|

市場調查報告書

商品編碼

1833427

連網摩托車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Connected Motorcycle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

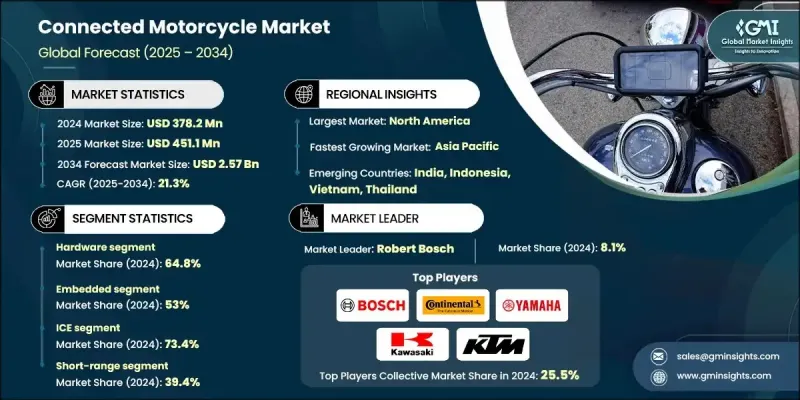

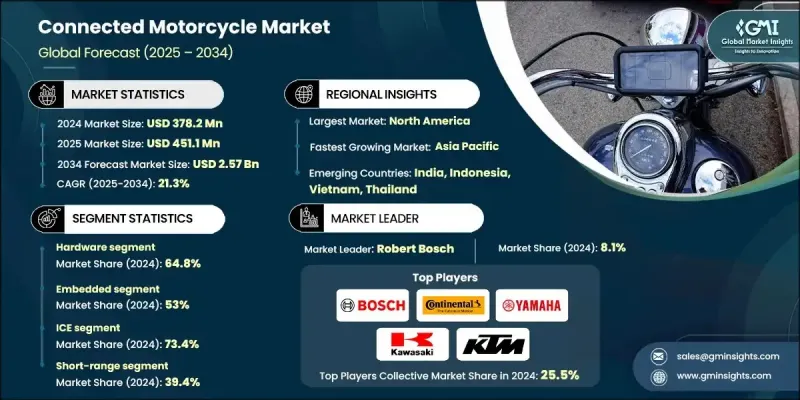

2024 年全球連網摩托車市場價值為 3.782 億美元,預計到 2034 年將以 21.3% 的複合年成長率成長至 25.7 億美元。

互聯摩托車的日益普及得益於碰撞預警、盲點監控和即時交通更新等安全功能。這些進步減少了事故發生,提高了騎乘者的使用率,並在消費市場和車隊市場催生了對嵌入式互聯解決方案的需求。電動摩托車和踏板車的普及進一步推動了互聯需求,使其能夠更好地管理電池、監控性能並實現無線更新。互聯摩托車也透過路線最佳化、預測性維護和即時追蹤等功能,為城市配送服務、叫車公司和物流車隊提供支援。基於訂閱的遠端資訊處理服務開闢了經常性收入的途徑,促進了有線或嵌入式互聯的使用,從而加速了這些車輛的商業市場。摩托車製造商正專注於整合感測器、攝影機和車聯網 (V2X) 通訊,以提高騎乘者安全性、提升營運效率並促進高級互聯功能的普及。這些系統擴大被設計為與智慧城市等智慧基礎設施無縫協作,從而在全球範圍內提供始終互聯的功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.782億美元 |

| 預測值 | 25.7億美元 |

| 複合年成長率 | 21.3% |

硬體領域在2024年佔據了64.8%的市場佔有率,預計到2034年將以20.7%的複合年成長率成長。 GNSS/GPS、加速度計等感測器以及高級駕駛輔助系統 (ARAS) 組件的整合,正在將摩托車轉變為高度互聯的車輛。這些感測器不僅提供安全功能,還能實現預測性維護和即時診斷,為駕駛者提供更完善的體驗。製造商目前正專注於開發緊湊、低功耗的遠端資訊處理控制單元 (TCU)、顯示器和通訊模組,以確保互聯互通,同時最大限度地減少對電池壽命和車輛性能的影響,尤其是在電動摩托車領域。

