|

市場調查報告書

商品編碼

1833439

InGaAs 雪崩光電二極體 (InGaAs APD) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測InGaAs Avalanche Photodiode (InGaAs APD) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球 InGaAs 雪崩光電二極體市場價值為 3.1217 億美元,預計將以 8.7% 的複合年成長率成長,到 2034 年達到 7.0029 億美元。

這一成長得益於對光纖通訊網路需求的激增,而這種需求的激增又源於人們對高速網際網路、雲端平台和數據密集型應用日益成長的依賴。 InGaAs 雪崩光電二極體 (APD) 對於確保在高效能電信環境(包括長距離傳輸、城域網路和先進的資料中心基礎設施)中快速且準確地偵測光訊號至關重要。其高響應速度、快速訊號處理能力和低雜訊特性使其成為當今頻寬驅動型世界中不可或缺的一部分。隨著電信營運商不斷增強其基礎設施以支援下一代連接,以及各行各業數位轉型的持續推進,InGaAs APD 的角色變得越來越重要。此外,隨著基於雷射雷達 (LiDAR) 的應用在自動化、測繪和機器人等行業中日益普及,對能夠在近紅外線波長下高效工作的光電探測器的需求也持續攀升。這些趨勢為 InGaAs APD 市場的創新和產品擴展創造了強勁動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.1217億美元 |

| 預測值 | 7.0029億美元 |

| 複合年成長率 | 8.7% |

中波長段(1.0 至 1.55 µm)在 2024 年創造了 1.481 億美元的市場規模,預計複合年成長率為 10%。該領域受益於其在工業和環境應用(包括光纖、光譜學和精密感測技術)中日益成長的實用性。重點仍然是最佳化光電二極體,使其具有針對特定波長的反應能力、熱穩定性和降低電子干擾。製造商正在不斷提高其性能參數,以更好地滿足電信和科學行業不斷變化的需求,因為這些行業對精度和可靠性至關重要。

2024年,單光子雪崩二極體 (SPAD) 市場規模達1.1449億美元。這些二極體能夠以極高的精度探測單一光子,使其成為快節奏、光線受限環境的理想選擇。量子應用、微光成像系統和時間分辨分析領域的需求不斷成長,持續加速了SPAD技術的創新。製造商正在大力投資緊湊型、相容於CMOS且具有超低抖動的SPAD陣列,以便輕鬆整合到更小的光子系統中。 SPAD陣列在導航、3D成像和科學研究領域的應用預計將豐富其應用場景,並擴大其商業價值。

2024年,美國InGaAs雪崩光電二極體(InGaAs APD)市場規模達7,460萬美元。美國市場的成長源自於光子技術在商業和國防領域的日益普及。先進光學感測和通訊工具在航太、電信和科研領域的廣泛應用,正在為InGaAs APD創造長期需求。隨著光纖網路的發展以及雷射雷達(LiDAR)在基礎設施和安全系統中的應用不斷擴大,對高精度光電探測器的需求將繼續推動區域市場的發展。

InGaAs 雪崩光電二極體 (InGaAs APD) 市場的知名行業參與者包括 Hamamatsu Photonics、Albis Optoelectronics AG (Enablence)、Excelitas Technologies、OSI Optoelectronics、Laser Components DG, Inc.、First Sensor、Dexerials Corporation 和 Thors Inc. InGaAs 雪崩光電二極體市場的主要參與者正在實施多方面策略以增強其競爭優勢。主要重點是技術創新,公司將投資投入研發以提高光譜靈敏度、降低噪音水平並增強在不同環境條件下的性能。許多公司也正在多樣化產品組合,為量子運算、LiDAR和先進電信系統等垂直領域推出緊湊型和專用光電二極體。與零件製造商和系統整合商的策略合作夥伴關係有助於簡化產品採用。此外,該公司正在利用 CMOS 整合等半導體製造技術的進步來實現大規模生產和小型化。為了進一步提升市場佔有率,全球參與者持續擴大其分銷網路,並針對高成長產業的區域和特定應用需求客製化解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 光纖通訊需求不斷成長

- LiDAR應用的成長

- 醫學影像技術的擴展

- 量子通訊和光子學的出現

- 軍事和航太進步

- 產業陷阱與挑戰

- 製造和材料成本高

- 高光功率下動態範圍有限且飽和

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 單光子雪崩二極體(SPAD)

- 多光子雪崩二極體(MPAD)

- 線性模式雪崩光電二極體

第6章:市場估計與預測:依波長範圍,2021 - 2034

- 主要趨勢

- 短波長(最長 1.0 µm)

- 中波長(1.0 至 1.55 µm)

- 長波長(1.55 µm 以上)

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 商業的

- 3D成像

- 手勢識別

- 深度感應

- 汽車LiDAR

- 其他

- 資訊科技和電信

- 高速光互連

- 光收發器

- 長距離光纖通訊

- 城域網路及接取網

- 無源光網路(PON)

- 其他

- 航太與國防

- 通訊鏈路

- 光通訊

- 軍用LiDAR和測距儀

- 遙感

- 其他

- 工業的

- 機器視覺

- 工業自動化

- 監控

- 計量與檢驗

- 其他

- 衛生保健

- 光學相干斷層掃描(OCT)

- 正子斷層掃描(PET)

- 生物醫學感

- 近紅外光譜

- 其他

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球參與者:

- Hamamatsu Photonics

- Excelitas Technologies

- OSI Optoelectronics

- Thorlabs Inc.

