|

市場調查報告書

商品編碼

1833626

炊具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cookware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

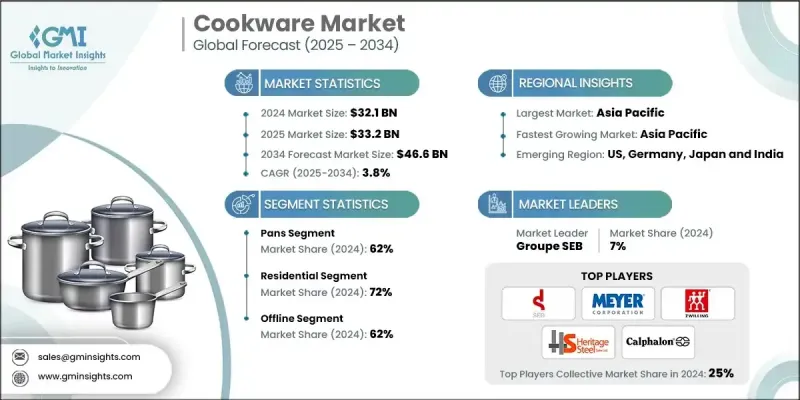

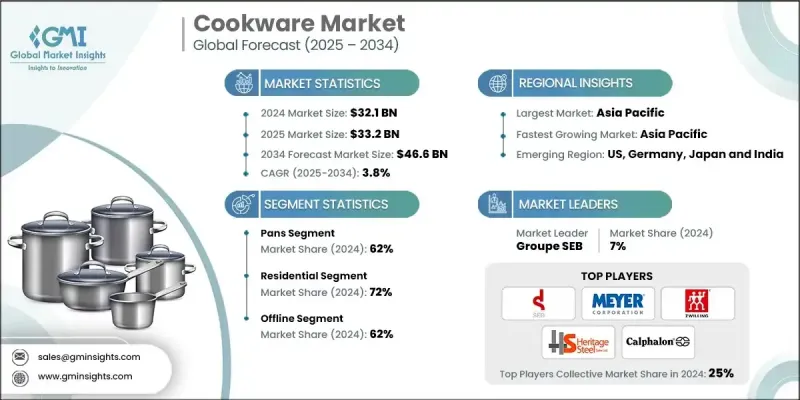

2024 年全球炊具市場價值為 321 億美元,預計到 2034 年將以 3.8% 的複合年成長率成長至 466 億美元。

隨著越來越多的人重視健康和清潔飲食,在家做飯的趨勢越來越強勁。消費者不僅烹飪頻率更高,而且更注重烹飪工具,青睞那些更健康的烹飪方法(例如低油或無油烹飪)的炊具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 321億美元 |

| 預測值 | 466億美元 |

| 複合年成長率 | 3.8% |

2024年,鍋具市場佔據了相當大的佔有率,這得益於其在所有菜系和不同技能水平的日常烹飪中都發揮著至關重要的作用。從不沾煎鍋到鑄鐵煎鍋和不銹鋼炒鍋,消費者對性能、耐用性和安全性的要求越來越高。快速、健康的居家烹飪方式日益流行,這推動了人們對受熱均勻、符合人體工學設計且兼容現代爐灶的鍋具的需求。

2024年,受人們對家常菜、廚房改造和烹飪愛好日益成長的興趣推動,家用廚具市場收入可觀。隨著消費者尋求在家中重現餐廳風味菜餚,兼具功能性和美感的基本款和專業款廚具的需求明顯上升。城市化和公寓生活也正在影響產品設計,推動品牌開發節省空間、功能多樣的廚具。廚具公司正專注於生活風格品牌建立、影響力合作以及價值驅動的產品線,以吸引更廣泛的家庭烹飪群體。

2025-2034年,線下市場將以可觀的複合年成長率成長,這主要得益於高階消費和觸覺體驗的推動。消費者通常更傾向於在實體店內評估炊具的重量、手感和材質。零售連鎖店、百貨商場和專業廚具店仍然是首次購買者和忠實品牌客戶的關鍵接觸點。企業透過線下銷售,透過現場展示、經驗豐富的店員和獨家產品發布來提升店內體驗,從而增強其零售影響力。

