|

市場調查報告書

商品編碼

1833411

結合疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Conjugate Vaccine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

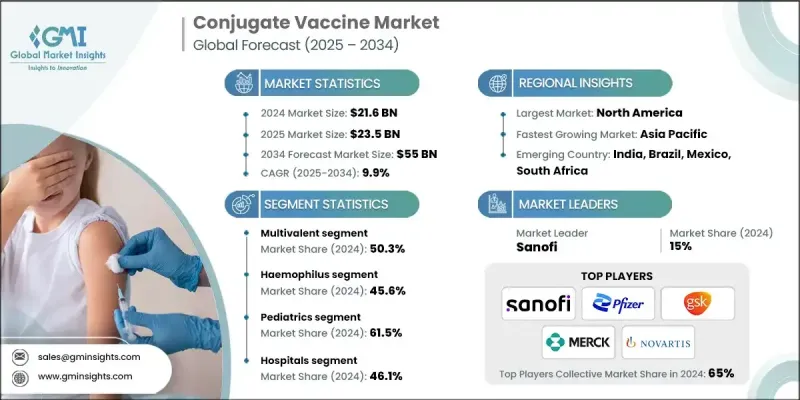

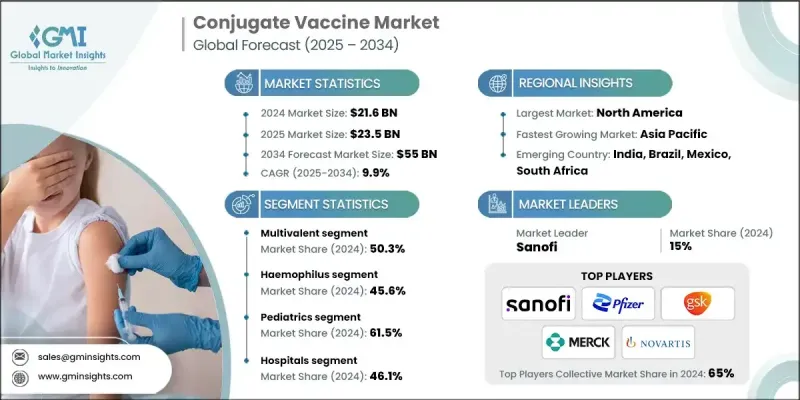

2024 年全球結合疫苗市場價值為 216 億美元,預計將以 9.9% 的複合年成長率成長,到 2034 年達到 550 億美元。

隨著這些疾病的持續發病率,對有效預防措施的需求變得更加迫切。結合疫苗已成為一種強力的解決方案,與傳統的多醣疫苗相比,它具有更強的免疫原性和更持久的保護作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 216億美元 |

| 預測值 | 550億美元 |

| 複合年成長率 | 9.9% |

多價領域採用率不斷提高

多價疫苗由於其能夠透過單一劑型針對多種病原體菌株,在結合疫苗市場中發展勢頭強勁。這種方法可以增強廣譜免疫力,這在多種血清型同時流行的地區尤其重要。透過減少所需的注射次數,多價疫苗可以提高患者的依從性並簡化免疫接種程序。製造商正在積極投資研發下一代多價結合疫苗,以更少的劑量提供更強的保護。隨著醫療保健行業日益重視效率和覆蓋率,預計該領域將在未來市場成長中佔據重要地位,尤其是在兒科和公共衛生疫苗接種計劃中。

嗜血桿菌感染率上升

2024年,嗜血桿菌(Hib)疫苗市場佔有相當大的佔有率。 Hib感染是幼兒細菌性腦膜炎和肺炎的主要原因,廣泛的免疫接種已顯著降低了全球許多地區Hib的發生率。 Hib結合疫苗即使在嬰兒時期也能有效引發強烈的免疫反應,使其成為兒童早期免疫接種計畫的基石。隨著各國努力消除疫苗可預防疾病並擴大免疫覆蓋率,Hib結合疫苗的需求維持穩定。

兒科需求不斷成長

2024年,兒科疫苗市場佔據了強勁的佔有率,這要歸功於嬰幼兒在最脆弱的時期迫切需要保護他們免受危及生命的細菌感染。全球各國的國家免疫計畫都優先考慮在兒童早期接種結合疫苗,因為其安全性、免疫原性以及誘發持久免疫力的能力都已得到證實。結合疫苗易於與聯合注射液結合使用,這進一步提高了兒科族群的接種率。

北美將成為推動力地區

2024年,北美結合疫苗市場收入可觀,這得益於先進的醫療基礎設施、積極的免疫接種計劃以及高度的公共衛生意識。美國疾病管制與預防中心(CDC)和美國食品藥物管理局(FDA)等機構的監管支持,確保了結合疫苗能夠及時獲得批准並納入常規免疫接種計畫。大型製藥公司的入駐以及持續的研究投入,促進了創新和市場競爭力的提升。

