|

市場調查報告書

商品編碼

1833644

機上盒市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Set-Top Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

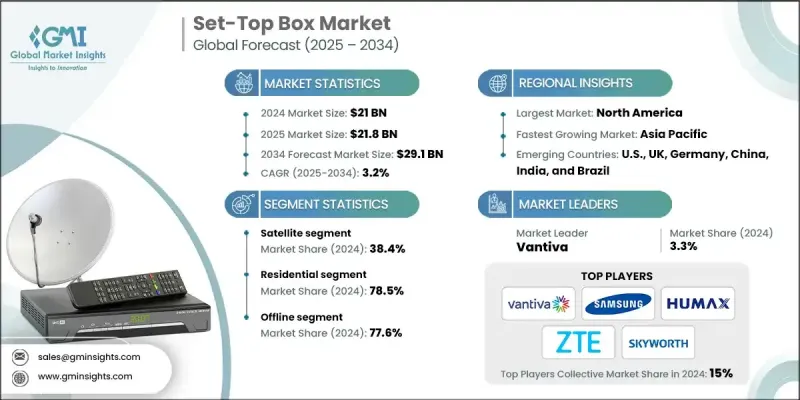

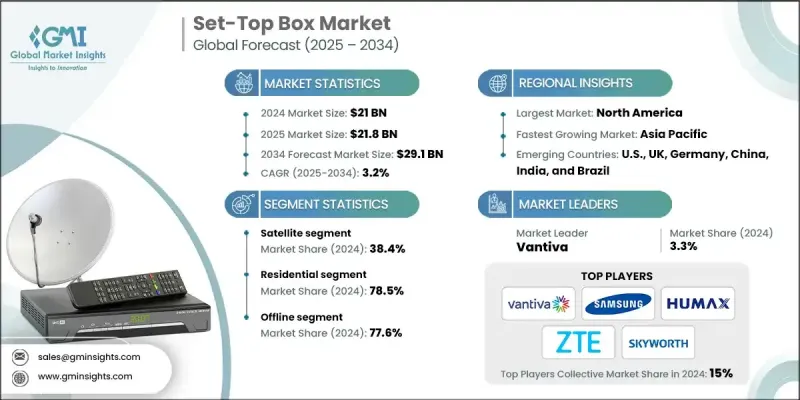

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球機上盒市場規模估計為 210 億美元,預計將從 2025 年的 218 億美元成長到 2034 年的 291 億美元,複合年成長率為 3.2%。

隨著消費者對視訊品質的期望不斷提高,對支援高清、4K 甚至 8K 解析度的機上盒的需求也日益旺盛。廣播公司和內容提供者正在大力推動機上盒的升級,以提升觀看體驗,從而推動機上盒的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 210億美元 |

| 預測值 | 291億美元 |

| 複合年成長率 | 3.2% |

衛星段

2024年,衛星市場佔了相當大的佔有率。這些機上盒對於向偏遠或服務匱乏的地區提供高品質的數位內容至關重要,為傳統廣播提供了可靠的替代方案。隨著壓縮技術和訊號強度的進步,衛星機上盒現已支援高畫質和4K內容,從而提升了整體觀看體驗。

住宅部分

2024年,住宅市場將佔據相當大的佔有率,這得益於家庭對多樣化內容、高清廣播以及與家庭娛樂系統無縫整合的需求。儘管智慧電視和串流平台日益興起,但許多消費者仍然更喜歡機上盒,因為它具有直播電視、DVR功能以及存取區域或付費內容的功能。

線下需求不斷成長

2024年,線下市場佔據了相當大的佔有率。許多消費者仍然傾向於離線購買電子產品,尤其是在技術安裝協助或售後支援至關重要的情況下。零售商通常會將機上盒與促銷優惠或安裝服務捆綁銷售,為那些可能不太懂技術的買家增添價值。為此,製造商正在投資銷售點行銷、員工培訓計劃和店內演示,以提高知名度並提升轉換率。保持強大的線下影響力,可以確保品牌在電商滲透率可能有限的本地市場中也能保持競爭力。

北美將成為利潤豐厚的地區

2024年,北美機上盒市場佔據了相當大的佔有率,其特點是家庭媒體消費量高,串流媒體技術的競爭也十分激烈。雖然「掐線」現象減少了對傳統有線電視盒的需求,但人們對融合了無線廣播、點播串流媒體和智慧家居的混合型機上盒的興趣日益濃厚。此外,市場也在不斷升級,以支援4K和語音遙控器,這反映了消費者不斷變化的期望。