嵌入式系統細分市場在2024年佔據53%的市場佔有率,預計2025年至2034年的複合年成長率將達到22.6%。摩托車製造商擴大在其新車型中嵌入整合碰撞警報、盲點偵測和V2X通訊等先進功能的遠端資訊處理單元。這些系統需要持續的高頻寬連接,對於安全性和合規性以及提升騎乘體驗至關重要。基於智慧型手機的解決方案,尤其是在電動摩托車上,還支援自行車導航、騎乘記錄和性能分析等功能,進一步促進了該細分市場的成長。

2024年,美國連網摩托車市場佔87.4%,預計2025年至2034年的複合年成長率為23.2%。美國憑藉寶馬摩托車、哈雷戴維森、羅伯特·博世和大陸集團等主要公司的強大影響力,引領這一市場,這些公司在聯網摩托車解決方案的研發、分銷和整合方面擁有廣泛的經驗。電動摩托車的普及度也在不斷提升,其車型配備了先進的聯網功能,旨在滿足注重環保的消費者的需求,他們尋求與行動應用程式和導航系統無縫整合,以及即時診斷功能。

聯網摩托車市場的知名企業包括寶馬摩托車、杜卡迪、雅馬哈、川崎、本田、哈雷戴維森、KTM、比亞喬、羅伯特博世和大陸集團等。這些公司正在推動連網摩托車技術的創新,專注於提升騎乘體驗的安全性和性能。為了鞏固市場地位,連網摩托車行業的公司正在大力投資研發,將遠端資訊處理、V2X 通訊和 ARAS 等尖端技術融入他們的摩托車中。透過嵌入先進的安全系統和連網解決方案,他們為消費者提供了更高的價值主張。此外,許多公司專注於與行動應用程式和遠端資訊處理平台進行無縫整合,使騎士能夠監控和最佳化摩托車的性能。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預報

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 安全性和騎士輔助的採用率不斷提高。

- 電動摩托車(EV)的成長

- 擴大船隊規模和商業用途

- 政府法規和智慧旅行計劃

- 智慧型手機與物聯網的融合日益增強

- 產業陷阱與挑戰

- 連接系統成本高

- 資料安全和隱私問題

- 市場機會

- 電動摩托車的成長

- 車隊和商業應用

- 高級騎士輔助系統 (ARAS) 整合

- 售後市場和改裝市場

- 成長動力

- 技術與創新格局

- 人工智慧與機器學習整合

- 人工智慧驅動的騎士輔助系統

- 機器學習分析

- 人工智慧驅動的服務最佳化

- 5G與邊緣運算革命

- 5G網路整合優勢

- 邊緣運算實施

- 5G基礎設施準備評估

- 區塊鏈和分散式帳本技術

- 基於區塊鏈的服務平台

- 供應鍊和維護追蹤

- 共享旅遊和租賃應用

- 物聯網 (IoT) 和感測器整合

- 先進的感測器技術

- 物聯網平台整合

- 擴增實境與虛擬實境整合

- AR增強導航和訊息

- VR訓練與模擬應用

- 自動摩托車系統

- 自主技術發展現狀

- 自平衡和穩定系統

- 自主導航與控制

- 市場準備和採用時間表

- 數位孿生與仿真技術

- 數位孿生實施

- 基於模擬的服務

- 網路安全與資料保護

- 威脅評估和漏洞分析

- 安全實施策略

- 法規遵從性和標準

- 安全措施的成本效益分析

- 人工智慧與機器學習整合

- 成長潛力分析

- 監管格局

- 區域監管機構

- 網路安全法規與合規

- 合規成本分析及影響

- 責任與保險框架的演變

- 波特的分析

- PESTEL分析

- 專利分析

- 未來展望與市場顛覆

- 技術顛覆路線圖

- 市場演變情景

- 樂觀的成長前景

- 保守成長情景

- 中斷場景

- 價格趨勢

- 按地區

- 按組件

- 成本分解分析

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 硬體

- 交通控制單元

- 展示

- 感應器

- 其他

- 軟體

- 服務

- 專業服務

- 託管服務

第6章:市場估計與預測:依連結性,2021 - 2034

- 主要趨勢

- 嵌入式

- 繫留

- 售後市場

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 插電式混合動力

- 油電混合車

- 燃料電池電動車

- 純電動車

第8章:市場估計與預測:按網路,2021 - 2034 年

- 主要趨勢

- 蜂巢

- 短距離

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 私人的

- 商業的

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 荷蘭

- 俄羅斯

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 新加坡

- 韓國

- 泰國

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球領導者

- BMW 摩托車

- 杜卡迪

- 哈雷戴維森

- 本田

- 川崎

- KTM

- 雅馬哈

- 技術平台提供者

- 亞馬遜網路服務

- 美國電話電報公司

- 羅伯特·博世

- 大陸航空

- 愛立信

- 英特爾

- 微軟

- 高通科技公司

- 威瑞森通訊

- 區域冠軍和新興玩家

- 巴賈吉汽車

- 悟五郎

- 英雄摩托車公司

- 閃電摩托車

- 比亞喬

- 皇家恩菲爾德

- TVS 汽車公司

- 零摩托車

The Global Connected Motorcycle Market was valued at USD 378.2 million in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 2.57 billion by 2034.

