|

市場調查報告書

商品編碼

1833406

水痘帶狀皰疹病毒感染治療市場機會、成長動力、產業趨勢分析及2025-2034年預測Varicella Zoster Virus Infection Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

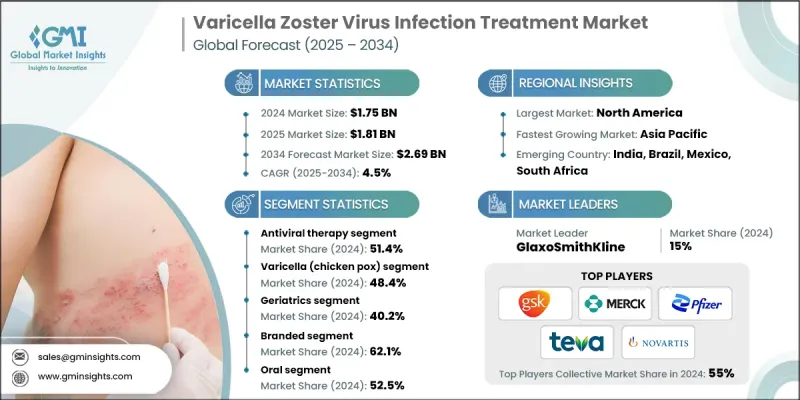

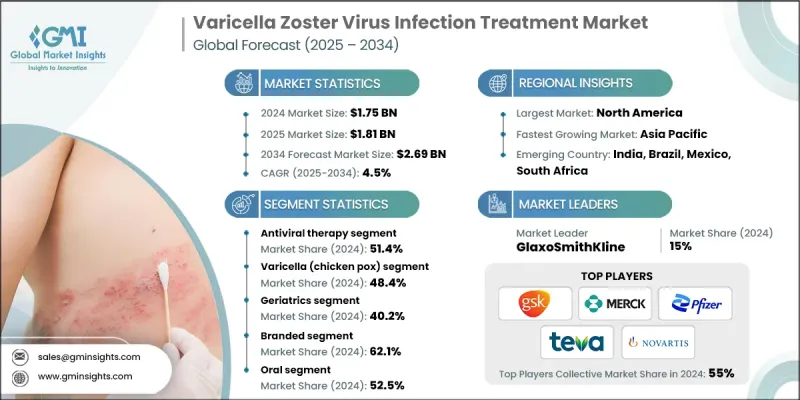

2024 年全球水痘帶狀皰疹病毒感染治療市場價值為 17.5 億美元,預計將以 4.5% 的複合年成長率成長,到 2034 年達到 26.9 億美元。

隨著全球人口老化,免疫系統較弱的人數顯著增加,這大大增加了他們患帶狀皰疹的風險,帶狀皰疹是一種由水痘帶狀皰疹病毒重新激活引起的疼痛性皮疹。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17.5億美元 |

| 預測值 | 26.9億美元 |

| 複合年成長率 | 4.5% |

抗病毒療法的採用率不斷上升

抗病毒治療領域在2024年佔了相當大的佔有率,這得益於阿昔洛韋、伐昔洛韋和泛昔洛韋等藥物在治療帶狀皰疹和減少帶狀皰疹後神經痛等併發症方面的有效性。這些藥物通常用於免疫功能正常和免疫功能低下的患者,老年族群和免疫防禦能力較弱的人群對這些藥物的需求正在增加。

水痘盛行率不斷上升

水痘疫苗在2024年佔據了相當大的佔有率。突破性感染和未接種疫苗的人群仍然需要治療,尤其是在發展中地區。雖然抗病毒藥物可用於治療嚴重的兒童或成人病例,但主要重點仍然是預防。為了鞏固市場地位,各公司正在與公共衛生部門密切合作,擴大水痘疫苗的涵蓋範圍,並透過學校免疫計畫提高公眾意識。

老年人盛行率不斷上升

由於老年人罹患帶狀皰疹及其併發症的風險增加,老年醫學領域將在2025-2034年期間實現良好的複合年成長率。隨著年齡成長,免疫力逐漸下降,老年人尤其容易感染病毒,通常需要及時抗病毒治療,在許多情況下還需要長期的疼痛管理。重組帶狀皰疹疫苗等高效疫苗的推出已將重點轉向預防,但在漏接種疫苗或疫苗無效的情況下,對支持性治療的需求仍然強勁。

北美將成為利潤豐厚的地區

到2034年,北美水痘-帶狀皰疹病毒感染治療市場有望實現顯著成長,這得益於強大的醫療基礎設施、較高的疫苗覆蓋率以及龐大的老齡化人口。在美國,帶狀皰疹疫苗的接種率很高,並得到了公共和私人支付機構的報銷支持。此外,早期採用先進的抗病毒療法有助於減少因治療延遲而導致的併發症。

水痘帶狀皰疹病毒感染治療市場的主要參與者有聖克魯斯生物技術公司、邁蘭公司、輝瑞公司、SK化學公司、長春百川生物技術公司、梯瓦製藥公司、Apotex公司、諾華公司、博士倫生物技術公司、Kamada公司、山德士公司、葛蘭素史克公司、默克公司、Glenmark-Bio-Bio科學技術公司。

為了在水痘帶狀皰疹病毒感染治療市場中維持並擴大影響力,各公司正在採取多管齊下的策略,將產品創新、地理擴張和公共衛生合作融為一體。研發投入正轉向下一代抗病毒藥物和具有更持久免疫力的改良疫苗配方。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 帶狀皰疹盛行率不斷上升

