|

市場調查報告書

商品編碼

1833430

底座式開關設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pad Mounted Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

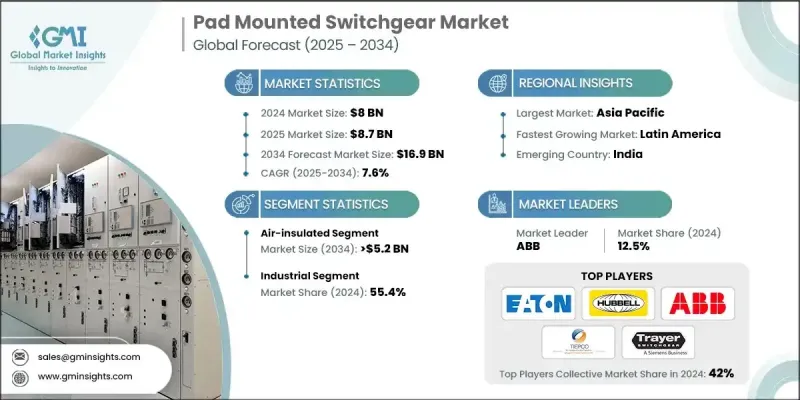

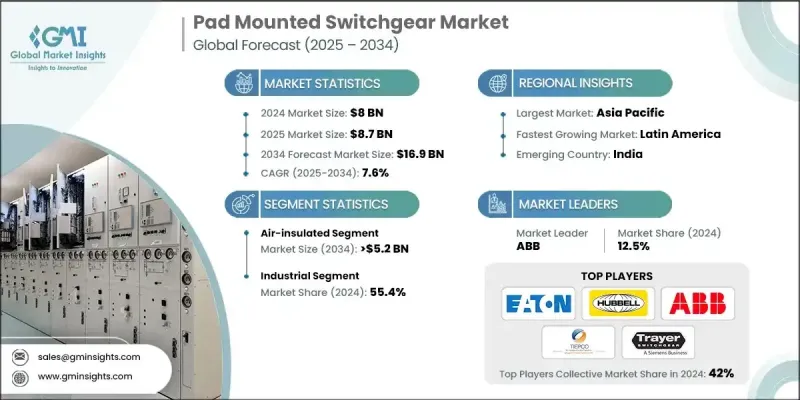

2024 年全球底座式開關設備市場價值為 80 億美元,預計到 2034 年將以 7.6% 的複合年成長率成長至 169 億美元。

城市基礎設施的持續擴張以及對高效能地下配電系統日益成長的需求是推動市場成長的主要因素。老化的電網(尤其是在大都市地區)正在推動現代化改造項目,這些項目傾向於緊湊可靠的開關設備系統。此外,智慧電網和數位化變電站的廣泛應用也為先進的開關設備整合創造了持續的機會。隨著電動車充電網路的普及,尤其是在高密度區域,對可靠且節省空間的電源管理系統的需求日益成長。政府對智慧基礎設施和環保發展的支持進一步提升了該市場的前景。商業和工業發展項目的不斷成長也促進了安裝量的增加。此外,隨著風能和太陽能等再生能源的部署不斷擴大,分散式電力系統變得越來越重要,從而推動了智慧開關設備的更廣泛部署。事實證明,具有感測器功能的基座式系統對於現代公用事業網路中的即時電網監控和預測性維護至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 80億美元 |

| 預測值 | 169億美元 |

| 複合年成長率 | 7.6% |

預計到2034年,氣體絕緣墊式安裝開關設備市場將以7%的複合年成長率成長。這一成長源於市場對緊湊、堅固、可在嚴苛環境條件下可靠運作的配電解決方案日益成長的需求。其密封結構和低維護設計使其成為空間有限且電力需求較高的地區的理想選擇。隨著城市電網的現代化升級,對安全性、性能和使用壽命更高的氣體絕緣解決方案的需求持續成長。

到2034年,商業領域的複合年成長率將達到8.2%。人口稠密地區的零售中心、商業房地產和大型資料設施的不斷發展,直接影響產品需求。這些系統因其佈局緊湊、易於部署和長期可靠性而備受青睞。隨著人們對安全性、能源效率和不間斷服務的期望不斷提高,底座式開關櫃正成為商業配電基礎設施的首選。

2024年,美國底座式開關設備市場規模達18億美元。電網彈性投資的不斷增加、新建公用事業規模基礎設施的建設以及全國範圍內更嚴格的合規要求是推動市場擴張的關鍵因素。隨著城鎮化進程的加速和電力可靠性標準的日益嚴格,對公用事業和商業開發商而言,高性能開關設備的需求日益迫切。

