|

市場調查報告書

商品編碼

1833636

產前及新生兒基因檢測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Prenatal and Newborn Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球產前和新生兒基因檢測市場價值為 81 億美元,預計到 2034 年將以 12.8% 的複合年成長率成長至 91 億美元。

唐氏症、囊性纖維化和脊髓性肌肉萎縮症等遺傳疾病的盛行率日益上升,推動了透過產前和新生兒基因檢測進行早期發現的需求。越來越多的準父母尋求保障和早期介入方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 81億美元 |

| 預測值 | 91億美元 |

| 複合年成長率 | 12.8% |

試劑盒與試劑應用日益普及

試劑盒和試劑細分市場在2024年佔據了相當大的佔有率,因為這些耗材對於臨床診斷和研究工作流程都至關重要。實驗室和診斷中心依賴高品質、可靠的試劑來確保結果的準確性和可重複性。隨著早期基因篩檢需求的不斷成長,檢測量不斷成長,耗材的重複使用特性將持續提升細分市場的績效。

產前檢查需求不斷增加

由於產婦年齡成長、風險意識增強以及臨床上大力推廣非侵入性和侵入性檢測,產前檢測領域在2024年佔據了相當大的佔有率。這些檢測有助於在懷孕早期檢測出染色體異常、基因突變和胎兒畸形,有助於臨床上做出更明智的決策。孕早期篩檢的興起以及基因檢測範圍的擴大推動了該領域的持續成長。

cfDNA 獲得關注

2024 年,無細胞 DNA (cfDNA) 檢測領域將佔據永續的佔有率,這得益於一種用於篩檢 21、18 和 13 三體等常見染色體疾病的非侵入性、高度準確的方法。此方法可分析母體血液中循環的胎兒 DNA 片段,從而減少了對羊膜穿刺等侵入性手術的需求。

北美將成為推動力地區

由於強大的醫療基礎設施、先進的實驗室能力以及廣泛的基因檢測服務,北美產前和新生兒基因檢測市場預計將在2024年實現大幅成長。在美國和加拿大,早期篩檢已被廣泛採用,這得益於良好的保險覆蓋範圍、監管支持以及公眾意識的不斷提升。基因組醫學的持續投入、NIPT指南的擴展以及基於人工智慧的診斷工具的整合,將進一步推動該地區市場的成長。

產前和新生兒基因檢測市場的主要參與者有 Genes2me、Trivitron Healthcare、Retrogen、Aetna、Fulgent Genetics、Eurofins、Illumina、CENTOGENE、Genelab (Clevergene)、Thermo Fisher Scientific、Myriad Genetics、Nateras、Revvity、LaCARCAR、BGI Group、Billion Scientific、Myriad Genetics、Naterd、Labvity、LaCAR

為了鞏固其在產前和新生兒基因檢測市場的地位,各公司正在推行創新驅動和擴張導向的混合策略。許多公司正在投資研發,以開發高通量平台,並擴大其檢測組合,以涵蓋罕見遺傳疾病和遺傳性疾病。與醫院、學術機構和技術合作夥伴的策略合作,使其能夠更快地滲透市場,並涵蓋多樣化的患者群體。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產婦年齡上升,產前篩檢需求增加

- NIPT 檢測需求不斷成長

- 遺傳疾病發生率上升

- 父母對早期診斷的認知與需求不斷增強

- 不斷改進技術,提高準確性和可近性

- 產業陷阱與挑戰

- 高級測試成本高昂

- 資料隱私和安全

- 市場機會

- 產前護理中個人化醫療的需求日益成長

- 新興市場的滲透率不斷提高

- 擴大公私合作舉措

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 基因檢測產業的投資與融資格局

- 技術格局

- 新興技術

- 現有技術

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品和服務,2021 - 2034 年

- 主要趨勢

- 試劑盒和試劑

- 服務

第6章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 產前檢查

- 篩檢

- 非侵入性產前檢測(NIPT)

- 攜帶者篩檢

- 血清篩檢

- 頸部透明帶超音波檢查

- 診斷

- 絨毛膜絨毛取樣(CVS)

- 羊膜穿刺術

- 篩檢

- 新生兒檢查

- 足跟採血檢查

- 聽力篩檢

- 嚴重先天性心臟缺陷(CCHD)