- 區域參與者:

- Albis Optoelectronics (Enablence)

- Dexerials Corporation

- First Sensor

- GPD Optoelectronics Corp.

- Laser Components GmbH

- LONTEN

- Voxtel Inc.

- 新興參與者:

- Advanced Photonix, Inc.

- GoFoton

- New England Photoconductor (NEP)

- NuPhotonics LLC

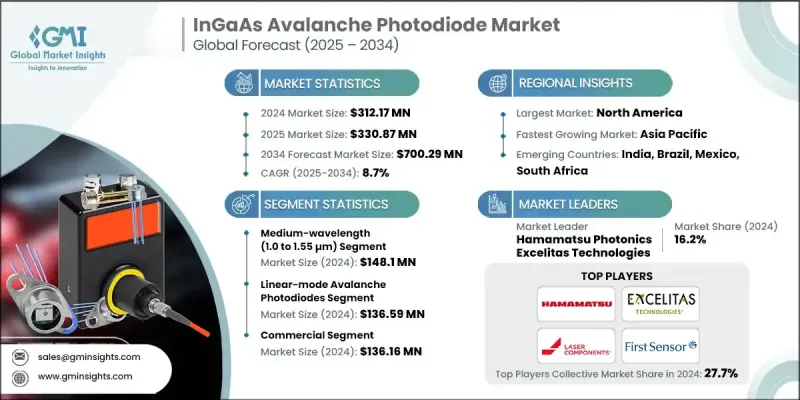

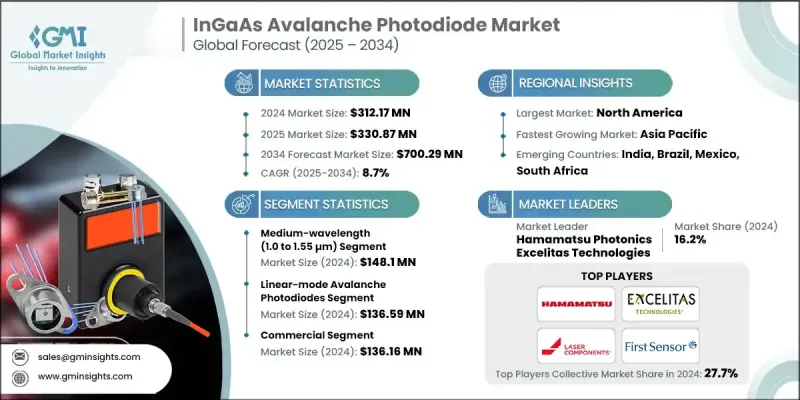

The Global InGaAs Avalanche Photodiode Market was valued at USD 312.17 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 700.29 million by 2034.

This growth is supported by the surging demand for fiber-optic communication networks, driven by the increasing dependence on high-speed internet, cloud platforms, and data-heavy applications. InGaAs avalanche photodiodes (APDs) are critical to ensuring rapid and accurate optical signal detection in high-performance telecommunication environments, including long-distance transmission, metropolitan networks, and advanced data center infrastructure. Their high responsiveness, fast signal processing capabilities, and low-noise characteristics make them essential in today's bandwidth-driven world. As telecom providers ramp up their infrastructure to support next-gen connectivity and as digital transformation continues across sectors, the role of InGaAs APDs becomes increasingly vital. Furthermore, as LiDAR-based applications become more widespread across industries such as automation, mapping, and robotics, the demand for photo detectors that can operate efficiently in near-infrared wavelengths continues to climb. These trends are creating strong momentum for innovation and product expansion within the InGaAs APD market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.17 Million |

| Forecast Value | $700.29 Million |

| CAGR | 8.7% |

The medium-wavelength segment (1.0 to 1.55 µm) generated USD 148.1 million in 2024 and is forecasted to grow at a 10% CAGR. This segment benefits from its increasing utility in industrial and environmental applications, including fiber optics, spectroscopy, and precision sensing technologies. The emphasis remains on optimizing photodiodes for wavelength-specific responsiveness, thermal stability, and reduced electronic interference. Manufacturers are continually enhancing their performance parameters to better serve evolving requirements from telecommunications and scientific industries, where accuracy and reliability are paramount.