2024年,亞太地區炊具市場佔據了相當大的佔有率,這得益於可支配收入的成長、快速的城市化以及對家庭烹飪的強烈文化重視。隨著消費者將本地烹飪習慣與全球趨勢結合,中國、印度、日本和東南亞等市場對傳統和現代炊具的需求均呈現激增之勢。領先品牌正在透過在地化產品設計、區域製造中心和策略性零售合作夥伴關係來擴大其影響力。

炊具市場的主要參與者有 Cuisinart、BERNDES Kuchen、GreenPan、Coleman、Meyer Corporation、Heritage Steel、All-Clad、Tramontina、NuWave、Zwilling、GoodCook、Calphalon、TTK Prestige、Hawkins Cookers 和 Groupe SEB。

為了鞏固市場地位,炊具公司正在部署多層次策略,重點在於創新、品牌差異化和全球擴張。許多公司正在投資研發,以開發符合現代性能和健康標準的無毒、永續材料和產品。與名廚、網紅和美食內容創作者的策略合作有助於提升品牌知名度和顧客信任度。同時,公司正在多元化銷售管道,將D2C模式與傳統零售相結合,以最大限度地擴大市場覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對家庭烹飪的興趣增加

- 可支配所得不斷成長

- 都市化進程加速

- 增加家居裝修項目支出

- 產業陷阱與挑戰

- 優質炊具材料成本高昂

- 來自低成本、低品質替代品的競爭

- 機會

- 對環保和永續炊具的需求不斷成長

- 智慧炊具日益普及

- 成長動力

- 成長潛力分析

- Future market trends

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS編碼:76151021)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品,2021 - 2034

- 主要趨勢

- 平底鍋

- 煎鍋

- 炒鍋

- 平底鍋

- 烤盤

- 其他(烹飪架、烹飪工具、烤盤、壓力鍋)

- 鍋

- 火盆

- 醬汁鍋

- 炸鍋

- 荷蘭烤鍋/燉鍋

- 其他

- 烘焙用具

- Bread and loaf pan

- 烤盤

- 蛋糕盤

- 鬆餅盤

- 其他

- 其他

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 不銹鋼

- Cast & enameled cast iron

- 鋁和陽極氧化鋁

- 碳鋼

- 不黏

- 其他

第7章:市場估計與預測:依塗層類型,2021 - 2034

- 主要趨勢

- 不黏(聚四氟乙烯)

- 陶瓷塗層

- 硬質陽極氧化鋁

- 無塗層/自然飾面

第8章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- HoReCa

- 麵包店

- 餐飲服務

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司網站

- 離線

- 專賣店

- 大型零售商店

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- All-Clad

- BERNDES Kuchen

- Calphalon

- Coleman

- Cuisinart

- GoodCook

- GreenPan

- Groupe SEB

- Hawkins Cookers

- Heritage Steel

- Meyer Corporation

- NuWave

- Tramontina

- TTK Prestige

- Zwilling

The Global Cookware Market was valued at USD 32.1 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 46.6 billion by 2034.

As more individuals prioritize wellness and clean eating, the shift toward preparing meals at home has gained strong momentum. Consumers are not only cooking more frequently but are also paying closer attention to the tools they use, favoring cookware that promotes healthier cooking methods, such as low-oil or oil-free preparations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.1 Billion |

| Forecast Value | $46.6 Billion |

| CAGR | 3.8% |

The pans segment held a significant share in 2024, driven by its essential role in everyday cooking across all cuisines and skill levels. From non-stick frying pans to cast-iron skillets and stainless-steel saute pans, consumers are increasingly selective about performance, durability, and safety. The growing popularity of quick, healthy meal preparation at home is fueling demand for pans that offer even heat distribution, ergonomic designs, and compatibility with modern stovetops.

