|

市場調查報告書

商品編碼

1833418

風力渦輪機齒輪箱維修和翻新市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wind Turbine Gearbox Repair and Refurbishment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

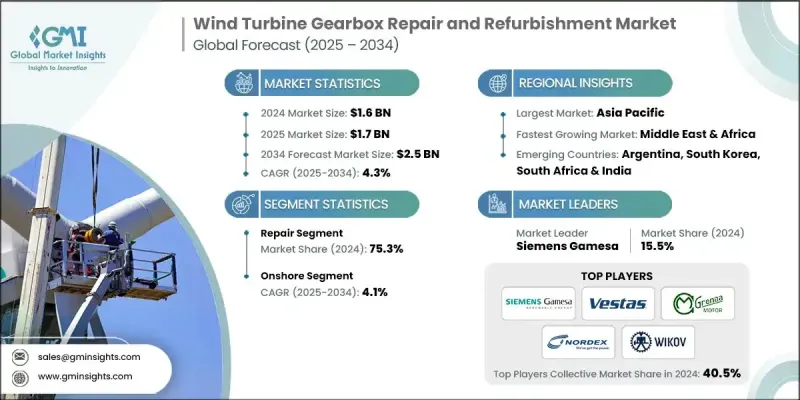

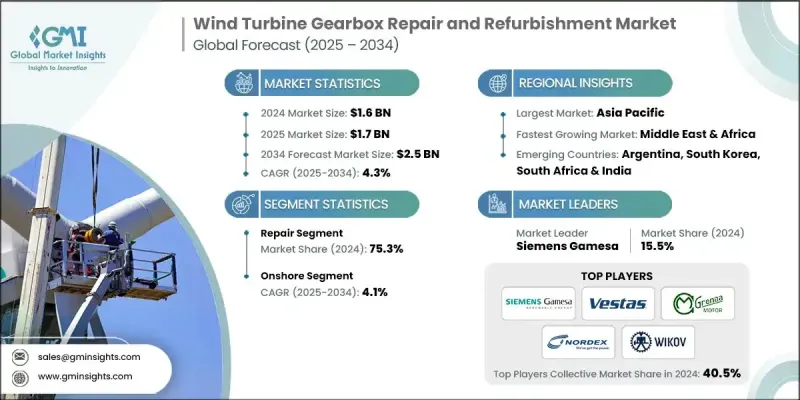

2024 年全球風力渦輪機齒輪箱維修和翻新市場價值為 16 億美元,預計到 2034 年將以 4.3% 的複合年成長率成長至 25 億美元。

隨著全球風力渦輪機群的老化,許多渦輪機面臨性能下降和機械故障,尤其是齒輪箱。這推動了對維修和翻新服務的需求,以延長現有資產的使用壽命並提高能源生產效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 4.3% |

維修領域需求不斷成長

隨著車輛老化和磨損,維修領域在2024年經歷了顯著成長。隨著全球風力渦輪機安裝數量的不斷增加,齒輪箱維修需求也達到了歷史最高水準。操作員更傾向於選擇維修而非更換,因為透過適當的維護可以實現成本效益和延長使用壽命。企業擴大投資於預測性維護技術和即時監控,以便在問題導致重大故障之前發現它們,從而減少停機時間和維護成本。

陸上採用率不斷提高

受全球陸域風電場普及的推動,2024年陸上風電市場將佔顯著佔有率。陸域風力渦輪機比離岸風力渦輪機更容易安裝,維修也更方便、更經濟。隨著營運商越來越重視最佳化陸上渦輪機的使用壽命,許多業者開始選擇翻新服務,而非徹底更換。

亞太地區將成為推動力地區

2024年,亞太地區風力渦輪機齒輪箱維修和翻新市場將保持永續的佔有率,這得益於該地區對再生能源投資的不斷增加,尤其是在中國、印度和日本等國家。隨著該地區風能裝置容量的擴大,對齒輪箱維修和翻新服務的需求也隨之激增。

風力渦輪機齒輪箱維修和翻新市場的主要參與者有 Prokon Energy、Siemens Gamesa、DBSantasalo、REM Surface Engineering、Vestas、Turbine Repair Solutions、H&N Wind、GBS Gearbox Services International、Metalock Engineering、Multigear GmbH、ABS Wind、BHI、Connected Wind Services、Metalock Engineering、Multigear GmbH、ABS Wind Services、BHI、Connected Wind Services、Norda、Dalr. FGGS Field Services。