結合疫苗市場的主要參與者包括印度血清研究所、默克、SK Bioscience、輝瑞、Bio-Med、諾華、泰姬製藥、葛蘭素史克、賽諾菲和巴拉特生物技術。

為了鞏固在結合疫苗市場的地位,各公司正致力於多管齊下的策略,包括擴大疫苗組合、提高生產可擴展性以及建立策略夥伴關係。領先的製造商正在開發多價疫苗和聯合疫苗,以增強疾病覆蓋率並簡化免疫接種計劃。此外,他們還在投資新的給藥平台,例如預充式注射器和單劑量小瓶,以提高用戶便利性並減少浪費。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 傳染病日益流行

- 老年人和兒科人口不斷成長

- 增強臨床意識和免疫指南

- 數位健康和遠距醫療平台的擴展

- 產業陷阱與挑戰

- 品牌療法和生物療法成本高昂

- 安全性問題和副作用

- 市場機會

- 新興市場需求不斷成長

- 轉向個人化和聯合治療

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 管道分析

- 技術和創新格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 多價

- 單價

- 五價

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 肺炎球菌

- 嗜血桿菌

- 腦膜炎球菌

- 其他適應症

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 兒科

- 成年人

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 兒科診所

- 公共衛生機構

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Bharat Biotech

- Bio-Med

- GlaxoSmithKline

- Merck

- Novartis

- Pfizer

- Sanofi

- Serum Institute of India

- SK Bioscience

- Taj Pharmaceuticals

The Global Conjugate Vaccine Market was valued at USD 21.6 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 55 billion by 2034.

As the incidence of these diseases persists, the need for effective, preventive measures has become more urgent. Conjugate vaccines have emerged as a powerful solution, offering enhanced immunogenicity and longer-lasting protection compared to traditional polysaccharide vaccines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.6 Billion |

| Forecast Value | $55 Billion |

| CAGR | 9.9% |

Increasing Adoption Multivalent Sector

The multivalent segment is gaining significant momentum in the conjugate vaccine market due to its ability to target multiple strains of pathogens within a single formulation. This approach enhances broad-spectrum immunity, which is especially valuable in regions where multiple serotypes circulate simultaneously. By reducing the number of injections required, multivalent vaccines improve patient compliance and streamline immunization schedules. Manufacturers are actively investing in R&D to develop next-generation multivalent conjugate vaccines that provide stronger protection with fewer doses. As the healthcare industry increasingly emphasizes efficiency and coverage, this segment is expected to drive a substantial portion of future market growth, particularly in pediatric and public health vaccination programs.

Rising Prevalence of Haemophilus

The Haemophilus segment held a significant share in 2024. Hib infection is a leading cause of bacterial meningitis and pneumonia in young children, and widespread immunization has dramatically reduced its incidence in many parts of the world. The effectiveness of Hib conjugate vaccines in triggering strong immune responses, even in infants, has made them a cornerstone of early childhood immunization programs. As countries work to eliminate vaccine-preventable diseases and expand immunization coverage, the demand for Hib conjugate vaccines remains steady.

Increasing Demand in Pediatrics

The pediatrics segment held a robust share in 2024, driven by the critical need to protect infants and young children from life-threatening bacterial infections during their most vulnerable years. National immunization schedules across the globe prioritize conjugate vaccines in early childhood due to their proven safety, immunogenicity, and ability to induce long-lasting immunity. The convenience of integrating conjugate vaccines into combination shots further boosts uptake among pediatric populations.

North America to Emerge as a Propelling Region

North America conjugate vaccine market generated substantial revenues in 2024, supported by advanced healthcare infrastructure, proactive immunization programs, and a high level of public health awareness. Regulatory support from agencies like the CDC and FDA ensures timely approval and inclusion of conjugate vaccines in routine immunization schedules. The presence of major pharmaceutical companies and continued investment in research fuel innovation and market competitiveness.

Major players in the conjugate vaccine market are Serum Institute of India, Merck, SK Bioscience, Pfizer, Bio-Med, Novartis, Taj Pharmaceuticals, GlaxoSmithKline, Sanofi, and Bharat Biotech.

To strengthen their presence in the conjugate vaccine market, companies are focusing on a multi-pronged strategy that includes expanding vaccine portfolios, improving manufacturing scalability, and entering strategic partnerships. Leading manufacturers are developing multivalent and combination vaccines to enhance disease coverage and streamline immunization programs. Investments in new delivery platforms, such as pre-filled syringes and single-dose vials, are being made to improve user convenience and reduce wastage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Indication

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of infectious diseases

- 3.2.1.2 Growing geriatric and paediatric populations

- 3.2.1.3 Enhanced clinical awareness and immunization guidelines

- 3.2.1.4 Expansion of digital health and telemedicine platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and biologic therapies

- 3.2.2.2 Safety concerns and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in emerging markets

- 3.2.3.2 Shift toward personalized and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Technology and innovation landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Multivalent

- 5.3 Monovalent

- 5.4 Pentavalent

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pneumococcal

- 6.3 Haemophilus

- 6.4 Meningococcal

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Pediatric clinics

- 8.4 Public health agencies

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bharat Biotech

- 10.2 Bio-Med

- 10.3 GlaxoSmithKline

- 10.4 Merck

- 10.5 Novartis

- 10.6 Pfizer

- 10.7 Sanofi

- 10.8 Serum Institute of India

- 10.9 SK Bioscience

- 10.10 Taj Pharmaceuticals