|

市場調查報告書

商品編碼

1833436

女性健康治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Womens Health Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

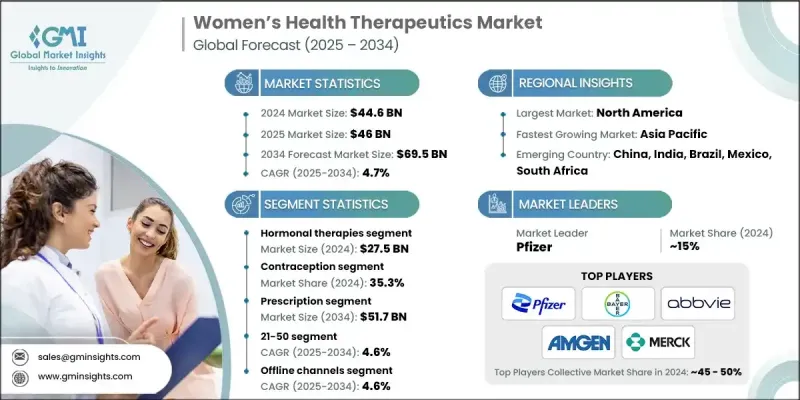

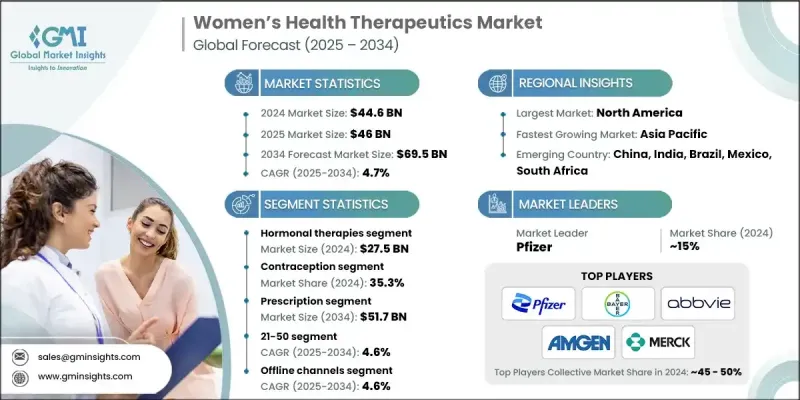

2024 年全球女性健康治療市場價值為 446 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 695 億美元。

子宮內膜異位症、更年期相關問題、多囊性卵巢症候群 (PCOS) 和骨質疏鬆症等疾病日益常見。日益加重的疾病負擔推動了對更有效、更有針對性的治療方法的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 446億美元 |

| 預測值 | 695億美元 |

| 複合年成長率 | 4.7% |

荷爾蒙療法的採用率不斷提高

2024年,荷爾蒙療法領域佔據了相當大的佔有率,這得益於針對更年期症狀、子宮內膜異位症和荷爾蒙失衡等疾病的治療需求不斷成長。隨著人們對荷爾蒙替代療法 (HRT) 以及未經治療的荷爾蒙問題的長期健康影響的認知不斷提高,越來越多的女性正在尋求醫療干預。市場在給藥機制方面不斷創新,包括貼片、凝膠和緩釋植入物,從而提高了患者的依從性。

避孕普及率不斷上升

2024年,避孕市場佔據了相當大的佔有率,這得益於對長效可逆避孕藥 (LARC) 和非荷爾蒙避孕藥需求的不斷成長。現代生活方式、推遲計劃生育以及公共衛生部門對生殖自主權日益成長的支持,推動了廣泛人群對避孕藥的採用。隨著陰道環、子宮內避孕器 (IUD) 和注射劑型的創新,避孕市場正在超越傳統的口服避孕藥。

獲得牽引力的處方

處方藥市場在2024年佔據了相當大的佔有率,這得益於骨質疏鬆症、生育問題和婦科癌症等疾病的大多數治療都具有臨床性質。醫生仍然是關鍵的決策者,患者對處方藥的信任度繼續推動品牌忠誠度。法規核准途徑、處方集定位和保險覆蓋範圍對此領域的銷售業績有顯著影響。

北美將成為推動力地區

2025-2034年期間,北美女性健康治療市場可望實現可觀的複合年成長率。該地區受益於先進的醫療基礎設施、強力的監管以及患者和醫療機構的高度認知。市場參與者正在利用優惠的報銷政策以及對女性生命週期各個階段(從青春期到更年期後)的針對性治療日益成長的需求。

女性健康治療市場的主要參與者有 Theramex、Cipla、Kissei Pharmaceutical、Evofem、輝瑞、Shionogi、Ferring、Organon、安進、Besins、Allergan (AbbVie)、賽諾菲、Gedeon Richter、Lupin、Atossa Therapeutics、諾華、強生和拜耳。

為了鞏固在女性健康治療領域的市場地位,各公司正採取多管齊下的策略。關鍵策略包括透過內部研發和許可交易來擴大產品線,尤其針對子宮肌瘤和女性性功能障礙等醫療資源匱乏的疾病。此外,各公司也利用併購來鞏固市場地位並獲得創新技術。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 慢性病和生活方式疾病盛行率上升

- 加強教育和公共衛生活動

- 個人化醫療日益進步

- 對月經健康和衛生療法的需求不斷增加

- 產業陷阱與挑戰

- 月經、不孕和更年期的社會恥辱

- 治療費用高

- 監管挑戰

- 市場機會

- 新興市場的擴張

- 預防性女性保健日益受到關注

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 女性健康領域的投資與融資格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 荷爾蒙療法