The growing adoption of connected motorcycles is driven by safety features, such as collision warnings, blind-spot monitoring, and real-time traffic updates. These advancements reduce accidents, increase rider adoption, and create demand for embedded connectivity solutions across both consumer and fleet markets. The expansion of electric motorcycles and scooters further fuels the demand for connectivity, allowing for better battery management, performance monitoring, and over-the-air updates. Connected motorcycles also support urban delivery services, ride-hailing companies, and logistics fleets by enabling route optimization, predictive maintenance, and real-time tracking. The subscription-based telematics services have opened avenues for recurring revenue, promoting the use of tethered or embedded connectivity, which is accelerating the commercial market for these vehicles. Motorcycle manufacturers are focusing on integrating sensors, cameras, and Vehicle-to-Everything (V2X) communication to improve rider safety, enhance operational efficiency, and increase the adoption of advanced connectivity features. These systems are increasingly being designed to work seamlessly with smart infrastructure, such as smart cities, to offer always-connected capabilities globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $378.2 Million |

| Forecast Value | $2.57 Billion |

| CAGR | 21.3% |

The hardware segment held a 64.8% share in 2024 and is anticipated to grow at a CAGR of 20.7% through 2034. The integration of sensors like GNSS/GPS, accelerometers, and components of Advanced Rider Assistance Systems (ARAS) is transforming motorcycles into highly connected vehicles. These sensors not only provide safety features but also enable predictive maintenance and real-time diagnostics, offering a more sophisticated experience for riders. Manufacturers are now focusing on developing compact, low-power telematics control units (TCUs), displays, and communication modules to ensure connectivity while minimizing the impact on battery life and vehicle performance, especially in the electric motorcycle sector.

The embedded systems segment held a share of 53% in 2024 and is expected to grow at a CAGR of 22.6% from 2025 to 2034. Motorcycle manufacturers are increasingly embedding telematics units that incorporate advanced features like collision alerts, blind-spot detection, and V2X communication in their new models. These systems demand constant, high-bandwidth connectivity and have become essential for safety and compliance features as well as for enhancing the rider experience. Smartphone-based solutions, particularly on electric motorcycles, also allow for functions such as bike navigation, ride logging, and performance analytics, further contributing to the segment's growth.

U.S. Connected Motorcycle Market held 87.4% in 2024, with a forecasted CAGR of 23.2% from 2025 to 2034. The U.S. leads this market due to the strong presence of key companies such as BMW Motorrad, Harley-Davidson, Robert Bosch, and Continental, which have extensive R&D, distribution, and integration of connected motorcycle solutions. The popularity of electric motorcycles is also rising, with models featuring advanced connectivity capabilities, designed to meet the demands of environmentally conscious consumers who seek seamless integration with mobile apps and navigation systems, as well as real-time diagnostic features.

Prominent players in the Connected Motorcycle Market include companies like BMW Motorrad, Ducati, Yamaha, Kawasaki, Honda, Harley-Davidson, KTM, Piaggio, Robert Bosch, and Continental. These companies are driving innovation in connected motorcycle technologies, focusing on safety and performance features that enhance the riding experience. To strengthen their market position, companies in the connected motorcycle industry are investing heavily in research and development to integrate cutting-edge technologies such as telematics, V2X communication, and ARAS into their motorcycles. By embedding advanced safety systems and connectivity solutions, they are offering a higher value proposition to consumers. In addition, many companies are focusing on creating seamless integration with mobile apps and telematics platforms, allowing riders to monitor and optimize their motorcycles' performance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Connectivity

- 2.2.4 Propulsion

- 2.2.5 Network

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

- 2.6.1 Supply chain diversification strategy

- 2.6.2 Product portfolio enhancement

- 2.6.3 Partnership and alliance opportunities

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising safety and rider assistance adoption.

