|

市場調查報告書

商品編碼

1833414

個人 3D 列印機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Personal 3D Printers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

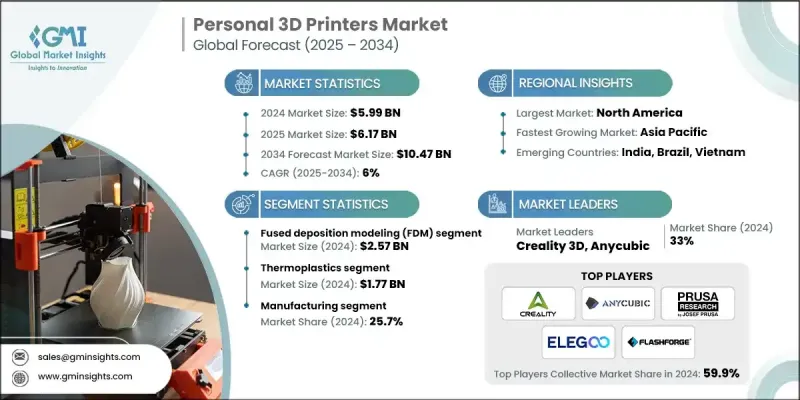

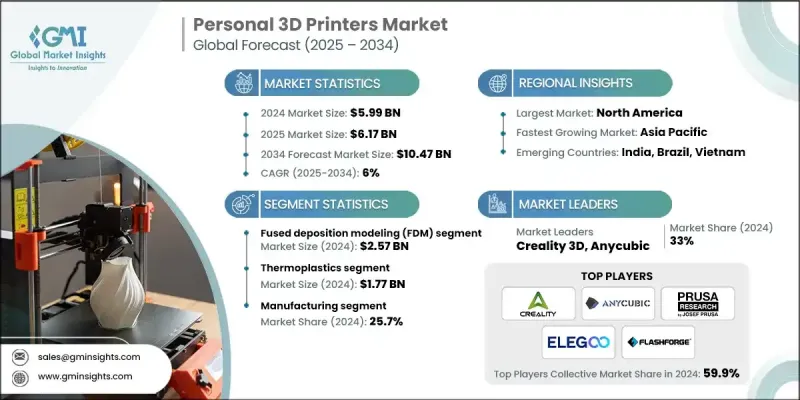

2024 年全球個人 3D 列印機市場價值為 59.9 億美元,預計將以 6% 的複合年成長率成長,到 2034 年達到 104.7 億美元。

桌上型 3D 列印機價格的穩定下降一直是最強勁的成長動力之一,因為價格實惠為業餘愛好者、教育工作者和小型企業掃除了使用障礙。設計和性能的持續改進,包括更高的解析度、多材料列印和直覺的介面,進一步促進了其普及。如今,價格實惠的機器能夠提供專業品質的輸出,對個人和機構都具有吸引力。此外,創客文化和 DIY 社群的興起也促進了個人用戶印表機的普及。學校、社區工作室和小型企業日益廣泛的使用正在傳播印表機的認知,而線上平台和論壇則拓展了技術知識。這些文化變革強調創造力、創新和實踐學習,創造了一個將個人 3D 列印機視為實驗、教育和獨立產品開發必備工具的環境。隨著印表機可近性的提高,在尋求高效能、低成本原型設計和客製化解決方案的學生、業餘愛好者和獨立專業人士中,3D 列印機的普及率持續快速成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 59.9億美元 |

| 預測值 | 104.7億美元 |

| 複合年成長率 | 6% |

熔融沈積成型 (FDM) 細分市場在 2024 年的市場規模為 25.7 億美元,複合年成長率為 7.1%。其優勢在於多功能性、低材料成本和易用性,使其成為消費市場和教育市場的主導選擇。近期,FDM 技術的發展帶來了具有自動調平、靜音步進驅動器和智慧耗材檢測功能的機型,從而提升了用戶體驗。為了保持競爭力,製造商優先考慮模組化系統、多材料支援和簡化的使用者介面,以降低設定的複雜性。

2024年,熱塑性材料市場規模達17.7億美元,預計複合年成長率為5.3%。其價格實惠、適應性強且與FDM印表機相容,使其仍是原型設計和教育用途的首選。 Creality和Prusa Research等公司正在擴展其線材產品線,提供更豐富的PLA、PETG和ABS選項,以滿足使用者對耐用性、柔韌性和環保性的需求。此外,該公司還致力於開發可回收聚合物和專用共混物,以提高抗衝擊性或生物相容性,以用於醫療建模等應用。

2024年,美國個人3D列印機市場規模達16.1億美元。市場成長得益於其成熟的消費性電子生態系統以及3D列印技術與K-12和高等教育體系的融合。包括Creality(透過經銷商)、Bambu Lab和Prusa在內的主要製造商佔據了線上和線下通路的主導地位,並擁有強大的耗材、備件和維修服務網路。強大的創客和教育者社群促進了3D列印機的廣泛應用,而可靠的供應鏈則使最終用戶能夠更順暢地採用3D列印機。