In 2024, the single-photon avalanche diodes (SPADs) segment accounted for USD 114.49 million. These diodes can detect individual photons with exceptional precision, making them ideal for fast-paced, light-restricted environments. Increasing demand in quantum applications, low-light imaging systems, and time-resolved analytics continues to accelerate innovation in SPAD technology. Manufacturers are heavily investing in compact, CMOS-compatible SPAD arrays with ultra-low jitter to allow easy integration into smaller photonic systems. Their integration into navigation, 3D imaging, and scientific research fields is expected to diversify use cases and expand commercial interest.

U.S. InGaAs Avalanche Photodiode (InGaAs APD) Market generated USD 74.6 million in 2024. Growth in the U.S. stems from the rising implementation of photonic technologies in both commercial and defense sectors. The widespread use of advanced optical sensing and communication tools across aerospace, telecom, and scientific research is creating long-term demand for InGaAs APDs. As optical fiber networks grow and LiDAR use expands in infrastructure and security systems, the need for high-accuracy photodetectors continues to drive regional market performance.

Prominent industry participants in the InGaAs Avalanche Photodiode (InGaAs APD) Market include Hamamatsu Photonics, Albis Optoelectronics AG (Enablence), Excelitas Technologies, OSI Optoelectronics, Laser Components DG, Inc., First Sensor, Dexerials Corporation, and Thorlabs Inc. These companies play a critical role in shaping the technological evolution and commercial success of the industry. Key players in the InGaAs avalanche photodiode market are implementing multifaceted strategies to enhance their competitive edge. A primary focus is on technological innovation, with companies channeling investments into R&D to improve spectral sensitivity, reduce noise levels, and enhance performance across varying environmental conditions. Many are also diversifying product portfolios, introducing compact and application-specific photodiodes for verticals such as quantum computing, LiDAR, and advanced telecom systems. Strategic partnerships with component manufacturers and system integrators help streamline product adoption. Additionally, firms are leveraging semiconductor fabrication advancements like CMOS integration to enable mass production and miniaturization. To further boost market presence, global players continue to expand their distribution networks and tailor solutions for regional and application-specific demands across high-growth sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type trends

- 2.2.3 Wavelength range trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in fiber-optic communication

- 3.2.1.2 Growth of LiDAR applications

- 3.2.1.3 Expansion of medical imaging technologies

- 3.2.1.4 Emergence of quantum communication & photonics

- 3.2.1.5 Military & aerospace advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Limited dynamic range and saturation at high optical powers

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Single-photon Avalanche Diodes (SPADs)

- 5.3 Multi-photon Avalanche Diodes (MPADs)

- 5.4 Linear-mode Avalanche Photodiodes

Chapter 6 Market Estimates and Forecast, By Wavelength Range, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Short-wavelength (up to 1.0 µm)

- 6.3 Medium-wavelength (1.0 to 1.55 µm)

- 6.4 Long-wavelength (1.55 µm and above)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.2.1 3D imaging

- 7.2.2 Gesture recognition

- 7.2.3 Depth sensing

- 7.2.4 Automotive LiDAR

- 7.2.5 Others

- 7.3 IT & Telecommunication

- 7.3.1 High-speed optical interconnects

- 7.3.2 Optical transceivers

- 7.3.3 Long-haul optical fiber communication

- 7.3.4 Metro and access networks

- 7.3.5 Passive optical networks (PONs)

- 7.3.6 Others

- 7.4 Aerospace & Defense

- 7.4.1 Communication links

- 7.4.2 Optical communication

- 7.4.3 Military LiDAR and rangefinding

- 7.4.4 Remote sensing

- 7.4.5 Others

- 7.5 Industrial

- 7.5.1 Machine vision

- 7.5.2 Industrial automation

- 7.5.3 Monitoring

- 7.5.4 Metrology & inspection

- 7.5.5 Others

- 7.6 Healthcare

- 7.6.1 Optical Coherence Tomography (OCT)

- 7.6.2 Positron Emission Tomography (PET)

- 7.6.3 Biomedical sensing

- 7.6.4 Near-infrared spectroscopy

- 7.6.5 Others

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players:

- 9.1.1 Hamamatsu Photonics

- 9.1.2 Excelitas Technologies

- 9.1.3 OSI Optoelectronics

- 9.1.4 Thorlabs Inc.

- 9.2 Regional Players:

- 9.2.1 Albis Optoelectronics (Enablence)

- 9.2.2 Dexerials Corporation

- 9.2.3 First Sensor

- 9.2.4 GPD Optoelectronics Corp.

- 9.2.5 Laser Components GmbH

- 9.2.6 LONTEN

- 9.2.7 Voxtel Inc.

- 9.3 Emerging Players:

- 9.3.1 Advanced Photonix, Inc.

- 9.3.2 GoFoton

- 9.3.3 New England Photoconductor (NEP)

- 9.3.4 NuPhotonics LLC