|

市場調查報告書

商品編碼

1833421

滑動托盤盒市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Slide Tray Box Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

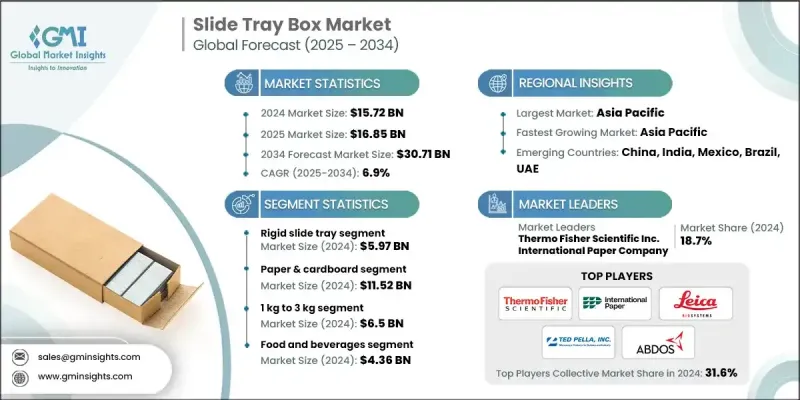

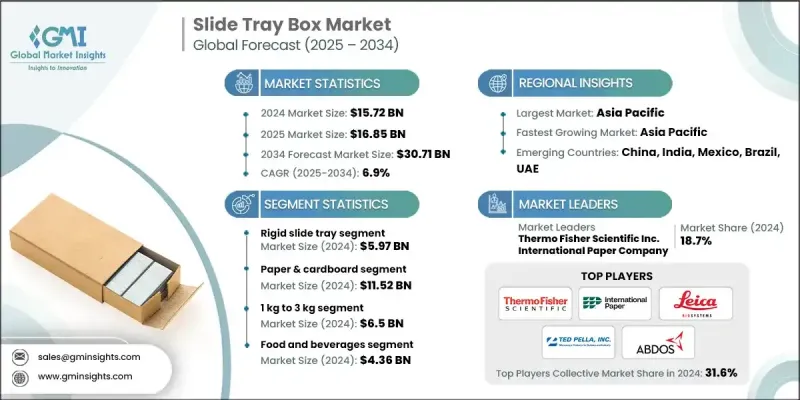

2024 年全球滑動托盤盒市場價值為 157.2 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 307.1 億美元。

推動這一成長的因素包括:消費者對提升開箱體驗的高階包裝需求日益成長,日益成長的環保意識推動永續包裝替代品的開發,以及電子商務和直銷管道的蓬勃發展。各大品牌正增加對高影響力包裝設計的投入,以提升產品認知度並提升顧客互動。滑動托盤盒常用於奢侈品、電子產品、化妝品和特色食品市場,兼具耐用的結構和高階的美感。它們是展示精緻飾面、獨立隔層和保護性內襯產品的首選。永續性是另一個主要催化劑,法規和不斷變化的買家價值觀鼓勵使用可回收材料,例如牛皮紙、瓦楞紙或多層紙板。隨著履行速度和客製化成為品牌策略的核心,全球市場對滑動托盤盒等靈活、堅固且外觀醒目的包裝的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 157.2億美元 |

| 預測值 | 307.1億美元 |

| 複合年成長率 | 6.9% |

2024年,硬質滑動托盤市場產值達到59.7億美元,這得益於其在電子產品、個人護理和禮品等高階產品領域的日益普及。這些托盤盒透過層壓紙板結構、柔軟觸感塗層和精密表面處理,不斷提升其性能,以吸引高階消費者。製造商正在與品牌進行聯合創作,以提供快速週轉、季節性或網紅主導的系列產品,使其在線上和零售環境中都能在視覺和戰術上脫穎而出。

2024年,紙質和紙板滑動托盤盒市場規模達115.2億美元。瓦楞紙結構和多層紙板設計的進步,正在幫助品牌同時滿足其可回收性和視覺呈現的需求。這些材料解決方案正被用作塑膠的永續替代品,且不會損害其耐用性和貨架吸引力。