全球個人 3D 列印機產業的知名公司包括 Bambu Lab、FlashForge、Creality 3D、Phrozen、Tronxy、Anycubic、Artillery 3D、QIDI Tech、Elegoo、Raise3D、Monoprice、MakerBot、Ultimaker(已與 MakerBot、Snape、MakerBot、Sarcan、MakerBot、Yelcan、MakerBot、Sarcan、MakerBot、Acan、MakerA、Sakr. DigiLab、Tenlog 3D、LulzBot(由 Aleph Objects 收購)、Anycubic Photon、XYZprinting、Sindoh 和 Voxelab。個人 3D 列印機市場的公司正專注於提升可及性、使用者體驗和永續性的策略,以確保更強大的競爭優勢。許多公司正在投資具有直覺用戶介面的模組化多材料印表機,使其適合初學者和經驗豐富的用戶。擴展線材產品組合也是一項核心策略,製造商提供環保、可回收且性能卓越的材料,以滿足多樣化的應用需求。強大的社群參與仍然是核心,企業正在建立線上知識庫,提供開源設計,並培養創客網路。企業正在加強與學校和大學的合作,以搶佔教育市場。諸如線材回收和低能耗印表機等永續發展舉措,有助於企業與具有環保意識的用戶建立信任,同時在不斷成長的全球市場中提升品牌價值。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 桌上型電腦的價格實惠

- 擴大 DIY 和創客文化

- 教育融合

- 使用者友善的軟體和生態系統

- 客製化趨勢的成長

- 產業陷阱與挑戰

- 材料多功能性有限

- 維護和可靠性問題

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按印刷技術,2021 - 2034 年

- 主要趨勢

- 熔融沈積成型(FDM)

- 立體光刻(SLA)

- 數位光處理 (DLP)

- 選擇性雷射燒結(SLS)

- 黏合劑噴射

- 噴墨列印/材料噴射

- 其他

第6章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 熱塑性塑膠

- 解放軍

- ABS

- 聚對苯二甲酸乙二酯

- 尼龍

- 其他

- 光聚合物/樹脂

- 標準樹脂

- 堅韌的樹脂

- 軟性樹脂

- 可澆注樹脂

- 複合材料

- 碳纖維注入

- 木質填充

- 金屬填充

- 其他

第7章:市場估計與預測:按價格範圍,2021 - 2034 年

- 主要趨勢

- 低階(300美元以下)

- 中檔(300-1,000美元)

- 高階(1,000 美元以上)

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 網路零售

- 品牌自有網站

- 電子商務平台

- 線下零售

- 科技和電子產品商店

- 教育供應商及教育科技經銷商

- 授權經銷商

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 教育

- 衛生保健

- 航太和國防

- 汽車

- 消費品

- 製造業

- 首飾

- 其他

第 10 章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者:

- Anycubic

- Bambu Lab

- Creality 3D

- Elegoo

- FlashForge

- Formlabs

- MakerBot

- Prusa Research

- QIDI Tech

- Raise3D

- Ultimaker

- XYZprinting

- 區域參與者:

- Dremel DigiLab

- LulzBot

- Monoprice

- Sindoh

- Snapmaker

- Voxelab

- Wanhao

- 新興參與者:

- Artillery 3D

- Peopoly

- Phrozen

- Tenlog 3D

- Tronxy

The Global Personal 3D Printers Market was valued at USD 5.99 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 10.47 billion by 2034.

The steady decline in pricing for desktop 3D printers has been one of the strongest growth drivers, as affordability has removed barriers for hobbyists, educators, and small-scale businesses. Continuous improvements in design and performance, including better resolution, multi-material printing, and intuitive interfaces, have further encouraged adoption. Affordable machines now deliver professional-quality output, making them attractive to individuals and institutions alike. Alongside this, the rise of maker culture and DIY communities has reinforced the adoption of single-user printers. Growing use in schools, community workshops, and small enterprises is spreading awareness, while online platforms and forums expand technical knowledge. These cultural changes emphasize creativity, innovation, and practical learning, creating an environment where personal 3D printers are seen as essential tools for experimentation, education, and independent product development. As accessibility improves, adoption continues to grow rapidly among students, hobbyists, and independent professionals seeking efficient, low-cost prototyping and customization solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.99 Billion |

| Forecast Value | $10.47 Billion |

| CAGR | 6% |

The fused deposition modeling (FDM) segment generated USD 2.57 billion in 2024, expanding at a CAGR of 7.1%. Its strength lies in its versatility, low material costs, and ease of access, making it a dominant choice for both consumer and education markets. Recent advances have introduced models with automated leveling, silent stepper drivers, and smart filament detection, enhancing user experience. To remain competitive, manufacturers are prioritizing modular systems, multi-material support, and simplified user interfaces that reduce setup complexity.

The thermoplastics material segment was valued at USD 1.77 billion in 2024 and is projected to grow at a CAGR of 5.3%. Their affordability, adaptability, and compatibility with FDM printers ensure they remain the preferred choice for prototyping and educational uses. Companies such as Creality and Prusa Research are broadening their filament lines with improved PLA, PETG, and ABS options, addressing user needs for durability, flexibility, and eco-friendliness. The focus is also shifting toward recyclable polymers and specialized blends for improved impact resistance or biocompatibility for applications like medical modeling.

