|

市場調查報告書

商品編碼

1833422

防靜電泡棉包裝市場機會、成長動力、產業趨勢分析及2025-2034年預測Anti-Static Foam Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

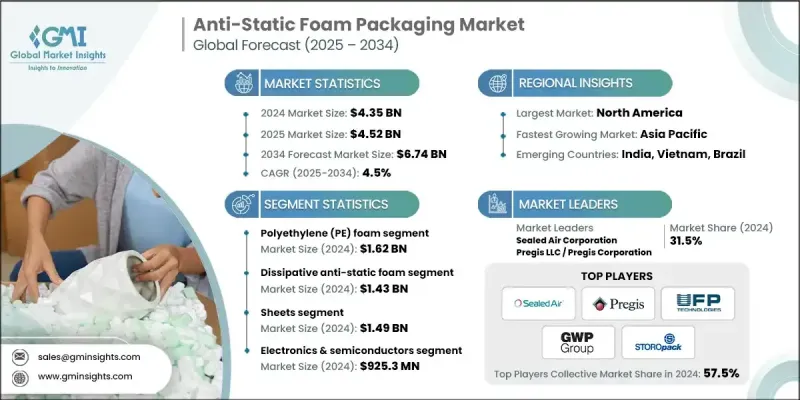

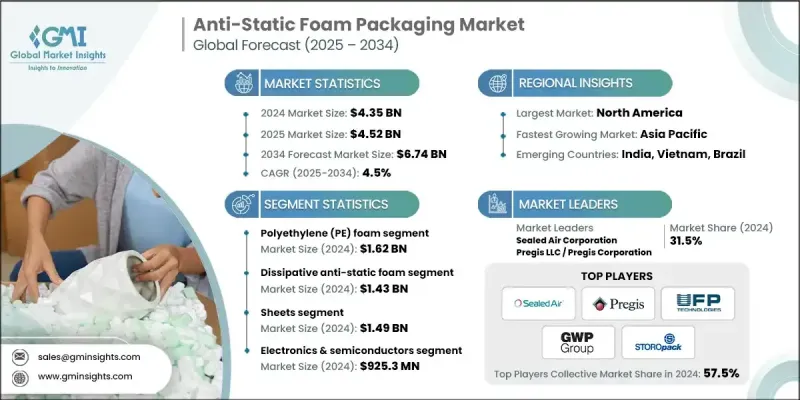

2024 年全球防靜電泡棉包裝市場價值為 43.5 億美元,預計到 2034 年將以 4.5% 的複合年成長率成長至 67.4 億美元。

半導體、電路板和消費性電子產品等敏感電子設備的成長推動了對防靜電泡沫包裝的需求,以防止在儲存和運輸過程中因靜電放電而造成的損壞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 43.5億美元 |

| 預測值 | 67.4億美元 |

| 複合年成長率 | 4.5% |

聚乙烯(PE)泡沫的採用率不斷上升

聚乙烯 (PE) 泡棉憑藉其輕質特性、緩衝性能和優異的抗靜電性能,在 2024 年佔據了顯著的市場佔有率。 PE 泡棉廣泛用於保護精密電子元件,其設計和應用靈活性高,適用於客製化插件、托盤和包裝。隨著對經濟高效的防護材料的需求不斷成長,該領域在製造商和供應商中持續成長。

床單需求不斷成長

板材細分市場在2024年實現了永續的市場佔有率,這得益於其多功能性和易於自訂的特性。這些板材非常適合切割成各種工業和消費應用中的插件、隔板和保護層。此細分市場受益於倉儲、運輸和組裝環節日益成長的需求,在這些環節中,防止零件靜電積聚至關重要。

電子和半導體產業將獲得發展動力

到2034年,電子和半導體領域將保持顯著成長,這得益於防止靜電放電損壞微晶片、處理器和印刷電路板等高靈敏度設備的需求。隨著技術變得越來越緊湊和性能越來越高,包裝精度和保護變得比以往任何時候都更加重要。服務於該領域的公司正在開發具有更嚴格靜電控制規範的泡沫解決方案,並整合無塵室包裝、配套和合規性測試等增值服務,以支援半導體製造和物流的品質保證。

北美將成為推動力地區

由於其強大的電子製造生態系統和完善的物流基礎設施,北美防靜電泡沫包裝市場在2024年保持持續成長。該地區擁有多家關鍵企業,是包裝技術創新的中心。監管部門對產品安全的重視,加上敏感電子產品的高價值出口,將持續推動市場成長。

