|

市場調查報告書

商品編碼

1833618

胰島素注射裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Insulin Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

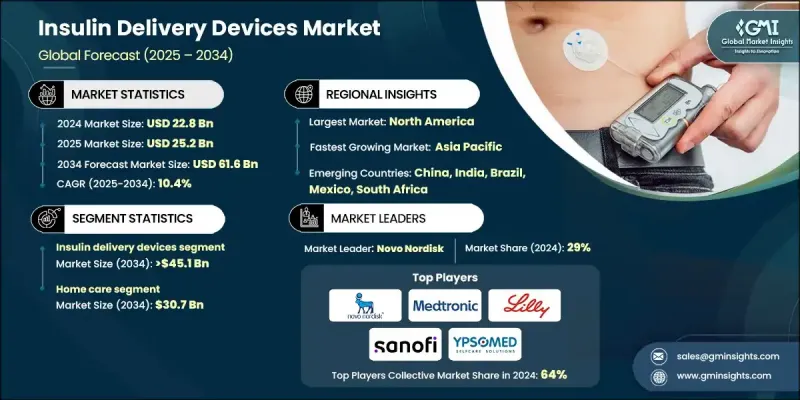

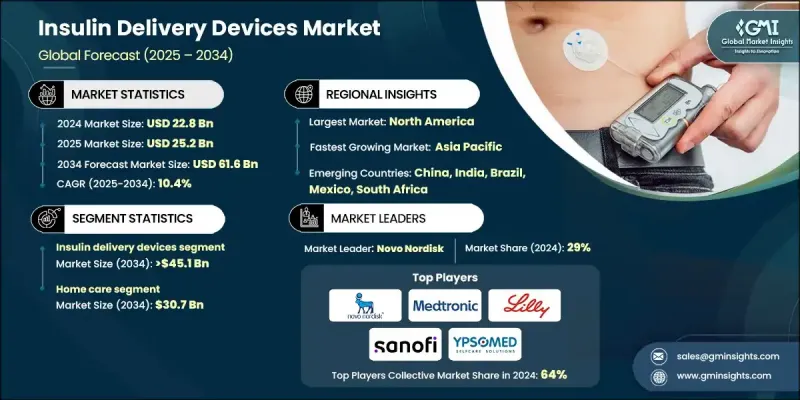

2024 年全球胰島素輸送裝置市值為 228 億美元,預計到 2034 年將以 10.4% 的複合年成長率成長至 616 億美元。

這一強勁成長的動力源於全球糖尿病患病率的上升、技術的不斷進步以及人們對疾病自我管理意識的不斷增強。患者越來越需要使用者友善、便攜且精準的胰島素給藥方案,包括胰島素筆、胰島素幫浦和胰島素貼片,以便更好地管理血糖水平。此外,全球衛生組織和各國政府正透過致力於改善糖尿病照護的舉措,在加速市場擴張方面發揮著至關重要的作用。例如,世界衛生組織的《全球糖尿病契約》旨在降低糖尿病風險,並確保所有患者都能獲得負擔得起的優質治療。胰島素給藥裝置是安全有效注射胰島素的重要工具,當人體無法自然產生足夠的胰島素時,它可以幫助患者維持適當的血糖水平。技術創新仍是推動市場成長的重要因素,各公司透過整合人體工學手柄、預充式藥筒和自動給藥等功能,提升了設備的舒適性、安全性和易用性。藍牙和行動應用程式連接等數位技術的整合,為患者和醫療保健提供者提供了即時胰島素治療資料,從而實現了更個人化和高效的管理。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 228億美元 |

| 預測值 | 616億美元 |

| 複合年成長率 | 10.4% |

胰島素給藥設備市場在2024年佔據了73.5%的市場佔有率,這得益於其先進的技術、耐用性以及日益受到患者和醫護人員的青睞。此領域包括胰島素筆、胰島素幫浦等設備,旨在提供精準、便利且用戶友善的胰島素給藥。這些設備因其易用性、便攜性以及與數位健康平台連接的能力而廣受歡迎,使其成為獨立糖尿病管理不可或缺的工具。這些設備有助於最大限度地減少給藥錯誤,並提高整體治療效果。

