|

市場調查報告書

商品編碼

1833637

無管胰島素幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tubeless Insulin Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

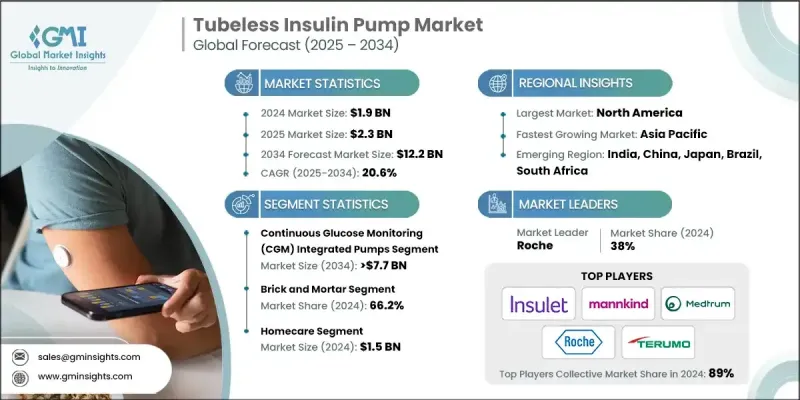

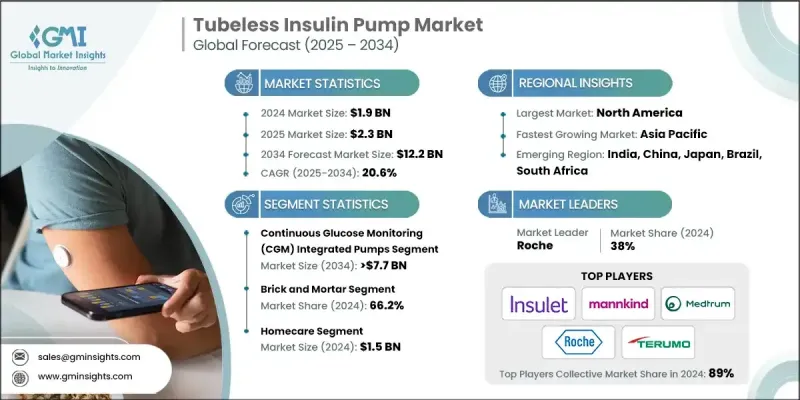

2024 年全球無管胰島素幫浦市場價值為 19 億美元,預計到 2034 年將以 20.6% 的複合年成長率成長至 122 億美元。

根據世界衛生組織 (WHO) 統計,糖尿病是全球主要死亡原因之一,病例數的不斷成長迫切需要更有效率、更易於管理的治療方案。傳統的胰島素給藥方法,例如每日注射,往往會導致治療效果不一致、患者依從性降低以及不適。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 122億美元 |

| 複合年成長率 | 20.6% |

持續血糖監測(CGM)一體幫浦的需求不斷成長

2024年,持續血糖監測 (CGM) 一體式幫浦市場佔據了相當大的佔有率,這得益於提供即時血糖水平資料的糖尿病管理。 CGM一體式幫浦可根據持續血糖監測無縫調整胰島素輸送,進而降低低血糖或高血糖的風險。將CGM和胰島素輸送功能整合在一個設備中,可確保使用者獲得更好的控制、精準度和便利性,尤其對於需要持續監測的第1型糖尿病患者而言。

實體店面獲得發展

2024年,實體店市場收入可觀,這主要得益於醫院、診所和藥店,這些場所通常銷售、開立處方並提供無管胰島素幫浦維修服務。該領域的重點在於胰島素幫浦的分銷和患者正確使用胰島素幫浦的初步培訓。該領域的公司正努力與醫療保健提供者建立牢固的關係,提供全面的培訓和支援服務,以確保患者了解如何有效地使用胰島素幫浦。

居家照護採用率不斷上升

隨著患者尋求更便利的居家糖尿病管理解決方案,家庭護理領域在2024年佔據了相當大的佔有率。該領域的無管胰島素幫浦具有靈活性、自主性和易用性,使患者能夠在家中管理胰島素輸送。隨著醫療保健系統轉向以患者為中心的護理,各公司正專注於提供遠端監控、遠距醫療諮詢和患者教育等支援服務,以確保成功的結果並實現更好的健康管理。

區域洞察

北美將獲得發展動力

2024年,北美無管胰島素幫浦市場佔據了顯著佔有率,這得益於糖尿病盛行率的上升以及先進糖尿病管理工具的普及。該市場的一個關鍵促進因素是,人們越來越傾向於使用更便利、侵入性更低的胰島素輸送系統,尤其是在第1型糖尿病患者中。隨著保險覆蓋範圍的擴大以及對持續胰島素輸送益處的認知不斷提高,北美患者開始選擇便攜性和功能性更強的無管胰島素幫浦。

無管胰島素幫浦市場的主要參與者有 Medtrum、MicroTech、Roche、TERUMO、Insulet、MannKind Corporation 和 Pharmasens。