防靜電泡棉包裝市場的主要參與者有 Kaneka Corporation、Foam Fabricators, Inc.、GWP Group Limited、Antistat、Pregis Corporation、UFP Technologies, Inc.、Conductive Containers, Inc. (CCI)、Flexipol Foams Pvt. Ltd.、Storoion Hans Reichenecker Gth、Richenecker NVS、Rectic. AB、BASF SE、Polymer Packaging Inc.、Tekni-Plex, Inc.、Protective Packaging Corporation、Sonoco Products Company 和 ACH Foam Technologies。

為了鞏固其在防靜電泡棉包裝市場的地位,各公司正採取以創新、永續性和以客戶為中心的服務為中心的策略。許多公司正在投資環保材料和可回收泡沫,以滿足日益成長的環保需求。其他公司則透過精密切割技術和模組化包裝系統來增強產品客製化。與電子產品製造商和物流供應商的策略合作有助於簡化供應鏈並確保長期合約的簽訂。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 電子和半導體製造業蓬勃發展

- 全球電子產品電子商務的興起

- 汽車電子產品的擴展和電動車的普及

- 微型化、ESD敏感元件的激增

- 航太、國防和醫療器材包裝的應用

- 產業陷阱與挑戰

- 生產和材料成本高

- 環境問題和回收限制

- 市場機會

- 新興地區半導體工廠的擴張

- 人工智慧和機器學習在光刻製程控制中的整合

- 高數值孔徑EUV技術的發展

- 對先進封裝和 3D IC 的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 公司簡介 市佔率分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 關鍵參與者的競爭基準化分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理分佈比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依材料類型,2021 - 2034 年

- 聚乙烯(PE)泡沫

- 聚氨酯(PU)泡沫

- 聚丙烯(PP)泡沫

- 其他材質(例如 PVC、ESD 波紋泡棉)

第6章:市場估計與預測:依產品類型,2021-2034 年

- 導電防靜電泡沫

- 耗散防靜電泡沫

- 屏蔽防靜電泡沫

- 靜電中性泡沫

第7章:市場估計與預測:依形式,2021 - 2034

- 工作表

- 麵包捲

- 包包和小袋

- 插入件和托盤

- 客製化形狀(模切、模壓)

第 8 章:市場估計與預測:按最終用途產業,2021-2034 年

- 電子與半導體

- 汽車

- 消費性電器

- 航太與國防

- 醫療保健和醫療器械

- 工業設備

- 其他(例如電信、再生能源)

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 魚子

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 羅拉塔姆

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 羅馬

第10章:公司簡介

- Sealed Air Corporation

- Pregis Corporation

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Conductive Containers, Inc. (CCI)

- Antistat

- Nefab AB

- Polymer Packaging Inc.

- ACH Foam Technologies

- Foam Fabricators, Inc.

- BASF SE

- Dow Chemical Company

- Kaneka Corporation

- Recticel NV

- Tekni-Plex, Inc.

- DS Smith Plc

- UFP Technologies, Inc.

- GWP Group Limited

- Protective Packaging Corporation

- Flexipol Foams Pvt. Ltd.

The Global Anti-Static Foam Packaging Market was valued at USD 4.35 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 6.74 billion by 2034.

The growth of sensitive electronic devices such as semiconductors, circuit boards, and consumer electronics drives the need for anti-static foam packaging to prevent damage from electrostatic discharge during storage and transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.35 Billion |

| Forecast Value | $6.74 Billion |

| CAGR | 4.5% |

Rising Adoption of Polyethylene (PE) Foam

The polyethylene (PE) foam segment held a notable share in 2024, owing to its lightweight nature, cushioning ability, and excellent resistance to static discharge. Widely used for protecting delicate electronic components, PE foam provides flexibility in both design and application, making it suitable for custom inserts, trays, and wraps. With a growing demand for cost-effective protective materials, this segment continues to gain momentum among manufacturers and suppliers.

Increasing Demand for Sheets

The sheets segment generated a sustainable share in 2024, backed by its versatility and ease of customization. These sheets are ideal for cutting into inserts, dividers, and protective layers used in various industrial and consumer applications. The segment benefits from rising demand across warehousing, shipping, and assembly operations where component protection against static buildup is critical.

Electronics & Semiconductors to Gain Traction

The electronics and semiconductors segment will grow at a significant rate through 2034, driven by the need to prevent electrostatic discharge damage to highly sensitive devices like microchips, processors, and PCBs. As technology becomes more compact and performance-intensive, packaging precision and protection have become more critical than ever. Companies serving this segment are developing foam solutions with tighter static control specifications and integrating value-added services such as cleanroom packaging, kitting, and compliance testing to support quality assurance in semiconductor manufacturing and logistics.