2024年,美國滑動托盤盒市場規模達31.9億美元,複合年成長率達5.6%。零售包裝趨勢的上升、D2C品牌的快速成長以及消費者對永續解決方案日益成長的偏好,共同推動了美國滑動托盤盒市場的成長。個人護理、電子產品和美食等行業紛紛採用滑動托盤盒形式,打造獨特而奢華的開箱體驗。燙金、磁扣和紋理覆膜等精加工技術正逐漸成為主流,促使當地製造商採用數位印刷機和半自動塗膠系統建造模組化生產裝置,以高效地處理小批量、以設計為中心的生產任務。

活躍於載玻片托盤盒市場的主要參與者包括徠卡生物系統公司 Nussloch GmbH、希思羅科學公司 (Heathrow Scientific)、泰德佩拉公司 (Ted Pella, Inc.)、分子生物學產品公司 (Molecular Biology Products Inc. (MBPS)、ProSciTech、Abdos Labtech Private Limited、科學科技公司 (Hurst Scient)、Labtech 公司 (International (Internology)、國際紙業公司 (International)、國際紙業公司 (International)、國際紙業公司 (International (Hurst)、科學科技公司 (Internology)、國際紙業公司 (Internettech Private)、國際紙業公司 (International)、國際紙業公司 (Internology)、國際紙業公司 (Internology)、國際紙業公司 (Internology)、國際紙業公司 (Hurational)、Labtech Private) Company)、賽默飛世爾科技公司 (Thermo Fisher Scientific Inc.) 和 Agar Scientific Ltd.。 領先的公司正致力於永續發展,轉向可回收和可生物分解的材料,以滿足監管和消費者的期望。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對優質品牌和開箱體驗的需求不斷成長

- 永續性和監管推動環保包裝

- 電子商務和直接面對消費者 (D2C) 品牌蓬勃發展

- 包裝設計的客製化和靈活性

- 奢侈品和禮品市場的成長

- 產業陷阱與挑戰

- 生產和供應鏈成本高

- 自動化製造的可擴展性有限

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 公司簡介 市佔率分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 關鍵參與者的競爭基準化分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理分佈比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 剛性滑動托盤盒

- 可折疊滑動托盤盒

- 窗戶滑動托盤盒

- 磁性載玻片托盤盒

第6章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 紙張和紙板

- 維珍董事會

- 再生板

- 牛皮紙基

- 塑膠

- 寵物

- PVC

- 可生物分解塑膠

- 金屬

- 錫

- 鋁

- 木頭

第7章:市場估計與預測:按產能,2021 - 2034

- 主要趨勢

- 最多 1 公斤

- 1公斤至3公斤

- 3公斤至5公斤

- 5公斤以上

第 8 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 消費性電子產品

- 化學品

- 製藥和醫療保健

- 消費品

- 個人護理和化妝品

- 服裝和配件

- 文具及禮品

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 荷蘭

- 魚子

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太區

- 拉丁美洲

- 巴西

- 墨西哥

- 羅拉塔姆

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 羅馬

第10章:公司簡介

- 全球參與者

- Merck

- International Paper Company

- Leica Biosystems Nussloch GmbH

- Thermo Fisher Scientific Inc.

- 區域參與者

- Abdos Labtech Private Limited

- Agar Scientific Ltd.

- Heathrow Scientific

- Heinrich Buhl GmbH

- Hurst Scientific

- Molecular Biology Products Inc. (MBPS)

- Ted Pella, Inc.

- 新興玩家

- Duke Packaging

- ProSciTech

The Global Slide Tray Box Market was valued at USD 15.72 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 30.71 billion by 2034.

The growth is driven by increasing consumer demand for premium packaging that enhances unboxing experiences, rising environmental concerns pushing sustainable packaging alternatives, and the booming presence of e-commerce and direct-to-consumer channels. Brands are increasingly investing in high-impact packaging designs to improve product perception and elevate customer interaction. Slide tray boxes, often used in luxury, electronics, cosmetics, and specialty food markets, offer both a durable structure and a high-end aesthetic. They are a top choice for showcasing products with refined finishes, separate compartments, and protective inner linings. Sustainability is another major catalyst, with regulations and shifting buyer values encouraging the use of recyclable materials such as kraft, corrugated, or layered paperboard. As fulfillment speed and customization become central to brand strategies, the demand for flexible, sturdy, and visually striking packaging like slide tray boxes continues to rise across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.72 billion |

| Forecast Value | $30.71 billion |

| CAGR | 6.9% |

The rigid slide tray segment generated USD 5.97 billion in 2024, driven by its rising use in premium product segments like electronics, personal care, and gifting. These boxes are increasingly enhanced through layered board construction, soft-touch coatings, and precision finishes that appeal to upscale consumers. Manufacturers are tapping into co-creation with brands to deliver quick-turn, seasonal, or influencer-led collections that stand out visually and tactically in both online and retail environments.

