|

市場調查報告書

商品編碼

1833402

腦性麻痺治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cerebral Palsy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

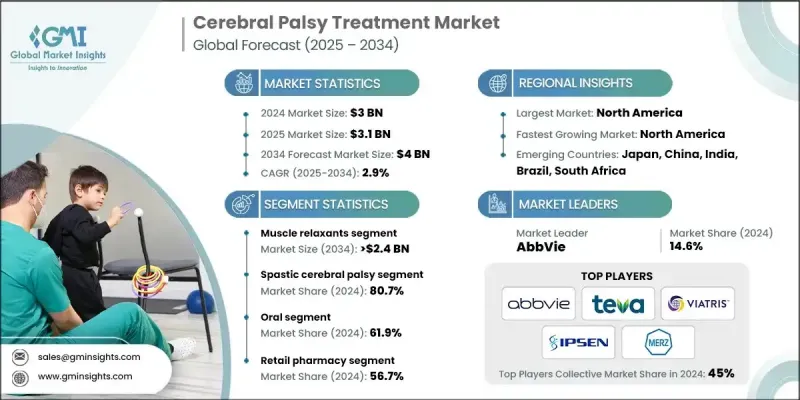

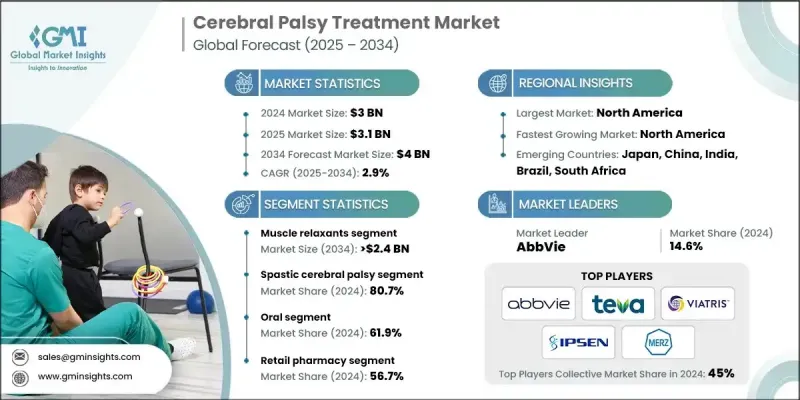

2024 年全球腦性麻痺治療市場價值為 30 億美元,預計將以 2.9% 的複合年成長率成長,到 2034 年達到 40 億美元。

腦性麻痺盛行率的上升是推動市場成長的重要因素。新生兒護理和醫療技術的進步提高了早產兒和低出生體重兒的存活率,而這些嬰兒患腦性麻痺的風險較高。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 2.9% |

肌肉鬆弛劑需求不斷增加

2024年,肌肉鬆弛劑市場佔有重要佔有率,因為這些藥物通常用於治療肌肉僵硬和痙攣,而肌肉僵硬和痙攣是腦性麻痺患者最嚴重的兩種症狀。巴氯芬、地西泮和替扎尼定等藥物被廣泛用於降低肌肉張力過高、改善活動能力,從而更好地參與物理治療。隨著對非侵入性和藥物干預措施的需求不斷成長,該市場將繼續保持成長動能。

痙攣腦性麻痺節段

痙攣性腦性麻痺在2024年佔據了相當大的佔有率,佔確診病例的很大一部分。這種亞型的特徵是肌肉緊張或僵硬,從而影響運動和姿勢。因此,它是大多數治療計劃和干涉策略的主要臨床重點。由於人們越來越重視早期診斷、多學科護理模式以及藥物和物理治療的引入,該領域的市場需求強勁。

口服藥物的採用率不斷上升

口服藥物市場在2024年佔據了顯著的市場佔有率,這得益於其易於給藥、患者依從性高以及治療應用範圍廣。肌肉鬆弛劑和抗痙攣劑等藥物通常配製成口服劑型,尤其適用於那些可能因注射或輸液而感到不適的兒童。這種給藥方式在長期治療計畫中仍受到醫師和照護人員的青睞。

北美將成為利潤豐厚的地區

2024年,北美腦性麻痺治療市場顯著成長,這得益於確診病例數的增加和治療方案的進步。該地區完善的醫療基礎設施以及對研究和創新的高度重視,推動了市場發展。美國和加拿大的患者能夠更方便地獲得各種治療方案,包括肉毒桿菌療法、骨科手術和輔助設備。護理人員意識的提高以及早期介入計畫的進展,進一步支持了市場擴張。

腦性麻痺治療市場的主要參與者有 Teva、Novartis、UCB、CHEPLAPHARM、Amneal、Roche、GSK、Dr.Reddy's、AbbVie、VIATRIS、Merz Pharmaceuticals 和 IPSEN。

在北美腦性麻痺治療市場營運的公司正致力於多管齊下的策略,以鞏固其市場地位。他們大力投資研發,以創新更有效、更侵入性更低的治療方案。與醫院、復健中心和學術機構的合作促進了臨床研究和產品驗證。透過與醫療保健提供者和專科診所的合作,增強分銷網路,改善患者獲得治療的管道。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 腦性麻痺盛行率上升

- 藥物配方的進步

- 提高認知和早期診斷

- 研發活動投資激增

- 產業陷阱與挑戰

- 與藥物相關的不良反應

- 市場機會

- 標靶治療的發展

- 製藥公司與兒科醫院之間的策略夥伴關係

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 家庭醫療保健在腦性麻痺管理中的作用

- 居家照護對腦性癱瘓患者的重要性

- 家庭治療服務(物理、職業、語言)

