|

市場調查報告書

商品編碼

1833390

門袋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wicketed Bag Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

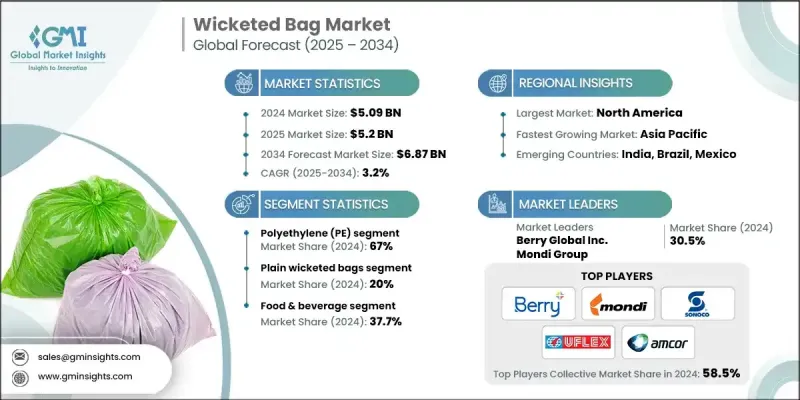

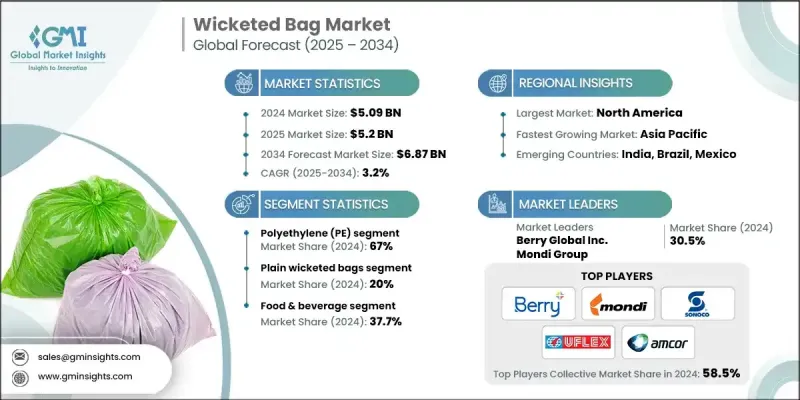

2024 年全球門袋市場價值為 50.9 億美元,預計到 2034 年將以 3.2% 的複合年成長率成長至 68.7 億美元。

全球食品產業的擴張在推動需求方面發揮核心作用,因為小袋廣泛用於包裝烘焙產品、冷凍食品和其他易腐食品。食品安全標準的日益嚴格正在塑造包裝產業,促使製造商確保產品完整性並防止污染。小袋以其與自動填充系統的兼容性而聞名,有助於提高大型食品加工設施的效率。電子商務和有組織的零售業的快速崛起也顯著促進了市場發展,對安全、靈活且美觀的包裝的需求持續成長。隨著網購的興起,包裝在確保耐用性和透明度的同時,在運輸過程中保護產品也變得越來越重要。此外,超市、大賣場和便利商店的日益普及,進一步推動了對兼具視覺吸引力和功能性的可靠包裝解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 50.9億美元 |

| 預測值 | 68.7億美元 |

| 複合年成長率 | 3.2% |

2024年,聚乙烯市值達34.1億美元。其受歡迎程度源自於其多功能性、成本效益以及優異的耐用性和靈活性,使其成為食品、醫療保健和零售包裝的理想選擇。聚乙烯在自動化灌裝製程的卓越性能確保了高速生產和運作可靠性,使其始終是大規模包裝應用的首選材料。

2024年,普通封口袋市場規模達10.2億美元。其普及的主要原因是價格實惠且與高速灌裝機相容。這類包裝袋廣泛應用於烘焙食品、農產品和工業產品的散裝包裝,在這些產品中,成本節約和營運吞吐量比品牌推廣更為重要。

美國紙袋市場規模在2024年達到14.1億美元,複合年成長率為1.4%。美國紙袋市場的成長主要得益於食品加工產業的蓬勃發展,尤其是烘焙食品、冷凍食品和新鮮農產品。衛生、高效、外觀精美的便利包裝需求旺盛。此外,消費者偏好的轉變和更嚴格的環境法規也為環保包裝材料的未來成長帶來了巨大的機會。