- 其他新生兒檢測類型

第7章:市場估計與預測:按技術分類,2021 - 2034 年

- 主要趨勢

- 下一代定序(NGS)

- 遊離DNA(cfDNA)

- 陣列比較基因組雜交(aCGH)

- 螢光原位雜合技術(FISH)

- 光譜法

- 全外顯子定序(WES)

- 其他技術

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 唐氏綜合症

- 苯酮尿症(PKU)

- 囊性纖維化(CF)

- 鐮狀細胞性貧血

- 先天性甲狀腺功能低下症

- Pendred症候群

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 醫院

- 診斷實驗室

- 產科和專科診所

- 其他最終用途

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aetna

- Agilent

- BGI Group

- BilliontoOne

- CENTOGENE

- Eurofins

- Fulgent Genetics

- Genelab (Clevergene)

- Genes2me

- Illumina

- Labcorp

- LaCAR

- Myriad Genetics

- Natera

- Retrogen

- Revvity

- Thermo Fisher Scientific

- Trivitron Healthcare

- Yourgene Health

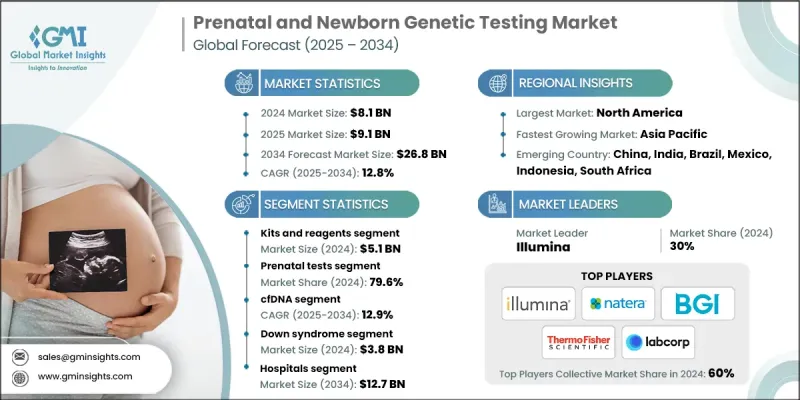

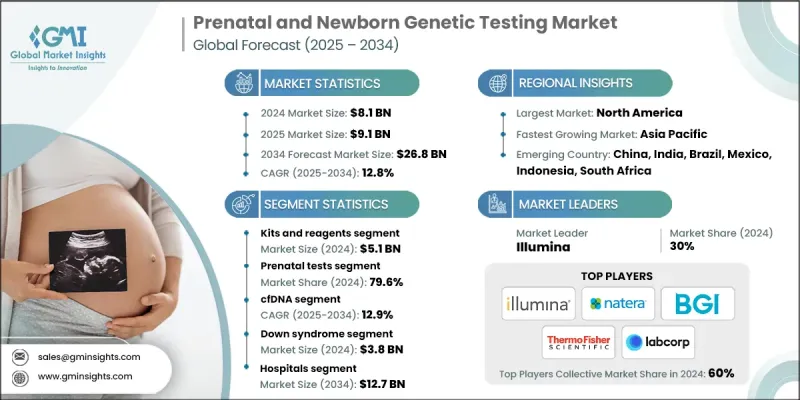

The Global Prenatal and Newborn Genetic Testing Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 9.1 billion by 2034.

The increasing prevalence of genetic conditions such as Down syndrome, cystic fibrosis, and spinal muscular atrophy is driving demand for early detection through prenatal and newborn genetic testing. Expectant parents are increasingly seeking reassurance and early intervention options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 12.8% |

Rising Adoption of Kits and Reagents Segment

The kits and reagents segment held a significant share in 2024, as these consumables are essential for both clinical diagnostics and research workflows. Laboratories and diagnostic centers depend on high-quality, reliable reagents to ensure accurate and reproducible results. As testing volumes grow, driven by increasing demand for early genetic screening, the recurring nature of consumable use continues to boost segment performance.

