|

市場調查報告書

商品編碼

1833408

航空網路安全市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aviation Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

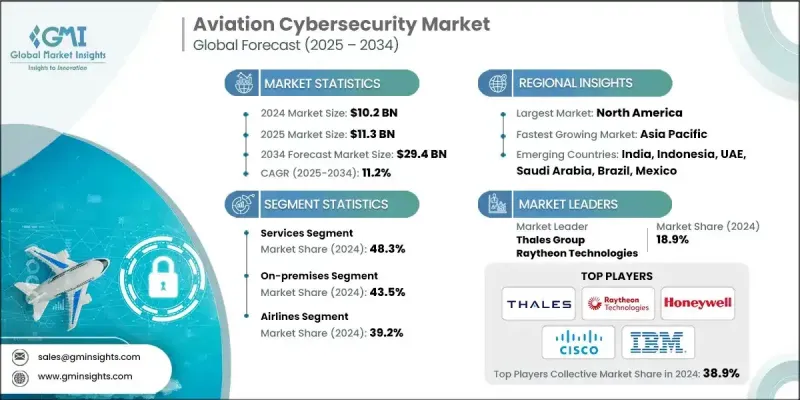

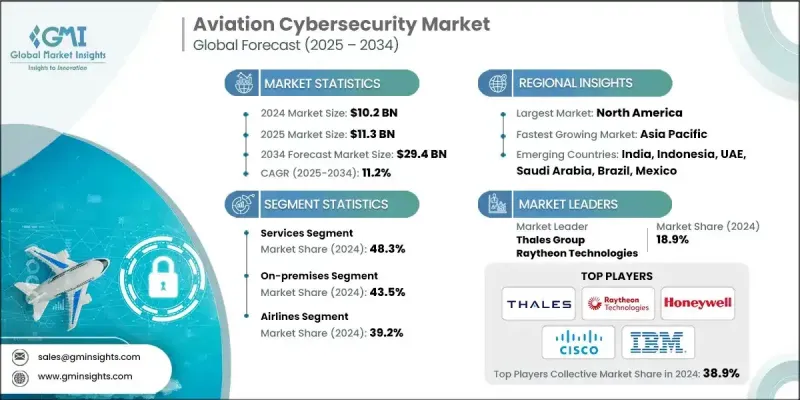

2024 年全球航空網路安全市場價值為 102 億美元,預計到 2034 年將以 11.2% 的複合年成長率成長至 294 億美元。

隨著系統互聯程度的提高,網路威脅也日益增多,這推動了這一成長。監管機構要求制定嚴格的安全協議;飛機系統、機場和航空公司營運越來越依賴連網技術,而這些技術也暴露出新的漏洞。勒索軟體和惡意軟體事件急劇增加,迫使營運商採用複雜的網路安全工具來保護資料、營運和乘客安全。隨著商業航空和空中交通的擴張,複雜性也隨之增加,為攻擊者創造了更多的切入點。從國內民航局到國際組織的監管合規性都要求加密、入侵偵測、身分管理和持續監控。服務提供者和解決方案開發人員必須不斷發展,才能在快速變化的威脅情況下同時滿足安全性和合規性需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 102億美元 |

| 預測值 | 294億美元 |

| 複合年成長率 | 11.2% |

2024年,服務業佔據了48.3%的市場佔有率,佔據主導地位,因為在威脅日益複雜的情況下,對專家驅動的解決方案的需求不斷成長。航空公司、機場、飛機原始設備製造商和航空服務提供者越來越依賴第三方供應商來提供託管安全服務,包括全天候威脅監控、事件回應、合規審計、風險評估和網路安全培訓。隨著航空營運的資料密集度和互聯程度不斷提高,將這些服務外包使組織能夠獲取高階威脅情報,降低內部開銷,並及時應對快速發展的全球法規。

由於許多航空業者傾向於完全掌控安全營運和關鍵系統,內部部署部分在2024年佔了43.5%的佔有率。對於大型機場、空中導航服務供應商和航太原始設備製造商而言,內部管理基礎設施有助於確保端到端的可視性、自訂配置以及更好地響應特定行業的合規性要求。這些實體通常託管專有系統、遺留設備以及敏感的乘客或國家安全資料,這些數據必須受到嚴格的保密政策保護。

