|

市場調查報告書

商品編碼

1833407

胰島素筆市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Insulin Pen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

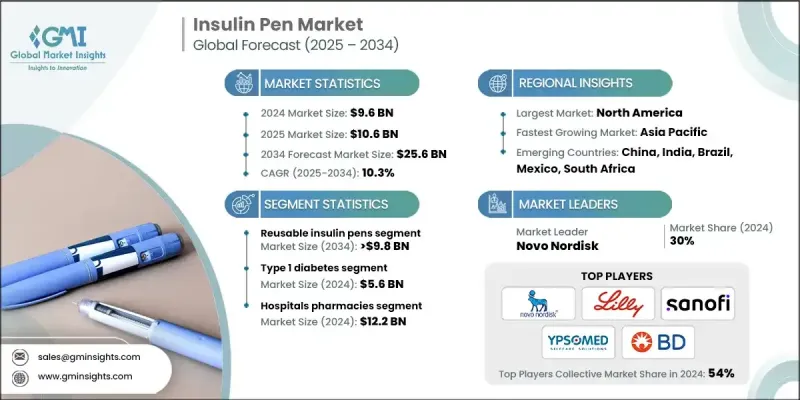

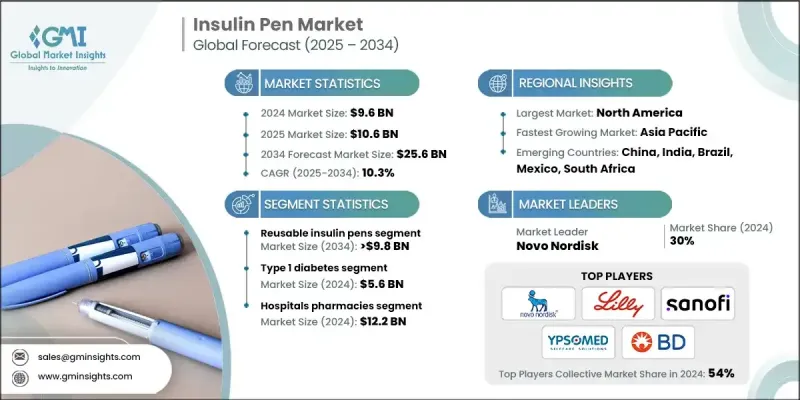

2024 年全球胰島素筆市場價值為 96 億美元,預計到 2034 年將以 10.3% 的複合年成長率成長至 256 億美元。

在全球範圍內,1型和第2型糖尿病患者數量的不斷增加是胰島素筆需求成長的主要驅動力。隨著糖尿病患者人數的持續成長,尤其是在城市地區和老齡化人口中,對便捷可靠的胰島素注射方法的需求也日益成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 96億美元 |

| 預測值 | 256億美元 |

| 複合年成長率 | 10.3% |

可重複使用胰島素筆部分

由於對經濟高效、永續且方便用戶使用的胰島素注射裝置的需求不斷成長,可重複使用胰島素筆市場正經歷強勁成長。與一次性胰島素注射裝置相比,可重複使用胰島素筆具有長期經濟效益,推動了這一成長。這些注射筆深受需要每日多次注射的患者的青睞,因為它們支持精準劑量,並且相容於多種胰島素筆芯。

1 型糖尿病盛行率不斷上升

2024年,第1型糖尿病市場佔了強勁的佔有率。由於第1型糖尿病患者需要終生胰島素治療,因此對高效、便攜且隱藏的胰島素給藥方法的需求持續成長。胰島素筆,尤其是具有智慧劑量功能的胰島素筆,由於使用方便且訓練需求低,非常適合這類族群。

醫院藥局採用率不斷上升

2024年,醫院藥局在急診和新診斷患者中佔據了相當大的佔有率。標準化劑量、感染控制和易於員工培訓推動了這一成長。醫院更青睞胰島素筆,因為它安全可靠,並能降低劑量錯誤的風險。製造商正透過提供大包裝解決方案、醫院員工培訓模組和延長保存期限的產品來滿足機構需求。

北美胰島素筆市場

2024年,北美胰島素筆市場保持了永續的佔有率。高糖尿病盛行率、先進的醫療基礎設施以及廣泛的保險覆蓋是支持該地區市場主導地位的關鍵因素。美國正大力推廣智慧胰島素筆和簡化糖尿病管理的數位健康平台。為了鞏固市場地位,各公司正利用直接面對消費者的行銷方式,擴大透過零售藥局的分銷管道,並加強病患支援計畫。

胰島素筆市場的主要參與者包括Medmix、Julphar、東寶藥業、賽諾菲、甘李藥業、諾和諾德、Owen Mumford、Haselmeier、Ypsomed、Biocon Biologics、禮來公司、美敦力、Wockhardt、Becton、Dickinson and Company和蘇州鵬業醫療器材。