預計到2034年,家庭護理市場規模將達到307億美元,這得益於越來越多的患者選擇在家中舒適地管理糖尿病。易於使用的設備的普及、自我照顧意識的增強以及公共衛生機構的支持性政策,都助長了這一趨勢。患者更青睞攜帶式胰島素注射裝置,因為它們可以簡化日常治療流程並減少就診次數。一次性胰島素筆和穿戴式胰島素幫浦以其便捷可靠而聞名,由於其培訓要求低,在家庭環境中尤其受歡迎。

2024年,北美胰島素注射裝置市場佔據41.6%的市場佔有率,這得益於其高糖尿病盛行率、先進的醫療基礎設施以及強力的監管支持。該地區的醫療保健系統注重精準性、安全性和使用者友善性,這使得胰島素筆成為住院和門診患者的首選。這些裝置透過醫院藥局、零售店和線上平台廣泛普及,加上保險覆蓋和政府支持,進一步加速了其普及。

胰島素給藥裝置市場的主要參與者包括 Biocon、Novo Nordisk、Becton Dickinson and Company、Medtronic plc、Eli Lilly & Company、Insulet Corporation、Terumo Corporation、B. Braun Melsungen AG、Sanofi、Haselmeier、Ypsomed Holdings、東寶藥業、Julphar Corporation、Tandem、Deifical Corporation、Owenm、Ouk、 Corporation、Gan & Lee Pharmaceuticals、蘇州鵬業醫療器材、Pacetronix 和 MicroPort。胰島素給藥裝置市場的公司專注於幾項核心策略,以加強其市場地位並擴大其全球影響力。持續投資於研發至關重要,這樣才能推出具有增強可用性、安全性和連接功能(例如 AI 驅動的劑量和遠端監控)的創新產品。擴大分銷管道,包括與醫療保健提供者、藥局和數位健康平台建立合作夥伴關係,有助於提高全球產品的可及性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 糖尿病盛行率上升

- 胰島素輸送裝置的技術進步

- 糖尿病照護支出增加

- 優惠的設備保險和報銷政策

- 採取便利措施

- 產業陷阱與挑戰

- 胰島素輸送裝置成本高

- 發展中國家的自付費用高

- 嚴格的政府法規

- 市場機會

- 與數位健康平台整合

- 智慧及穿戴式裝置開發

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 2024年定價分析

- 專利分析

- 報銷場景

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 胰島素輸送裝置

- 胰島素幫浦

- 管式幫浦

- 無內胎幫浦

- 鋼筆

- 可重複使用的

- 一次性的

- 其他胰島素輸送裝置

- 胰島素幫浦

- 耗材

- 測試條

- 筆針

- 標準

- 安全

- 注射器

- 胰島素幫浦耗材

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 居家護理

- 其他最終用戶

第7章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Biocon

- Debiotech SA

- Dongbao Pharmaceutical

- Eli Lilly & Company

- F. Hoffmann-La Roche Ltd.

- Gan & Lee Pharmaceuticals

- Haselmeier

- Insulet Corporation

- Julphar

- Lenomed Medical

- Medtronic plc

- MicroPort

- Nipro Corporation

- Novo Nordisk

- Owen Mumford

- Sanofi

- Scientific Corporation

- Suzhou Peng Ye Medical Devices

- Tandem Diabetes Care

- Terumo Corporation

- ViCentra BV

- Wockhardt Ltd.

- Ypsomed Holdings

The Global Insulin Delivery Devices Market was valued at USD 22.8 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 61.6 billion by 2034.

This robust growth is driven by the increasing prevalence of diabetes worldwide, continuous advancements in technology, and greater awareness around self-management of the disease. Patients are increasingly demanding user-friendly, portable, and accurate insulin delivery options, including insulin pens, pumps, and patch devices, to better manage their glucose levels. Furthermore, global health organizations and national governments are playing a vital role in accelerating market expansion through initiatives focused on improving diabetes care. The World Health Organization's Global Diabetes Compact, for example, aims to reduce diabetes risk and ensure that all patients have access to affordable, quality treatment. Insulin delivery devices are essential tools designed to administer insulin safely and effectively, helping individuals maintain proper blood sugar levels when their bodies cannot produce enough insulin naturally. Technological innovation remains a significant factor propelling market growth, with companies enhancing device comfort, safety, and ease of use by incorporating features such as ergonomic grips, prefilled cartridges, and automated dosing. The integration of digital technologies like Bluetooth and mobile app connectivity is providing patients and healthcare providers with real-time insulin therapy data, enabling more personalized and efficient management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.8 billion |

| Forecast Value | $61.6 billion |

| CAGR | 10.4% |

The insulin delivery device segment held 73.5% share in 2024, owing to its advanced technology, durability, and increasing preference among both patients and healthcare professionals. This segment includes devices such as insulin pens, pumps, and others, all designed to provide precise, convenient, and user-friendly insulin administration. Their popularity stems from ease of use, portability, and the ability to connect with digital health platforms, making them indispensable tools for independent diabetes management. These devices help minimize dosing errors and enhance overall treatment outcomes.

