|

市場調查報告書

商品編碼

1833641

子宮內避孕器市場機會、成長動力、產業趨勢分析及2025-2034年預測Intrauterine Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

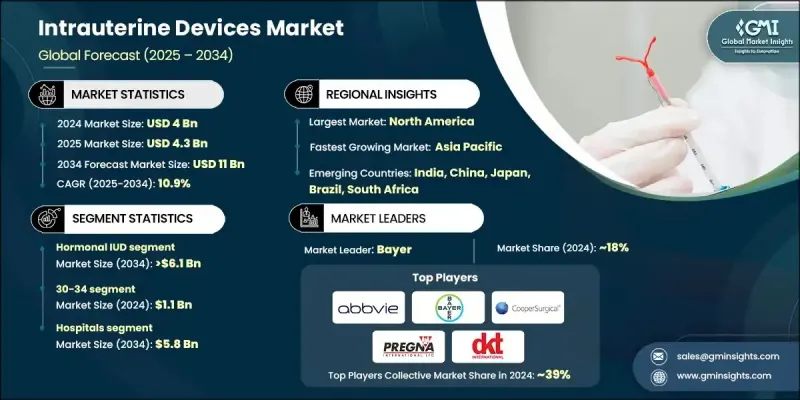

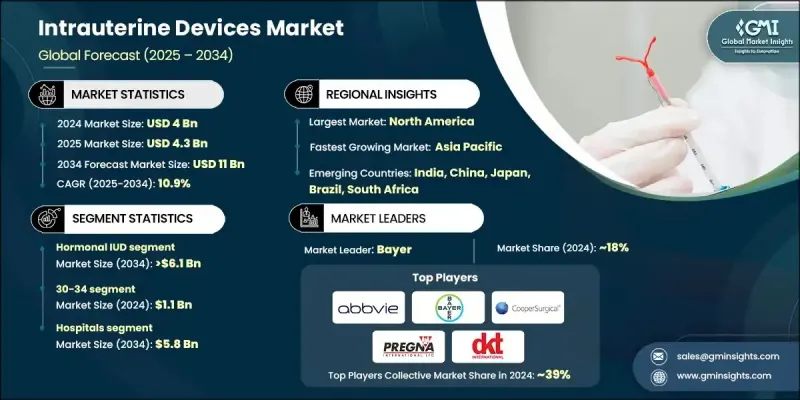

2024 年全球子宮內避孕器市場價值為 40 億美元,預計到 2034 年將以 10.9% 的複合年成長率成長至 110 億美元。

強勁的成長勢頭得益於支持性監管政策、女性對子宮內避孕器多種用途認知的提高以及意外懷孕的高發生率。子宮內避孕器不僅因其在避孕方面的作用而日益受到認可,還因其更廣泛的健康應用而受到認可,包括管理月經過多、子宮內膜異位症和圍絕經期症狀。隨著教育舉措、數位健康平台的興起以及生殖保健資訊獲取管道的改善,女性現在能夠就長期避孕選擇做出更明智的決定。醫療保健專業人員在為患者提供有關子宮內避孕器的安全性、有效性和其他健康益處的諮詢方面發揮著重要作用,這在全球範圍內提高了其接受度。子宮內避孕器是一種小型、靈活的T形避孕工具,旨在提供可靠、可逆且長效的避孕措施。諸如鐵基非荷爾蒙節育器等新興創新產品正在開發中,旨在最大限度地減少副作用並提供無激素解決方案。這些技術進步正在改變子宮內避孕器的格局,增強女性的選擇,並加強長期的市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 40億美元 |

| 預測值 | 110億美元 |

| 複合年成長率 | 10.9% |

2024年,激素類子宮內避孕器市場佔據53.8%的市場佔有率,這得益於其在避孕和改善月經健康方面的功效。荷爾蒙類子宮內避孕器,尤其是釋放左炔諾孕酮的子宮內避孕器,因其持久保護、維護成本低以及諸如減少月經出血和緩解子宮內膜異位症症狀等附加治療優勢而被廣泛採用。由於其雙重功效,醫療保健提供者經常推薦這些節育器,從而鞏固了其在市場上的主導地位。

2024年,醫院市場佔據53.2%的佔有率,預計到2034年將創造58億美元的市場價值。醫院在提供長效可逆避孕措施方面仍然至關重要,因為它們能夠提供經驗豐富的婦產科醫生進行安全放置子宮內避孕器。一些地區已採用產後子宮內避孕器放置方案,擴大了可近性,並有助於減少意外懷孕,尤其是在孕產婦保健系統健全的地區。

2024年,美國子宮內避孕器市場規模達14.4億美元,預計2025年至2034年期間的複合年成長率將達到10.3%。公共衛生計劃和宣傳活動的不斷加強,推動了子宮內避孕器作為一種安全、有效且便捷的避孕方式的使用。相較於每日服用避孕藥等短期避孕方式,長效可逆避孕法的受歡迎程度日益提升,進一步加速了美國和加拿大不同族群對子宮內避孕器的採用。

活躍於子宮內避孕器產業的知名公司包括 MONA LISA、Meril、Sebela Pharmaceuticals、DKT、PREGNA、SMB、AbbVie、Prosan、GIMA、Bayer、Medicines360、eurogine、GYNO CARE、CooperSurgical、HLL Lifecare Limited 等。為了鞏固在子宮內避孕器市場的領先地位,這些公司正致力於擴大產品組合,涵蓋荷爾蒙和非荷爾蒙產品,包括開發旨在最大程度減少副作用和提高用戶舒適度的創新材料。此外,它們還與醫療保健組織和政府計畫進行策略合作,以擴大子宮內避孕器的可及性和採用率。許多公司也投資宣傳活動,向女性宣傳子宮內避孕器除了避孕之外的益處,例如月經健康管理。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 有利的監管環境