- 疼痛和症狀管理藥物

- GnRH調節劑

- 骨骼健康劑

- 代謝藥物

- 生育藥物

- 其他藥物類型

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 避孕

- 更年期和停經後管理

- 荷爾蒙失調

- 子宮內膜異位症和子宮肌瘤

- 生殖健康及生育保健

- 骨骼健康與骨質疏鬆症

- 其他應用

第7章:市場估計與預測:按藥物類型,2021 - 2034

- 主要趨勢

- 場外交易(OTC)

- 處方

第8章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 20歲以下

- 21-50

- 51歲以上

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線下通路

- 醫院藥房

- 零售藥局

- 其他線下門市

- 線上通路

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Allergan (AbbVie)

- Amgen

- Atossa Therapeutics

- Bayer

- Besins

- Cipla

- Evofem

- Ferring

- Gedeon Richter

- Johnson & Johnson

- Kissei Pharmaceutical

- Lupin

- Novartis

- Organon

- Pfizer

- Sanofi

- Shionogi

- Theramex

The Global Womens Health Therapeutics Market was valued at USD 44.6 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 69.5 billion by 2034.

Conditions like endometriosis, menopause-related issues, polycystic ovary syndrome (PCOS), and osteoporosis is increasingly common. This growing disease burden is pushing demand for more effective and targeted therapeutics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.6 Billion |

| Forecast Value | $69.5 Billion |

| CAGR | 4.7% |

Increasing Adoption of Hormonal Therapies

The hormonal therapies segment held a significant share in 2024, driven by the rising demand for treatments that address conditions such as menopause symptoms, endometriosis, and hormonal imbalances. As awareness grows around hormone replacement therapy (HRT) and the long-term health impacts of untreated hormonal issues, more women are seeking medical intervention. The market has seen continuous innovation in delivery mechanisms, including patches, gels, and sustained-release implants, which enhance patient compliance.

Rising Prevalence of Contraception

The contraception segment generated a sizeable share in 2024, driven by rising demand for both long-acting reversible contraceptives (LARCs) and non-hormonal options. Modern lifestyles, delayed family planning, and growing public health support for reproductive autonomy have fueled adoption across a broad demographic. The market is evolving beyond traditional oral contraceptives, with innovations in vaginal rings, intrauterine devices (IUDs), and injectable formats.

Prescription to Gain Traction

The prescription segment held a substantial share in 2024, owing to the clinical nature of most treatments for conditions like osteoporosis, fertility issues, and gynecological cancers. Physicians remain key decision-makers, and patient trust in prescribed medications continues to drive brand loyalty. Regulatory approval pathways, formulary positioning, and insurance coverage significantly impact sales performance in this segment.

North America to Emerge as a Propelling Region

North America womens health therapeutics market is poised to grow at a decent CAGR during 2025-2034. The region benefits from advanced healthcare infrastructure, strong regulatory oversight, and high awareness levels among both patients and providers. Market players are capitalizing on favorable reimbursement policies and rising demand for targeted treatments across various stages of a woman's life cycle, from adolescence to post-menopause.

Major players in the women's health therapeutics market are Theramex, Cipla, Kissei Pharmaceutical, Evofem, Pfizer, Shionogi, Ferring, Organon, Amgen, Besins, Allergan (AbbVie), Sanofi, Gedeon Richter, Lupin, Atossa Therapeutics, Novartis, Johnson & Johnson, and Bayer.

To strengthen their market foothold in the women's health therapeutics space, companies are focusing on a multi-pronged approach. Key strategies include expanding product pipelines through in-house R&D and licensing deals, particularly for underserved conditions such as uterine fibroids and female sexual dysfunction. Mergers and acquisitions are also being used to consolidate market presence and gain access to innovative technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Application

- 2.2.4 Medication type

- 2.2.5 Age group

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic and lifestyle diseases

- 3.2.1.2 Enhanced education and public health campaigns

- 3.2.1.3 Growing advancement in personalized medicine

- 3.2.1.4 Increasing demand for menstrual health and hygiene therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Social stigma around menstruation, infertility, and menopause

- 3.2.2.2 High treatment cost

- 3.2.2.3 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Growing focus on preventive women's healthcare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Investment and funding landscape in the women's health sector

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hormonal therapies

- 5.3 Pain and symptom management drugs

- 5.4 GnRH modulators

- 5.5 Bone health agents

- 5.6 Metabolic drugs

- 5.7 Fertility drugs

- 5.8 Other drug types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Contraception

- 6.3 Menopause and post-menopausal management

- 6.4 Hormonal disorders

- 6.5 Endometriosis and uterine fibroids

- 6.6 Reproductive health and fertility care

- 6.7 Bone health and osteoporosis

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Over the counter (OTC)

- 7.3 Prescription

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 20

- 8.3 21-50

- 8.4 51 and above

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channels

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline stores

- 9.3 Online channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Allergan (AbbVie)

- 11.2 Amgen

- 11.3 Atossa Therapeutics

- 11.4 Bayer

- 11.5 Besins

- 11.6 Cipla

- 11.7 Evofem

- 11.8 Ferring

- 11.9 Gedeon Richter

- 11.10 Johnson & Johnson

- 11.11 Kissei Pharmaceutical

- 11.12 Lupin

- 11.13 Novartis

- 11.14 Organon

- 11.15 Pfizer

- 11.16 Sanofi

- 11.17 Shionogi

- 11.18 Theramex