機上盒市場的主要參與者有創維、Humax、蘋果、中興、Intek Digital、三星、Dish Network、Sagemcom、華為、Vestel、ARRIS、Kaon Media、EchoStar、Technicolor(Vantiva)和康普。

機上盒市場的領導者正在採取多層次的策略來鞏固其市場地位。關鍵策略包括開發混合型和基於安卓系統的機上盒,以連接傳統電視和串流媒體,為消費者提供更多樣化的觀看體驗。各公司還優先考慮軟體更新、直覺的用戶介面以及與智慧助理的整合,以提升產品用戶黏性。與內容供應商和電信業者建立策略聯盟有助於簡化分銷流程並擴大用戶群。此外,各公司也透過設計節能硬體和可回收包裝來實踐永續發展概念,以順應環保的消費趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 家庭娛樂和串流媒體服務的需求不斷成長

- 技術進步

- 網路普及率和智慧電視整合度不斷提高

- 產業陷阱與挑戰

- 價格敏感度和商品化

- 依賴內容提供者和區域許可

- 機會

- 與 OTT 平台和應用生態系統整合

- 智慧家庭與物聯網整合

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼:85287100)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:機上盒市場估價與預測:依產品類型,2021-2034

- 主要趨勢

- 電纜

- 衛星機上盒

- IPTV/OTT

- 混合

- 其他

第6章:機上盒市場估計與預測:依紀錄,2021-2034

- 主要趨勢

- 標準清晰度

- 高畫質

- 超高畫質

- 4K 以上

第7章:機上盒市場估計與預測:依技術分類,2021-2034

- 主要趨勢

- 數位視訊廣播

- 數位視訊廣播

- 數位視訊廣播

- 混合

- MPEG-2

- MPEG-4

- 安卓

- USB 儲存

- 其他

第8章:機上盒市場估計與預測:依服務類型,2021-2034

- 主要趨勢

- 付費電視

- 免費播放

第9章:機上盒市場估計與預測:按速度,2021-2034

- 主要趨勢

- 低於 100 Mbps

- 100 Mbps 至 500 Mbps

- 500 Mbps以上

- 十億位元速度(1 Gbps 以上)

第 10 章:機上盒市場估計與預測:按應用,2021-2034 年

- 主要趨勢

- 溝通

- 媒體內容

- 音訊/視訊

- 賭博

- 網頁內容

- 雲端服務

- 其他

第 11 章:機上盒市場估計與預測:依最終用途,2021-2034 年

- 主要趨勢

- 住宅

- 商業的

第 12 章:機上盒市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 公司網站

- 電子商務

- 離線

- 專賣店

- 大賣場/超市

- 零售店

- 其他

第 13 章:機上盒市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 14 章:公司簡介

- Apple

- ARRIS

- CommScope

- Dish Network

- EchoStar

- Huawei

- Humax

- Intek Digital

- Kaon Media

- Sagemcom

- Samsung

- Skyworth

- Technicolor (Vantiva)

- Vestel

- ZTE

The global set-top box market was estimated at USD 21 billion in 2024 and is expected to grow from USD 21.8 billion in 2025 to USD 29.1 billion by 2034, at a CAGR of 3.2%, according to the latest report published by Global Market Insights Inc.

As consumer expectations for video quality increase, there's strong demand for set-top boxes that support HD, 4K, and even 8K resolution. Broadcasters and content providers are pushing upgrades to enhance viewing experiences, driving STB adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21 Billion |

| Forecast Value | $29.1 Billion |

| CAGR | 3.2% |

Satellite Segment

The satellite segment generated a significant share in 2024. These STBs are essential for delivering high-quality digital content to remote or underserved areas, offering a reliable alternative to traditional broadcasting. With advancements in compression technology and signal strength, satellite STBs now support HD and 4K content, enhancing the overall viewing experience.

Residential Segment

The residential segment held a sizeable share in 2024, fueled by households seeking access to diverse content, high-definition broadcasts, and seamless integration with home entertainment systems. Despite the rise of smart TVs and streaming platforms, many consumers still prefer STBs for live TV, DVR capabilities, and access to regional or premium content.

