|

市場調查報告書

商品編碼

1833625

露天採礦設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Surface Mining Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

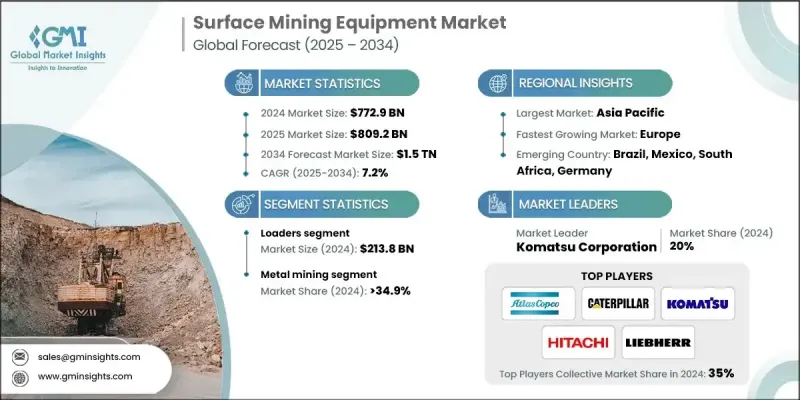

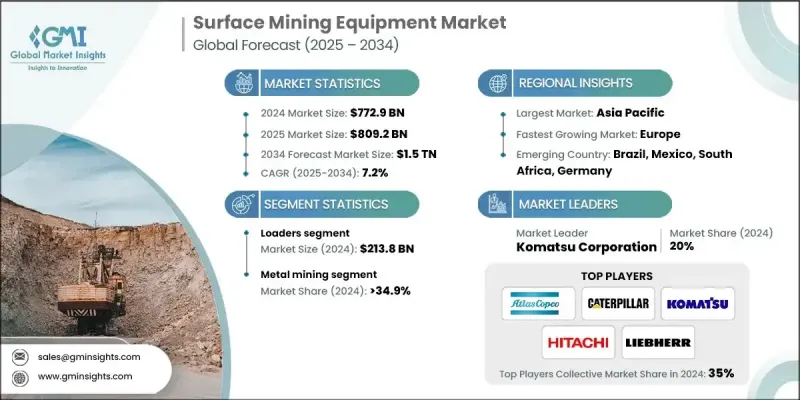

2024 年全球露天採礦設備市場價值為 7,729 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長,達到 1.5 兆美元。

這一成長的動力源於建築、電子和汽車等主要終端產業對礦產和金屬需求的不斷成長。由於這些產業嚴重依賴原料,採礦企業正在增加對技術先進設備的投資,以提高產量、提升營運可靠性並簡化流程。企業正在迅速將自動化和數位化平台整合到其採礦業務中,以提高效率、降低人為風險並最大限度地減少停機時間。配備即時監控系統和人工智慧分析功能的智慧機械正在改變營運商管理生產力和資源配置的方式。透過集中控制系統做出明智決策的能力,使採礦作業更快、更安全、更具成本效益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7729億美元 |

| 預測值 | 1.5兆美元 |

| 複合年成長率 | 7.2% |

市場也正向永續和環保的實踐轉變。隨著嚴格法規的訂定,製造商正在引入混合動力和電動採礦機械,以減少排放。更清潔的引擎技術、生物燃料相容性和節能設計正在成為標準。此外,節水系統和除塵解決方案正在實施,以幫助營運達到環境基準。先進的安全系統,包括基於LiDAR和雷達的防撞系統,正在提高現場安全性,而遠端控制機器使操作員能夠在場外安全地工作,從而降低現場風險。

2024年,裝載機市場規模達2,138億美元,在露天採礦活動中仍扮演著至關重要的角色。裝載機在運輸、裝載和堆料等作業中功能多樣,是各種規模採礦作業不可或缺的裝備。更高的燃油效率和在各種地形條件下的堅固耐用性能繼續推動裝載機的普及,尤其是在企業尋求能夠在惡劣條件下運行的可靠設備的情況下。

2024年,金屬礦業板塊佔據了34.9%的市場佔有率,這得益於對鐵、鋁、銅和金等金屬需求的成長。電子、建築和運輸等行業的消費成長正在推動礦業項目的擴張。露天採礦仍然是首選方法,因為它具有更高的開採能力和成本優勢,有助於企業在控制成本的同時擴大營運規模。

2024年,美國露天採礦設備市場佔76%的市場佔有率,為區域成長做出了重大貢獻。隨著先進技術的快速應用以及對數位化工具和自動化的日益依賴,美國的採礦作業正變得更加有效率和安全。支持性立法、稅收優惠以及商品價格的上漲正在鼓勵設備升級和新設備的採購。注重永續發展的政府政策和創新激勵措施也有助於刺激對現代環保設備的需求。

影響全球露天採礦設備市場的關鍵公司包括必和必拓、美卓、巴里克黃金、小松、利勃海爾、力拓、英美資源集團、日立建機、自由港麥克莫蘭銅金公司、山特維克、阿特拉斯·科普柯、JC Bamford Excavators、淡水河谷、Boart Longyear、Caterpillar和沃爾沃。為了鞏固其在露天採礦設備市場的競爭地位,領先企業正優先考慮創新、策略合作夥伴關係和永續性。許多公司正在擴展其產品線,包括電動和混合動力機械,以符合全球排放目標。對自動化、人工智慧整合和數位監控工具的投資使公司能夠提供具有更高效率和預測性維護能力的智慧型設備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 工業領域對金屬的需求不斷成長

