|

市場調查報告書

商品編碼

1833632

醫療保健諮詢服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Healthcare Consulting Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

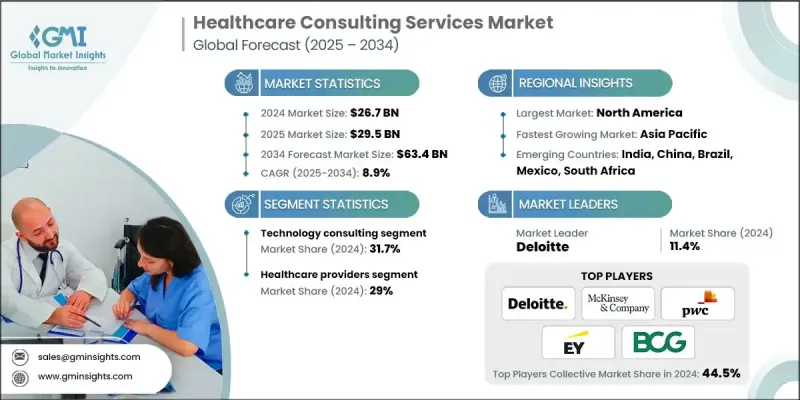

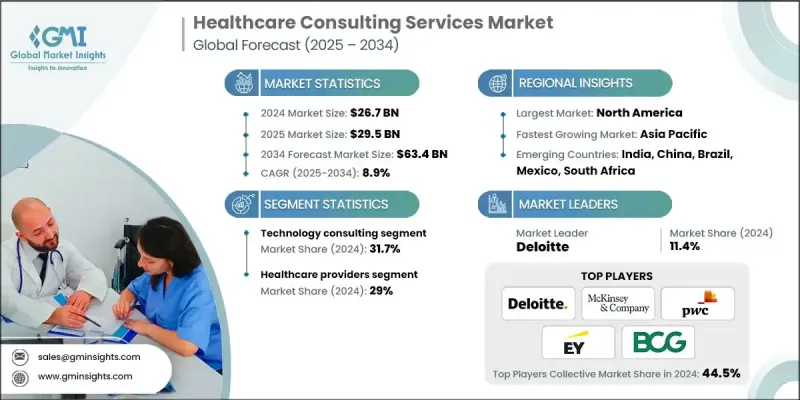

根據 Global Market Insights Inc. 發布的最新報告,全球醫療諮詢服務市場規模在 2024 年估計為 267 億美元,預計將從 2025 年的 295 億美元成長到 2034 年的 634 億美元,複合年成長率為 8.9%。

電子健康記錄 (EHR)、遠距醫療平台和人工智慧診斷等數位轉型的推動,催生了對專家指導的強烈需求。醫療保健顧問能夠幫助醫療服務提供者和付款人選擇、部署和最佳化符合臨床和業務目標的數位化工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 267億美元 |

| 預測值 | 634億美元 |

| 複合年成長率 | 8.9% |

技術諮詢將獲得發展動力

隨著醫療服務提供者和付款方加速數位轉型,技術諮詢領域在2024年佔據了顯著的佔有率。從實施電子健康記錄 (EHR) 和遠距醫療平台,到部署人工智慧驅動的分析和網路安全解決方案,技術顧問是幫助醫療機構適應更以資料為中心、互聯互通的生態系統的重要合作夥伴。隨著數位醫療的普及,對策略性、可擴展且合規的技術路線圖的需求仍然是諮詢公司的主要成長動力。

醫療保健提供者的採用率不斷上升

醫療保健提供者細分市場在2024年創造了可觀的收入,這得益於最佳化營運、改善病患治療效果和降低管理成本的需求。顧問與提供者組織緊密合作,重新設計醫療服務模式,與基於價值的醫療框架保持一致,並管理臨床和財務績效。無論是在勞動力規劃、數位整合或供應鏈最佳化方面,提供者擴大尋求專家顧問的幫助,以適應快速變化的醫療保健格局。

北美將成為推動力地區

2024年,北美醫療諮詢服務市場維持了永續的佔有率,這得益於先進的醫療基礎設施、高水準的技術應用以及對法規合規性的高度重視。美國在需求方面處於領先地位,這得益於其持續向基於價值的報銷模式轉變、人口健康計劃以及大型醫院網路和保險公司的數位轉型。顧問公司正在透過投資專業人才、本地交付能力和跨職能服務來擴大其影響力,以滿足城鄉市場客戶的多樣化需求。

醫療保健諮詢服務市場的主要參與者有 IQVIA、Guidehouse、LEK Consulting、Vizient、凱捷、安永、波士頓諮詢集團、Cognizant、貝恩公司、德勤、奧緯諮詢、埃森哲、Chartis、普華永道 (PwC)、ClearView Healthcare Partners、科爾尼、NTT DATA、HURON、麥肯道 (PwC)、ClearView Healthcare Partners、科爾尼、NTT DATA、HURON、麥肯錫公司和畢馬威錫。

為了鞏固自身地位,醫療諮詢服務市場的領先公司正在採取注重專業化、可擴展性和以客戶為中心的創新的策略。許多公司正在組建垂直領域的專業團隊,這些團隊在付款人策略、人口健康或法規遵循等領域擁有深厚的專業知識。這些公司還透過收購或與醫療科技新創公司合作來擴展其數位化能力,從而能夠提供端到端的轉型服務。此外,資料安全和互通性也受到高度重視,一些公司正在開發符合《健康保險流通與責任法》(HIPAA) 和其他隱私法規的框架。透過將策略諮詢與實際實施和長期變革管理相結合,諮詢服務提供者正在將自己定位為醫療轉型中不可或缺的合作夥伴。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 醫療保健領域的技術進步