為了鞏固市場地位,風力渦輪機齒輪箱維修和翻新市場的公司正在採取多項關鍵策略。技術創新是重中之重,各公司紛紛投資先進的診斷工具、預測性維護和資料分析技術,以提高維修的準確性和效率。此外,許多公司正在擴大其地理覆蓋範圍,尤其是在亞太和歐洲等地區,以滿足不斷成長的需求。最後,各公司正致力於提高供應鏈的彈性,以解決零件供應問題並縮短交貨時間,確保更快的反應時間並最大限度地減少渦輪機停機時間。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 製造能力評估

- 供應鏈彈性和風險因素

- 配電網路分析

- 成本結構分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 戰略儀表板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依類型,2021 - 2034

- 主要趨勢

- 維修

- 翻新

第6章:市場規模及預測:依部署,2021 - 2034

- 主要趨勢

- 陸上

- 海上

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 亞太地區

- 中國

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABS Wind

- AIS Wind Energy

- BHI Energy

- Connected Wind Services

- Dana Incorporated

- DBSantasalo

- FGGS Field Services

- GBS Gearbox Services International

- Grenaa Motorfabrik

- H&N Wind

- Metalock Engineering

- Multigear GmbH

- Nordex SE

- Prokon Energy

- REM Surface Engineering

- Sadler Machine Co

- Siemens Gamesa

- Turbine Repair Solutions

- Vestas

- Wikov

The Global Wind Turbine Gearbox Repair and Refurbishment Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 2.5 billion by 2034.

As the global fleet of wind turbines ages, many turbines are facing performance degradation and mechanical failures, especially in their gearboxes. This drives the need for repair and refurbishment services to extend the operational life of existing assets and improve energy production efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.3% |

Rising Demand in the Repair Segment

The repair segment experienced significant growth in 2024, as vehicles age and undergo wear and tear. With the rising number of installed wind turbines globally, demand for gearbox repairs is at an all-time high. Operators prefer repairs over replacements due to the cost-effectiveness and extended lifespan that can be achieved through proper maintenance. Companies are increasingly investing in predictive maintenance technologies and real-time monitoring to identify issues before they lead to significant failures, thereby reducing downtime and maintenance costs.

Increasing Adoption in Onshore

The onshore segment held a significant share in 2024, driven by the prevalence of onshore wind farms around the world. Onshore wind turbines are more accessible than their offshore counterparts, making repairs easier and more affordable. With an increasing emphasis on optimizing the lifespan of onshore turbines, many operators are turning to refurbishment services rather than complete replacements.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific wind turbine gearbox repair and refurbishment market held a sustainable share in 2024, driven by the region's increasing investments in renewable energy, particularly in countries like China, India, and Japan. As wind energy capacity expands across the region, the demand for gearbox repairs and refurbishment services is surging.

Major players in the wind turbine gearbox repair and refurbishment market are Prokon Energy, Siemens Gamesa, DBSantasalo, REM Surface Engineering, Vestas, Turbine Repair Solutions, H&N Wind, GBS Gearbox Services International, Metalock Engineering, Multigear GmbH, ABS Wind, BHI Energy, Connected Wind Services, Nordex SE, Wikov, Dana Incorporated, Grenaa Motorfabrik, Sadler Machine Co., and FGGS Field Services.

To strengthen their market position, companies in the wind turbine gearbox repair and refurbishment market are employing several key strategies. Technological innovation is at the forefront, with companies investing in advanced diagnostic tools, predictive maintenance, and data analytics to improve repair accuracy and efficiency. Additionally, many companies are expanding their geographic footprint, especially in regions like Asia Pacific and Europe, to meet the rising demand. Lastly, firms are focusing on improving supply chain resilience to address parts availability and reduce lead times, ensuring faster response times and minimizing turbine downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Deployment trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Repair

- 5.3 Refurbishment

Chapter 6 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 UK

- 7.3.4 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 South Korea

- 7.5 Middle East & Africa

- 7.5.1 South Africa

- 7.5.2 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABS Wind

- 8.2 AIS Wind Energy

- 8.3 BHI Energy

- 8.4 Connected Wind Services

- 8.5 Dana Incorporated

- 8.6 DBSantasalo

- 8.7 FGGS Field Services

- 8.8 GBS Gearbox Services International

- 8.9 Grenaa Motorfabrik

- 8.10 H&N Wind

- 8.11 Metalock Engineering

- 8.12 Multigear GmbH

- 8.13 Nordex SE

- 8.14 Prokon Energy

- 8.15 REM Surface Engineering

- 8.16 Sadler Machine Co

- 8.17 Siemens Gamesa

- 8.18 Turbine Repair Solutions

- 8.19 Vestas

- 8.20 Wikov