- 女性對各種子宮內避孕器應用的認知不斷提高

- 意外懷孕數量高

- 政府預防意外墮胎和懷孕的舉措

- 計劃性延遲妊娠的傾向日益增強

- 產業陷阱與挑戰

- 設備成本高

- 存在多種健康問題的風險

- 保險覆蓋範圍和獲取途徑的差異

- 市場機會

- 長期避孕需求不斷增加

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 現有技術

- 新興技術

- 未來市場趨勢

- 報銷場景

- 消費者行為和趨勢

- 品牌分析

- 管道分析

- 避孕以外的治療應用

- 2024年定價分析

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 銅子宮內避孕器

- 荷爾蒙子宮內避孕器

第6章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 15-19

- 20-24

- 25-29

- 30-34

- 35-39

- 40-44

- 45歲以上

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 婦科診所

- 社區健康照護中心

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AbbVie

- Bayer

- CooperSurgical

- DKT

- eurogine

- GIMA

- GYNO CARE

- HLL Lifecare Limited

- Medicines360

- Meril

- MONA LISA

- PREGNA

- Prosan

- Sebela Pharmaceuticals

- SMB

The Global Intrauterine Devices Market was valued at USD 4 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 11 billion by 2034.

The strong growth trajectory is driven by supportive regulatory policies, greater awareness among women about the diverse uses of IUDs, and the high incidence of unintended pregnancies. IUDs are increasingly acknowledged not only for their role in birth control but also for wider health applications, including the management of heavy menstrual bleeding, endometriosis, and perimenopausal symptoms. With the rise of educational initiatives, digital health platforms, and improved access to reproductive care information, women are now empowered to make more informed decisions about long-term contraceptive options. Healthcare professionals play a significant role by counseling patients on the safety, effectiveness, and additional health benefits of IUDs, which has boosted acceptance globally. Intrauterine devices are small, flexible, T-shaped contraceptive tools designed to provide reliable, reversible, and long-acting pregnancy prevention. Emerging innovations, such as iron-based non-hormonal devices, are being developed to minimize side effects and provide hormone-free solutions. These technological advancements are transforming the IUD landscape, enhancing choices for women, and reinforcing long-term market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $11 Billion |

| CAGR | 10.9% |

The hormonal IUD segment held 53.8% share in 2024, supported by its effectiveness in preventing pregnancy and improving menstrual health. Hormonal IUDs, particularly those releasing levonorgestrel, are widely adopted for their long-lasting protection, low maintenance, and added therapeutic advantages, such as reduced menstrual bleeding and relief from endometriosis symptoms. Healthcare providers frequently recommend them due to their dual benefits, strengthening their dominance in the market.

The hospitals segment held 53.2% share in 2024 and is forecasted to generate USD 5.8 billion by 2034. Hospitals remain vital in delivering long-acting reversible contraception, as they provide access to skilled gynecologists and obstetricians for safe insertion procedures. The adoption of postpartum IUD insertion protocols in several regions has broadened access and contributed to a decline in unplanned pregnancies, particularly in areas with robust maternal healthcare systems.

U.S. Intrauterine Devices Market was valued at USD 1.44 billion in 2024 and is estimated to grow at a CAGR of 10.3% between 2025 and 2034. Increased public health initiatives and awareness campaigns have encouraged the use of IUDs as a safe, effective, and convenient contraceptive option. Growing preference for long-acting reversible contraception over short-term alternatives, such as daily pills, has further accelerated adoption across diverse demographics in the U.S. and Canada.

Prominent companies active in the Intrauterine Devices Industry include MONA LISA, Meril, Sebela Pharmaceuticals, DKT, PREGNA, SMB, AbbVie, Prosan, GIMA, Bayer, Medicines360, eurogine, GYNO CARE, CooperSurgical, HLL Lifecare Limited, and others. To strengthen their foothold in the intrauterine devices market, leading companies are focusing on expanding product portfolios with both hormonal and non-hormonal options, including the development of innovative materials designed to minimize side effects and improve user comfort. Strategic collaborations with healthcare organizations and government programs are being pursued to broaden access and adoption rates. Many players are also investing in awareness campaigns to educate women on the benefits of IUDs beyond contraception, such as menstrual health management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Age group trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favorable regulatory scenario

- 3.2.1.2 Rising awareness among women regarding various IUD applications

- 3.2.1.3 High number of unintended pregnancies

- 3.2.1.4 Government initiatives for the prevention of unwanted abortions and pregnancies

- 3.2.1.5 Growing inclination towards planned delayed pregnancy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the device

- 3.2.2.2 Risk of several health issues

- 3.2.2.3 Variability in insurance coverage and access

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for long-term contraception

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Consumer behaviour and trends

- 3.9 Brand analysis

- 3.10 Pipeline analysis

- 3.11 Therapeutic applications beyond contraception

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Copper IUD

- 5.3 Hormonal IUD

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 15-19

- 6.3 20-24

- 6.4 25-29

- 6.5 30-34

- 6.6 35-39

- 6.7 40-44

- 6.8 45+

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Gynecology clinics

- 7.4 Community health care centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Bayer

- 9.3 CooperSurgical

- 9.4 DKT

- 9.5 eurogine

- 9.6 GIMA

- 9.7 GYNO CARE

- 9.8 HLL Lifecare Limited

- 9.9 Medicines360

- 9.10 Meril

- 9.11 MONA LISA

- 9.12 PREGNA

- 9.13 Prosan

- 9.14 Sebela Pharmaceuticals

- 9.15 SMB