為了鞏固市場地位,胰島素筆市場的領先公司高度重視創新、策略合作夥伴關係以及以患者為中心的解決方案。許多公司正在投資智慧胰島素筆技術,整合藍牙連接、劑量記憶和行動應用程式同步功能,以提供更優質的糖尿病管理工具。與數位健康平台和血糖監測公司的合作也有助於建立更一體化的醫療生態系統。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 糖尿病盛行率上升

- 胰島素筆的技術進步

- 增強糖尿病自我管理意識

- 產業陷阱與挑戰

- 胰島素筆成本高

- 低收入地區滲透率有限

- 市場機會

- 智慧功能與數位平台的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 按類型

- 按地區

- 報銷情況

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 可重複使用的胰島素筆

- 一次性胰島素筆

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 1型糖尿病

- 2型糖尿病

- 妊娠糖尿病

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Becton, Dickinson and Company

- Biocon Biologics

- Dongbao Pharmaceutical

- Eli Lilly and Co

- Gan & Lee Pharmaceuticals

- Haselmeier

- Julphar

- Medmix

- Medtronic

- Novo Nordisk

- Owen Mumford

- Sanofi

- Suzhou Peng Ye Medical Devices

- Wockhardt

- Ypsomed

The Global Insulin Pen Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 25.6 billion by 2034.

The increasing number of people diagnosed with both Type 1 and Type 2 diabetes worldwide is a primary driver of insulin pen demand. As the diabetic population continues to grow, particularly in urban areas and among aging demographics, the need for convenient and reliable insulin delivery methods is escalating.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 10.3% |

Reusable Insulin Pens Segment

The reusable insulin pens segment is experiencing robust growth due to rising demand for cost-effective, sustainable, and user-friendly insulin delivery devices. The growth is driven by the long-term economic benefits reusable pens offer compared to disposable models. These pens are favored by patients requiring multiple daily injections, as they support dose precision and are compatible with a wide range of insulin cartridges.

Increasing Prevalence of Type 1 Diabetes Segment

The Type 1 diabetes segment held a robust share in 2024. As individuals with Type 1 diabetes require lifelong insulin therapy, there is a continuous need for efficient, portable, and discreet insulin delivery methods. Insulin pens, particularly those with smart dosing capabilities, are well-suited to this population due to their convenience and minimal training requirements.

Rising Adoption in Hospital Pharmacies

The hospital pharmacies segment held a sizeable share in 2024 in acute care settings and for newly diagnosed patients. The growth is driven by standardized dosing, infection control, and ease of staff training. Hospitals prefer insulin pens for their safety features and reduced risk of dosage errors. Manufacturers are responding by offering bulk packaging solutions, training modules for hospital staff, and extended shelf-life products to meet institutional needs.

North America Insulin Pen Market

North America insulin pen market held a sustainable share in 2024. High diabetes prevalence, advanced healthcare infrastructure, and widespread insurance coverage are key factors supporting this region's dominance. The U.S. is witnessing strong adoption of smart insulin pens and digital health platforms that streamline diabetes management. To reinforce their market position, companies are leveraging direct-to-consumer marketing, expanding distribution through retail pharmacies, and enhancing patient support programs.

Major players in the insulin pen market are Medmix, Julphar, Dongbao Pharmaceutical, Sanofi, Gan & Lee Pharmaceuticals, Novo Nordisk, Owen Mumford, Haselmeier, Ypsomed, Biocon Biologics, Eli Lilly and Co., Medtronic, Wockhardt, Becton, Dickinson and Company, and Suzhou Peng Ye Medical Devices.

To strengthen their foothold, leading companies in the insulin pen market are heavily focused on innovation, strategic partnerships, and patient-centric solutions. Many are investing in smart insulin pen technology, integrating Bluetooth connectivity, dose memory, and mobile app synchronization to offer better diabetes management tools. Collaborations with digital health platforms and glucose monitoring companies are also helping create more integrated care ecosystems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Indication trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in insulin pens

- 3.2.1.3 Enhanced awareness of self-management of diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin pens

- 3.2.2.2 Limited penetration in low-income regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart features and digital platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.7.1 By type

- 3.7.2 By region

- 3.8 Reimbursement landscape

- 3.9 Patent analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable insulin pens

- 5.3 Disposable insulin pens

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Biocon Biologics

- 9.3 Dongbao Pharmaceutical

- 9.4 Eli Lilly and Co

- 9.5 Gan & Lee Pharmaceuticals

- 9.6 Haselmeier

- 9.7 Julphar

- 9.8 Medmix

- 9.9 Medtronic

- 9.10 Novo Nordisk

- 9.11 Owen Mumford

- 9.12 Sanofi

- 9.13 Suzhou Peng Ye Medical Devices

- 9.14 Wockhardt

- 9.15 Ypsomed