North America to Emerge as a Propelling Region

North America anti-static foam packaging market held sustained growth in 2024, owing to its robust electronics manufacturing ecosystem and well-established logistics infrastructure. The region is home to several key players and serves as a hub for innovation in packaging technology. Regulatory focus on product safety, coupled with high-value exports of sensitive electronics, continues to fuel market growth.

Major players in the anti-static foam packaging market are Kaneka Corporation, Foam Fabricators, Inc., GWP Group Limited, Antistat, Pregis Corporation, UFP Technologies, Inc., Conductive Containers, Inc. (CCI), Flexipol Foams Pvt. Ltd., Storopack Hans Reichenecker GmbH, Recticel NV, DS Smith Plc, Dow Chemical Company, Sealed Air Corporation, Nefab AB, BASF SE, Polymer Packaging Inc., Tekni-Plex, Inc., Protective Packaging Corporation, Sonoco Products Company, and ACH Foam Technologies.

To strengthen their position in the anti-static foam packaging market, companies are adopting strategies centered around innovation, sustainability, and customer-centric service. Many are investing in eco-friendly materials and recyclable foams to meet growing environmental expectations. Others are enhancing product customization through precision cutting technologies and modular packaging systems. Strategic collaborations with electronics manufacturers and logistics providers help streamline supply chains and secure recurring contracts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Material Type

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 End use Industry

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Boom in electronics and semiconductor manufacturing

- 3.2.1.2 Rise in global e-commerce for electronics

- 3.2.1.3 Expansion of automotive electronics and ev adoption

- 3.2.1.4 Proliferation of miniaturized, ESD-sensitive components

- 3.2.1.5 Adoption in aerospace, defense, and medical device packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Production and Material Costs

- 3.2.2.2 Environmental Concerns and Recycling Limitations

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion of semiconductor fabs in emerging regions

- 3.2.3.2 Integration of AI and machine learning in lithography process control

- 3.2.3.3 Development of High-NA EUV technology

- 3.2.3.4 Growing demand for advanced packaging and 3D ICs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Million)

- 5.1 Polyethylene (PE) Foam

- 5.2 Polyurethane (PU) Foam

- 5.3 Polypropylene (PP) Foam

- 5.4 Other Materials (e.g., PVC, ESD corrugated foam)

Chapter 6 Market estimates & forecast, By Product Type, 2021 - 2034 (USD Million)

- 6.1 Conductive Anti-Static Foam

- 6.2 Dissipative Anti-Static Foam

- 6.3 Shielding Anti-Static Foam

- 6.4 Static-Neutral Foam

Chapter 7 Market estimates & forecast, By Form, 2021 - 2034 (USD Million)

- 7.1 Sheets

- 7.2 Rolls

- 7.3 Bags & Pouches

- 7.4 Inserts & Trays

- 7.5 Custom Shapes (Die-cut, Molded)

Chapter 8 Market estimates & forecast, By End use Industry, 2021-2034 (USD Million)

- 8.1 Electronics & Semiconductors

- 8.2 Automotive

- 8.3 Consumer Appliances

- 8.4 Aerospace & Defense

- 8.5 Healthcare & Medical Devices

- 8.6 Industrial Equipment

- 8.7 Others (e.g., telecom, renewable energy)

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.3.7 ROE

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 RoAPAC

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 RoLATAM

- 9.6 Middle East & Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

- 9.6.4 RoMEA

Chapter 10 Company Profile

- 10.1 Sealed Air Corporation

- 10.2 Pregis Corporation

- 10.3 Sonoco Products Company

- 10.4 Storopack Hans Reichenecker GmbH

- 10.5 Conductive Containers, Inc. (CCI)

- 10.6 Antistat

- 10.7 Nefab AB

- 10.8 Polymer Packaging Inc.

- 10.9 ACH Foam Technologies

- 10.10 Foam Fabricators, Inc.

- 10.11 BASF SE

- 10.12 Dow Chemical Company

- 10.13 Kaneka Corporation

- 10.14 Recticel NV

- 10.15 Tekni-Plex, Inc.

- 10.16 DS Smith Plc

- 10.17 UFP Technologies, Inc.

- 10.18 GWP Group Limited

- 10.19 Protective Packaging Corporation

- 10.20 Flexipol Foams Pvt. Ltd.