為了鞏固在無管胰島素幫浦市場的地位和市場地位,各公司正專注於幾個關鍵策略。首先,他們大力投資研發,將持續血糖監測 (CGM)、人工智慧 (AI) 和遠端監控等尖端技術融入他們的胰島素幫浦中,從而增強患者的控制能力和易用性。此外,各公司正在與醫療保健提供者和保險公司建立策略合作夥伴關係,以提高患者的設備可及性和覆蓋範圍。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 糖尿病盛行率上升

- 無管胰島素幫浦的技術進步

- 糖尿病照護支出增加

- 傳統和侵入式胰島素幫浦造成的損傷

- 採取便利措施

- 產業陷阱與挑戰

- 無管胰島素幫浦的長期成本高昂

- 嚴格的政府法規

- 市場機會

- 轉向穿戴式和方便用戶使用型設備

- 居家護理領域採用率不斷提高

- 成長動力

- 成長潛力分析

- 報銷場景

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 2021-2024 年各地區糖尿病發生率及盛行率

- 北美洲

- 歐洲

- 亞太地區

- 排

- 新產品開發格局

- 啟動場景

- 2024年定價分析

- 投資前景

- 消費者行為分析

- 波特的分析

- PESTEL分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 排

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按技術分類,2021 - 2034 年

- 主要趨勢

- 持續血糖監測(CGM)整合泵

- 標準無內胎泵

第6章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 實體店面

- 電子商務

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 居家護理

- 醫院和診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 排

第9章:公司簡介

- Insulet

- MannKind Corporation

- Medtrum

- MicroTech

- Pharmasens

- Roche

- TERUMO

The Global Tubeless Insulin Pump Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 12.2 billion by 2034.

According to the World Health Organization (WHO), diabetes is one of the leading causes of death globally, and the rising number of cases is creating an urgent need for more efficient and manageable treatment options. The traditional methods of insulin administration, such as daily injections, often lead to inconsistent results, reduced patient adherence, and discomfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 20.6% |

Rising Demand for Continuous Glucose Monitoring (CGM) Integral Pumps

The continuous glucose monitoring (CGM) integral pumps segment held a significant share in 2024, driven by diabetes management that offers real-time data on glucose levels. CGM-integral pumps allow for seamless insulin delivery adjustments based on constant glucose monitoring, reducing the risk of hypo- or hyperglycemia. The combination of CGM and insulin delivery in one device ensures better control, precision, and convenience for users, especially for those with type 1 diabetes who require continuous monitoring.

Bricks and Mortar to Gain Traction

The bricks and mortar segment generated significant revenues in 2024, driven by hospitals, clinics, and pharmacies, where tubeless insulin pumps are often sold, prescribed, and serviced. The focus is on the distribution and initial training of patients in proper pump usage. Companies in this segment are working to establish strong relationships with healthcare providers, offering comprehensive training and support services to ensure patients understand how to use their pumps effectively.

Rising Adoption in Homecare

The homecare segment held a sizeable share in 2024, as patients seek more convenient, at-home diabetes management solutions. Tubeless insulin pumps in this sector offer flexibility, discretion, and ease of use, allowing patients to manage their insulin delivery at home. As healthcare systems move toward patient-centric care, companies are focusing on offering support services such as remote monitoring, telemedicine consultations, and patient education to ensure successful outcomes and better health management.

Regional Insights

North America to Gain Traction

North America tubeless insulin pump market held a notable share in 2024, driven by the increasing prevalence of diabetes and the rising adoption of advanced diabetes management tools. A key driver in this market is the increasing preference for more convenient, less invasive insulin delivery systems, particularly among type 1 diabetes patients. With the availability of insurance coverage and growing awareness of the benefits of continuous insulin delivery, patients in North America are opting for tubeless insulin pumps that offer enhanced portability and functionality.

Major players in the tubeless insulin pump market are Medtrum, MicroTech, Roche, TERUMO, Insulet, MannKind Corporation, and Pharmasens.

To strengthen their presence and market foothold in the tubeless insulin pump market, companies are focusing on several key strategies. First, they are heavily investing in research and development to integrate cutting-edge technologies such as continuous glucose monitoring (CGM), artificial intelligence (AI), and remote monitoring into their pumps, which provide enhanced control and ease of use for patients. Additionally, companies are forming strategic partnerships with healthcare providers and insurers to improve device accessibility and coverage for patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in tubeless insulin pumps

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Injuries caused by conventional & invasive insulin pumps

- 3.2.1.5 Adoption of facilitative initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High long-term costs associated with the tubeless insulin pumps

- 3.2.2.2 Stringent government regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward wearable & user-friendly devices

- 3.2.3.2 Growing adoption in homecare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Incidence & prevalence of diabetes, by region, 2021-2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 RoW

- 3.9 New product development landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Investment landscape

- 3.13 Consumer behaviour analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 RoW

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous glucose monitoring (CGM) integrated pumps

- 5.3 Standard tubeless pumps

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Brick and mortar

- 6.3 E-commerce

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Homecare

- 7.3 Hospitals & clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 RoW

Chapter 9 Company Profiles

- 9.1 Insulet

- 9.2 MannKind Corporation

- 9.3 Medtrum

- 9.4 MicroTech

- 9.5 Pharmasens

- 9.6 Roche

- 9.7 TERUMO