- 發展中國家城市化進程加速

- 有利的政府法規

- 產業陷阱與挑戰

- 初始成本高

- 更嚴格的環境法規

- 機會

- 採用自動化和智慧製造

- 新興市場的擴張

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 裝載機

- 挖土機

- 破碎、粉碎和篩選設備

- 鑽孔機和破碎機

- 自卸車

- 鏟子

- 平地機

- 其他

第6章:市場估計與預測:依方法,2021-2034 年

- 主要趨勢

- 露天開採

- 梯田採礦

- 露天採礦

第7章:市場估計與預測:按應用 2021-2034

- 主要趨勢

- 採煤

- 金屬礦業

- 礦產開採

- 其他(鋁土礦開採)

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Anglo American

- Atlas Copco

- Barrick Gold

- BHP Billiton

- Boart Longyear

- Caterpillar

- Freeport-McMoRan

- Hitachi Construction Machinery

- JC Bamford Excavators

- Komatsu

- Liebherr

- Metso

- Rio Tinto

- Sandvik

- Vale

- Volvo

The Global Surface Mining Equipment Market was valued at USD 772.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 1.5 trillion by 2034.

The growth is fueled by rising demand for minerals and metals across major end-use industries, including construction, electronics, and automotive. As these sectors rely heavily on raw materials, mining operations are increasingly investing in technologically advanced equipment to boost output, improve operational reliability, and streamline processes. Companies are rapidly integrating automation and digital platforms into their mining operations to enhance efficiency, reduce human risk, and minimize downtime. Intelligent machinery equipped with real-time monitoring systems and AI-based analytics is transforming how operators manage productivity and resource allocation. The ability to make informed decisions through centralized control systems is making mining operations faster, safer, and more cost-effective.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $772.9 Billion |

| Forecast Value | $1.5 Trillion |

| CAGR | 7.2% |

The market is also seeing a shift toward sustainable and eco-conscious practices. With strict regulations in place, manufacturers are introducing hybrid and electric-powered mining machinery to reduce emissions. Cleaner engine technologies, biofuel compatibility, and energy-saving designs are becoming standard. Additionally, water conservation systems and dust control solutions are being implemented to help operations meet environmental benchmarks. Advanced safety systems, including LiDAR- and radar-based collision prevention, are enhancing site safety while remote-controlled machines allow operators to work safely from off-site locations, lowering on-site risk.

In 2024, the loaders segment generated USD 213.8 billion, maintaining a vital role in surface mining activities. Their versatility in handling tasks such as transporting, loading, and stockpiling makes them indispensable for mining operations of all scales. Enhanced fuel efficiency and rugged performance across varied terrains continue to drive their popularity, especially as companies seek reliable equipment that performs under harsh conditions.

The metal mining segment captured a 34.9% share in 2024, supported by heightened demand for metals like iron, aluminum, copper, and gold. Increased consumption from sectors like electronics, building, and transportation is driving expansion in mining projects. Surface mining remains a preferred method due to its higher extraction capacity and cost advantages, which are helping companies scale operations while managing expenses.

United States Surface Mining Equipment Market held a 76% share in 2024, contributing significantly to regional growth. With the rapid adoption of advanced technologies and increasing reliance on digital tools and automation, mining operations in the U.S. are becoming more efficient and safer. Supportive legislation, tax benefits, and higher commodity prices are encouraging upgrades and new equipment purchases. Sustainability-focused government policies and innovation incentives are also helping fuel demand for modern, environmentally friendly equipment.

Key companies shaping the Global Surface Mining Equipment Market include BHP Billiton, Metso, Barrick Gold, Komatsu, Liebherr, Rio Tinto, Anglo American, Hitachi Construction Machinery, Freeport-McMoRan, Sandvik, Atlas Copco, J.C. Bamford Excavators, Vale, Boart Longyear, Caterpillar, and Volvo. To reinforce their competitive position in the surface mining equipment market, leading players are prioritizing innovation, strategic partnerships, and sustainability. Many are expanding their product lines with electric and hybrid machinery to align with global emission targets. Investment in automation, AI integration, and digital monitoring tools is enabling companies to offer intelligent equipment with enhanced efficiency and predictive maintenance capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Method trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for metals in industries

- 3.2.1.2 Increasing urbanization in developing countries

- 3.2.1.3 Favorable government regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Stricter environmental regulations

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of automation and smart manufacturing

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Loaders

- 5.3 Excavators

- 5.4 Crushing, pulverizing and screen equipment

- 5.5 Drills & breakers

- 5.6 Dumper

- 5.7 Shovels

- 5.8 Motor graders

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Strip mining

- 6.3 Terrace mining

- 6.4 Open-pit mining

Chapter 7 Market Estimates and Forecast, By Application 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Coal mining

- 7.3 Metal mining

- 7.4 Mineral mining

- 7.5 Other (bauxite mining)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Anglo American

- 10.2 Atlas Copco

- 10.3 Barrick Gold

- 10.4 BHP Billiton

- 10.5 Boart Longyear

- 10.6 Caterpillar

- 10.7 Freeport-McMoRan

- 10.8 Hitachi Construction Machinery

- 10.9 J.C. Bamford Excavators

- 10.10 Komatsu

- 10.11 Liebherr

- 10.12 Metso

- 10.13 Rio Tinto

- 10.14 Sandvik

- 10.15 Vale

- 10.16 Volvo