The home care segment is anticipated to reach USD 30.7 billion by 2034, fueled by a growing number of patients choosing to manage diabetes within the comfort of their own homes. The availability of easy-to-use devices, increased awareness of self-care, and supportive policies from public health bodies all contribute to this trend. Patients prefer portable insulin delivery devices that simplify daily treatment routines and reduce hospital visits. Disposable insulin pens and wearable pumps, known for their convenience and reliability, are especially popular in home settings due to minimal training requirements.

North America Insulin Delivery Devices Market held 41.6% share in 2024, driven by a high diabetes prevalence, advanced healthcare infrastructure, and strong regulatory backing. The region's healthcare systems emphasize precision, safety, and user-friendliness, which makes insulin pens the favored choice in both inpatient and outpatient settings. The widespread availability of these devices through hospital pharmacies, retail outlets, and online platforms, combined with insurance coverage and government support, further accelerates adoption.

Key players in the Insulin Delivery Devices Market include Biocon, Novo Nordisk, Becton Dickinson and Company, Medtronic plc, Eli Lilly & Company, Insulet Corporation, Terumo Corporation, B. Braun Melsungen AG, Sanofi, Haselmeier, Ypsomed Holdings, Dongbao Pharmaceutical, Julphar, Tandem Diabetes Care, Owen Mumford, ViCentra B.V., Scientific Corporation, Debiotech S.A., Nipro Corporation, Gan & Lee Pharmaceuticals, Suzhou Peng Ye Medical Devices, Pacetronix, and MicroPort. Companies in the insulin delivery devices market focus on several core strategies to strengthen their market position and expand their global footprint. Continuous investment in research and development is crucial, enabling the launch of innovative products with enhanced usability, safety, and connectivity features such as AI-powered dosing and remote monitoring. Expanding distribution channels, including partnerships with healthcare providers, pharmacies, and digital health platforms, helps improve product accessibility worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in insulin delivery devices

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Favourable device insurance and reimbursement policies

- 3.2.1.5 Adoption of facilitative initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin delivery devices

- 3.2.2.2 High out-of-pocket expenditure in developing countries

- 3.2.2.3 Stringent government regulations

- 3.2.3 Market opportunities

- 3.2.4 Integration with digital health platforms

- 3.2.5 Development of smart and wearable devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Insulin delivery devices

- 5.2.1 Insulin pumps

- 5.2.1.1 Tubed pumps

- 5.2.1.2 Tubeless pumps

- 5.2.2 Pens

- 5.2.2.1 Reusable

- 5.2.2.2 Disposable

- 5.2.3 Other insulin delivery devices

- 5.2.1 Insulin pumps

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Pen needles

- 5.3.2.1 Standard

- 5.3.2.2 Safety

- 5.3.3 Syringes

- 5.3.4 Insulin pumps consumables

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and Clinics

- 6.3 Home care

- 6.4 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 B. Braun Melsungen AG

- 8.2 Becton, Dickinson and Company

- 8.3 Biocon

- 8.4 Debiotech S.A.

- 8.5 Dongbao Pharmaceutical

- 8.6 Eli Lilly & Company

- 8.7 F. Hoffmann-La Roche Ltd.

- 8.8 Gan & Lee Pharmaceuticals

- 8.9 Haselmeier

- 8.10 Insulet Corporation

- 8.11 Julphar

- 8.12 Lenomed Medical

- 8.13 Medtronic plc

- 8.14 MicroPort

- 8.15 Nipro Corporation

- 8.16 Novo Nordisk

- 8.17 Owen Mumford

- 8.18 Sanofi

- 8.19 Scientific Corporation

- 8.20 Suzhou Peng Ye Medical Devices

- 8.21 Tandem Diabetes Care

- 8.22 Terumo Corporation

- 8.23 ViCentra B.V.

- 8.24 Wockhardt Ltd.

- 8.25 Ypsomed Holdings