|

市場調查報告書

商品編碼

1833409

厭食症市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Anorexiants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

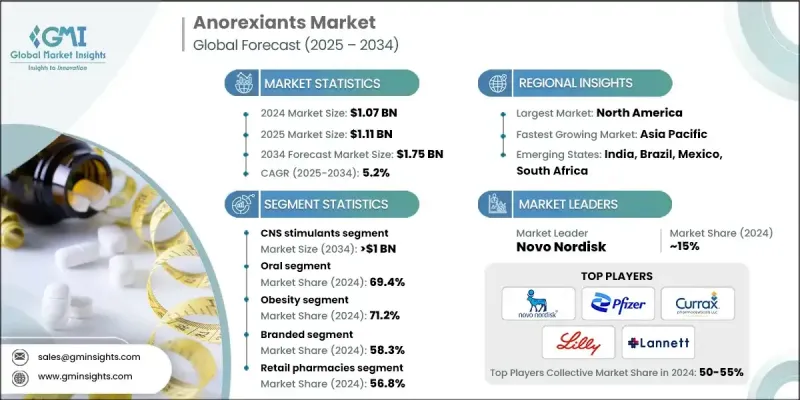

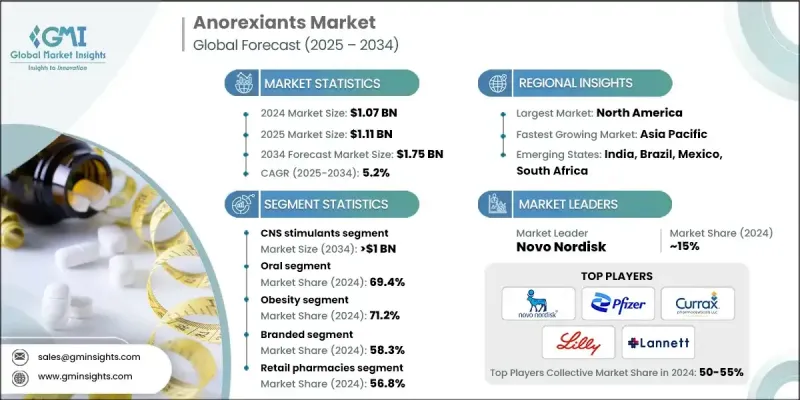

2024 年全球厭食症市場價值為 10.7 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 17.5 億美元。

全球肥胖和超重人口的成長是厭食藥市場的主要驅動力之一。隨著第2型糖尿病、高血壓和心血管疾病等生活方式疾病的日益普遍,包括厭食藥在內的體重管理藥物的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10.7億美元 |

| 預測值 | 17.5億美元 |

| 複合年成長率 | 5.2% |

中樞神經興奮劑的採用率不斷上升

2024年,中樞神經興奮劑市場在食慾抑制和體重管理的推動下,收入可觀。此類藥物,例如芬特明和二乙丙酮,透過提高大腦中的多巴胺和去甲腎上腺素水平來發揮作用,從而抑制食慾並促進能量消耗。隨著越來越多的患者轉向使用能夠幫助控制肥胖症和第2型糖尿病等相關疾病的藥物,預計該市場將持續成長,尤其是在處方減重領域。

口服藥物獲得青睞

2024年,口服厭食藥市場佔據了相當大的佔有率,這得益於患者對易於使用、非侵入性治療的偏好。奧利司他和芬特明/托吡酯等口服厭食藥因其便捷、易得且療效確切而廣受歡迎。這些藥物通常作為更廣泛的體重管理方案的一部分,該方案還包括飲食調整和身體活動。

肥胖盛行率不斷上升

受全球肥胖危機加劇的推動,肥胖領域在2024年佔據了強勁的市場佔有率。隨著與高血壓、第2型糖尿病和心血管疾病等慢性疾病相關的肥胖率不斷上升,對有效減肥療法的需求也隨之激增。該領域的厭食症藥物被視為管理中度至重度肥胖的關鍵工具,尤其是在單靠飲食和運動等生活方式改變不足的情況下。

北美將成為利潤豐厚的地區

由於完善的醫療基礎設施、高水準的醫療支出以及人們對肥胖相關健康風險的認知不斷提高,北美厭食症藥物市場將在2025-2034年期間實現可觀的複合年成長率。因此,北美公司正專注於推出新的厭食症藥物,並利用直接面對消費者的行銷策略來提高藥物的接受度。

厭食症藥物市場的主要參與者有 KVK-Tech、Teva Pharmaceuticals、Lannett Company、Novo Nordisk、Valeant Pharmaceuticals、Currax Pharmaceuticals、Eli Lilly and Company、Aventis Pharmaceuticals、Zydus Pharmaceuticals、Pfizer 和 Vivus。

為了鞏固其市場地位和立足點,厭食症藥物市場的公司正在採取各種關鍵策略。這些策略包括創新產品開發,特別是聯合療法和非興奮劑配方,以滿足不同患者的偏好和需求。該公司也大力投資患者教育和數位健康解決方案,例如應用程式和線上諮詢服務,以提高治療依從性並最佳化減肥效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 肥胖和代謝紊亂的盛行率不斷上升