Rising Demand in Offline

The offline segment held a significant share in 2024. Many consumers still prefer in-person purchasing electronics, especially when technical setup assistance or after-sales support is a priority. Retailers often bundle STBs with promotional offers or installation services, adding value for buyers who may not be as tech-savvy. In response, manufacturers are investing in point-of-sale marketing, staff training programs, and in-store demos to enhance visibility and boost conversion rates. Maintaining a strong offline presence ensures that brands remain accessible in local markets where e-commerce penetration may be limited.

North America to Emerge as a Lucrative Region

North America set-top box market held a sizeable share in 2024, characterized by high household media consumption and intense competition from streaming technologies. While cord-cutting has reduced demand for traditional cable boxes, there's growing interest in hybrid STBs that combine over-the-air broadcast, on-demand streaming, and smart home integration. The market is also seeing upgrades to support 4K and voice-enabled remotes, reflecting changing consumer expectations.

Major players in the set-top box market are Skyworth, Humax, Apple, ZTE, Intek Digital, Samsung, Dish Network, Sagemcom, Huawei, Vestel, ARRIS, Kaon Media, EchoStar, Technicolor (Vantiva), and CommScope.

Leading players in the set-top box market are adopting a multi-layered approach to strengthen their market position. Key strategies include developing hybrid and Android-based STBs that bridge traditional TV and streaming, offering consumers a more versatile viewing experience. Companies are also prioritizing software updates, intuitive UIs, and integration with smart assistants to increase product stickiness. Strategic alliances with content providers and telecom operators help streamline distribution and expand user bases. Moreover, firms are embracing sustainability by designing energy-efficient hardware and recyclable packaging to align with eco-conscious consumer trends.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Recording

- 2.2.4 Technology

- 2.2.5 Service type

- 2.2.6 Speed

- 2.2.7 Application

- 2.2.8 End Use

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for home entertainment and streaming services

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing internet penetration and smart TV integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Price sensitivity and commoditization

- 3.2.2.2 Dependency on content providers and regional licensing

- 3.2.3 Opportunities

- 3.2.3.1 Integration with OTT platforms and app ecosystems

- 3.2.3.2 Smart home and IoT integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 85287100)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Set-Top Box Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Cable

- 5.3 Satellite STB

- 5.4 IPTV/OTT

- 5.5 Hybrid

- 5.6 Others

Chapter 6 Set-Top Box Market Estimates & Forecast, By Recording, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Standard definition

- 6.3 High definition

- 6.4 UHD

- 6.5 4K & above

Chapter 7 Set-Top Box Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 DVB-C

- 7.3 DVB-S

- 7.4 DVB-T

- 7.5 Hybrid

- 7.6 MPEG-2

- 7.7 MPEG-4

- 7.8 Android

- 7.9 USB storage

- 7.10 Others

Chapter 8 Set-Top Box Market Estimates & Forecast, By Service Type, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Pay TV

- 8.3 Free to air

Chapter 9 Set-Top Box Market Estimates & Forecast, By Speed, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Below 100 Mbps

- 9.3 100 Mbps to 500 Mbps

- 9.4 Above 500 Mbps

- 9.5 Gigabit Speed (1 Gbps and above)

Chapter 10 Set-Top Box Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Communication

- 10.3 Media content

- 10.4 Audio/video

- 10.5 Gaming

- 10.6 Web content

- 10.7 Cloud services

- 10.8 Others

Chapter 11 Set-Top Box Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Residential

- 11.3 Commercial

Chapter 12 Set-Top Box Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Online

- 12.2.1 Company website

- 12.2.2 E-commerce

- 12.3 Offline

- 12.3.1 Specialty stores

- 12.3.2 Hypermarket/supermarket

- 12.3.3 Retail stores

- 12.3.4 Others

Chapter 13 Set-Top Box Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Apple

- 14.2 ARRIS

- 14.3 CommScope

- 14.4 Dish Network

- 14.5 EchoStar

- 14.6 Huawei

- 14.7 Humax

- 14.8 Intek Digital

- 14.9 Kaon Media

- 14.10 Sagemcom

- 14.11 Samsung

- 14.12 Skyworth

- 14.13 Technicolor (Vantiva)

- 14.14 Vestel

- 14.15 ZTE