- 3.2.1.2 Growth of electric motorcycles (EVs)

- 3.2.1.3 Expansion of fleet and commercial use

- 3.2.1.4 Government regulations and smart mobility initiatives

- 3.2.1.5 Increasing smartphone and IOT integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of connected systems

- 3.2.2.2 Data security and privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Electric motorcycle growth

- 3.2.3.2 Fleet and commercial applications

- 3.2.3.3 Advanced rider assistance systems (ARAS) integration

- 3.2.3.4 Aftermarket and retrofit market

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.3.1 Artificial Intelligence & Machine Learning Integration

- 3.3.1.1 AI-powered rider assistance systems

- 3.3.1.2 Machine learning analytics

- 3.3.1.3 AI-driven service optimization

- 3.3.2 5G & Edge Computing Revolution

- 3.3.2.1 5G network integration benefits

- 3.3.2.2 Edge computing implementation

- 3.3.2.3 5G infrastructure readiness assessment

- 3.3.3 Blockchain & Distributed Ledger Technology

- 3.3.3.1 Blockchain-based service platforms

- 3.3.3.2 Supply chain & maintenance tracking

- 3.3.3.3 Shared mobility & rental applications

- 3.3.4 Internet of Things (IoT) & Sensor Integration

- 3.3.4.1 Advanced sensor technologies

- 3.3.4.2 IoT platform integration

- 3.3.5 Augmented Reality & Virtual Reality Integration

- 3.3.5.1 AR-enhanced navigation & information

- 3.3.5.2 VR training & simulation applications

- 3.3.6 Autonomous Motorcycle Systems

- 3.3.6.1 Autonomous technology development status

- 3.3.6.2 Self-balancing & stability systems

- 3.3.6.3 Autonomous navigation & control

- 3.3.6.4 Market readiness & adoption timeline

- 3.3.7 Digital Twin & Simulation Technology

- 3.3.7.1 Digital twin implementation

- 3.3.7.2 Simulation-based services

- 3.3.8 Cybersecurity & Data Protection

- 3.3.8.1 Threat assessment & vulnerability analysis

- 3.3.8.2 Security implementation strategies

- 3.3.8.3 Regulatory compliance & standards

- 3.3.8.4 Cost-benefit analysis of security measures

- 3.3.1 Artificial Intelligence & Machine Learning Integration

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Regional regulatory landscape

- 3.5.2 Cybersecurity regulations & compliance

- 3.5.3 Compliance cost analysis & impact

- 3.5.4 Liability & insurance framework evolution

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Future Outlook & Market Disruption

- 3.9.1 Technology Disruption Roadmap

- 3.9.2 Market Evolution Scenarios

- 3.9.2.1 Optimistic Growth Scenario

- 3.9.2.2 Conservative Growth Scenario

- 3.9.2.3 Disruption Scenario

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By Component

- 3.11 Cost breakdown analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 TCU

- 5.2.2 Display

- 5.2.3 Sensors

- 5.2.4 Others

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional service

- 5.4.2 Managed service

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Aftermarket

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.3.1 PHEV

- 7.3.2 HEV

- 7.3.3 FCEV

- 7.3.4 BEV

Chapter 8 Market Estimates & Forecast, By Network, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Cellular

- 8.3 Short range

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Private

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 Australia

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Indonesia

- 10.4.5 Japan

- 10.4.6 Singapore

- 10.4.7 South Korea

- 10.4.8 Thailand

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1.1 Global Leaders

- 11.1.1.1 BMW Motorrad

- 11.1.1.2 Ducati

- 11.1.1.3 Harley-Davidson

- 11.1.1.4 Honda

- 11.1.1.5 Kawasaki

- 11.1.1.6 KTM

- 11.1.1.7 Yamaha

- 11.1.2 Technology Platform Providers

- 11.1.2.1 Amazon Web Services

- 11.1.2.2 AT&T

- 11.1.2.3 Robert Bosch

- 11.1.2.4 Continental

- 11.1.2.5 Ericsson

- 11.1.2.6 Intel

- 11.1.2.7 Microsoft

- 11.1.2.8 Qualcomm Technologies

- 11.1.2.9 Verizon Communications

- 11.1.3 Regional Champions & Emerging Players

- 11.1.3.1 Bajaj Auto

- 11.1.3.2 Gogoro

- 11.1.3.3 Hero MotoCorp

- 11.1.3.4 Lightning Motorcycles

- 11.1.3.5 Piaggio

- 11.1.3.6 Royal Enfield

- 11.1.3.7 TVS Motor Company

- 11.1.3.8 Zero Motorcycles