2024年,美國航空網路安全市場價值達35億美元,這得益於一千多個商業機場的存在、嚴格的網路安全規定以及連網飛機技術的日益普及。聯邦航空管理局(FAA)、美國運輸安全局(TSA)和加拿大資訊安全局(CISA)等機構制定的聯邦法規和行業特定合規框架,要求對通訊網路、空中交通管理系統和乘客資訊資料庫進行嚴格保護。

IBM公司、霍尼韋爾國際公司、空中巴士公司、洛克希德·馬丁公司、諾斯羅普·格魯曼公司、雷神技術公司、BAE系統公司、泰雷茲集團、Leidos公司和思科系統公司等航空網路安全市場的主要公司,在全球航空業安全架構的開發、部署和維護中發揮重要作用。航空網路安全市場的公司正在推行幾項關鍵策略。他們強調投資人工智慧驅動的威脅偵測、異常挖掘和預測分析,以保持對網路攻擊的領先地位。他們與監管機構和航空組織建立合作夥伴關係,以確保其解決方案中融入合規框架。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 互聯飛機系統的採用日益增多

- 針對航空業的網路威脅日益增多

- 嚴格的監理合規要求

- 商業航空和空中交通的成長

- 人工智慧和物聯網在航空營運中的融合

- 產業陷阱與挑戰

- 網路安全解決方案成本高昂

- 航空業缺乏熟練的網路安全專業人員

- 市場機會

- 新興市場網路安全服務的擴展

- 開發人工智慧驅動的網路安全解決方案

- 對基於雲端的航空網路安全平台的需求

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 國防預算分析

- 全球國防開支趨勢

- 區域國防預算分配

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 重點國防現代化項目

- 預算預測(2025-2034)

- 對產業成長的影響

- 各國國防預算

- 供應鏈彈性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 合併、收購和策略夥伴關係格局

- 風險評估與管理

- 主要合約授予(2021-2024)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按解決方案,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場估計與預測:按證券類型,2021 - 2034 年

- 主要趨勢

- 網路安全

- 防火牆

- 入侵偵測/預防系統(IDS/IPS)

- 虛擬私人網路(VPN)

- 其他

- 應用程式和雲端安全

- Web 和行動應用程式安全

- 雲端安全平台

- 安全軟體開發

- 其他

- 端點和身分安全

- 端點檢測與響應(EDR/XDR)

- 反惡意軟體/反勒索軟體工具

- 身分和存取管理

- 其他

- 資料安全和加密

- 資料遺失防護 (DLP)

- 資料庫安全

- 加密和金鑰管理

- 其他

- 其他

第7章:市場估計與預測:按部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

- 混合

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 航空

- 機場和地面營運商

- 空中交通管制當局

- 飛機製造商和原始設備製造商

- MRO 提供者

- 其他

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球關鍵參與者

- Airbus

- BAE Systems

- Honeywell International Inc.

- IBM Corporation

- Thales Group

- 區域關鍵參與者

- 北美洲

- Cisco Systems

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Leidos

- Optiv Security

- Aviation SecOps

- 歐洲

- Rohde & Schwarz

- SITA

- The Boeing Company

- Cyviation

- Darktrace

- 亞太地區

- Wattlecorp Cybersecurity Labs LLP

- 北美洲

- 利基市場參與者/顛覆者

- Darktrace

- Dionach

The Global Aviation Cybersecurity Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 29.4 billion by 2034.

The growth is driven by the growing cyber threats as its systems become more interconnected. Regulatory bodies demand strict security protocols; aircraft systems, airports, and airline operations are increasingly relying on connected technologies that expose new vulnerabilities. Ransomware and malware incidents grow dramatically, pushing operators to adopt sophisticated cybersecurity tools to protect data, operations, and passenger safety. As commercial aviation and air traffic expand, complexity rises, creating more entry points for attackers. Regulatory compliance from domestic civil aviation authorities to international organizations requires encryption, intrusion detection, identity management, and continuous monitoring. Service providers and solution developers must evolve to meet both safety and compliance demands in a fast-changing threat landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 billion |

| Forecast Value | $29.4 billion |

| CAGR | 11.2% |

The services segment held a 48.3% share in 2024, dominating due to the rising need for expert-driven solutions amid the growing complexity of threats. Airlines, airports, aircraft OEMs, and aviation service providers increasingly rely on third-party vendors to handle managed security services, including 24/7 threat monitoring, incident response, compliance audits, risk assessments, and cybersecurity training. With aviation operations becoming more data-intensive and interconnected, outsourcing these services allows organizations to access advanced threat intelligence, reduce internal overhead, and stay aligned with rapidly evolving global regulations.