- 併購活動增加

- 全球研發支出不斷增加

- 產業陷阱與挑戰

- 隱性成本和營運動態

- 市場機會

- 數位醫療轉型的需求日益成長

- 對人工智慧和資料分析整合的需求

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 推出新服務類型

- 擴張計劃

第5章:市場估計與預測:按服務類型,2021 - 2034 年

- 主要趨勢

- 技術諮詢

- 策略諮詢

- 營運諮詢

- 財務諮詢

- 其他服務類型

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫療保健提供者

- 醫療保健付款人

- 生命科學和製藥公司

- 醫療科技和數位健康公司

- 政府和監管機構

第7章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Accenture

- Bain & Company

- Boston Consulting Group

- Capgemini

- Chartis

- ClearView Healthcare Partners

- Cognizant

- Deloitte

- Ernst & Young

- Guidehouse

- HURON

- IQVIA

- Kearney

- KPMG

- LEK Consulting

- McKinsey & Company

- NTT DATA

- Oliver Wyman

- PricewaterhouseCoopers (PwC)

- Vizient

The global healthcare consulting services market was estimated at USD 26.7 billion in 2024 and is expected to grow from USD 29.5 billion in 2025 to USD 63.4 billion in 2034, at a CAGR of 8.9%, according to the latest report published by Global Market Insights Inc.

The push toward digitization, such as implementing electronic health records (EHR), telemedicine platforms, and AI-powered diagnostics, is creating a strong need for expert guidance. Healthcare consultants support providers and payers in choosing, deploying, and optimizing digital tools that align with clinical and business objectives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.7 Billion |

| Forecast Value | $63.4 Billion |

| CAGR | 8.9% |

Technology Consulting to Gain Traction

The technology consulting segment held a notable share in 2024, as providers and payers accelerate digital initiatives to modernize their operations. From implementing electronic health records (EHRs) and telehealth platforms to deploying AI-driven analytics and cybersecurity solutions, technology consultants are essential partners in helping healthcare organizations adapt to a more data-centric, connected ecosystem. As digital health adoption grows, the demand for strategic, scalable, and compliant technology roadmaps remains a major growth driver for consulting firms.

Rising Adoption of Healthcare Providers

The healthcare providers segment generated significant revenues in 2024, driven by the need to optimize operations, improve patient outcomes, and reduce administrative overhead. Consultants work closely with provider organizations to redesign care delivery models, align with value-based care frameworks, and manage clinical and financial performance. Whether it's workforce planning, digital integration, or supply chain optimization, providers are increasingly turning to expert advisors to help them adapt to a fast-changing healthcare landscape.

North America to Emerge as a Propelling Region

North America healthcare consulting services market held a sustainable share in 2024, driven by advanced healthcare infrastructure, high levels of technology adoption, and a strong focus on regulatory compliance. The United States leads in demand, fueled by ongoing shifts toward value-based reimbursement models, population health initiatives, and digital transformation across large hospital networks and insurance providers. Consulting firms are expanding their presence by investing in specialized talent, local delivery capabilities, and cross-functional service offerings to meet the diverse needs of clients in both urban and rural markets.

Major players in the healthcare consulting services market are IQVIA, Guidehouse, L.E.K. Consulting, Vizient, Capgemini, Ernst & Young, Boston Consulting Group, Cognizant, Bain & Company, Deloitte, Oliver Wyman, Accenture, Chartis, PricewaterhouseCoopers (PwC), ClearView Healthcare Partners, Kearney, NTT DATA, HURON, McKinsey & Company, and KPMG.

To strengthen their position, leading firms in the healthcare consulting services market are adopting strategies that focus on specialization, scalability, and client-centric innovation. Many are building vertical-specific teams with deep domain expertise in areas like payer strategy, population health, or regulatory compliance. Firms are also expanding their digital capabilities through acquisitions or partnerships with health tech startups, allowing them to offer end-to-end transformation services. Additionally, a strong emphasis is being placed on data security and interoperability, with companies developing frameworks that align with HIPAA and other privacy mandates. By combining strategic advisory with hands-on implementation and long-term change management, consulting providers are positioning themselves as indispensable partners in healthcare transformation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in the healthcare sector

- 3.2.1.2 Increased merger and acquisitions activity

- 3.2.1.3 Rising global spending on research and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hidden costs and operational dynamics

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for digital health transformation

- 3.2.3.2 Demand for AI and data analytics integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Technology consulting

- 5.3 Strategy consulting

- 5.4 Operations consulting

- 5.5 Financial consulting

- 5.6 Other service types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare providers

- 6.3 Healthcare payers

- 6.4 Life science and pharma companies

- 6.5 Healthcare technology and digital health companies

- 6.6 Government and regulatory agencies

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Bain & Company

- 8.3 Boston Consulting Group

- 8.4 Capgemini

- 8.5 Chartis

- 8.6 ClearView Healthcare Partners

- 8.7 Cognizant

- 8.8 Deloitte

- 8.9 Ernst & Young

- 8.10 Guidehouse

- 8.11 HURON

- 8.12 IQVIA

- 8.13 Kearney

- 8.14 KPMG

- 8.15 L.E.K Consulting

- 8.16 McKinsey & Company

- 8.17 NTT DATA

- 8.18 Oliver Wyman

- 8.19 PricewaterhouseCoopers (PwC)

- 8.20 Vizient