影響全球門框袋產業的知名公司包括 Mondi Group、Berry Global Inc.、ProAmpac、Novolex Holdings Inc.、Sealed Air、Bischof + Klein、Amcor plc、Royal Bags、Uflex Ltd.、Cascades、Coveris Holdings SA、Pack Tech、Sonoco Products Company、International Paper、Advic Packing 和 Impance。為了鞏固在門框袋市場的立足點,領先公司正在採用一系列以創新、永續性和效率為重點的策略。企業正在投資環保材料,以滿足對可回收和可生物分解包裝日益成長的需求。他們還透過先進的自動化系統擴大生產能力,以提高產量並降低成本。與大型食品加工商和零售商的合作被優先考慮,以確保長期供應合約並擴大客戶範圍。品牌建立工作正在轉向客製化解決方案,使製造商能夠提供增強知名度和消費者吸引力的包裝。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 食品包裝需求不斷成長

- 電子商務與零售業的擴張

- 製藥和醫療應用的興起

- 印刷和客製化方面的進步

- 轉向可回收和可堆肥的袋子材料

- 產業陷阱與挑戰

- 對一次性塑膠的嚴格監管

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 聚乙烯(PE)

- 低密度聚乙烯(LDPE)

- 高密度聚乙烯(HDPE)

- 聚丙烯(PP)

- 聚氯乙烯(PVC)

- 聚酯纖維(PET)

- 可生物分解塑膠

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 普通的帶門袋

- 印花小門袋

- 穿孔小門袋

- 底部有角撐板的門袋

- 側邊插角袋

- 拉鍊袋

- 通風/網狀隔板袋

第7章:市場估計與預測:按袋容量,2021 - 2034

- 主要趨勢

- 最多 1 磅

- 1-5磅

- 5-10磅

- 10-25磅

- 超過25磅

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷(B2B)

- 分銷商/批發商

- 網路零售

第9章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 食品和飲料

- 烘焙產品(麵包、小圓麵包)

- 冷凍食品(肉類、海鮮)

- 零食和糖果

- 乳製品

- 醫療保健

- 手術套件

- 醫療器材

- 個人護理和化妝品

- 一次性產品

- 化妝品套裝

- 零售和消費品

- 服飾

- 玩具

- 工業包裝

- 備用零件

- 電氣元件

- 電商/快遞

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 全球參與者:

- Amcor plc

- Berry Global Inc.

- Cascades

- Graphic Packaging International

- International Paper

- Klabin

- Mondi Group

- Novolex Holdings Inc.

- ProAmpac

- Sealed Air

- Smurfit Kappa

- Sonoco Products Company

- Uflex Ltd.

- WestRock

- 區域參與者:

- Bischof + Klein

- Coveris Holdings SA

- Imperial Bag and Paper

- Novolex

- Pack Tech

- Royal Bags

- 新興參與者:

- Advance Packaging

- St. Johns Packaging Ltd.

The Global Wicketed Bag Market was valued at USD 5.09 billion in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 6.87 billion by 2034.

The expansion of the global food industry plays a central role in driving demand, as wicketed bags are extensively used in the packaging of items such as bakery products, frozen goods, and other perishable items. Growing compliance with food safety standards is shaping the packaging sector, pushing manufacturers to ensure product integrity and prevent contamination. Wicketed bags, known for their compatibility with automated filling systems, help increase efficiency in large-scale food processing facilities. The rapid rise of e-commerce and organized retail has also significantly contributed to market momentum, as the demand for secure, flexible, and attractive packaging continues to expand. With online shopping on the rise, packaging guarantees durability and transparency while protecting products during transport is increasingly critical. Moreover, the growing presence of supermarkets, hypermarkets, and convenience stores further boosts the requirement for reliable packaging solutions that combine visual appeal with functional performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.09 Billion |

| Forecast Value | $6.87 Billion |

| CAGR | 3.2% |

The polyethylene segment was valued at USD 3.41 billion in 2024. Its popularity is attributed to its versatility, cost-efficiency, and ability to deliver durability and flexibility, making it ideal for use across food, healthcare, and retail packaging. Its excellent performance in automated filling processes ensures high-speed production and operational reliability, maintaining its position as the preferred material for large-scale packaging applications.

The plain wicketed bags segment accounted for USD 1.02 billion in 2024. Their adoption is largely driven by their affordability and compatibility with high-speed filling machines. These bags are heavily used in bulk packaging for bakery, produce, and industrial products, where cost savings and operational throughput are prioritized over branding.

