on this segment, manufacturers are enhancing cooling efficiency, integrating smart sensors for thermal monitoring, and offering modular designs that simplify installation and maintenance.

Utility to Gain Traction

The utility segment held a sustainable share in 2024, driven by the constant need to expand, upgrade, and stabilize national transmission and distribution networks. Power utilities rely on oil-filled transformers for their proven reliability, load-handling capacity, and long operational life-especially in high-voltage applications. With the rising integration of renewable energy sources and aging infrastructure in many countries, the utility sector is investing heavily in transformer upgrades.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific oil-filled power transformer market held a sizeable share in 2024, fueled by rapid industrialization, population growth, and massive investments in power infrastructure. Countries like China, India, and Indonesia are expanding their grid networks to meet rising electricity demand, while also modernizing outdated systems to reduce losses and improve efficiency. The market in this region is highly dynamic, with local manufacturing, government-backed electrification projects, and strong public-private partnerships driving momentum.

Major players in the oil filled power transformer market are KPRS, Siemens Energy, LS ELECTRIC, Daelim Transformer, Fuji Electric, CG Power & Industrial Solutions, Hitachi Energy, Ormazabal, Bharat Heavy Electricals Limited (BHEL), SGB SMIT, GE Vernova, Toshiba Energy Systems & Solutions Corporation, Bharat Bijlee Limited, Elsewedy Electric, Mitsubishi Electric, Kirloskar Electric Company, Celme, Hyosung Heavy Industries, Eaton, Schneider Electric.

To solidify their presence, leading manufacturers in oil-filled power transformer market is pursuing a multi-pronged strategy focused on innovation, regional expansion, and digital integration. Many are investing in R&D to develop high-efficiency cores, advanced insulation materials, and compact designs that cater to evolving grid demands. Strategic collaborations with utility providers and EPC contractors are enabling turnkey project capabilities and long-term service agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Rating trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import export trade analysis

- 3.3.1 Key importing countries

- 3.3.2 Key exporting countries

- 3.4 Price trend analysis, (USD/Unit)

- 3.4.1 By technology

- 3.5 Cost analysis of oil filled power transformers

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Self-Cooled

- 5.3 Water Cooled

- 5.4 Forced Oil

- 5.5 Others

Chapter 6 Market Size and Forecast, By Rating, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 ≤ 100 MVA

- 6.3 > 100 MVA to ≤ 500 MVA

- 6.4 > 500 MVA to ≤ 800 MVA

- 6.5 > 800 MVA

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Bharat Heavy Electricals Limited (BHEL)

- 9.2 Bharat Bijlee Limited

- 9.3 Celme

- 9.4 CG Power & Industrial Solutions

- 9.5 Daelim Transformer

- 9.6 Eaton

- 9.7 Elsewedy Electric

- 9.8 Fuji Electric

- 9.9 GE Vernova

- 9.10 Hitachi Energy

- 9.11 Hyosung Heavy Industries

- 9.12 Kirloskar Electric Company

- 9.13 KPRS

- 9.14 LS ELECTRIC

- 9.15 Mitsubishi Electric

- 9.16 Ormazabal

- 9.17 Schneider Electric

- 9.18 SGB SMIT

- 9.19 Siemens Energy

- 9.20 Toshiba Energy Systems & Solutions Corporation