- 人口老化和免疫功能低下的患者

- 疫苗技術的進步

- 政府免疫計劃

- 產業陷阱與挑戰

- 品牌抗病毒藥物和疫苗成本高昂

- 發展中地區的認知有限

- 市場機會

- 聯合療法和長效療法的開發

- 個人化免疫策略

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 管道分析

- 定價分析

- 專利格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按治療類型,2021 - 2034

- 主要趨勢

- 抗病毒治療

- 阿昔洛韋

- 伐昔洛韋

- 泛昔洛韋

- 其他抗病毒療法

- 皮質類固醇和抗發炎藥

- 疫苗

- 其他治療類型

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 水痘

- 帶狀皰疹

- 其他適應症

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 兒科

- 成年人

- 老年病學

第 8 章:市場估計與預測:按產品類型,2021 - 2034 年

- 主要趨勢

- 品牌

- 泛型

第9章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 外用

- 注射劑

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Apotex

- Bausch Health

- Bio-Rad Laboratories

- Changchun BCHT Biotechnology

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Kamada

- Merck & Co.

- Mylan

- Novartis

- Pfizer

- Sandoz

- Santa Cruz Biotechnology

- Sinovac

- SK Chemicals

- Teva Pharmaceuticals

The Global Varicella Zoster Virus Infection Treatment Market was valued at USD 1.75 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 2.69 billion by 2034.

As the global population continues to age, there is a marked rise in the number of individuals experiencing a weakened immune system, which significantly increases their risk of developing shingles (herpes zoster), a painful skin rash caused by the reactivation of the varicella zoster virus.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.75 Billion |

| Forecast Value | $2.69 Billion |

| CAGR | 4.5% |

Rising Adoption of Antiviral Therapy

The antiviral therapy segment held a substantial share in 2024, owing to the effectiveness of agents like acyclovir, valacyclovir, and famciclovir in managing herpes zoster and reducing complications such as postherpetic neuralgia. These medications are typically prescribed to both immunocompetent and immunocompromised patients, with demand rising among aging populations and those with weakened immune defenses.

Increasing Prevalence of Varicella (Chickenpox)

The varicella segment generated a substantial share in 2024. The breakthrough infections and unvaccinated populations continue to present treatment needs, particularly in developing regions. While antivirals may be used in severe pediatric or adult cases, the primary focus remains on prevention. To enhance their foothold, companies are working closely with public health authorities to expand access to varicella vaccines and raise awareness through school-based immunization programs.

Growing Prevalence Among Geriatrics

The geriatrics segment will grow at a decent CAGR during 2025-2034, owing to the increased risk of herpes zoster and its complications among older adults. As immunity wanes with age, seniors are particularly vulnerable to reactivation of the virus, often requiring prompt antiviral therapy and, in many cases, long-term pain management. The introduction of highly effective vaccines like the recombinant zoster vaccine has shifted the focus toward prevention, yet there remains strong demand for supportive treatments in cases where vaccination is missed or ineffective.

North America to Emerge as a Lucrative Region

North America varicella zoster virus infection treatment market is poised to witness significant growth by 2034, supported by robust healthcare infrastructure, high vaccine coverage, and a large aging population. The United States has seen strong uptake of shingles vaccines, with reimbursement support from both public and private payers. In addition, early adoption of advanced antiviral therapies has helped reduce complications associated with delayed treatment.

Major players in the varicella zoster virus infection treatment market are Santa Cruz Biotechnology, Mylan, Pfizer, SK Chemicals, Changchun BCHT Biotechnology, Teva Pharmaceuticals, Apotex, Novartis, Bausch Health, Kamada, Sandoz, GlaxoSmithKline, Merck & Co., Glenmark Pharmaceuticals, Bio-Rad Laboratories, and Sinovac.

To maintain and grow their foothold in the varicella zoster virus infection treatment market, companies are employing multi-pronged strategies that combine product innovation, geographic expansion, and public health collaboration. R&D investment is being directed toward next-generation antivirals and improved vaccine formulations with longer-lasting immunity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Indication trends

- 2.2.4 Age group trends

- 2.2.5 Product type trends

- 2.2.6 Route of administration trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of herpes zoster

- 3.2.1.2 Aging population and immunocompromised patients

- 3.2.1.3 Advancements in vaccine technology

- 3.2.1.4 Government immunization programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded antivirals and vaccines

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination and long-acting therapies

- 3.2.3.2 Personalized immunization strategies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Pricing analysis

- 3.8 Patent landscape

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antiviral therapy

- 5.2.1 Acyclovir

- 5.2.2 Valacyclovir

- 5.2.3 Famciclovir

- 5.2.4 Other antiviral therapies

- 5.3 Corticosteroids and anti-inflammatory agents

- 5.4 Vaccines

- 5.5 Other treatment types

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Varicella (chicken pox)

- 6.3 Herpes zoster (shingles)

- 6.4 Other indications

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

- 7.4 Geriatrics

Chapter 8 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Branded

- 8.3 Generics

Chapter 9 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Oral

- 9.3 Topical

- 9.4 Injectables

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals and clinics

- 10.3 Homecare settings

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Apotex

- 12.2 Bausch Health

- 12.3 Bio-Rad Laboratories

- 12.4 Changchun BCHT Biotechnology

- 12.5 GlaxoSmithKline

- 12.6 Glenmark Pharmaceuticals

- 12.7 Kamada

- 12.8 Merck & Co.

- 12.9 Mylan

- 12.10 Novartis

- 12.11 Pfizer

- 12.12 Sandoz

- 12.13 Santa Cruz Biotechnology

- 12.14 Sinovac

- 12.15 SK Chemicals

- 12.16 Teva Pharmaceuticals