U.S. Wicketed Bag Market reached USD 1.41 billion in 2024 at a CAGR of 1.4%. Growth in the country is primarily supported by the expanding food processing sector, particularly in baked goods, frozen foods, and fresh produce. Convenience packaging that is hygienic, efficient, and visually appealing is in high demand. In addition, the shift toward eco-friendly packaging materials presents a significant opportunity for future growth, supported by changing consumer preferences and stricter environmental regulations.

Prominent companies shaping the Global Wicketed Bag Industry include Mondi Group, Berry Global Inc., ProAmpac, Novolex Holdings Inc., Sealed Air, Bischof + Klein, Amcor plc, Royal Bags, Uflex Ltd., Cascades, Coveris Holdings S.A., Pack Tech, Sonoco Products Company, International Paper, Graphic Packaging International, Advance Packaging, and Imperial Bag and Paper. To strengthen their foothold in the wicketed bag market, leading companies are adopting a mix of strategies focused on innovation, sustainability, and efficiency. Firms are investing in eco-friendly materials to address the rising demand for recyclable and biodegradable packaging. They are also expanding production capabilities with advanced automated systems to improve throughput and reduce costs. Partnerships with large food processors and retailers are being prioritized to secure long-term supply contracts and expand customer reach. Branding efforts are shifting toward customized solutions, enabling manufacturers to offer packaging that enhances visibility and consumer appeal.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand in food packaging

- 3.2.1.2 Expansion of e-commerce and retail

- 3.2.1.3 Rise in pharmaceutical & medical applications

- 3.2.1.4 Advancements in printing and customization

- 3.2.1.5 Shift toward recyclable and compostable bag materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations on single-use plastics

- 3.2.2.2 Raw material price volatility

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.2.1 Low-density Polyethylene (LDPE)

- 5.2.2 High-density Polyethylene (HDPE)

- 5.3 Polypropylene (PP)

- 5.4 Polyvinyl Chloride (PVC)

- 5.5 Polyester (PET)

- 5.6 Biodegradable plastics

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Plain wicketed bags

- 6.3 Printed wicketed bags

- 6.4 Perforated wicketed bags

- 6.5 Bottom-gusseted wicketed bags

- 6.6 Side-gusseted wicketed bags

- 6.7 Zipper wicketed bags

- 6.8 Ventilated/mesh wicketed bags

Chapter 7 Market Estimates and Forecast, By Bag Capacity, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Up to 1 lb

- 7.3 1-5 lbs

- 7.4 5-10 lbs

- 7.5 10-25 lbs

- 7.6 Above 25 lbs

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Direct sales (B2B)

- 8.3 Distributors/wholesalers

- 8.4 Online retail

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.2.1 Bakery products (bread, buns)

- 9.2.2 Frozen foods (meat, seafood)

- 9.2.3 Snacks & confectionery

- 9.2.4 Dairy products

- 9.3 Healthcare & medical

- 9.3.1 Surgical kits

- 9.3.2 Medical devices

- 9.4 Personal care & cosmetics

- 9.4.1 Disposable products

- 9.4.2 Cosmetic kits

- 9.5 Retail & consumer goods

- 9.5.1 Apparel

- 9.5.2 Toys

- 9.6 Industrial packaging

- 9.6.1 Spare parts

- 9.6.2 Electrical components

- 9.7 E-commerce / courier

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players:

- 11.1.1 Amcor plc

- 11.1.2 Berry Global Inc.

- 11.1.3 Cascades

- 11.1.4 Graphic Packaging International

- 11.1.5 International Paper

- 11.1.6 Klabin

- 11.1.7 Mondi Group

- 11.1.8 Novolex Holdings Inc.

- 11.1.9 ProAmpac

- 11.1.10 Sealed Air

- 11.1.11 Smurfit Kappa

- 11.1.12 Sonoco Products Company

- 11.1.13 Uflex Ltd.

- 11.1.14 WestRock

- 11.2 Regional Players:

- 11.2.1 Bischof + Klein

- 11.2.2 Coveris Holdings S.A.

- 11.2.3 Imperial Bag and Paper

- 11.2.4 Novolex

- 11.2.5 Pack Tech

- 11.2.6 Royal Bags

- 11.3 Emerging Players:

- 11.3.1 Advance Packaging

- 11.3.2 St. Johns Packaging Ltd.