U.S. Personal 3D Printers Market generated USD 1.61 billion in 2024. Market growth is supported by its established consumer electronics ecosystem and integration of 3D printing into both K-12 and higher education systems. Key manufacturers, including Creality (through distributors), Bambu Lab, and Prusa, dominate online and offline channels, supported by robust networks for filaments, spare parts, and repair services. A strong community of makers and educators fosters broader usage, while reliable supply chains make adoption smoother for end users.

Prominent companies in the Global Personal 3D Printers Industry include Bambu Lab, FlashForge, Creality 3D, Phrozen, Tronxy, Anycubic, Artillery 3D, QIDI Tech, Elegoo, Raise3D, Monoprice, MakerBot, Ultimaker (merged with MakerBot as UltiMaker), Prusa Research, Peopoly, Formlabs, Snapmaker, Wanhao, Dremel DigiLab, Tenlog 3D, LulzBot (by Aleph Objects), Anycubic Photon, XYZprinting, Sindoh, and Voxelab. Companies in the personal 3D printers market are focusing on strategies that enhance accessibility, user experience, and sustainability to secure a stronger competitive edge. Many are investing in modular, multi-material printers with intuitive user interfaces, making them suitable for beginners and experienced users alike. Expansion of filament portfolios is also a core strategy, with manufacturers offering eco-friendly, recyclable, and performance-driven materials to meet diverse application needs. Strong community engagement remains central, with firms building online knowledge bases, offering open-source designs, and cultivating maker networks. Partnerships with schools and universities are being strengthened to capture the education sector. Sustainability initiatives such as filament recycling and low-energy printers help companies build trust with eco-conscious users while enhancing brand value in a growing global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Printer technology trends

- 2.2.3 Material type trends

- 2.2.4 Price range trends

- 2.2.5 Distribution channel trends

- 2.2.6 End user trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Affordability of Desktop models

- 3.2.1.2 Expanding DIY & maker culture

- 3.2.1.3 Educational integration

- 3.2.1.4 User-friendly software & ecosystems

- 3.2.1.5 Growth of customization trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited material versatility

- 3.2.2.2 Maintenance & reliability issues

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market estimates and forecast, by Printing Technology, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fused Deposition Modeling (FDM)

- 5.3 Stereolithography (SLA)

- 5.4 Digital Light Processing (DLP)

- 5.5 Selective Laser Sintering (SLS)

- 5.6 Binder jetting

- 5.7 Inkjet printing / material jetting

- 5.8 Others

Chapter 6 Market estimates and forecast, by Material Type, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Thermoplastics

- 6.2.1 PLA

- 6.2.2 ABS

- 6.2.3 PETG

- 6.2.4 Nylon

- 6.2.5 Others

- 6.3 Photopolymers/resin

- 6.3.1 Standard resin

- 6.3.2 Tough resin

- 6.3.3 Flexible resin

- 6.3.4 Castable resin

- 6.4 Composites

- 6.4.1 Carbon-fiber infused

- 6.4.2 Wood-filled

- 6.4.3 Metal-filled

- 6.5 Others

Chapter 7 Market estimates and forecast, by Price Range, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Low-end (Below USD 300)

- 7.3 Mid-range (USD 300-1,000)

- 7.4 High-end (Above USD 1,000)

Chapter 8 Market estimates and forecast, by Distribution Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online retail

- 8.2.1 Brand-owned websites

- 8.2.2 E-commerce platforms

- 8.3 Offline retail

- 8.3.1 Technology & electronics stores

- 8.3.2 Educational suppliers & EdTech distributors

- 8.3.3 Authorized dealers

Chapter 9 Market estimates and forecast, by End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Education

- 9.3 Healthcare

- 9.4 Aerospace and Defense

- 9.5 Automotive

- 9.6 Consumer Goods

- 9.7 Manufacturing

- 9.8 Jewellery

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players:

- 11.1.1 Anycubic

- 11.1.2 Bambu Lab

- 11.1.3. Creality 3D

- 11.1.4 Elegoo

- 11.1.5 FlashForge

- 11.1.6 Formlabs

- 11.1.7 MakerBot

- 11.1.8 Prusa Research

- 11.1.9 QIDI Tech

- 11.1.10 Raise3D

- 11.1.11 Ultimaker

- 11.1.12 XYZprinting

- 11.2 Regional Players:

- 11.2.1 Dremel DigiLab

- 11.2.2 LulzBot

- 11.2.3 Monoprice

- 11.2.4 Sindoh

- 11.2.5 Snapmaker

- 11.2.6 Voxelab

- 11.2.7 Wanhao

- 11.3 Emerging Players:

- 11.3.1. Artillery 3D

- 11.3.2 Peopoly

- 11.3.3 Phrozen

- 11.3.4. Tenlog 3D

- 11.3.5 Tronxy