- 老年人和青少年人口不斷增加

- 增強臨床意識和治療指南

- 數位健康和遠距醫療平台的擴展

- 產業陷阱與挑戰

- 品牌療法和生物療法成本高昂

- 安全性問題和副作用

- 市場機會

- 新興市場需求不斷成長

- 個人化和聯合療法日益成為趨勢

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 臨床試驗分析

- 定價分析

- 技術和創新格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- GLP-1受體激動劑

- 中樞神經興奮劑

- 其他藥物類別

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

第7章:市場估計與預測:按適應症,2021 - 2034

- 主要趨勢

- 肥胖

- 體重過重伴隨合併症

第 8 章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 品牌

- 泛型

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 零售藥局

- 醫院藥房

- 網路藥局

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aventis Pharmaceuticals

- Currax Pharmaceuticals

- Eli Lilly

- KVK-Tech

- Lannett Company

- Novo Nordisk

- Pfizer

- Teva Pharmaceuticals

- Valeant Pharmaceuticals

- Vivus

- Zydus Pharmaceuticals

The Global Anorexiants Market was valued at USD 1.07 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.75 billion by 2034.

The global rise in obesity and overweight populations is one of the primary drivers of the anorexiants market. As lifestyle diseases like type 2 diabetes, hypertension, and cardiovascular diseases become more prevalent, demand for weight management drugs, including anorexiants, continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.07 Billion |

| Forecast Value | $1.75 Billion |

| CAGR | 5.2% |

Rising Adoption of CNS Stimulants

The CNS stimulants segment generated significant revenues in 2024, driven by appetite suppression and weight management. Medications in this category, like phentermine and diethylpropion, work by increasing dopamine and norepinephrine levels in the brain, which suppresses appetite and promotes energy expenditure. This segment is expected to witness continued growth, particularly in the prescription weight loss space, as more patients turn to medications that can help them manage obesity and related conditions like type 2 diabetes.

Oral to Gain Traction

The oral segment of the anorexiants market held a substantial share in 2024, driven by patient preference for easy-to-use, non-invasive treatments. Oral anorexiants like Orlistat and phentermine/topiramate have become popular choices due to their convenience, availability, and proven efficacy. These drugs are often prescribed as part of a broader weight management regimen that includes dietary changes and physical activity.

Increasing Prevalence of Obesity

The obesity segment held a robust share in 2024, driven by the escalating global obesity crisis. With increasing rates of obesity linked to chronic diseases like hypertension, type 2 diabetes, and cardiovascular diseases, demand for effective weight-loss therapies is surging. Anorexiants in this segment are viewed as critical tools in the management of moderate to severe obesity, especially when lifestyle changes like diet and exercise alone are insufficient.

North America to Emerge as a Lucrative Region

North America anorexiants market will grow at a decent CAGR during 2025-2034, owing to well-established healthcare infrastructure, high levels of healthcare spending, and increasing awareness about obesity-related health risks. As a result, North American companies are focusing on launching new anorexiants and leveraging direct-to-consumer marketing strategies to increase drug adoption.

Major players in the anorexiants market are KVK-Tech, Teva Pharmaceuticals, Lannett Company, Novo Nordisk, Valeant Pharmaceuticals, Currax Pharmaceuticals, Eli Lilly and Company, Aventis Pharmaceuticals, Zydus Pharmaceuticals, Pfizer, and Vivus.

To strengthen their presence and market foothold, companies in the anorexiants market are employing a variety of key strategies. These include innovative product development, particularly regarding combination therapies and non-stimulant formulations, which cater to different patient preferences and needs. Companies are also investing heavily in patient education and digital health solutions, such as apps and online counseling services, to increase treatment adherence and optimize weight loss outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Route of administration

- 2.2.4 Indication

- 2.2.5 Drug Type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of obesity and metabolic disorders

- 3.2.1.2 Growing geriatric and adolescent populations

- 3.2.1.3 Enhanced clinical awareness and treatment guidelines

- 3.2.1.4 Expansion of digital health and telemedicine platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and biologic therapies

- 3.2.2.2 Safety concerns and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in emerging markets

- 3.2.3.2 Growing shift toward personalized and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Clinical trial analysis

- 3.7 Pricing analysis

- 3.8 Technology and innovation landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 GLP-1 receptor agonists

- 5.3 CNS stimulants

- 5.4 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Obesity

- 7.3 Overweight with comorbidities

Chapter 8 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Retail pharmacies

- 9.3 Hospital pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aventis Pharmaceuticals

- 11.2 Currax Pharmaceuticals

- 11.3 Eli Lilly

- 11.4 KVK-Tech

- 11.5 Lannett Company

- 11.6 Novo Nordisk

- 11.7 Pfizer

- 11.8 Teva Pharmaceuticals

- 11.9 Valeant Pharmaceuticals

- 11.10 Vivus

- 11.11 Zydus Pharmaceuticals