The residential segment generated substantial revenues in 2024, fueled by rising interest in home-cooked meals, kitchen makeovers, and culinary hobbies. As consumers seek to recreate restaurant-style dishes at home, there's a clear uptick in demand for both basic and specialty cookware that combines function with aesthetic appeal. Urbanization and apartment living are also shaping product design, pushing brands to develop space-saving, multi-functional pieces. Cookware companies are focusing on lifestyle branding, influence partnerships, and value-driven product lines to appeal to a broad base of home cooks.

The offline segment will grow at a decent CAGR during 2025-2034, driven by premium and tactile purchases. Consumers often prefer to evaluate the weight, feel, and material quality of cookware in-store before making a purchase. Retail chains, department stores, and specialty kitchen outlets continue to be critical touchpoints for both first-time buyers and loyal brand customers. Offline sales with companies enhance in-store experiences through live demos, knowledgeable staff, and exclusive product launches to strengthen their retail presence.

Asia Pacific cookware market held a substantial share in 2024, driven by rising disposable incomes, rapid urbanization, and a strong cultural emphasis on home cooking. Markets like China, India, Japan, and Southeast Asia are witnessing a surge in both traditional and modern cookware demand as consumers blend local cooking practices with global trends. Leading brands are expanding their footprint through localized product designs, regional manufacturing hubs, and strategic retail partnerships.

Major players in the cookware market are Cuisinart, BERNDES Kuchen, GreenPan, Coleman, Meyer Corporation, Heritage Steel, All-Clad, Tramontina, NuWave, Zwilling, GoodCook, Calphalon, TTK Prestige, Hawkins Cookers, and Groupe SEB.

To strengthen their market position, cookware companies are deploying multi-layered strategies focused on innovation, brand differentiation, and global expansion. Many are investing in R&D to develop non-toxic, sustainable materials and products that meet modern performance and health standards. Strategic collaborations with celebrity chefs, influencers, and food content creators help drive brand visibility and customer trust. At the same time, companies are diversifying their sales channels, combining D2C models with traditional retail to maximize market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Coating type

- 2.2.5 Price

- 2.2.6 End Use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased interest in home cooking

- 3.2.1.2 Growing disposable income

- 3.2.1.3 Rising urbanization

- 3.2.1.4 Increased spending on home improvement projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of premium cookware materials

- 3.2.2.2 Competition from low-cost, low-quality alternatives

- 3.2.3 Opportunities

- 3.2.3.1 Growing demand for eco-friendly and sustainable cookware

- 3.2.3.2 Rising popularity of smart cookware

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code: 76151021)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Pan

- 5.2.1 Fry pan

- 5.2.2 Saute pan

- 5.2.3 Saucepan

- 5.2.4 Roasting pan

- 5.2.5 Others (cooking racks, cooking tools, bakeware, pressure cookers)

- 5.3 Pots

- 5.3.1 Brazier

- 5.3.2 Sauce pot

- 5.3.3 Fryer pot

- 5.3.4 Dutch oven/ cocotte pots

- 5.3.5 Others

- 5.4 Bakeware

- 5.4.1 Bread and loaf pan

- 5.4.2 Sheet pan

- 5.4.3 Cake pans

- 5.4.4 Muffin pans

- 5.4.5 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Cast & enameled cast iron

- 6.4 Aluminum & anodized aluminum

- 6.5 Carbon steel

- 6.6 Non-stick

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Coating Type, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Nonstick (PTFE)

- 7.3 Ceramic coated

- 7.4 Hard-anodized aluminum

- 7.5 Uncoated / natural finish

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 HoReCa

- 9.3.2 Bakery

- 9.3.3 Catering services

- 9.3.4 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce sites

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Mega retail stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 All-Clad

- 12.2 BERNDES Kuchen

- 12.3 Calphalon

- 12.4 Coleman

- 12.5 Cuisinart

- 12.6 GoodCook

- 12.7 GreenPan

- 12.8 Groupe SEB

- 12.9 Hawkins Cookers

- 12.10 Heritage Steel

- 12.11 Meyer Corporation

- 12.12 NuWave

- 12.13 Tramontina

- 12.14 TTK Prestige

- 12.15 Zwilling