The paper & cardboard-based slide tray boxes segment was valued at USD 11.52 billion in 2024. Advancements in corrugated structures and multi-layer board designs are helping brands meet their recyclability and visual presentation needs simultaneously. These material solutions are being adopted as sustainable alternatives to plastic without compromising durability or shelf appeal.

U.S. Slide Tray Box Market was valued at USD 3.19 billion in 2024, growing at a CAGR of 5.6%. Growth across the U.S. is influenced by elevated retail packaging trends, fast growth in D2C brand launches, and mounting consumer preference for sustainable solutions. Sectors such as personal care, electronics, and gourmet foods use slide tray formats to create unique and luxurious unboxing experiences. Finishing techniques like foil stamping, magnetic closures, and textured laminates are becoming mainstream, driving local manufacturers to install modular production setups using digital presses and semi-automated gluing systems to handle small-volume, design-centric runs efficiently.

Key players active in the Slide Tray Box Market include Leica Biosystems Nussloch GmbH, Heathrow Scientific, Ted Pella, Inc., Molecular Biology Products Inc. (MBPS), ProSciTech, Abdos Labtech Private Limited, Hurst Scientific, International Paper Company, Thermo Fisher Scientific Inc., and Agar Scientific Ltd. Leading firms are focusing on sustainability by shifting toward recyclable and biodegradable materials, meeting both regulatory and consumer expectations. Partnerships with luxury brands, electronics companies, and D2C labels help drive co-branded, customized packaging solutions. Players are also investing in advanced printing technologies, automation, and short-run digital equipment to enhance production agility and precision.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Product type

- 2.2.2 Material type

- 2.2.3 Capacity

- 2.2.4 End use industry

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for premium branding & unboxing experience

- 3.2.1.2 Sustainability and regulatory push toward eco-friendly packaging

- 3.2.1.3 Boom in e-commerce and direct-to-consumer (D2C) brands

- 3.2.1.4 Customization and flexibility in packaging design

- 3.2.1.5 Growth of the luxury and gifting market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and supply chain costs

- 3.2.2.2 Limited scalability in automated manufacturing

- 3.2.3 Market Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Rigid slide tray boxes

- 5.3 Foldable slide tray boxes

- 5.4 Window slide tray boxes

- 5.5 Magnetic slide tray boxes

Chapter 6 Market estimates & forecast, By Material Type, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Paper & cardboard

- 6.2.1 Virgin board

- 6.2.2 Recycled board

- 6.2.3 Kraft paper-based

- 6.3 Plastic

- 6.3.1 PET

- 6.3.2 PVC

- 6.3.3 Biodegradable plastics

- 6.4 Metal

- 6.4.1 Tin

- 6.4.2 Aluminum

- 6.5 Wood

Chapter 7 Market estimates & forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Up to 1 Kg

- 7.3 1 Kg to 3 Kg

- 7.4 3 Kg to 5 Kg

- 7.5 Above 5 Kg

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Consumer electronics

- 8.4 Chemicals

- 8.5 Pharmaceuticals and healthcare

- 8.6 Consumer goods

- 8.6.1 Personal care & cosmetics

- 8.6.2 Apparel & accessories

- 8.6.3 Stationery & gifts

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Netherlands

- 9.3.6 ROE

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 RoAPAC

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 RoLATAM

- 9.6 Middle East & Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

- 9.6.4 RoMEA

Chapter 10 Company Profile

- 10.1 Global Players

- 10.1.1 Merck

- 10.1.2 International Paper Company

- 10.1.3 Leica Biosystems Nussloch GmbH

- 10.1.4 Thermo Fisher Scientific Inc.

- 10.2 Regional Players

- 10.2.1 Abdos Labtech Private Limited

- 10.2.2 Agar Scientific Ltd.

- 10.2.3 Heathrow Scientific

- 10.2.4 Heinrich Buhl GmbH

- 10.2.5 Hurst Scientific

- 10.2.6 Molecular Biology Products Inc. (MBPS)

- 10.2.7 Ted Pella, Inc.

- 10.3 Emerging Players

- 10.3.1 Duke Packaging

- 10.3.2 ProSciTech