The on-premises segment held a 43.5% share in 2024 as many aviation players prefer to retain full control over security operations and critical systems. For large airports, air navigation service providers, and aerospace OEMs, managing infrastructure internally helps ensure end-to-end visibility, custom configuration, and better responsiveness to sector-specific compliance requirements. These entities often host proprietary systems, legacy equipment, and sensitive passenger or national security data that must be protected under strict confidentiality policies.

U.S. Aviation Cybersecurity Market was valued at USD 3.5 billion in 2024, underpinned by the presence of over a thousand commercial airports, stringent cybersecurity mandates, and the expanding use of connected aircraft technologies. Federal regulations and industry-specific compliance frameworks set by authorities such as the FAA, TSA, and CISA mandate rigorous protection of communication networks, air traffic management systems, and passenger information databases.

Major firms in the Aviation Cybersecurity Market, such as IBM Corporation, Honeywell International Inc., Airbus, Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, Thales Group, Leidos, and Cisco Systems, play significant roles in developing, deploying, and maintaining secure architecture across the aviation sector globally. Companies in the Aviation Cybersecurity Market are pursuing several key strategies. They emphasize investment in AI-powered threat detection, anomaly mining, and predictive analytics to stay ahead of cyberattacks. They forge partnerships with regulatory bodies and aviation organizations to ensure compliance frameworks are built into their solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Solution trends

- 2.2.2 Security type trends

- 2.2.3 Deployment mode trends

- 2.2.4 End Use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of connected aircraft systems

- 3.2.1.2 Rising cyber threats targeting aviation

- 3.2.1.3 Stringent regulatory compliance requirements

- 3.2.1.4 Growth in commercial aviation and air traffic

- 3.2.1.5 Integration of AI and IoT in aviation operations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cybersecurity solutions

- 3.2.2.2 Lack of skilled cybersecurity professionals in aviation

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cybersecurity services in emerging markets

- 3.2.3.2 Development of AI-driven cybersecurity solutions

- 3.2.3.3 Demand for cloud-based aviation cybersecurity platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Solution, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Security Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Network security

- 6.2.1 Firewalls

- 6.2.2 Intrusion Detection/Prevention Systems (IDS/IPS)

- 6.2.3 Virtual Private Networks (VPNs)

- 6.2.4 Others

- 6.3 Application & cloud security

- 6.3.1 Web & mobile application security

- 6.3.2 Cloud security platforms

- 6.3.3 Secure software development

- 6.3.4 Others

- 6.4 Endpoint & identity security

- 6.4.1 Endpoint detection & response (EDR/XDR)

- 6.4.2 Anti-malware / Anti-ransomware Tools

- 6.4.3 Identity & access management

- 6.4.4 Others

- 6.5 Data Security & encryption

- 6.5.1 Data loss prevention (DLP)

- 6.5.2 Database security

- 6.5.3 Encryption & key management

- 6.5.4 Others

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Airlines

- 8.3 Airports & ground operators

- 8.4 Air traffic control authorities

- 8.5 Aircraft manufacturers & OEMs

- 8.6 MRO providers

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Airbus

- 10.1.2 BAE Systems

- 10.1.3 Honeywell International Inc.

- 10.1.4 IBM Corporation

- 10.1.5 Thales Group

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Cisco Systems

- 10.2.1.2 Lockheed Martin

- 10.2.1.3 Northrop Grumman

- 10.2.1.4 Raytheon Technologies

- 10.2.1.5 Leidos

- 10.2.1.6 Optiv Security

- 10.2.1.7 Aviation SecOps

- 10.2.2 Europe

- 10.2.2.1 Rohde & Schwarz

- 10.2.2.2 SITA

- 10.2.2.3 The Boeing Company

- 10.2.2.4 Cyviation

- 10.2.2.5 Darktrace

- 10.2.3 Asia Pacific

- 10.2.3.1 Wattlecorp Cybersecurity Labs LLP

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Darktrace

- 10.3.2 Dionach