Increasing Demand for the Prenatal Tests Segment

The prenatal tests segment held a sizeable share in 2024, owing to rising maternal age, increased risk awareness, and strong clinical adoption of non-invasive and invasive testing options. These tests help detect chromosomal abnormalities, genetic mutations, and fetal anomalies early in pregnancy, enabling more informed clinical decision-making. The shift toward first-trimester screening and the inclusion of expanded genetic panels have fueled sustained growth in this segment.

cfDNA to Gain Traction

The cell-free DNA (cfDNA) testing segment held a sustainable share in 2024, driven by a non-invasive, highly accurate method to screen for common chromosomal conditions like trisomy 21, 18, and 13. This method analyzes fetal DNA fragments circulating in maternal blood, reducing the need for invasive procedures like amniocentesis.

North America to Emerge as a Propelling Region

North America prenatal and newborn genetic testing market is poised to grow at a sizeable share in 2024, driven by strong healthcare infrastructure, advanced lab capabilities, and widespread access to genetic services. In the U.S. and Canada, early screening is widely adopted, supported by favorable insurance coverage, regulatory backing, and increasing public awareness. Continued investment in genomic medicine, expansion of NIPT guidelines, and integration of AI-based diagnostic tools are further fueling market growth across this region.

Major players in the prenatal and newborn genetic testing market are Genes2me, Trivitron Healthcare, Retrogen, Aetna, Fulgent Genetics, Eurofins, Illumina, CENTOGENE, Genelab (Clevergene), Thermo Fisher Scientific, Myriad Genetics, Natera, Revvity, LaCAR, BGI Group, BillionToOne, LabCorp, Agilent, and Yourgene Health.

To strengthen their position in the prenatal and newborn genetic testing market, companies are pursuing a mix of innovation-driven and expansion-focused strategies. Many are investing in R&D to develop high-throughput platforms and broaden their test portfolios to cover rare genetic conditions and inherited disorders. Strategic collaborations with hospitals, academic institutions, and technology partners are enabling faster market penetration and access to diverse patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product and services trends

- 2.2.3 Test type trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising maternal age and increasing demand for prenatal screening

- 3.2.1.2 Increasing demand for NIPT testing

- 3.2.1.3 Rising incidence of genetic disorders

- 3.2.1.4 Growing parental awareness and demand for early diagnosis

- 3.2.1.5 Expanding advancement in technologies for accuracy and accessibility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced tests

- 3.2.2.2 Data privacy and security

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for personalized medicine in prenatal care

- 3.2.3.2 Increasing penetration in emerging markets

- 3.2.3.3 Expanding public-private initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Investment and funding landscape in the genetic testing industry

- 3.6 Technological landscape

- 3.6.1 Emerging technologies

- 3.6.2 Current technologies

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits and reagents

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prenatal tests

- 6.2.1 Screening

- 6.2.1.1 Non-invasive prenatal testing (NIPT)

- 6.2.1.2 Carrier screening

- 6.2.1.3 Serum screening

- 6.2.1.4 Nuchal translucency ultrasound

- 6.2.2 Diagnostic

- 6.2.2.1 Chorionic villus sampling (CVS)

- 6.2.2.2 Amniocentesis

- 6.2.1 Screening

- 6.3 Newborn tests

- 6.3.1 Heel prick test

- 6.3.2 Hearing screening

- 6.3.3 Critical congenital heart defect (CCHD)

- 6.3.4 Other newborn test types

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Next-generation sequencing (NGS)

- 7.3 Cell-free DNA (cfDNA)

- 7.4 Array-comparative genomic hybridization (aCGH)

- 7.5 Fluorescence in-situ hybridization (FISH)

- 7.6 Spectrometry

- 7.7 Whole exome sequencing (WES)

- 7.8 Other technologies

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Down syndrome

- 8.3 Phenylketonuria (PKU)

- 8.4 Cystic fibrosis (CF)

- 8.5 Sickle cell anemia

- 8.6 Congenital hypothyroidism

- 8.7 Pendred syndrome

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Maternity and specialty clinics

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aetna

- 11.2 Agilent

- 11.3 BGI Group

- 11.4 BilliontoOne

- 11.5 CENTOGENE

- 11.6 Eurofins

- 11.7 Fulgent Genetics

- 11.8 Genelab (Clevergene)

- 11.9 Genes2me

- 11.10 Illumina

- 11.11 Labcorp

- 11.12 LaCAR

- 11.13 Myriad Genetics

- 11.14 Natera

- 11.15 Retrogen

- 11.16 Revvity

- 11.17 Thermo Fisher Scientific

- 11.18 Trivitron Healthcare

- 11.19 Yourgene Health