- 在家中使用輔助設備和行動輔助設備

- 居家照護和照護人員支持動態

- 居家照護與醫院照護的成本效益

- 報銷場景

- 品牌分析

- 管道分析

- 新興治療療法

- 定價分析

- 消費者行為分析

- 投資前景

- 流行病學情景

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 肌肉鬆弛劑

- 抗驚厥藥

- 抗膽鹼藥物

- 抗憂鬱藥

- 其他藥物類型

第6章:市場估計與預測:依疾病類型,2021 - 2034 年

- 主要趨勢

- 痙攣性腦性麻痺

- 四肢癱瘓

- 雙癱

- 偏癱

- 運動障礙性腦性麻痺

- 共濟失調性腦性麻痺

- 混合性腦性麻痺

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 零售藥局

- 醫院藥房

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Amneal

- CHEPLAPHARM

- Dr.Reddy's

- GSK

- IPSEN

- Merz Pharmaceuticals

- Novartis

- Roche

- Teva

- UCB

- VIATRIS

The Global Cerebral Palsy Treatment Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 2.9% to reach USD 4 billion by 2034.

The rising prevalence of cerebral palsy is a significant factor driving growth in the market. Advances in neonatal care and medical technology have led to improved survival rates of premature and low-birth-weight infants who are at higher risk for developing cerebral palsy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 2.9% |

Rising Demand for Muscle Relaxants

The muscle relaxants segment held a significant share in 2024, as these medications are commonly prescribed to manage muscle stiffness and spasticity, two of the most debilitating symptoms in cerebral palsy patients. Drugs like baclofen, diazepam, and tizanidine are widely used to reduce excessive muscle tone and improve mobility, allowing for better participation in physical therapy. The segment continues to gain momentum as demand for non-invasive and drug-based interventions grows.

Spastic Cerebral Palsy Segment

The spastic cerebral palsy generated a notable share in 2024, accounting for many diagnosed cases. This subtype is characterized by tight or stiff muscles, which impair movement and posture. As a result, it represents the primary clinical focus of most treatment plans and intervention strategies. The market demand in this segment is robust, driven by a growing emphasis on early diagnosis, multidisciplinary care models, and the introduction of both drug-based and physical therapies.

Rising Adoption of Oral Drugs

The oral segment generated a notable share in 2024, driven by its ease of administration, patient compliance, and broad therapeutic applicability. Medications such as muscle relaxants and antispastic agents are often formulated for oral use, especially in children who may find injections or infusions distressing. This delivery route continues to be favored by physicians and caregivers alike for long-term treatment plans.

North America to Emerge as a Lucrative Region

North America cerebral palsy treatment market witnessed notable growth in 2024, driven by an increasing number of diagnosed cases and advancements in therapeutic options. The market benefits from the region's well-established healthcare infrastructure and strong focus on research and innovation. Patients in the U.S. and Canada are gaining better access to a wide range of treatments, including botulinum toxin therapies, orthopedic surgeries, and assistive devices. Growing awareness among caregivers and early intervention programs further supports market expansion.

Major Players in the cerebral palsy treatment market are Teva, Novartis, UCB, CHEPLAPHARM, Amneal, Roche, GSK, Dr.Reddy's, AbbVie, VIATRIS, Merz Pharmaceuticals, and IPSEN.

Companies operating in the North America cerebral palsy treatment market are focusing on a multi-pronged strategy to strengthen their foothold. They invest heavily in research and development to innovate more effective and less invasive treatment options. Collaborations with hospitals, rehabilitation centers, and academic institutions facilitate clinical studies and product validation. Enhancing distribution networks through partnerships with healthcare providers and specialty clinics improves patient access to therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Route of administration trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cerebral palsy

- 3.2.1.2 Advancements in drug formulations

- 3.2.1.3 Increased awareness and early diagnosis

- 3.2.1.4 Surging investments in research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of targeted therapies

- 3.2.3.2 Strategic partnerships between pharma companies and pediatric hospitals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Role of home healthcare in cerebral palsy management

- 3.6.1 Importance of home-based care for CP patients

- 3.6.2 Home-based therapy services (physical, occupational, speech)

- 3.6.3 Use of assistive devices and mobility aids at home

- 3.6.4 Home nursing and caregiver support dynamics

- 3.6.5 Cost-benefit aspects of home care vs hospital care

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Emerging treatment therapies

- 3.11 Pricing analysis

- 3.12 Consumer behaviour analysis

- 3.13 Investment landscape

- 3.14 Epidemiological scenario

- 3.15 Gap analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Muscle relaxants

- 5.3 Anticonvulsants

- 5.4 Anticholinergics

- 5.5 Antidepressants

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spastic cerebral palsy

- 6.2.1 Quadriplegia

- 6.2.2 Diplegia

- 6.2.3 Hemiplegia

- 6.3 Dyskinetic cerebral palsy

- 6.4 Ataxic cerebral palsy

- 6.5 Mixed cerebral palsy

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amneal

- 10.3 CHEPLAPHARM

- 10.4 Dr.Reddy's

- 10.5 GSK

- 10.6 IPSEN

- 10.7 Merz Pharmaceuticals

- 10.8 Novartis

- 10.9 Roche

- 10.10 Teva

- 10.11 UCB

- 10.12 VIATRIS