在全球箱式開關設備市場積極運作的關鍵參與者包括 Switchgear.US、Powell Industries、S&C Electric Company、Eaton、Trayer、ABB、Celeasco、Entec Electric & Electronic、Electro-Mechanical, LLC、G&W Electric、Maddox Industrial Transformer、nVent、Scott ManEPuring Ltd、HubTI 和 Elliott。為了鞏固市場地位,箱式開關設備製造商高度重視創新、產品客製化和全球佈局擴張。各公司正在投資智慧技術,整合感測器和數位介面,以支援即時診斷、預測性維護和遠端監控功能。與公用事業和基礎設施開發商建立策略聯盟,有助於擴大產品在智慧城市和工業中心的部署。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- > 5kV 至 ≤ 15 kV

- > 15千伏至≤25千伏

- > 25千伏至≤38千伏

第6章:市場規模及預測:依絕緣材料,2021 - 2034

- 主要趨勢

- 空氣

- 氣體

- 固體電介質

- 其他

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- Celeasco

- Eaton

- Electro-Mechanical, LLC

- Elliott

- Entec Electric & Electronic

- G&W Electric

- Hubbell

- Lucy Group Ltd

- Maddox Industrial Transformer

- nVent

- Powell Industries

- PRE Edward Biel

- S&C Electric Company

- Scott Manufacturing Solutions

- Switchgear.US

- TIEPCO

- Trayer

The Global Pad Mounted Switchgear Market was valued at USD 8 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 16.9 billion by 2034.

The continued expansion of urban infrastructure and the rising demand for efficient underground power distribution systems are major factors contributing to market growth. Aging electrical grids, particularly in metropolitan regions, are prompting modernization projects that favor compact and reliable switchgear systems. Moreover, the widespread adoption of smart grids and digital substations is creating consistent opportunities for advanced switchgear integration. With electric vehicle charging networks gaining ground, especially in high-density zones, the need for dependable and space-efficient power management systems is rising. Government support for intelligent infrastructure and environmentally conscious development further enhances the outlook for this market. The growing number of commercial and industrial developments also contributes to the increase in installations. Additionally, as renewable energy deployment, such as wind and solar, expands, decentralized power systems are becoming more critical, fueling greater deployment of intelligent switchgear. Pad-mounted systems with sensor-based capabilities are proving essential for real-time grid monitoring and predictive maintenance in modern utility networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 7.6% |

The gas-insulated pad mounted switchgear segment is projected to grow at a CAGR of 7% through 2034. This growth is driven by the rising need for compact and robust distribution solutions that perform reliably under challenging environmental conditions. Their sealed construction and low-maintenance design make them ideal for areas with limited space and higher power demand. As cities modernize their grid networks, the demand for gas-insulated solutions offering improved safety, performance, and longevity continues to rise.

The commercial segment will grow at a CAGR of 8.2% through 2034. The increasing development of retail hubs, commercial properties, and large-scale data facilities in populated regions is directly influencing product demand. These systems are favored for their compact layout, easy deployment, and long-term reliability. With increasing expectations around safety, energy efficiency, and uninterrupted service, pad-mounted switchgear is becoming the preferred choice in commercial power distribution infrastructure.

United States Pad Mounted Switchgear Market was valued at USD 1.8 billion in 2024. Rising investments in grid resilience, new utility-scale infrastructure, and stronger compliance requirements across the country are key contributors to market expansion. As urbanization accelerates and power reliability standards tighten, the need for high-performance switchgear has become increasingly critical for both utilities and commercial developers.

Key players actively operating in the global pad mounted switchgear market include Switchgear.US, Powell Industries, S&C Electric Company, Eaton, Trayer, ABB, Celeasco, Entec Electric & Electronic, Electro-Mechanical, LLC, G&W Electric, Maddox Industrial Transformer, nVent, Scott Manufacturing Solutions, TIEPCO, Lucy Group Ltd, Hubbell, PRE Edward Biel, and Elliott. To strengthen their market position, pad mounted switchgear manufacturers are heavily focused on innovation, product customization, and global footprint expansion. Companies are investing in smart technologies by integrating sensors and digital interfaces that support real-time diagnostics, predictive maintenance, and remote monitoring capabilities. Strategic alliances with utilities and infrastructure developers are helping expand product deployments in smart cities and industrial hubs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Voltage trends

- 2.1.3 Insulation trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 > 5kV to ≤ 15 kV

- 5.3 > 15 kV to ≤25 kV

- 5.4 > 25 kV to ≤ 38 kV

Chapter 6 Market Size and Forecast, By Insulation, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Air

- 6.3 Gas

- 6.4 Solid dielectric

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Celeasco

- 9.3 Eaton

- 9.4 Electro-Mechanical, LLC

- 9.5 Elliott

- 9.6 Entec Electric & Electronic

- 9.7 G&W Electric

- 9.8 Hubbell

- 9.9 Lucy Group Ltd

- 9.10 Maddox Industrial Transformer

- 9.11 nVent

- 9.12 Powell Industries

- 9.13 PRE Edward Biel

- 9.14 S&C Electric Company

- 9.15 Scott Manufacturing Solutions

- 9.16 Switchgear.US

- 9.17 TIEPCO

- 9.18 Trayer